[et_pb_section bb_built=”1″ admin_label=”Header – All Pages” transparent_background=”off” background_color=”#1e73be” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” custom_padding=”0px||0px|” next_background_color=”#000000″ custom_padding_tablet=”50px|0|50px|0″ custom_padding_last_edited=”on|desktop” global_module=”1221″][et_pb_row admin_label=”row” global_parent=”1221″ make_fullwidth=”off” use_custom_width=”off” width_unit=”on” use_custom_gutter=”off” custom_padding=”||5px|” allow_player_pause=”off” parallax=”off” parallax_method=”on” make_equal=”off” parallax_1=”off” parallax_method_1=”off” background_position=”top_left” background_repeat=”repeat” background_size=”initial”][et_pb_column type=”4_4″][et_pb_post_title global_parent=”1221″ title=”on” meta=”off” author=”on” date=”on” categories=”on” comments=”on” featured_image=”off” featured_placement=”below” parallax_effect=”on” parallax_method=”on” text_orientation=”left” text_color=”light” text_background=”off” text_bg_color=”rgba(255,255,255,0.9)” module_bg_color=”rgba(255,255,255,0)” use_border_color=”off” border_color=”#ffffff” border_style=”solid” custom_padding=”10px|||” parallax=”on” background_color=”rgba(255,255,255,0)” /][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section bb_built=”1″ fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” custom_padding=”30px||0px|” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” background_color=”#1e73be” prev_background_color=”#000000″ next_background_color=”#ffffff” custom_padding_tablet=”0px||0px|” global_module=”1228″][et_pb_row global_parent=”1228″ make_fullwidth=”off” use_custom_width=”off” width_unit=”on” use_custom_gutter=”off” custom_padding=”30px||0px|” allow_player_pause=”off” parallax=”off” parallax_method=”off” make_equal=”off” parallax_1=”off” parallax_method_1=”off” column_padding_mobile=”on” background_position=”top_left” background_repeat=”repeat” background_size=”initial”][et_pb_column type=”4_4″][et_pb_text global_parent=”1228″ background_layout=”light” text_orientation=”left” use_border_color=”off” border_color=”#ffffff” border_style=”solid” background_position=”top_left” background_repeat=”repeat” background_size=”initial”]

[breadcrumb]

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section bb_built=”1″ fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” gutter_width=”3″ custom_padding_tablet=”0px||0px|” custom_padding_last_edited=”on|desktop” prev_background_color=”#1e73be” next_background_color=”#000000″][et_pb_row][et_pb_column type=”4_4″][et_pb_toggle admin_label=”Index” _builder_version=”3.0.106″ title=”Index” open=”off”]

Contents

33.2 Exclusions from Section 33 requirements – Wholly owned entities within the group.

33.2.1 Extract from FRS102: Section 33.1A.

33.3 Related party defined – Persons/Individuals.

33.3.1 Extract from FRS102: Section 33.2(a)

33.3.2.2 Persons of close members of that person’s family.

33.3.2.2.1 Control, joint control and significant influence.

33.3.2.2.2 Close family members defined.

33.2.2.3 Key management personnel

33.2.2.4 Examples of close family members.

33.4 Related party defined – Entities.

33.4.1 Extract from FRS102: Section 33.2 (b) and Section 33.4.

33.4.2.2.1 Entities are members of a group.

33.4.2.2.3 Both entities are joint venture of the same third party.

33.4.2.2.6 Transactions with a subsidiary of a joint venture or associate.

33.5 Specific related party exclusions.

33.5.1 Extract from FRS102: Section 33.3-33.4.

33.5.2.2 Relationships that are not related parties.

33.6.1 Disclosure of parent-subsidiary relationships.

33.6.1.1 Extract from FRS102: Section 33.5.

33.6.2 Disclosure of key management personnel compensation.

33.6.2.1 Extract from FRS102: Section 33.6 – Section 33.7.

33.6.2.2.1 Key management personnel defined.

33.6.2.2.2.1 Directors duties merely incidental and incurred by parent entity.

33.6.2.2.2.1.1 Possible disclosure in financial statements where directors duties are incidental

33.6.2.2.3 Sample key management personnel disclosure.

33.6.3 Disclosure of related party transactions.

33.6.3.1 Extract from FRS102: Section 33.8-33.14.

33.6.3.2.2 Rules on disclosure of items being on an arm’s length basis.

33.6.3.2.4 Examples of related parties to be disclosed.

33.6.3.2.5 Illustrations of the related parties required by Section 33.8 to 33.14 of FRS102.

[/et_pb_toggle][/et_pb_column][/et_pb_row][et_pb_row][et_pb_column type=”3_4″][et_pb_text admin_label=”Main Body Text” text_orientation=”justified” use_border_color=”off” border_color_all=”off” module_alignment=”left” _builder_version=”3.17.6″]

The below extracts and guidance is applicable for periods beginning before 1 January 2019 and are based on the September 2015 version of FRS 102. For periods beginning on or after 1 January 2019, the March 2018 version of FRS 102 applies which incorporates the changes made by the Triennial review of FRS 102. Note the March 2018 version of FRS 102 can be voluntarily applies for periods beginning before 1 January 2019. For the extracts from the March 2018 version of FRS 102 and the related guidance please click on the following link. For details of a summary of the main changes as a result of the triennial review please see the following link.

33.2 Exclusions from Section 33 Requirements – Wholly Owned Entities Within the Group

33.2.1 Extract from FRS102: Section 33.1A

33.1A Disclosures need not be given of transactions entered into between two or more members of a group, provided that any subsidiary which a party to the transaction is wholly owned by such a member.

33.2.2 OmniPro comment

Section 33.1A of FRS102 does not require disclosures of transactions any balances between wholly owned members within the group, however see application of the above exemption in the below examples. Under Company Law the notes to the financial statements are required to show the amounts owed to/from group companies and these need to be disclosed in aggregate (it does not require disclosure of transactions).

Example 1: Wholly owned group exemption

In the group below all entities within the group can avail of the exemption contained in Section 33.1A of FRS102 in each of the entity sets of financial statements. Although Subsidiary D is not 100% owned by either Subsidiary A or B, it is still owned 100% within the group. Therefore any transactions between Subsidiary A, Subsidiary B, Subsidiary C and Subsidiary D do not have to be disclosed.

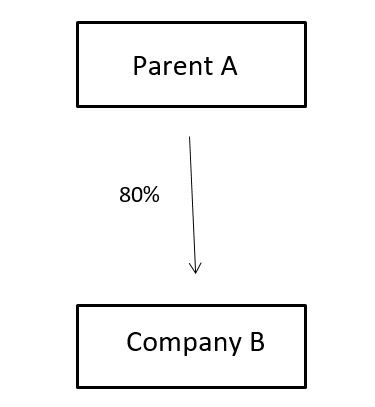

Example 2: Group exemption

The Section 33.1A of FRS102 exemption does not apply below as Parent A does not own 100% of Company B. Therefore, all transactions will need to be disclosed in Company B’s entity financial statements. In the parent consolidated financial statements the balances will be eliminated on consolidation so there are no issues.

[/et_pb_text][/et_pb_column][et_pb_column type=”1_4″][et_pb_toggle _builder_version=”3.0.106″ title=”Practical Examples” open=”off”]

Examples

Example 1: Wholly owned group exemption.

Example 3: Close family members.

Example 4: Close family members.

Example 5: entities are members of a group (Section 33.2(b)(I of FRS 102))

Example 7: Both entities are joint venture of the same third party (Section 33.2(b)(iii))

Example 10: Transactions with a subsidiary of a joint venture or associate.

Example 11: Pension funds (Section 33.2(b)(v)of FRS102)

Example 13: Extract from notes to the financial statements.

Example 14: Extract from notes to the financial statements.

Example 15: Extract from the notes to the financial statements.

[/et_pb_toggle][/et_pb_column][/et_pb_row][/et_pb_section]