[et_pb_section bb_built=”1″ admin_label=”Header – All Pages” transparent_background=”off” background_color=”#1e73be” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” custom_padding=”0px||0px|” next_background_color=”#000000″ custom_padding_tablet=”50px|0|50px|0″ custom_padding_last_edited=”on|desktop” global_module=”1221″][et_pb_row admin_label=”row” global_parent=”1221″ make_fullwidth=”off” use_custom_width=”off” width_unit=”on” use_custom_gutter=”off” custom_padding=”||5px|” allow_player_pause=”off” parallax=”off” parallax_method=”on” make_equal=”off” parallax_1=”off” parallax_method_1=”off” background_position=”top_left” background_repeat=”repeat” background_size=”initial”][et_pb_column type=”4_4″][et_pb_post_title global_parent=”1221″ title=”on” meta=”off” author=”on” date=”on” categories=”on” comments=”on” featured_image=”off” featured_placement=”below” parallax_effect=”on” parallax_method=”off” text_orientation=”left” text_color=”light” text_background=”off” text_bg_color=”rgba(255,255,255,0.9)” module_bg_color=”rgba(255,255,255,0)” use_border_color=”off” border_color=”#ffffff” border_style=”solid” custom_padding=”10px|||” parallax=”on” background_color=”rgba(255,255,255,0)” /][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section bb_built=”1″ fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” custom_padding=”30px||0px|” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” background_color=”#1e73be” prev_background_color=”#000000″ next_background_color=”#ffffff” custom_padding_tablet=”0px||0px|” global_module=”1228″][et_pb_row global_parent=”1228″ make_fullwidth=”off” use_custom_width=”off” width_unit=”on” use_custom_gutter=”off” custom_padding=”30px||0px|” allow_player_pause=”off” parallax=”off” parallax_method=”off” make_equal=”off” parallax_1=”off” parallax_method_1=”off” column_padding_mobile=”on” background_position=”top_left” background_repeat=”repeat” background_size=”initial”][et_pb_column type=”4_4″][et_pb_text global_parent=”1228″ background_layout=”light” text_orientation=”left” use_border_color=”off” border_color=”#ffffff” border_style=”solid” background_position=”top_left” background_repeat=”repeat” background_size=”initial”]

[breadcrumb]

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section bb_built=”1″ fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” gutter_width=”3″ custom_padding_tablet=”0px||0px|” custom_padding_last_edited=”on|desktop” prev_background_color=”#1e73be” next_background_color=”#000000″][et_pb_row][et_pb_column type=”4_4″][et_pb_toggle admin_label=”Index” _builder_version=”3.0.106″ title=”Index” open=”off”]

Contents

28.1.1 Extract from FRS102: Section 28.1.

28.2 General recognition principle for all employee benefits.

28.2.1 Extract from FRS102: Section 28.3-28.5.

28.3 Short-term employee benefits.

28.3.1.2 Example of Short term benefits.

28.4 Recognition and measurement: Short-term compensated absences.

28.4.1 Extract from FRS102: Section 28.6-28.7.

28.4.2.1 Accumulated compensation.

28.4.2.2 Holiday pay accrual examples.

28.4.3 No-accumulated compensation.

28.5 Recognition: Profit-sharing and bonus plans.

28.5.1 Extract from FRS102: Section 28.8.

28.6 Post-employment benefits: defined contribution plans.

28.6.1 Extract from FRS102: Section 28.9-28.10 and 29.13-28.13A.

28.6.2.1 Post employment benefit defined.

28.6.2.2 Defined contribution scheme – defined.

28.7 Multi-employer plans and state plans.

28.7.1 Extract from FRS102: Section 28.11-28.12.

28.7.2.1 Multi-Employer plans – defined.

28.7.2.3.1 Entity’s portion of the pension assets/liabilities can subsequently be determined.

28.8 Post-employment benefits: Defined benefit plans – recognition.

28.8.1 Extract from FRS102: Section 28.10(b) and Section 28.14.

28.8.2.1 Defined benefit scheme.

28.8.2.2 Method for calculating the defined benefit plan asset and liabilities.

28.8.2.2.1 Sample journal entries for a defined benefit plan.

28.9 Measurement of the net defined benefit liability.

28.9.1 Extract from FRS102: Section 28.15, 28.15A and 28.22.

28.9.2.1.1 Defined benefit asset net deemed to be recoverable.

28.9.2.3 Determining the figure to use from the actuarial report and the related accounting.

28.10 Inclusion of both vested and unvested benefits.

28.10.1 Extract from FRS102: Section 28.16.

28.11.1 Extract from FRS102: Section 28.17.

28.12 Actuarial valuation method.

28.12.1 Extract from FRS102: Section 28.18-28.20.

28.12.2.1 The valuation method and who can perform valuation.

28.12.2.2 Illustration of projected unit credit method.

28.13 Plan introductions, changes, curtailments and settlements.

28.13.1 Extract from FRS102: Section 28.21-28.21A.

28.13.2.1 Definition of a settlement and the accounting treatment.

28.13.2.2 Definition of a curtailment and accounting treatment.

28.14 Cost of a defined benefit plan.

28.14.1 Extract from FRS102: Section 28.23.

28.14.2.1 What costs get recognised in in the profit and loss account.

28.14.2.2 What costs get recognised in other in other comprehensive income.

28.14.3 Employer contributions.

28.15 Net interest cost –defined benefit plan.

28.15.1 Extract from FRS102: Section 28.24-28.24B.

28.16 Remeasurement of the net defined benefit liability.

28.16.1 Extract from FRS102: Section 28.25-28.27.

28.17.1 Extract from FRS102: Section 28.28.

28.18 Other long-term employee benefits.

28.18.1 Extract from FRS102: Section 28.29-28.30.

28.18.2.1 Example of other long term employee benefits.

28.18.2.2 Accounting requirements.

28.19.1 Extract from FRS102: Section 28.31-28.37.

27.19.2.1 Termination benefit defined.

28.19.2.2 Terminating payment included in contract.

28.20 Group defined benefit plans.

28.20.1 Extract from FRS102: Section 28.38.

28.21 Deferred tax and pension schemes.

28.21.1 Deferred tax on the defined benefit pension scheme liability/asset

28.21.2 Deferred tax on the defined contribution pension scheme.

28.22.1 Disclosures about short-term employee benefits.

28.22.1.1 Extract from FRS102: Section 28.39.

28.22.2 Disclosures – defined contribution plans.

28.22.2.1 Extract from FRS102: Section 28.40-28.40A.

28.22.2.2.1.1 Accounting policies.

28.22.2.2.1.1.1 Employee benefits.

28.22.2.2.1.2 Notes to the financial statements.

28.22.3 Disclosures – defined benefit plans.

28.22.3.1 Extract from FRS102: Section 28.41-28.41A.

28.22.3.2.1 Accounting policies.

28.22.3.2.2 Notes to the financial statements.

28.22.3.2.3 Extract from other comprehensive income showing actual gain/loss.

28.22.4 Disclosures about other long-term benefits.

28.22.4.1 Extract from FRS102: Section 28.42-28.44.

[/et_pb_toggle][/et_pb_column][/et_pb_row][et_pb_row][et_pb_column type=”3_4″][et_pb_text admin_label=”Main Body Text” text_orientation=”justified” use_border_color=”off” border_color_all=”off” module_alignment=”left” _builder_version=”3.17.6″]

28.9 Measurement of the net defined benefit liability

28.9.1 Extract from FRS102: Section 28.15, 28.15A and 28.22

28.15 An entity shall measure the net defined benefit liability for its obligations under defined benefit plans at the net total of the following amount

(a) the present value of its obligations under defined benefit plans (its defined benefit obligation) at the reporting date (paragraphs 28.16 to 28.21A provide guidance for measuring this obligation); minus

(b) the fair value at the reporting date of plan assets (if any) out of which the obligations are to be settled. Paragraphs 11.27 to 11.32 establish requirements for determining the fair values of those plan assets, except that, if the asset is an insurance policy that exactly matches the amount and timing of some or all of the benefits payable under the plan, the fair value of the asset is deemed to be the present value of the related obligation.

28.15A Where an entity has measured its defined benefit obligation using the projected unit credit method (including the use of appropriate actuarial assumptions), as set out in paragraph 28.18, it shall not recognise any additional liabilities to reflect differences between these assumptions and those used for the most recent actuarial valuation of the plan for funding purposes. For the avoidance of doubt, no additional liabilities shall be recognised in respect of an agreement with the defined benefit plan to fund a deficit (such as a schedule of contributions).

28.22 If the present value of the defined benefit obligation at the reporting date is less than the fair value of plan assets at that date, the plan has a surplus. An entity shall recognise a plan surplus as a defined benefit plan asset only to the extent that it is able to recover the surplus either through reduced contributions in the future or through refunds from the plan.

28.9.2 OmniPro comment

28.9.2.1 Measurement

Section 28.15 of FRS 102 makes it clear that future costs and income should be present valued. The amount recognised on the balance sheet is the net of the future pension liabilities present valued less the fair value of the pension plan assets.

As per section 28.15A of FRS 102 any contributions to fund a deficit are not required to be accounted for separately as these will already be reflected in the net pension liability under the projected unit credit method (as discussed at 28.11.2)The is no maximum on the value of liabilities to be recognised in the balance sheet. However any surplus asset should only be recognised where it can be shown that it will be able to recover the surplus either through reduced contributions in the future or through refunds from the plan as stated in Section 28.22 of FRS 102.

28.9.2.1.1 Defined benefit asset net deemed to be recoverable

If the net defined pension asset is not deemed to be recoverable then the movement for that element would be recognised through other comprehensive income as stated in Section 28.25 of FRS 102.

There is no requirement that there is a formal signed agreement with the trustees in relation to the reduction in future contributions or a refund, instead it can be recognised on the balance sheet if it can show that it is able to realise future economic benefits at some point in the future or whether this is when the pension scheme ends.

28.9.2.2 Deferred tax

Section 29 of FRS 102 requires a deferred tax asset/liability to be recognised on the net pension liability/benefit however, this should not be netted against the net pension liability/asset, it should be included within deferred tax on the balance sheet. See further discussion of deferred tax at 29.4.2.4.1.8.8

See example below of the points in the Sections 28.15 to 28.22 of FRS 102

28.9.2.3 Determining the figure to use from the actuarial report and the related accounting

Example 10: Calculating the net defined benefit asset/liability

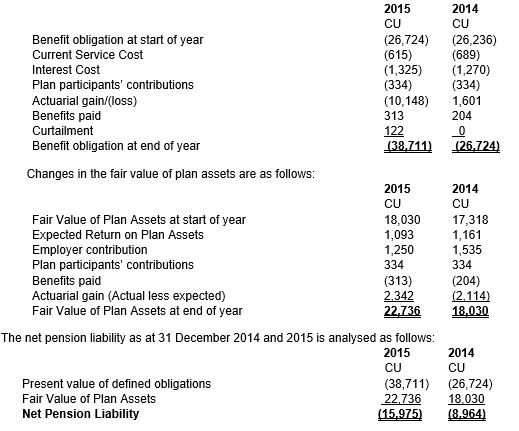

See below extract from an actuarial report detailing the movement in the plan assets during the year. See below the way in which this will be presented in the financial statements and the journals required to reflect these movements. Assume the prior year discount rate was 3.49% and the 2015 discount rate is 2.6%:

Changes in the present value of the defined benefit obligation are as follows:

See below the journals required in the entity’s financial statements assuming a deferred tax rate of 10%. How each of the main figures are determined is discussed in the sections that follow.

Example 11: Calculating the net defined benefit asset/liability

If in the above example this was a net defined benefit asset, then this asset could only be recognised where the company can reduce the future contributions or alternatively receive a refund, As stated in Section 28.15 of FRS 102 it must be certain that the refund or reduction of future pension benefits will occur. If the asset was not deemed to be recoverable, that element would be posted through other comprehensive income as per Section 28.25 of FRS 102

[/et_pb_text][/et_pb_column][et_pb_column type=”1_4″][et_pb_toggle _builder_version=”3.0.106″ title=”Practical Examples” open=”off”]

Examples

Example 1: Holiday pay accrual – carry forward of holiday leave including payment on leaving.

Example 2: Holiday pay accrual.

Example 3: Holiday pay accrual – no cash payment for untaken holidays on leaving.

Example 4: Holiday year differs to accounting year.

Example 5: Holiday year differs to accounting year.

Example 8: Defined contribution scheme.

Example 9: Defined benefit plan.

Example 10: Calculating the net defined benefit asset/liability.

Example 11: Calculating the net defined benefit asset/liability.

Example 12: Non-vesting conditions.

Example 13: Projected unit credit method.

Example 18: Other long term employee benefits.

Example 19: Termination benefits – Forced and voluntary redundancy.

Example 20: Recognising deferred tax.

Example 22: Extract from notes to the financial statements.

Example 23: Extract from the accounting policy notes and notes to the financial statements.

Example 24: Extract from the notes to the financial statements.

Example 26: Extract from notes to the financial statements.

[/et_pb_toggle][/et_pb_column][/et_pb_row][/et_pb_section]