[et_pb_section admin_label=”Header – All Pages” global_module=”1221″ transparent_background=”off” background_color=”#1e73be” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” gutter_width=”3″ custom_padding=”||0px|”][et_pb_row global_parent=”1221″ admin_label=”row”][et_pb_column type=”4_4″][et_pb_post_title global_parent=”1221″ admin_label=”Post Title” title=”on” meta=”off” author=”on” date=”on” categories=”on” comments=”on” featured_image=”off” featured_placement=”below” parallax_effect=”on” parallax_method=”on” text_orientation=”left” text_color=”light” text_background=”off” text_bg_color=”rgba(255,255,255,0.9)” module_bg_color=”rgba(255,255,255,0)” title_all_caps=”off” use_border_color=”off” border_color=”#ffffff” border_style=”solid” title_font=”|on|||” title_font_size=”35″ custom_padding=”10px|||”] [/et_pb_post_title][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” global_module=”1228″ fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” custom_padding=”0px||0px|” padding_mobile=”on” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” gutter_width=”3″][et_pb_row global_parent=”1228″ admin_label=”Row” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” use_custom_gutter=”off” gutter_width=”3″ custom_padding=”0px||0px|” padding_mobile=”off” allow_player_pause=”off” parallax=”off” parallax_method=”off” make_equal=”off” parallax_1=”off” parallax_method_1=”off” column_padding_mobile=”on”][et_pb_column type=”4_4″][et_pb_text global_parent=”1228″ admin_label=”Text” background_layout=”light” text_orientation=”left” text_font_size=”14″ use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [breadcrumb] [/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” fullwidth=”off” specialty=”off”][et_pb_row admin_label=”Row”][et_pb_column type=”1_2″][et_pb_text admin_label=”Text” background_layout=”light” text_orientation=”center” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [button link=”https://ie.frs102.com/members/premium-toolkit/” type=”big” color=”red”] Return to Main Index[/button] [/et_pb_text][/et_pb_column][et_pb_column type=”1_2″][et_pb_text admin_label=”Text” background_layout=”light” text_orientation=”center” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [button link=”https://ie.frs102.com/members/premium-toolkit/section-20/” type=”big” color=”red”] Return to Section 20 Home[/button] [/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” gutter_width=”3″][et_pb_row admin_label=”Row”][et_pb_column type=”4_4″][et_pb_text admin_label=”Main Body Text” background_layout=”light” text_orientation=”justified” use_border_color=”off” border_color=”#ffffff” border_style=”solid”]

Disclosures

Extract from FRS 102 – Section 20.30

Disclosures for operating leases – Lessors

20.30 A lessor shall disclose the following for operating leases:

(a) the future minimum lease payments under non-cancellable operating leases for each of the following periods:

(i) not later than one year;

(ii) later than one year and not later than five years; and

(iii) later than five years;

(b) total contingent rents recognised as income; and

(c) a general description of the lessor’s significant leasing arrangements, including, for example, information about contingent rent, renewal or purchase options and escalation clauses, and restrictions imposed by lease arrangements. 20.31 In addition, the requirements for disclosure about assets in accordance with Sections 17 and 27 apply to lessors for assets provided under operating leases.

OmniPro comment

See below illustration of the above points.

Example 10: Extract from an accounting policy note and the related disclosures – Operating Lease Lessors

Leases

(i) Operating leases

Leases in which substantially all the risks and rewards of ownership are retained by the lessor are classified as operating leases. Payments received under operating leases (net of any incentives provided to the lessee) are credited to profit or loss on a straight-line basis over the period of the lease.

(ii) Lease incentives

Incentives received to enter into a finance lease reduce the fair value of the asset and are included in the calculation of present value of future minimum lease payments.

Incentives received to enter into an operating lease are debited to the profit and loss account, to reduce the lease income, on a straight-line basis over the period of the lease.

Extract from notes to the financial statements

Commitments

At 31 December 2015, the company had the following annual receipts under non-cancellable operating leases that expire as follows:

|

|

2015 |

2014 |

|

|

CU |

CU |

|

Within one year |

145,000 |

145,000 |

|

Within two to five years |

100,000 |

100,000 |

|

Greater than five years |

– |

– |

Disclosures – Operating leases for lessees

Extract from FRS 102 – Section 20.16

20.16 A lessee shall make the following disclosures for operating leases:

(a) the total of future minimum lease payments under non-cancellable operating leases for each of the following periods:

(i) not later than one year;

(ii) later than one year and not later than five years;

AND

(iii) later than five years; and

(b) lease payments recognised as an expense.

Extract from FRS 102 Section 20.35

20.35 Disclosure requirements for lessees and lessors apply equally to sale and leaseback transactions. The required description of significant leasing arrangements includes description of unique or unusual provisions of the agreement or terms of the sale and leaseback transactions.

OmniPro comment

See below for application of these requirements. These differ from old GAAP as the total lease payments are required to be disclosed. Note it is the actual payments that are disclosed. The release of the lease incentive is ignored if applicable.

Example 11: Extract from an accounting policy note operating leases for lessees and related disclosure notes

Leases

(i) Operating leases

Leases in which substantially all the risks and rewards of ownership are retained by the lessor are classified as operating leases. Payments made under operating leases (net of any incentives received from the lessor) are charged to profit or loss on a straight-line basis over the period of the lease.

(ii) Lease incentives

Incentives received to enter into a finance lease reduce the fair value of the asset and are included in the calculation of present value of future minimum lease payments.

Incentives received to enter into an operating lease are credited to the profit and loss account, to reduce the lease expense, on a straight-line basis over the period of the lease.

Extract from notes to the financial statements

- Operating Profit

Operating profit is stated after charging:

|

|

2015 |

2014 |

|

|

CU |

CU |

|

Depreciation |

149,999 |

170,037 |

|

Directors’ remuneration: |

212,000 |

225,600 |

|

Impairment of assets/goodwill |

– |

– |

|

Profit of disposal of fixed assets |

– |

– |

|

Rentals under operating leases net of lease incentives |

– |

– |

|

Auditors’ remuneration |

|

|

|

Audit |

13,000 |

13,000 |

|

Non audit services |

3,000 |

3,000 |

|

Tax Advisory |

3,225 |

3,225 |

Commitments

At 31 December 2015, the company had the following commitments under non-cancellable operating leases that expire as follows:

|

|

2015 |

2014 |

|

|

CU |

CU |

|

Within one year |

145,000 |

145,000 |

|

Within two to five years |

100,000 |

100,000 |

|

Greater than five years |

– |

– |

Disclosures – financial statements of lessees: finance leases

Extract from FRS 102 – Section 20.13- 20.14

20.13 A lessee shall make the following disclosures for finance leases:

(a) for each class of asset, the net carrying amount at the end of the reporting period;

(b) the total of future minimum lease payments at the end of the reporting period, for each of the following periods:

(i) not later than one year;

(ii) later than one year and not later than five years; and

(iii) later than five years;

AND

(c) a general description of the lessee’s significant leasing arrangements including for example, information about contingent rent, renewal or purchase options and escalation clauses, subleases, and restrictions imposed by lease arrangements.

20.14 In addition, the requirements for disclosure about assets in accordance with Sections 17 and 27 apply to lessees for assets leased under finance leases.

OmniPro comment

See application of the disclosures in the examples below

Example 12: Extract from an accounting policy note and related disclosures for financial statements of lessees: finance leases

(a) Leases

Finance leases

Leases in which substantially all the risks and rewards of ownership are transferred by the lessor are classified as finance leases.

Tangible fixed assets acquired under finance leases are capitalised at the lease’s commencement at the lower of the fair value of the leased property and the present value of the minimum lease payments and are depreciated over the shorter of the lease term and their useful lives. The capital element of the lease obligation is recorded as a liability and the interest element of the finance lease rentals is charged to the profit and loss account on an annuity basis.

Each lease payment is apportioned between the liability and finance charges using the effective interest method

Extract from notes to the financial statements

TRADE AND OTHER PAYABLES <1 YEAR

|

|

2015 |

2014 |

|

|

CU |

CU |

|

Trade creditors |

708,675 |

475,652 |

|

Other creditors and accruals |

259,551 |

284,139 |

|

Bank Loans and overdrafts |

1,066,950 |

2,078,451 |

|

Finance Lease |

85,198 |

39,933 |

|

Corporation tax due |

280,351 |

64,812 |

|

Other Taxation and Social Security |

25,665 |

26,245 |

|

Deferred Tax |

7,481 |

4,625 |

|

|

2,433,871 |

2,973,863 |

TRADE AND OTHER PAYABLES >1 YEAR

|

|

2015 |

2014 |

|

|

CU |

CU |

|

Bank Loans |

1,903,810 |

2,30125 |

|

Warranty obligation |

65,000 |

– |

|

Finance lease |

147,400 |

– |

|

8% Preference Shares |

104,000 |

– |

|

Share appreciation rights |

15,000 |

– |

|

|

2,235,210 |

2,130,125 |

|

Hire purchase contracts – maturity and security |

2015 |

2014 |

|

|

CU |

CU |

|

Future minimum payments under hire purchase agreements are as follows: |

|

|

|

|

|

|

|

In one year or less |

14,049 |

13,000 |

|

In more than one year, but not more than five years In greater than 5 years |

5,136 – |

4,200 –

|

|

Total gross payments |

19,185 |

16,200 |

|

Less hire purchase charges included above |

(1,329) |

(1,000) |

|

|

17,856 |

15,200 |

Note to be included under the tangible fixed asset note

The following assets were held under finance lease:

|

|

2015 |

|

2014 |

|

|

CU |

|

CU |

|

Net Book Value |

66,884 |

|

129,389 |

|

Depreciation Charge for the Year |

29,015 |

|

31,317 |

Disclosures – financial statements of lessors: finance leases

Extract from FRS 102 – Section 20.23

20.23 A lessor shall make the following disclosures for finance leases:

(a) a reconciliation between the gross investment in the lease at the end of the reporting period, and the present value of minimum lease payments receivable at the end of the reporting period. In addition, a lessor shall disclose the gross investment in the lease and the present value of minimum lease payments receivable at the end of the reporting period, for each of the following periods:

(i) not later than one year;

(ii) later than one year and not later than five years;

AND

(iii) later than five years;

(b) unearned finance income;

(c) the unguaranteed residual values accruing to the benefit of the lessor;

(d) the accumulated allowance for uncollectible minimum lease payments receivable;

(e) contingent rents recognised as income in the period; and

(f) a general description of the lessor’s significant leasing arrangements, including, for example, information about contingent rent, renewal or purchase options and escalation clauses, subleases, and restrictions imposed by lease arrangements.

OmniPro comment

See application of the disclosures in the examples below

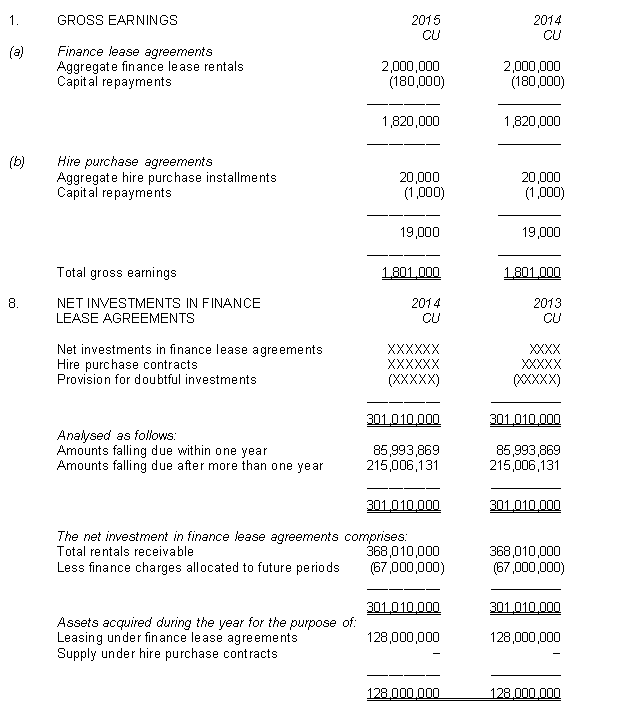

Example 13: Extract from an accounting policy note and related disclosures for financial statements of lessors: finance leases

Gross earnings

Gross earnings comprises the finance charge element of lease rentals, the profit or loss generated on the termination of lease agreements and administration fees pertaining to lease agreements. Gross earnings are stated net of trade rebates and trade discounts, and exclusive of value added tax.

Finance lease and hire purchase agreements

Finance charges are allocated to periods so as to give a constant rate of return on the net cash investment in the lease. The total net investment included in the balance sheet represents total lease payments receivable, net of finance charges relating to future periods. Bad debts are charged to the profit and loss account in the period in which they occur. Recoveries of bad debts previously charged to the profit and loss account are credited to the profit and loss account upon recovery of the bad debt. The net investment in finance lease and hire purchase agreements is stated net of a bad and doubtful debt provision.

Extract from notes to the financial statements

All of the assets were acquired from other group undertakings. Assets relating to agreements terminated during the first three years of the primary term, for reasons other than upgrade or settlement, are the subject of a ‘buyback’ agreement. The buyback value is dependent on the age of the asset and is calculated as a percentage of the capital value of the asset. The residual value is assumed to be nil at the end of the lease term.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]