[et_pb_section bb_built=”1″ admin_label=”Header – All Pages” transparent_background=”off” background_color=”#1e73be” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” custom_padding=”0px||0px|” next_background_color=”#000000″ custom_padding_tablet=”50px|0|50px|0″ custom_padding_last_edited=”on|desktop” global_module=”1221″][et_pb_row admin_label=”row” global_parent=”1221″ make_fullwidth=”off” use_custom_width=”off” width_unit=”on” use_custom_gutter=”off” custom_padding=”||5px|” allow_player_pause=”off” parallax=”off” parallax_method=”on” make_equal=”off” parallax_1=”off” parallax_method_1=”off” background_position=”top_left” background_repeat=”repeat” background_size=”initial”][et_pb_column type=”4_4″][et_pb_post_title global_parent=”1221″ title=”on” meta=”off” author=”on” date=”on” categories=”on” comments=”on” featured_image=”off” featured_placement=”below” parallax_effect=”on” parallax_method=”off” text_orientation=”left” text_color=”light” text_background=”off” text_bg_color=”rgba(255,255,255,0.9)” module_bg_color=”rgba(255,255,255,0)” use_border_color=”off” border_color=”#ffffff” border_style=”solid” custom_padding=”10px|||” parallax=”on” background_color=”rgba(255,255,255,0)” /][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section bb_built=”1″ fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” custom_padding=”30px||0px|” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” background_color=”#1e73be” prev_background_color=”#000000″ next_background_color=”#ffffff” custom_padding_tablet=”0px||0px|” global_module=”1228″][et_pb_row global_parent=”1228″ make_fullwidth=”off” use_custom_width=”off” width_unit=”on” use_custom_gutter=”off” custom_padding=”30px||0px|” allow_player_pause=”off” parallax=”off” parallax_method=”off” make_equal=”off” parallax_1=”off” parallax_method_1=”off” column_padding_mobile=”on” background_position=”top_left” background_repeat=”repeat” background_size=”initial”][et_pb_column type=”4_4″][et_pb_text global_parent=”1228″ background_layout=”light” text_orientation=”left” use_border_color=”off” border_color=”#ffffff” border_style=”solid” background_position=”top_left” background_repeat=”repeat” background_size=”initial”]

[breadcrumb]

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section bb_built=”1″ fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” gutter_width=”3″ custom_padding_tablet=”0px||0px|” custom_padding_last_edited=”on|desktop” prev_background_color=”#1e73be” next_background_color=”#000000″][et_pb_row][et_pb_column type=”4_4″][et_pb_toggle admin_label=”Index” _builder_version=”3.0.105″ title=”Section 1A – Index” open=”off”]

1A.1.1 Extract from FRS102: Section 1A.1-1A.4

1A.2.1 Section 1A – As applicable to the republic of Ireland

1A.2.1.2 Which companies can avail of Section 1A/Small Company’s regime?

1A.2.1.3 What remains the same?

1A.2.2 Section 1A and UK Companies

1A2.3 Choice to apply section 1A of FRS 102

1A.3.1 Extract from FRS102: Section 1A.5-.1A.6

1A.3.2 OmniPro comment – True and fair view

1A.4 Complete set of financial statements of a small entity

1A.4.1 Extract from FRS102: Section 1A.7-1A.11, Section 1AD.1 and Section 1A.16-1A.20

1A.4.2.1 What Section 1 means in practical terms?

1A.4.2.2 The minimum disclosure requirements and the requirements to still show a true and fair view

1A.4.2.3 Disclosure encouraged under S.1A

1A.4.2.4 Formats of Balance Sheet and profit and Loss Account

1A5 Information to be presented in the statement of financial position

1A5.1 Extract from FRS102: Section 1A.12-1A.13

1A6 Information to be presented in the income statement

1A6.1 Extract from FRS102: Section 1A.14-1A.15

1A7 Voluntary preparation of consolidated financial statements

1A7.1 Extract from FRS102: Section 1A.21-1A.22

1A8.1.1 Guidance on adapting the balance sheet formats

1A8.1.1.1 Extract from FRS102: Section 1AA.1

1A8.1.1.2.2 Required formats for entities

1A8.1.1.2.2.2 Format 1 – Balance sheet – set out in legislation – Schedule 3A

1A8.1.1.2.2.3: Format 2 – balance sheet – set out in legislation – Schedule 3A

1A8.1.1.2.2.4 Example – Format 1 – Balance sheet – practical application

1A8.1.1.2.2.5 Notes required to balance sheet

1A8.2.1 Abridged balance sheet

1A8.2.1.1 Extract from FRS102: Section 1AA.2

1A8.3.1.1 Extract from FRS102: Section 1AA.3-1AA.6

1A8.3.1.2.2 Example adapted/IFRS layout – Balance sheet

1A9.1.1 Guidance on adapting the profit and loss account formats

1A9.1.1.1 Extract from FRS102: Section 1AB.1

1A9.1.1.2.2 Application of format 1 profit and loss account set out in legislation

1A9.1.1.2.3 Application of format 2 – profit and loss account set out in legislation

1A9.1.1.2.4 Example format 1 – profit and loss account.

1A9.1.1.2.5 Notes required to profit and loss account at a minimum

1A9.9.1.2.5.1 Consolidated profit and loss note requirements

1A9.2 Abridged Profit and Loss Account

1A9.2.1 Extract from FRS102: Section 1AB.2

1A9.3 Adapted Profit and Loss Account

1A9.3.1 Extract from FRS102: Section 1AB.3-1AB.4

1A9.3.2.2: Example adapted/IFRS layout on the profit and loss accounts

1AC10 Appendix C to Section 1A (Applicable for UK entities)

1AC10.1 Disclosure requirements for small entities

1AC10.1.1 Extract from FRS102: Section 1AC.1-1AC.2

1A10.1.2.2 What entities must comply with Appendix C

1AC10.2.1 Extract from FRS102: Section 1AC.3-1AC.

1AC10.2.2.1.1 Accounting police disclosure

1AC10.2.2.1.1.2 Basis of preparation

1AC10.2.2.1.1.4 Basis of consolidation (if applicable)

1AC10.2.2.1.4.1 Subsidiary undertakings

1AC10.2.2.1.1.4.2 Associates and joint ventures

1AC10.2.2.1.1.5 Business combinations and goodwill [if applicable]

1AC10.2.2.1.1.8 Intangible assets

1AC10.2.2.1.1.9 Contingent acquisition consideration

1AC10.2.2.1.1.10 Financial assets

1AC10.2.2.1.1.11 General turnover accounting policy notes

1AC10.2.2.1.1.11.2 Turnover accounting policy for an insurance broker Turnover – commission income

1AC10.2.2.1.1.11.4 Turnover accounting policy note where turnover is derived from investments

1AC.10.2.2.1.1.11.5 Turnover accounting policy for a software

1AC10.2.2.1.1.11.6 Turnover accounting policy for a construction company

1AC10.2.2.1.1.12 Government grants

1AC10.2.2.1.1.12.1 Accruals model

1AC10.2.2.1.1.12.2 Performance model

1AC10.2.2.1.1.13 Dividend income

1AC10.2.2.1.1.14 Dividend distribution

1AC10.2.2.1.1.16 Financial instruments

1AC10.2.2.1.1.16.1 Trade and other debtors

1AC10.2.2.1.1.16.2 Cash and cash equivalents.

1AC10.2.2.1.1.16.3 Other financial assets.

1AC10.2.2.1.1.16.4 Trade and other creditors.

1AC10.2.2.1.1.16.7 Offsetting financial instruments.

1AC10.2.2.1.1.17 Compound financial instruments.

1AC10.2.2.1.1.19 Hedge accounting

1AC10.2.2.1.1.20.1 Environmental liabilities

1AC10.2.2.1.1.20.2 Closure costs

1AC10.2.2.1.1.21 Contingencies

1AC10.2.2.1.1.22 Employee Benefits

1AC10.2.2.1.1.23 Preference share capital

1AC10.2.2.1.1.24 Share capital

1AC10.2.2.1.1.25 Related party transactions

1AC10.2.2.1.1.26 Interest income

1AC10.2.2.1.1.28 Tangible fixed assets

1AC10.2.2.1.1.30 Investment properties

1AC10.2.2.1.1.31.1 Finance leases

1AC10.2.2.1.1.31.2 Operating leases

1AC10.2.2.1.1.31.3 Lease incentives

1AC10.2.2.1.1.32 Leasing company accounting policy

1AC10.2.2.1.1.33 Intangible assets

1AC10.2.2.1.1.35 Exceptional items

1AC10.2.2.1.1.36 Share based costs

1AC10.2.2.1.1.37 Investment properties

1AC10.2.2.1.1.38 Biological assets (where fair value is used)

1AC10.2.2.1.1.39 Biological assets – Livestock (where fair value model is adopted)

1AC10.2.2.1.1.40 Biological assets – Forestry (where cost model is adopted)

1AC10.2.2.1.1.41 Biological assets – Livestock (where cost model is adopted)

1AC10.3 Changes in presentation and accounting policies and corrections of prior period errors

1AC10.3.1 Extract from FRS102: Section 1AC.7-1AC.9

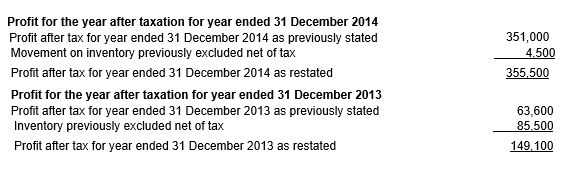

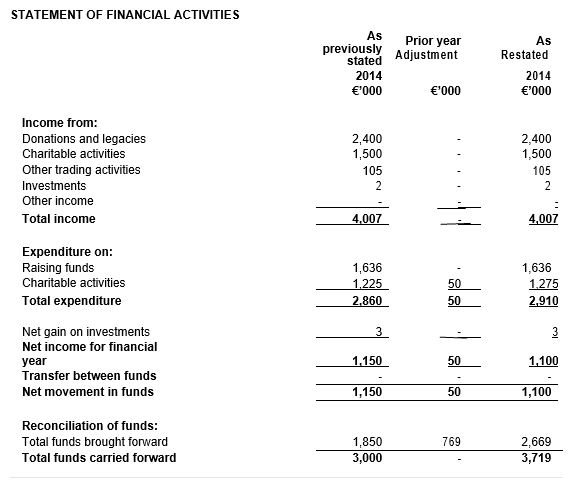

1AC10.3.2.2. Prior period adjustment disclosure

1AC10.3.2.2.1 Option 1 – Analysis of prior period adjustments

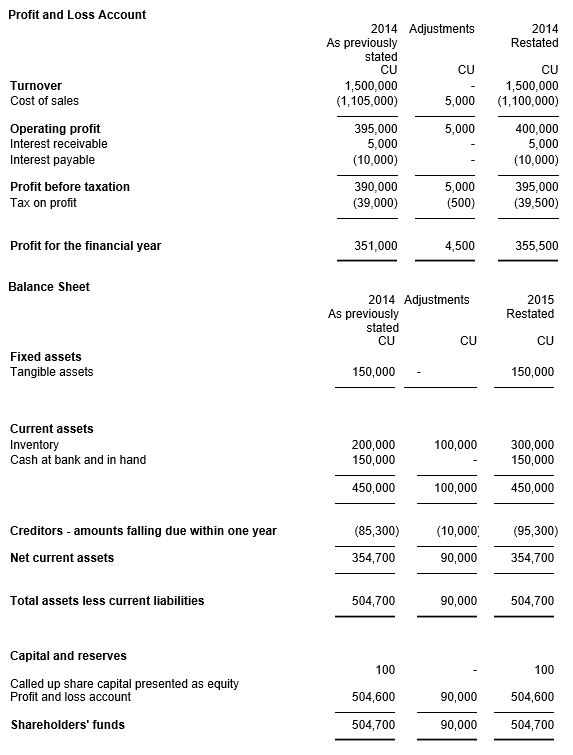

1AC10.3.2.2.2 Option 2: Analysis of prior period adjustments

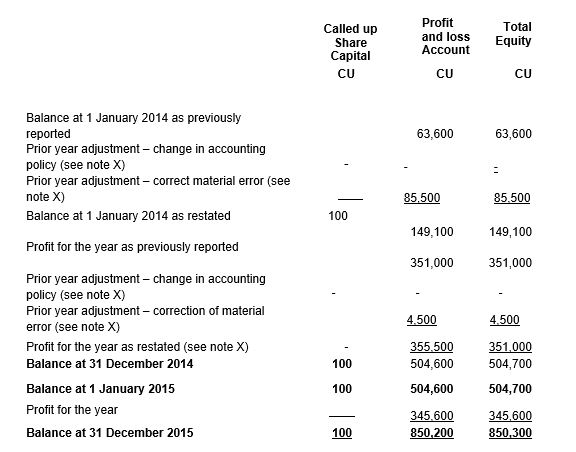

1AC10.3.2.2.2.3 Profit and Loss reserves note/statement of changes in equity

1AC10.3.2.2.3 Statement in changes in equity note – prior period error/change in accounting policy

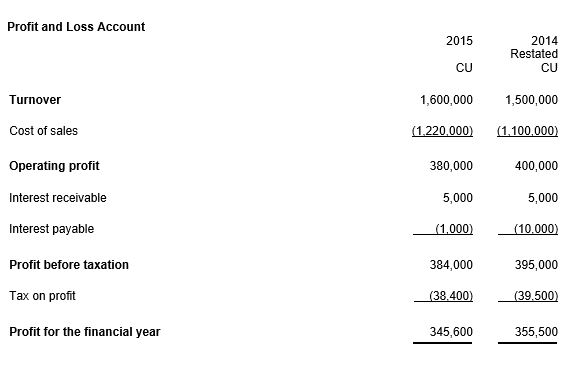

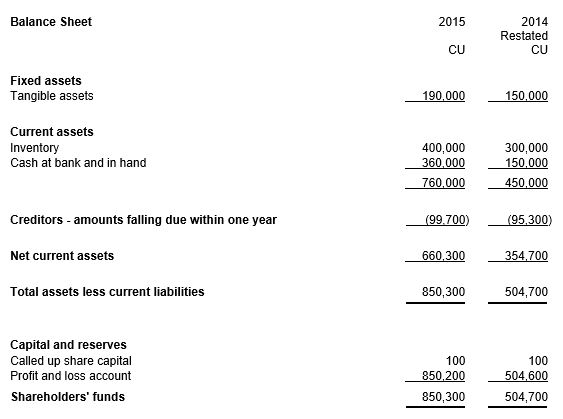

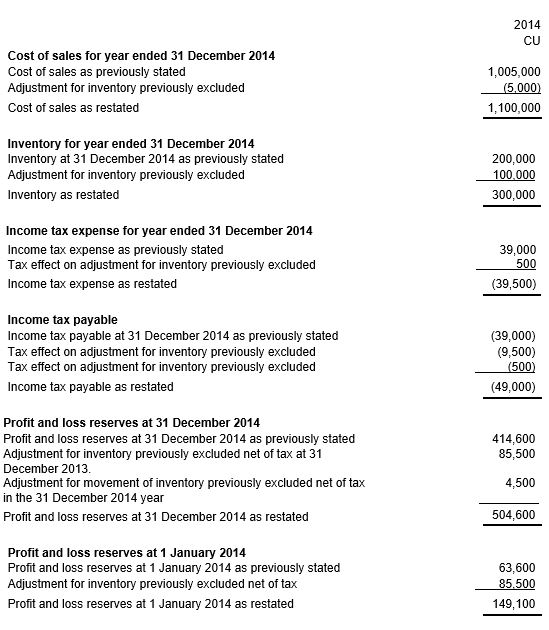

1AC10.3.2.2.4 Illustration of change in accounting policy disclosure

1AC10.3.2.2.4.1 Example extract of a change in accounting policy disclosure

1AD11.3.2.5 Change in classification from prior period

1AC10.4 True and fair override

1AC10.4.1 Extract from FRS102: Section 1AC.10

1AC10.5 Notes supporting the statement of financial position

1AC10.5.1 Extract from FRS102: Section 1AC.11-1AC.19

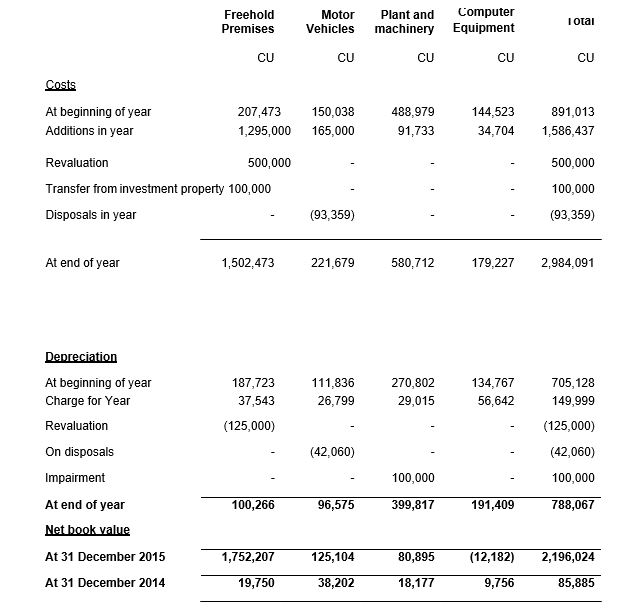

1AC10.5.2.1 Property, plant and equipment/tangible fixed assets. Including revaluation

1AC 10.5.2.1.1 Borrowing costs

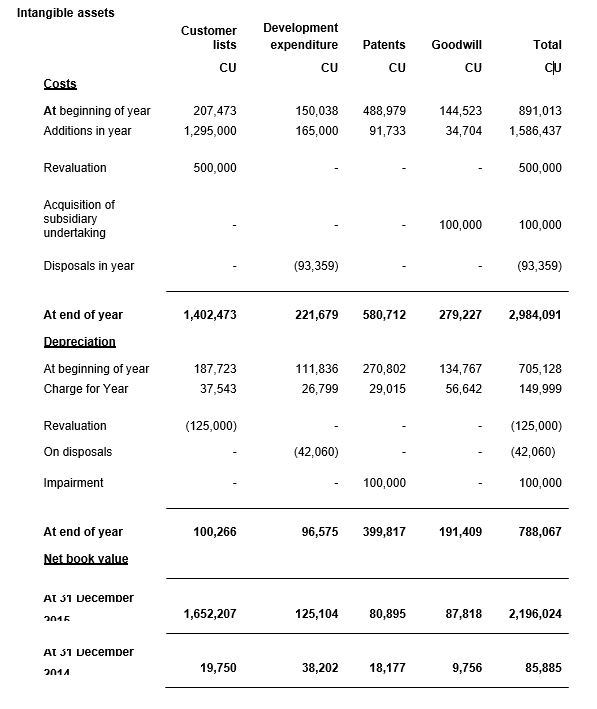

1AC10.5.2.2 Intangible assets including revaulation

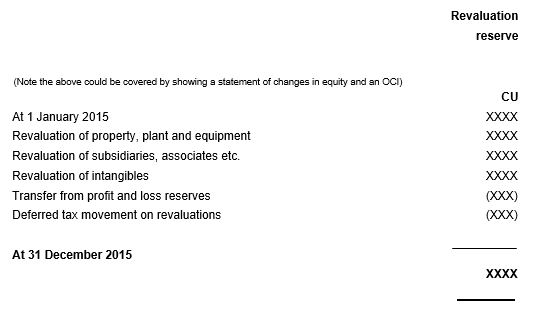

1AC10.5.2.4 Illustration of the revaluation reserve disclosures.

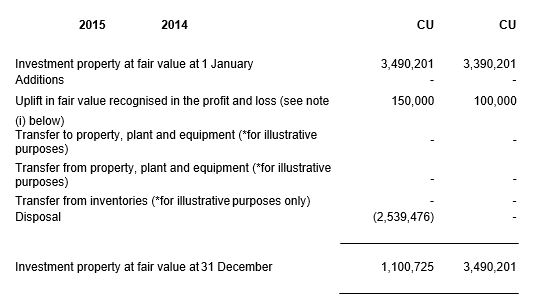

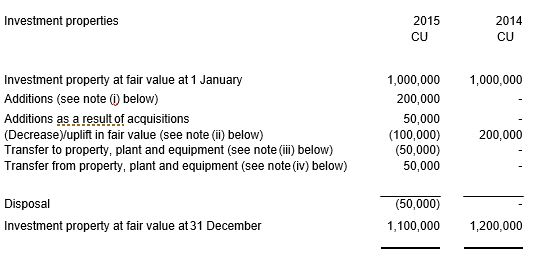

1AC10.5.2.5 Investment properties note

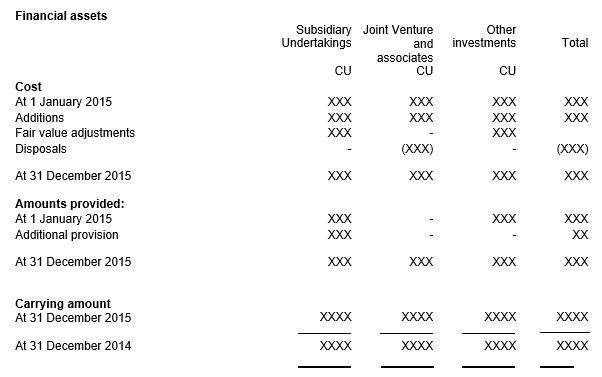

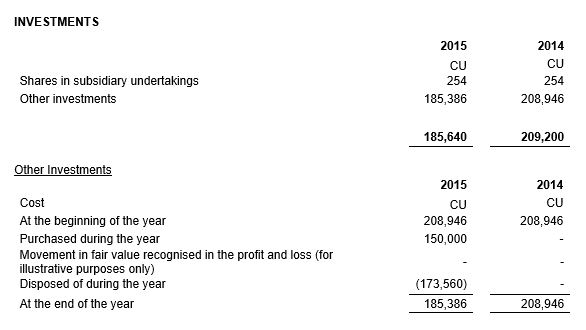

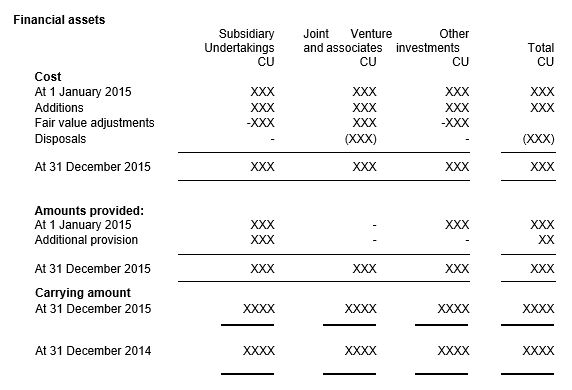

1AC10.5.2.6 Alternative layout for the investments note and illustration of financial assets

1AC10.6 Details of indebtness and securities held (if any) 91

1AC10.6.2 Extract from FRS 102: Section 1AC.27

1AC10.7.1 Extract from FRS102: Section 1AC.20-1AC.21

1AC10.8 Fair value measurement

1AC10.8.1 Extract from FRS102: Section 1AC.22-Section 1AC.24 and section 1AC.26

1AC10.8.2.2 Extract from the notes to the financial statements – note on investment property

1AC10.8.2.3 Investment note with investment in subsidiary, joint ventures and other investments

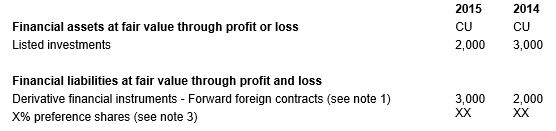

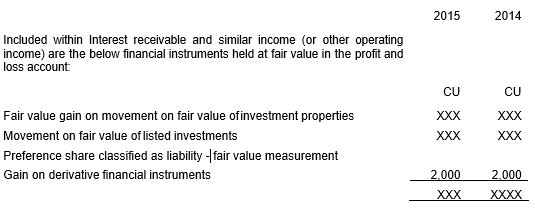

1AC10.8.2.4 Extract of notes to the financial statements – Financial instruments note disclosures

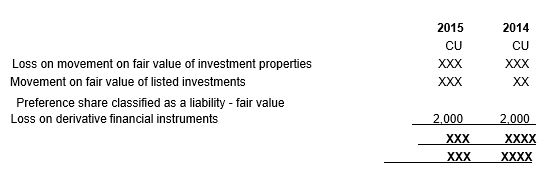

1AC10.8.2.4.1 Extract of notes to the financial statements – Interest receivable and similar income

1AC 8.2.4.2 Extract of notes to the financial statements – interest payable and similar expenses

1AC10.8.2.4.3 Alternative disclosure for profit and loss

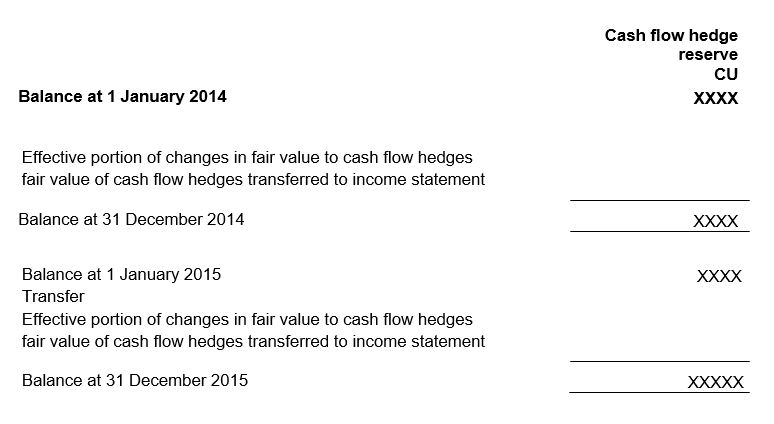

1AC10.8.2.4.4 Extract from other comprehensive income showing activity on cash flow hedges:

1AC10.8.2.4.4.1 Cash flow fair value hedge reserve disclosure requirements:

1AC10.9 Indebtedness, guarantees and financial commitments

1AC10.9.1 Extract from FRS102: Section 1AC.27-1AC.31

1AC10.9.2.2 Contingencies note

1AC10.9.2.3 Off-balance sheet arrangements note (section 1AC.31 od Appendix C of FRS 102)

1AC10.9.2.4 Commitments notes (section 1AC.31 of Appendix C of FRS 102)

1AC10.9.2.5 Indebtness note and security disclosures

1AC10.10 Notes supporting the income statement / profit and loss accounts

1AC10.10.1 Extract from FRS102: Section 1AC.32-1AC.33

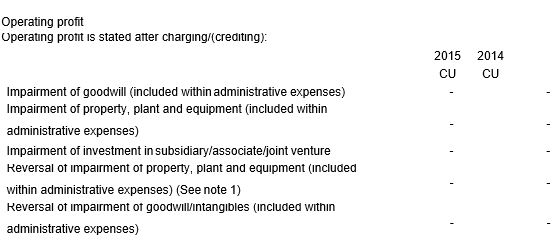

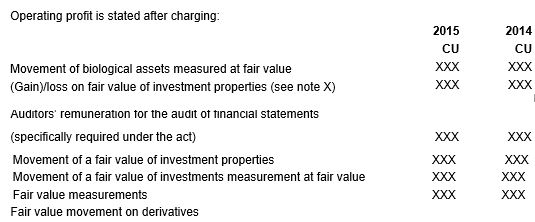

1AC10.10.2.2 Extract to show required profit and loss disclosures

1AC10.10.2.2.1 Exceptional item defined and the disclosure requirements

1AC10.10.2.2.2 Exceptional item disclosure

1AC10.10.2.3 Employee numbers disclosure:

1AC10.10.2.4 Other profit and loss disclosures

1AC10.11 Related party disclosures

1AC10.11.1 Extract from FRS102: Section 1AC.34-1AC.36

1AC10.11.2.1.1 Related party defined

1AC10.11.2.2 Related party note – with related entities

1AC10.11.2.3 Loans, guarantees, credit transactions entered into the benefit of directors

1AC10.11.2.4 Directors remuneration

1AC10.11.7 Controlling Party disclosure

1AC10.12.1 Extract from FRS102: Section 1AC.37-1AC.39

1AC10.12.2.1 Disclosures required describing the entity

1AC10.12.2.2 Post balance sheet events

1AC10.13.1 Auditors remuneration, Interest income or expense from loans to and from group entities

1AC10.13.1.1 Interest income or expense from loans to and from group entities

1AC10.13.1.2 Auditors remuneration

1AC10.13.2 Debtors and Creditors Note as required by Formats

1AC10.13.3 Share capital disclosures

1AD11 Appendix D to Section 1A (applicable for Republic of Ireland entities only)

1AD11.1 Disclosure requirements for small entities in the Republic of Ireland

1AD11.1.1 Extract from FRS102: Section 1AD.1-1AD.2

1A11.1.2.1 Summary section 1A disclosure checklist

1AD11.2.1 Extract from FRS102: Section 1AD.3-1AD.6

1AD11.2.2.1.1 General information

1AD11.2.2.1.2 Basis of preparation

1AD11.2.2.1.3 Consolidation exemption

1AD11.2.2.1.4 Basis of consolidation – (If Applicable)

1AD11.2.2.1.4.1 Subsidiary undertakings

1AD11.2.2.1.4.2 Associates and joint ventures

1AD11.2.2.1.4.3 Transactions eliminated on consolidation

1AD11.2.2.1.5 Business combinations and goodwill

1AD11.2.2.1.8 Intangible assets

1AD11.2.2.1.9 Contingent acquisition consideration

1AD11.2.2.1.10 Financial assets

1AD11.2.2.1.11.1 General turnover accounting policy notes

1AD11.2.2.11.2 Turnover accounting policy for an insurance broker

1AD11.2.2.11.4 Turnover accounting policy note where turnover is derived from investments Turnover

1AD11.2.2.11.5 Turnover accounting policy for a software company

1AD11.2.2.11.6 Turnover accounting policy for a construction company

1AD11.2.2.12 Government grants

1AD11.2.2.12.2 Performance model

1AD11.2.2.14 Dividend distribution

1AD11.2.2.16 Financial instruments

1AD11.2.2.16.1 Trade and other debtors

1AD11.2.2.16.2 Cash and cash equivalents.

1AD11.2.2.16.3 Other financial assets.

1AD11.2.2.16.4 Trade and other creditors.

1AD11.2.2.16.7 Offsetting financial instruments.

1AD11.2.2.17 Compound financial instruments.

1AD11.2.2.20.1 Environmental liabilities

1AD11.2.2.22 Employee Benefits

1AD11.2.2.23 Preference share capital

1AD11.2.2.25 Related party transactions

1AD11.2.2.28 Tangible fixed assets

1AD11.2.2.30 Investment properties

1AC10.2.2.1.1.31.1 Finance leases

1AD11.2.2.31.2 Operating leases

1AD11.2.2.31.3 Lease incentives

1AC10.2.2.1.1.32 Leasing company accounting policy

1AD11.2.2.33 Intangible assets

1AD11.2.2.35 Exceptional items

1AD11.2.2.36 Share based costs

1AD11.2.2.37 Investment properties

1AD11.2.2.38 Biological assets (where fair value is used)

1AD11.2.2.39 Biological assets – Livestock (where fair value model is adopted)

1AD11.2.2.40 Biological assets – Forestry (where cost model is adopted)

1AD11.2.2.41 Biological assets – Livestock (where cost model is adopted)

1AD11.2.2.1.42 Prior period adjustment – Change in accounting policy

1AD11.2.2.43 Change in accounting estimate

1AD11.3 Changes in presentation and accounting policies and corrections of prior period errors

1AD11.3.2 Extract from Section 1AD.8 to 1AD.10 of S1A of FRS 102

1AD11.3.2.2 Prior year adjustment disclosure

1AD11.3.2.2.1 Option 1: Analysis of prior year adjustments

1AD11.3.2.2.2 Option 2 – Analysis of prior year adjustments

AD11.3.2.2.3 Movement in profit and loss reserves note or statement of changes in equity

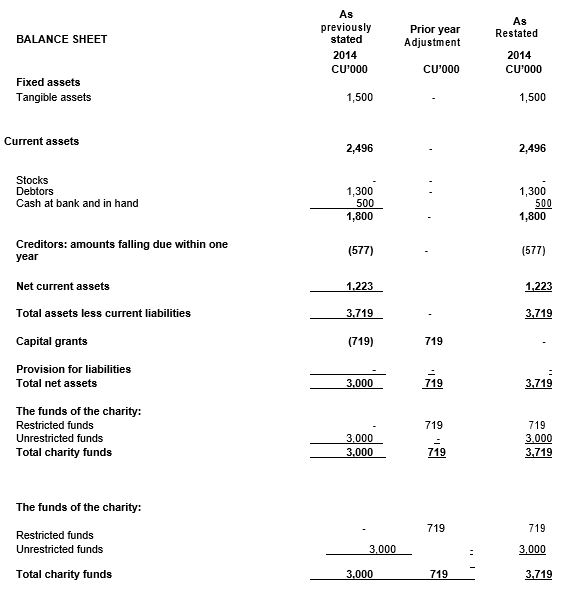

1AD11.3.2.4 Example extract of a change in accounting policy disclosure

1AD11.3.2.5 Change in classification from prior period

1AD11.4 True and fair view override

1AD11.4.1 Extracts from FRS 102: Section 1AD.11

1AD11.5 Notes to the statement of financial position – fixed assets

1AD11.5.1 Extract from FRS 102: Section 1AD.13 – 1AD.18

1AD11.5.2.1.3 Intangible assets

1AD11.5.2.1.5 Example disclosure for a revaluation reserve

1AD11.5.2.1.6 Investment properties

1AD11.5.2.1.7 Financial assets note

1AD11.6.1 Extracts from FRS 102: Section 1AD.20 – 1AD.21

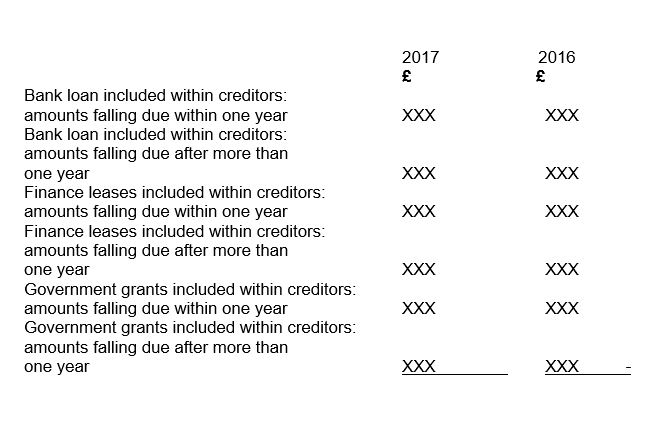

1AD11.7 Borrowing/creditors details

1AD11.7.1 Extracts from FRS 102: Sction 1AD.26 – 1AD.28

1AD11.8 Appropriation of profit or loss/profit and loss reserve movements

1AD11.8.1 Extract from FRS 102: Section 1AD.35

1AD11.9 Fair value measurement

1AD11.9.1 Extract from FRS 102; Section 1AC.22 to 1AC.25

1AD11.9.2.1 Analysis – fair value disclosure requirements

1AD11.9.2.2 Extract from the notes to the financial statements

1AD11.9.2.2.1 Investment property

1AD11.9.2.2.3 Financial instrument note disclosures

1AD11.9.2.2.4 Fair value reserve disclosures

1AD11.10 Notes to the income statements/profit and loss account

1AD11.10.1 Extract from FRS 102: Sections 1AD.36 to 1AD .37

1AD11.10.2.2 Extract to show required profit and loss disclosures

1AD11.10.2.2.1 Exceptional item defined and the disclosure requirements

1AD11.10.2.2.1.1 Exceptional item disclosure

1AD11.10.2.2.2 Employee note disclosure

1AD11.10.2.2.3 other profit and loss disclosures

1AD11.11 Related party disclosures – director’s remuneration

1AD11.11.1 Extract from FRS 102: sections 1AD.38 to 1AD.40

1AD11.11.2.1 Related parties defined

1AD11.11.2.1.1 Connected person defined

1AD11.11.2.2 Directors remuneration disclosure

1AD11.11.2.2.1 Make up of director’s remuneration

1AD11.12.1 Extracts from FRS 102: 1AD.41 to 1AD.47

1AD11.12.2.1.1 Application to non-companies

1AD11.12.2.1.2 Get out from disclosure if below a specified value.

1AD11.12.2.2 Disclosures of loans and guarantees for the benefit of directors.

1AD11.13 Related party transactions material transactions with directors

1AD11.13.1 Extracts from FRS 102: Secton 1AD.48

1AD11.13.2.2 Is there exemptions from the disclosure?

1AD11.14 Other related party transactions (other than transactions with director)

1AD11.14.1 Extracts from FRS 102: Section 1AD.51

1AD11.15 Ultimate controlling party

1AD11.15.1 Extract from FRS 102: Section 1A.50

1AD11.16 Post balance sheet events

1AD11.16.1 Extracts from FRS 102: Sections 1A.54

1AD.11.17 Guarantees, financial commitments and contingencies

1AD.11.17.1 Extract from FRS 102: Sections 1AD.28 to 1AD.34

1AD11.17.2.2 Contingencies (1AD.31 and 1AD.34 of Appendix D of FRS 102)

1AD11.18 Holding of own shares

1AD11.18.1 Extract form FRS 102; Section 1AD.49

1AD11.19.1 Extract from FRS 102; Sections 1AD.52 – 1AD.53 and 1AD.55

1AD11.19.2.1 Disclosing legal form, registered office, basis of preparation

1AD11.20 Other items required by the formats under Companies Act

1AD11.20.4 Creditors: amounts falling due within one-year note

1AD11.20.5 Creditors: Amounts falling due after more than one-year note

1AD11.20.6 provision for liabilities

1AE.13.1 Additional disclosures encouraged for small entities

1AE.13.1.1 Extract from FRS102: Section 1AE.1

1AE.13.1.2.2 Statement of compliance

1AE.13.1.2.3.1 Transition note adjustments example

1A11.2.2.1 Transition to FRS 102 – first time exemption – Section 1A

[/et_pb_toggle][/et_pb_column][/et_pb_row][et_pb_row][et_pb_column type=”3_4″][et_pb_text admin_label=”Main Body Text” text_orientation=”justified” use_border_color=”off” border_color_all=”off” module_alignment=”left” _builder_version=”3.17.6″]

1AC10 Appendix C to Section 1A (Applicable for UK entities)

1AC10.1 Disclosure requirements for small entities

1AC10.1.1 Extract from FRS102: Section 1AC.1-1AC.2

This appendix is an integral part of Section 1A.

This appendix sets out the disclosure requirements for small entities based on the requirements of company law in the UK. These are shown in italic font in the paragraphs below. Other than substituting company law terminology with the equivalent terminology used in FRS 102 (see Appendix III) the drafting is as close as possible to that set out in company law. References to Schedule 1 are to Schedule 1 of the Small Companies Regulations.

When there is a similar disclosure requirement in FRS 102 this has been indicated and those paragraphs of FRS 102 that have been cross-referenced are also highlighted by including an * in the left-hand margin (the * against paragraph 6.3(c) refers to a legal requirement in the Republic of Ireland only). In many cases compliance with the similar requirement of FRS 102 will result in compliance with the requirements below., however a small entity in the UK must ensure it complies with all the disclosure requirements of this appendix.

1AC.1 As a minimum, when relevant to its transactions, other events and conditions, a small entity in the UK shall provide the disclosures set out in this appendix.

1AC.2 The notes must be presented in the order in which, where relevant, the items to which they relate are presented in the statement of financial position and in the income statement. (Schedule 1, paragraph 42(2))

Paragraphs 8.3 and 8.4 address similar requirements.

1AC10.1.2 OmniPro Comment

1AC10.1.2.1 Overview

As per section 1AC.1 to 1AC.2 of section 1A of FRS 102 the disclosure requirements for a UK entity applying section 1A and the small companies regime must comply with this Appendix (Appendix C) at a minimum. Further disclosure must be included in order to show a true and fair view. Additional disclosures can be given voluntarily if the entity so wishes. For minimum required disclosures for Republic of Ireland entities see Appendix D of S1A of FRS 102.

1A10.1.2.2 What entities must comply with Appendix C

Appendix C only applies to UK entitIies. Republic of Ireland minimum disclosure requirements are detailed at Appendix D of S1A of FRS 102.

1AC10.2 Accounting policies

1AC10.2.1 Extract from FRS102: Section 1AC.3-1AC.

1AC.3 The accounting policies adopted by the small entity in determining the amounts to be included in respect of items shown in the statement of financial position and in determining the profit or loss of the small entity must be stated (including such policies with respect to the depreciation and impairment of assets). (Schedule 1, paragraph 44)

Paragraph 8.5 addresses similar requirements for disclosing significant accounting policies. Including information about the judgements made in applying the small entity’s accounting policies, as set out in paragraph 8.6, may be useful to users of the small entity’s financial statements.

1AC.4 If any amount is included in a small entity’s statement of financial position in respect of development costs, the note on accounting policies must include the following information:

(a) the period over which the amount of those costs originally capitalised is being or is to be written off; and

(b) the reasons for capitalising the development costs in question. (Schedule 1, paragraph 21(2))

Paragraph 18.27(a) addresses similar requirements to paragraph 1AC.4(a).

1AC.5 Where development costs are shown or included as an asset in the small entity’s financial statements and the amount is not treated as a realised loss because there are special circumstances justifying this, a note to the financial statements must state the reasons for showing development costs as an asset and that it is not a realized loss. (Section 844 of the Act) (1AC.6 Where in exceptional cases the useful life of intangible assets cannot be reliably estimated, there must be disclosed in a note to the financial statements the period over which those intangible assets are being written off and the reasons for choosing that period. (Schedule 1, paragraph 22(4))

Intangible assets include goodwill. Paragraphs 18.27(a) and 19.25(g) address similar requirements.

1AC10.1.2 OmniPro Comment

1AC10.1.2.1 Overview

As per section 1AC.1 to 1AC.2 of section 1A of FRS 102 the disclosure requirements for a UK entity applying section 1A and the small companies regime must comply with this Appendix (Appendix C) at a minimum. Further disclosure must be included in order to show a true and fair view. Additional disclosures can be given voluntarily if the entity so wishes. For minimum required disclosures for Republic of Ireland entities see Appendix D of S1A of FRS 102.

1A10.1.2.2 What entities must comply with Appendix C

Appendix C only applies to UK entitIies. Republic of Ireland minimum disclosure requirements are detailed at Appendix D of S1A of FRS 102.

1AC10.2 Accounting policies

1AC10.2.1 Extract from FRS102: Section 1AC.3-1AC.

1AC.3 The accounting policies adopted by the small entity in determining the amounts to be included in respect of items shown in the statement of financial position and in determining the profit or loss of the small entity must be stated (including such policies with respect to the depreciation and impairment of assets). (Schedule 1, paragraph 44)

Paragraph 8.5 addresses similar requirements for disclosing significant accounting policies. Including information about the judgements made in applying the small entity’s accounting policies, as set out in paragraph 8.6, may be useful to users of the small entity’s financial statements.

1AC.4 If any amount is included in a small entity’s statement of financial position in respect of development costs, the note on accounting policies must include the following information:

(a) the period over which the amount of those costs originally capitalised is being or is to be written off; and

(b) the reasons for capitalising the development costs in question. (Schedule 1, paragraph 21(2))

Paragraph 18.27(a) addresses similar requirements to paragraph 1AC.4(a)

1AC.5 Where development costs are shown or included as an asset in the small entity’s financial statements and the amount is not treated as a realised loss because there are special circumstances justifying this, a note to the financial statements must state the reasons for showing development costs as an asset and that it is not a realized loss. (Section 844 of the Act) (1AC.6 Where in exceptional cases the useful life of intangible assets cannot be reliably estimated, there must be disclosed in a note to the financial statements the period over which those intangible assets are being written off and the reasons for choosing that period. (Schedule 1, paragraph 22(4))

Intangible assets include goodwill. Paragraphs 18.27(a) and 19.25(g) address similar requirements.

1AC10.2.2 OmniPro comment

1AC10.2.2.1 Overview

See illustration of the requirements of Section 1AC.3 to 1AC.4 of Appendix C of S1A of FRS 102 below:

1AC10.2.2.1.1 Accounting police disclosure

See extract of examples of accounting policies note

1AC10.2.2.1.1.1 General information

OmniPro Sample Small Company Limited is primarily engaged in the provision of construction services to both the private and commercial sectors. The company’s’ registered office is Construction Place, Builders Lane, Dunblock, Any City.

The company is a limited liability company incorporated in Any City in the country with a company registration number of XXX.

[This is the first set of financial statements prepared by OmniPro Sample Small Company Limited in accordance with accounting standards issued by the Financial Reporting Council, including FRS 102 “The Financial Reporting Standard applicable in the UK and Republic of Ireland” (“FRS 102”). The company transitioned from previously extant UK and Irish GAAP to FRS 102 as at 1 January 2014. NOTE THIS IS ONLY INCLUDED IF IT IS THE FIRST YEAR IF NOT THIS DISCLOSURE IS NOT REQUIRED.]

The FRC issued amendments to FRS 102 called ‘Amendments to FRS 102-Small entities the Triennial review’ which can be applied for accounting periods beginning on or after 1 January 2019 with early adoption permitted. The company has adopted these amendments in these financial statements. (DELETE IF NOT APPLICABLE))

The significant accounting policies adopted by the Company and applied consistently in the preparation of these financial statements are as follows:

1AC10.2.2.1.1.2 Basis of preparation

The below paragraph is not required but encouraged under Appendix D (note is required if not prepared on a going concern)

The Financial Statements are prepared on the going concern basis[1], (NOTE CHANGE THIS HERE IF THE BASIS IS NOT GOING CONCERN AND PROVIDE THE BASIS FOR WHY THEY HAVE NOT BEEN PREPARED ON A GOING CONCERN), under the historical cost convention, [as modified by the revaluation of certain tangible fixed assets] and comply with the financial reporting standards of the Financial Reporting Council including FRS 102 “The Financial Reporting Standard applicable in the UK and Republic of Ireland” (“FRS 102”) [2] as adapted by Section 1A of FRS 102 and the Companies Act 2006.

The financial statements are prepared in CU which is the functional currency of the company[3].

1AC10.2.2.1.1.3 Consolidation

DISCLOSURES REQUIRED WHERE CONSOLIDTED FINANCIAL STATEMENTS ARE NOT PREPARED

NOTE: THE BELOW IS TO BE INCLUDED WHERE THE PARENT COMPANY IS EXEMPT FROM CONSOLIDATION DUE TO ITS IMMEDIATE PARENT COMPANY (WHICH IS IN THE EEA) PREPARING CONSOLIDATED FINANCIAL STATEMENTS. (NOT SPECIFICALLY REQUIRED BUT INCLUDED FOR BEST PRACTICE)

Consolidated accounts

The company has not prepared consolidated accounts for the period as, being a wholly owned subsidiary of the ultimate parent company, XXXXXX Limited, it is exempted from doing so under Section 9 of FRS 102 which is accommodated under Section 400 of the Companies Act 2006.

NOTE: THE BELOW IS TO BE INCLUDED WHERE THE PARENT COMPANY IS EXEMPT FROM CONSOLIDATION DUE TO ITS ULTIMATE PARENT COMPANY (WHICH IS IN OR OUTSIDE THE EEA) PREPARING CONSOLIDATED FINANCIAL STATEMENTS. (NOT SPECIFICALLY REQUIRED BUT INCLUDED FOR BEST PRACTICE)

Consolidated accounts

The company has not prepared consolidated accounts for the period as, being a wholly owned subsidiary of the ultimate parent company, XXXXXX Limited, it is exempted from doing so under Section 9 of FRS 102 which is accommodated under Section 401 of the Companies Act 2006.

[1] CA does not require disclosure however Appendix E of Section 1A of FRS 102 encourages an entity to disclose the fact that the financial statements have been prepared on the going concern basis. As this is encouraged we have included it in these financial statements. Where the entity has made a decision to wind up the entity that is required to be disclosed, there is no choice.

[2] Appendix 1AE.1 of FRS 102 encourages a statement of compliance to be included in the notes to the financial statements in order to show a true and fair view also.

Where the entity has made a decision to wind up the entity that is required to be disclosed, there is no choice.

Where there is uncertainties about going concern CA 2006 requires this to be disclosed. Appendix E of Section 1A of FRS 102 also encourages this in order to show a true and fair view.

[3] Not required by the CA or FRS 102 for small companies however it would be considered good practice.

[/et_pb_text][et_pb_text admin_label=”Text 2″ _builder_version=”3.17.6″]

NOTE: THE BELOW IS TO BE INCLUDED WHERE THE PARENT COMPANY IS EXEMPT FROM CONSOLIDATION DUE TO THE GROUP BEING CONSIDERED A SMALL COMPANY UNDER COMPANY LAW. (NOT SPECIFICALLY REQUIRED BUT INCLUDED FOR BEST PRACTICE)

Consolidation

The company and its subsidiaries combined meet the size exemption criteria for a group and the company is therefore exempt from the requirement to prepare consolidated financial statements by virtue of Section 479 of the Companies Act 2006. Consequently, these financial statements deal with the results of the company as a single entity.

NOTE: BASIS OF CONSOLIDATION DISCLOSURES REQUIRED WHERE CONSOLIDTED FINANCIAL STATEMENTS ARE PREPARED.

1AC10.2.2.1.1.4 Basis of consolidation (if applicable)

The Group financial statements reflect the consolidation of the results, assets and liabilities of the parent undertaking, the Company and all of its subsidiaries, together with the Group’s share of profits/losses of associates and joint ventures. Where a subsidiary, associate or joint venture is acquired or disposed of during the financial year, the Group financial statements include the attributable results from, or to, the effective date when control passes, or, in the case of associates, when significant influence is lost.

1AC10.2.1.1.4.1 Subsidiary undertakings

Subsidiaries are all entities (including special purpose entities) over which the Group has the power to govern the financial and operating policies generally accompanying a shareholding of more than one half of the voting rights. The existence and effect of potential voting rights that are currently exercisable or convertible are considered when assessing whether the Group controls another entity. Subsidiaries are fully consolidated from the date on which control is transferred to the Group. They are de-consolidated from the date that control ceases.

The acquisition method of accounting is used to account for business combinations by the Group. The consideration transferred for the acquisition of a subsidiary is the fair values of the assets transferred, the liabilities incurred and the equity interests issued by the Group. The consideration transferred includes the fair value of any asset or liability resulting from a contingent consideration arrangement. Acquisition related costs are capitalised with the cost of the investment. Identifiable assets acquired and liabilities and contingent liabilities assumed in a business combination are measured initially at their fair values at the acquisition date. On an acquisition by acquisition basis, the Group recognises any non-controlling interest in the acquiree either at fair value or at the non-controlling interest’s proportionate share of the acquiree’s net assets.

The excess of the consideration transferred, the amount of any non-controlling interest in the acquiree and the acquisition date fair value of any previous equity interest in the acquiree over the fair value of the group’s share of identifiable net assets acquired is recorded as goodwill. If this is less than the fairvalue of the net assets of the subsidiary acquired in the case of a bargain purchase, the difference is recognised as negative goodwill on the balance sheet and amortised through the profit and loss account in the period in which the non-monetary assets are recovered.

1AC10.2.2.1.1.4.2 Associates and joint ventures

Associates are those entities in which the Group has significant influence over, but not control of, the financial and operating policies. Joint ventures are those entities over which the Group has joint control, established by contractual agreement and requiring unanimous consent for strategic, financial and operating decisions. Investments in associates and joint ventures are accounted for using the equity method of accounting.

Under the equity method of accounting, the Group’s share of the post-acquisition profits or losses of its associates and joint ventures is recognised in the income statement. The income statement reflects, in profit before tax, the Group’s share of profit after tax of its associates and joint ventures in accordance with Section 14 of FRS102, ‘Investments in Associates’ and Section 15 of FRS 102, ‘Interests in Joint Ventures’. The Group’s interest in their net assets is included as investments in associates and joint ventures in the Group Statement of Financial Position at an amount representing the Group’s share of the fair value of the identifiable net assets at acquisition plus the Group’s share of post acquisition retained income and expenses. The Group’s investment in associates and joint ventures includes goodwill on acquisition. The amounts included in the financial statements in respect of the post acquisition income and expenses of associates and joint ventures are taken from their latest financial statements prepared up to their respective year ends together with management accounts for the intervening periods to the Group’s year end (if applicable). The fair value of any investment retained in a former subsidiary is regarded as a cost on initial recognition of an investment in an associate or joint venture. Where necessary, the accounting policies of associates and joint ventures have been changed to ensure consistency with the policies adopted by the Group.

1AC10.2.2.1.1.4.3 Transactions eliminated on consolidation

Intra-group balances and any unrealised gains and losses or income and expenses arising from intra- group transactions, are eliminated in preparing the Group financial statements. Unrealised gains and income and expenses arising from transactions with associates and joint ventures are eliminated to the extent of the Group’s interest in the entity. Unrealised losses are eliminated in the same way as unrealised gains, but only to the extent that they do not provide evidence of impairment.

1AC10.2.2.1.1.5 Business combinations and goodwill [if applicable]

All business combinations are accounted for by applying the purchase method. Goodwill represents amounts arising on acquisition of subsidiaries, associates and joint ventures. In respect of acquisitions that have occurred since XXXXX (INSERT DATE OF TRANSITION WHERE SECTION 35.10(A) EXEMPTION IS CLAIMED), goodwill represents the difference between the cost of the acquisition and the fair value of the net identifiable assets acquired. In respect of acquisitions prior to this date, goodwill is included on the basis of its deemed cost, i.e. original cost less accumulated amortisation from the date of acquisition up to XXXXX, which represents the amount recorded under UK and Irish GAAP. Goodwill is now stated at cost or deemed cost less any accumulated amortisation and impairment losses. In respect of associates and joint ventures, the carrying amount of goodwill is included in the carrying amount of the investment.

1AC10.2.2.1.1.6 Goodwill

Positive goodwill acquired on each business combination is capitalised, classified as an asset on the balance sheet and amortised on a straight line basis over its useful life of x years. Goodwill acquired in a business combination is, from the date of acquisition, allocated to each cash generating unit that is expected to benefit from the synergies of the combination. If an investment is disposed of any unamortised goodwill is subsumed within goodwill in the profit and loss on sale on discontinuance. Useful life is determined by reference to the period over which the values of the underlying businesses are expected to exceed the values of their identifiable net assets.

Goodwill is reviewed for impairment if events or changes in circumstances indicate that the carrying value may not be recoverable.

Negative goodwill represents the fair value of net assets on acquisition in excess of the fair value of consideration. Negative goodwill is capitalised and amortised through the profit and loss account in the period in which the non-monetary assets are recovered. In the case of fixed assets acquired, this is the period over which they are depreciated and in the case of stocks it is the period over which they are sold or otherwise realised.

1AC10.2.2.1.1.7 Impairment

The carrying amounts of the Group’s/Company’s assets, other than inventories (which are carried at the lower of cost and net realisable value), deferred tax assets (which are recognised based on recoverability), investment properties (which are carried at fair value), and those financial instruments, which are carried at fair value, are reviewed to determine whether there is an indication of impairment when an event or transaction indicates that there may be. If any such indication exists, an impairment test is carried out and the asset is written down to its recoverable amount.

The recoverable amount is the higher of an asset’s fair value less costs to sell and value in use. Value in use is defined as the present value of the future pre-tax and interest cash flows obtainable as a result of the asset’s continued use. The pre-tax and interest cash flows are discounted using a pre-tax discount rate that represents the current market risk free rate and the risks inherent in the asset. For the purposes of assessing impairment, assets are grouped at the lowest levels for which there are separately identifiable cash flows (cash-generating units).

An impairment loss is recognised whenever the carrying amount of an asset or its cash-generating unit exceeds its recoverable amount. An impairment loss is recognised in the profit and loss account, unless the asset has been revalued when the amount is recognised in other comprehensive income to the extent of any previously recognised revaluation. Thereafter any excess is recognised in profit or loss.

Impairment losses recognised in respect of cash-generating units are allocated first to reduce the carrying amount of any goodwill allocated to the cash-generating unit and then, to reduce the carrying amount of the other assets in the unit on a pro rata basis.

An impairment loss, other than in the case of goodwill, is reversed if there has been a change in the estimates used to determine the recoverable amount. If an impairment loss is subsequently reversed, the carrying amount of the asset (or asset’s cash generating unit) is increased to the revised estimate of its recoverable amount, but only to the extent that the revised carrying amount does not exceed the carrying amount that would have been determined (net of depreciation) had no impairment loss been recognised in prior periods. A reversal of an impairment loss is recognised in the profit and loss account.

1AC10.2.2.1.1.8 Intangible assets

Intangible assets acquired as part of a business combination are initially recognised at fair value being their deemed cost as at the date of acquisition. These generally include brand and customer related intangible assets. Computer software that is not an integral part of an item of computer hardware is also classified as an intangible asset. Where intangible assets are separately acquired, they are capitalised at cost. Cost comprises purchase price and other directly attributable costs.

Intangible assets with finite lives are amortised over the period of their expected useful lives in equal annual instalments, as follows;

Brands 5 to 10 years

Customer related 5 to 20 years

Supplier agreements 4 to 10 years

Computer related 3 to 7 years

Subsequent to initial recognition, intangible assets are stated at cost less accumulated amortisation and impairment losses incurred.

[/et_pb_text][et_pb_text admin_label=”Text 3″ _builder_version=”3.17.6″]

1AC10.2.2.1.1.9 Contingent acquisition consideration

Any contingent consideration to be transferred by the group is recognised at fair value at the acquisition date. Subsequent changes to the fair value of the contingent consideration that is deemed to be an asset or liability is recognised in accordance with Section 21. Any adjustments to the estimated contingent consideration are accounted for as an adjustment to goodwill as a current period adjustment as it reflects a change in estimate and the adjusted goodwill is amortised from that date. Contingent consideration that is classified as equity is not remeasured and its subsequent settlement is accounted for within equity. To the extent that contingent acquisition consideration is payable after more than one year from the date of acquisition, it is discounted at an appropriate loan interest rate and, accordingly, carried at net present value on the Balance Sheet. An appropriate interest charge, at a constant rate on the carrying amount adjusted to reflect market conditions, is reflected in the Profit and Loss over the earnout period, increasing the carrying amount so that the obligation will reflect its settlement at the time of maturity.

1AC10.2.2.1.1.10 Financial assets

Financial assets in subsidiaries and other financial fixed assets are stated at cost less provision for any diminution in value.

AND/OR

The company has adopted a policy of measuring investments in financial assets which can be reliably measured at their fair value, with changes in the fair value recognised in the profit and loss.

AND/OR

Financial assets which can be reliably measured are measured at their fair value, with changes in the fair value recognised in other comprehensive income and the revaluation reserve.

1AC10.2.2.1.1.11 General turnover accounting policy notes

1AC10.2.2.1.1.11.1 Turnover

Turnover represents net sales to customers and excludes trade discounts and Value Added Tax.

Turnover from the sale of goods is recognised when the significant risks and rewards of ownership of the goods have passed to the buyer, usually on dispatch of the goods. Turnover from the provision of services is recognised in the accounting period in which the services are rendered and the outcome of the contract can be estimated reliably. The company uses the percentage of completion method based on the actual service performed as a percentage of the total services to be provided.

Revenue in relation to maintenance and support is recognised on a straight line basis over the term of the contract with any unearned revenue included in deferred revenue.

1AC10.2.2.1.1.11.2 Turnover accounting policy for an insurance broker Turnover – commission income

Turnover represents commissions earned in the period together with overrider and profit commissions receivable. Commission income is recognised in the accounting period in which the policy commences. To the extent that future services need to be provided over the life of the policy which straddles an accounting period, revenue is deferred. Commission income in relation to claims handling is recognised in the accounting period in which the claims are settled. Overrider and profit commissions, if any, are recognised in line with the underlying agreements and amounts confirmed by product providers.

1AC10.2.2.1.1.11.3 Turnover accounting policy for a manufacturng company that produces, install and also engage in long term contracts using the stage of completion using the contract activity

Turnover

Turnover, excluding value added tax, represents the income received and receivable from third parties, in the ordinary course of business, for goods and services provided. Any discounts given to customers are deducted from turnover.

Revenue from the sale of products is recognised when the goods are dispatched to the customer. Revenue from the servicing of machines is recognised over the period of the performance of the service. Proceeds received in advance of product dispatch or performance of service are recorded as deferred revenue in the balance sheet.

Revenue from the sale of machines and manufactured steel components is recognised over the period of the design, build and installation contract. Where the outcome of a long-term contract can be estimated reliably, revenue and costs are recognised by reference to the stage of completion of the contract activity at the balance sheet date. This is normally measured by surveys of work performed to date. Variations in contract work are included to the extent that it is probable that they will result in revenue and they are capable of being reliably measured.

When the outcome of a long-term contract cannot be estimated reliably, contract revenue is recognised to the extent of contract costs incurred and that it is probable it will be recoverable. Contract costs are recognised as expenses in the period in which they are incurred. When it is probable that total contract costs will exceed total contract revenue, the expected loss is recognised as an expense immediately.

1AC10.2.2.1.1.11.4 Turnover accounting policy note where turnover is derived from investments

Turnover

Turnover represents dividends and other income received on investments held, net of irrecoverable withholding taxes. Dividends are recognised in the period to which the dividends relate.

1AC.10.2.2.1.1.11.5 Turnover accounting policy for a software

Company Turnover

Turnover, which excludes value added tax, represents the invoiced value of goods and services supplied and the value of long term contract work done, as outlined below.

The company usually sells its software as part of an overall solution offered to a customer, in which significant customisation and modification to the company’s software generally is required. As a result, revenue generally is recognised over the course of these long term projects.

Initial license fee for software revenue is recognised as work is performed, under the percentage of completion method of accounting. Subsequent license fee revenue is recognised upon completion of the specified conditions in each contract. Service revenue that involves significant ongoing obligations, including fees for customisation, implementation and modification, is recognised as work is performed, under the percentage of completion method of accounting.

Software revenue that does not require significant customisation and modification, is recognised upon delivery and installation. In managed service contracts, revenue from operation and maintenance of customers’ billing systems is recognised in the period in which the bills are produced. Revenue from ongoing support is recognised as work is performed. Revenue from third–party hardware and software sales is recognised upon delivery and installation, and recorded at gross or net amount according to whether the company acts as a Principal or as an Agent. Maintenance revenue is recognised ratably over the term of the maintenance agreement, which in most cases is one year or less. Losses are recognised on contracts in the period in which the liability is identified.

1AC10.2.2.1.1.11.6 Turnover accounting policy for a construction company

Turnover – contracting work

Where the outcome of a construction contract can be estimated reliably, revenue and costs are recognised by reference to the stage of completion of the contract activity at the balance sheet date. This is normally measured by reference to the proportion of costs incurred up to the date of the balance sheet to the estimated total costs. Variations in contract work, claims and incentive payments are included to the extent that it is probable that they will result in revenue and they are capable of being reliably measured.

When the outcome of a construction contract cannot be estimated reliably, contract revenue is recognised to the extent of contract costs incurred and that it is probable it will be recoverable. Contract costs are recognised as expenses in the period in which they are incurred. When it is probable that total contract costs will exceed total contract revenue, the expected loss is recognised as an expense immediately.

1AC10.2.2.1.1.11.7 Accounting policy where agreement exists for construction of real estate where recognised only when risk and reward transfer as opposed to using percentage completion

Revenue recognition

Revenue is recognised to the extent that it is probable the economic benefits will flow to the Company and the revenue can be reliably measured. Revenue is measured at the fair value of the consideration receivable. Revenue represents the value of goods and services supplied to customers net of value added tax and trade discounts. The following criteria must also be met before revenue is recognised.

Revenue on housing developments

Revenue on housing developments and the respective profits are recognised when the property is structurally complete and legally transferred to the purchaser.

Stock

Inventories are stated at the lower of cost and net realisable value. Net realisable value in respect of inventory property is assessed with reference to market prices at the reporting date, less estimate costs to complete including overheads and selling costs.

Building land and roads are stated at the lower of cost and net realisable less an appropriate proportion relating to plots sold in the case of estimates of estates in the course of developments.

The company assess at each balance sheet date whether the building land and roads is impaired in accordance with Section 13 and 27 of FRS 102. If an impairment has occurred, then the write down is recognised as an expense in the profit and loss account.

Work in progress – The cost of uncompleted and unsold new properties comprises direct labour and material costs. No profits are taken until houses are conveyed on legal completion to third parties.

1AC10.2.2.1.1.12 Government grants

1AC10.2.2.1.1.12.1 Accruals model

Example using an accruals model

Government grants are recognised at their fair value when it is reasonable to expect that the grants will be received and all related conditions will be met.

Grants that relate to specific capital expenditure are treated as deferred income which is then credited to the profit and loss account over the related asset’s useful (i.e. an accruals basis). Revenue grants are credited to the profit and loss account when receivable so as to match them with the expenditure to which they relate. Government grants received are included in ‘other income’ in profit or loss

1AC10.2.2.1.1.12.2 Performance model

Example using the performance model

Government grants are recognised when it is reasonable to expect that the grants will be received, and all related conditions will be met.

Grants that relate to specific capital expenditure are treated as deferred income which is then credited to the profit and loss account once the performance conditions of the grant have been met. Revenue grants are credited to the profit and loss account when the performance conditions for the grant are fulfilled.

1AC10.2.2.1.1.13 Dividend income

Dividend income from subsidiaries is recognised when the Company’s right to receive payment has been established.

1AC10.2.2.1.1.14 Dividend distribution

Dividend distribution to the company’s shareholders is recognised as a liability in the Company’s financial statements in the period in which the dividends are approved by the company’s shareholders.

1AC10.2.2.1.1.15 Currency

(a) Functional and presentation currency

Items included in the financial statements of the company are measured using the currency of the primary economic environment in which the company operates (“the functional currency”). The financial statements are presented in stg/euro, which is the company’s functional and presentation currency and is denoted by the symbol “CU”. OR The company has chosen to present the financial statement in a currency that differs from its functional currency so that it can be easily consolidated into the parent company’s financial statements.

(b) Transactions and balances

Foreign currency transactions are translated into the functional currency using the spot exchange rates at the dates of the transactions.

At each period end foreign currency monetary items are translated using the closing rate. Non-monetary items measured at historical cost are translated using the exchange rate at the date of the transaction and non-monetary items measured at fair value are measured using the exchange rate when fair value was determined.

Foreign exchange gains and losses that relate to borrowings and cash and cash equivalents are presented in the profit and loss account within ‘finance (expense)/income’. All other foreign exchange gains and losses are presented in the profit and loss account within ‘Other operating (losses)/gains’.

1AC10.2.2.1.1.16 Financial instruments

The company has adopted Section 11 and Section 12 of FRS 102 when accounting for financial instruments.

1AC10.2.2.1.1.16.1 Trade and other debtors

Trade and other debtors (including amounts owed to group companies if applicable) are recognised initially at transaction price (including transaction costs) unless a financing arrangement in exists in which case they are measured at the present value of future receipts discounted at a market rate. Subsequently these are measured at amortised cost less any provision for impairment. A provision for impairment of trade receivables is established when there is objective evidence that the company will not be able to collect all amounts due according to the original terms of receivables. The amount of the provision is the difference between the asset’s carrying amount and the present value of estimated future cash flows, discounted at the effective interest rate. All movements in the level of the provision required are recognised in the profit and loss.

1AC10.2.2.1.1.16.2 Cash and cash equivalents.

Cash and cash equivalents include cash on hand, demand deposits and other short- term highly liquid investments with original maturities of three months or less. Bank overdrafts are shown within borrowings in current liabilities on the statement of financial position.

1AC10.2.2.1.1.16.3 Other financial assets.

Other financial assets include investment which are not investments in subsidiaries, associates or joint ventures. Investments are initially measured at fair value which usually equates to the transaction price and subsequently at fair value where investments are listed on an active market or where non listed investments can be reliably measured. Movements in fair value is measured in the profit and loss.

Where fair value cannot be measured reliably or can no longer be measured reliably, investments are measured at cost less impairment.

[The entity has taken advantage of the exemption contained in Section 35.10(u) not to comply with the fair value measurement requirements of Section 11-Basic Finance Instruments and Section 12-Other Financial Instruments Issues on the date of transition to FRS 102 of 1 January 2014 or in the comparative financial period presented. Instead the entity has continued to apply the accounting policy requirements for these financial instruments under old UK GAAP. A transition adjustment has been posted to equity on 1 January 2015 so as to comply with the requirements of Section 11 and Section 12 for the current financial year as required by Section 35.10(u). As a result of availing of this exemption, listed investment have been carried at cost less impairment in the comparative financial period presented and any forward exchange contracts are disclosed as required under old UK GAAP accounting rules. (IF APPLICABLE)]

[/et_pb_text][et_pb_text admin_label=”Text 4″ _builder_version=”3.17.6″]

1AC10.2.2.1.1.16.4 Trade and other creditors.

Trade and other creditors are classified as current liabilities if payment is due within one year or less. If not, they are presented as non-current liabilities. Trade creditors, other creditors and amounts due to group companies are recognised initially at the transaction price net of transaction costs and subsequently measured at amortised cost using the effective interest method. Where a financing arrangement exists they are initially measured at the present value of future payments discounted at a reduced rate.

[The entity has elected to adopt the exemption contained in Section 35.10(v) and to apply the rules detailed in Section 11 to debt instruments with related parties where a financing arrangement existed on the 1 January 2015 as opposed to the date of transition on 1 January 2014. As a result, a transition adjustment was posted to recognise the loans due to/from related parties at the present value of the minimum future payments and amortised cost utilising the prevailing market rate on the 1 January 2015 as permitted by Section 35.10(v)(c). For the comparative year presented these balances are carried at the amount recognised under old UK GAAP that being the amounts received/advanced less repayments. (IF APPLICABLE)]As permitted by the amendment made to FRS 102 Section 11 for small entities by the FRC on 8 May 2017 amounts due from directors and shareholders of the entity are stated initially at the transaction price and subsequently at transaction price less repayments. The amortised cost model is not used. [1]

1AC10.10.2.2.1.1.16.5 Borrowings

Borrowings are recognised initially at the transaction price (present value of cash payable to the bank, including transaction costs). Borrowings are subsequently stated at amortised cost.

Interest expense is recognised on the basis of the effective interest method and is included in finance costs. OR

Borrowing costs – capitalisation rate

The company has adopted a policy of capitalising qualifying borrowing costs. The company capitalises general borrowing costs which are directly attributable to the acquisition of the qualifying asset. The capitalisation rate used is a weighted average of the rates applicable to the company’s general borrowings that are outstanding during the period. Given that weighted averages are utilised this results in a level of estimation. In determining the capitalisation rate the company excludes any specific borrowings related to obtaining non-qualifying assets.

Preference shares, which are mandatorily redeemable on a specific date, are classified as borrowings.

[1] Small entities as an exemption to para 11.13 of FRS 102 may measure a basic financial liability that is a loan from a director who is a natural person and a shareholder in the entity or a connected person initially at transaction price (i.e. The same way it was accounted for under old Irish GAAP/FRSSE.) The amendment was made by the FRC as a transitional measure on 8 May 2017 and it is effective immediately. If in the prior year (i.e, if accounts prepared under frs102 in prior period) the present value technique was used and the client now wants to revert back to the transaction price policy, a prior year adjustment is required in line with a change in accounting policy detailed in Section 10.13 of FRS 102. Note this exemption does not apply to inter companies.

The dividends on these preference shares are recognised in the profit and loss as a finance cost.

Borrowings are classified as current liabilities unless the Company has a right to defer settlement of the liability for at least 12 months after the reporting date.

1AC10.2.2.1.1.16.6 Derecognition

Financial liabilities are derecognised when the liability is extinguished, that being when the contractual obligation is discharged.

1AC10.2.2.1.1.16.7 Offsetting financial instruments

Financial assets and liabilities are offset and the net amount reported in the balance sheet when there is a legally enforceable right to offset the recognised amounts and there is an intention to settle on a net basis, or realise the asset and settle the liability simultaneously.

1AC10.2.2.1.1.17 Compound financial instruments

Compound financial instruments issued by the company comprise of convertible preference shares which can be converted to a set amount of ordinary shares at a future date. The liability component of the compound instrument is initially recognised at the fair value of a similar liability where the conversion to equity option is not available. Subsequently this is measured at amortised cost using the effective interest rate method. The equity component is measured the difference between the fair value of the liability component and the fair value of the instrument as a whole. The equity component is not re-measured. Transaction costs are apportioned to the equity and liability component as a proportion that each type instrument is to the total fair value of the compound instrument.

1AC10.2.2.1.1.18 Derivatives

Derivatives are initially recognised at fair value on the date the contract is entered into and subsequently re-measured at their fair value. Changes in the fair value are recognised in the profit and loss within finance costs or finance income as appropriate, unless they are included in a hedging arrangement.

Derivative financial instruments are not basic. Hedge accounting is not applied.

OR WHERE HEDGE ACCOUNTING IS APPLIED

Derivative financial instruments are used to manage the Group’s exposure to foreign currency risk and interest rate risk through the use of forward currency contracts and interest rate swaps. These derivatives are generally designated as cash flow hedges in accordance with Section 12. The Group does not enter into speculative derivative transactions.

1AC10.2.2.1.1.19 Hedge accounting

Cash flow hedges

Subject to the satisfaction of certain criteria, relating to the documentation of the risk, objectives and strategy for the hedging transaction and the ongoing measurement of its effectiveness, cash flow hedges are accounted for under hedge accounting rules. In such cases, any unrealised gain or loss arising on the effective portion of the derivative instrument is recognised in the cash flow hedging reserve, a separate component of equity and posted to other comprehensive income. Unrealised gains or losses on any ineffective portion of the derivative are recognised in the income statement. When the hedged transaction occurs the related gains or losses in the hedging reserve are transferred to the Income Statement.

The company engages in hedge accounting for forward contracts in order to manage foreign currency fluctuations as well as interest rate swaps.

Changes in fair values of derivatives designated as cash flow hedges which meet the conditions for hedge accounting are recognised in directly equity through other comprehensive income to the extent that they are effective. Any ineffectiveness is charged to the profit and loss. Any gain or loss recognised in Other Comprehensive Income is transferred from equity to the profit and loss when the hedge relationship ends.

Cash flow hedges are those of highly probable forecasted future income or expenses. In order to qualify for hedge accounting, the Group is required to document the relationship between the item being hedged and the hedging instrument and document the causes of hedge ineffectiveness.

There is no significant difference between the timing of the cash flows and income statement effect of cash flow hedges.

Fair value hedges

Changes in the fair value of derivatives that are designated and qualify as fair value hedges are recorded in the profit and loss, together with any changes in the fair value of the hedged asset or liability that are attributable to the hedged risk. If the hedge no longer meets the criteria for hedge accounting, the adjustment to the carrying amount of a hedged item for which the effective interest method is used is amortised to the profit and loss.

1AC10.2.2.1.1.20 Provisions

Provisions are recognised when the company has a present legal or constructive obligation as a result of past events; it is probable that an outflow of resources will be required to settle the obligation; and the amount of the obligation can be estimated reliably.

Where there are a number of similar obligations, the likelihood that an outflow will be required in settlement is determined by considering the class of obligations as a whole. A provision is recognised even if the likelihood of an outflow with respect to any one item included in the same class of obligations may be small.

Provisions are measured at the present value of the expenditures expected to be required to settle the obligation using a pre-tax rate that reflects current market assessments of the time value of money and the risks specific to the obligation. The increase in the provision due to passage of time is recognised as a finance cost.

The extent a legal or constructive obligation exists, the acquisition costs include the present value of estimated costs of dismantling and removing the asset and restoring the site. A change in estimated expenditures for dismantling, removal and restoration is added to/and or deducted from carrying value of the related asset. To the extent the change results in a negative carrying amount, the difference is recognised in the profit and loss. The change in depreciation is recognised prospectively.

OR WHERE REMEDIATION PROVISIONS ARE REQUIRED INCLUDE THE BELOW:

1AC10.2.2.1.1.20.1 Environmental liabilities

Liabilities for environmental costs are recognised when environmental assessments determine clean-ups are probable and the associated costs can be reasonably estimated. Generally the timing of these provisions coincides with the commitment to a formal plan of action or, if earlier, on divestment or on closure of active sites. The amount recognised at the balance sheet date is the latest best estimate of the expenditure required.

Discounted liabilities in respect of environmental liabilities and closures costs have been classified between amounts due within one year and due after one year. Provisions for long term obligations are discounted at a rate of X%.

OR WHERE CLOSURE COSTS INCLUDE THE BELOW

1AC10.2.2.1.1.20.2 Closure costs

All costs associated with the decision to cease trading have been recognised in these financial statements. These include a write down of assets, provisions for expected closure costs together with profit and losses expected to be incurred up to date of cessation of trading.

1AC10.2.2.1.1.21 Contingencies

Contingent liabilities, arising as a result of past events, are not recognised when (i) it is not probable that there will be an outflow of resources or that the amount cannot be reliably measured at the reporting date or (ii) when the existence will be confirmed by the occurrence or non- occurrence of uncertain future events not wholly within the company’s control. Contingent liabilities are disclosed in the financial statements unless the probability of an outflow of resources is remote.

Contingent assets are not recognised. Contingent assets are disclosed in the financial statements when an inflow of economic benefits is probable.

1AC10.2.2.1.1.22 Employee Benefits

The company provides a range of benefits to employees, including annual bonus arrangements, paid holiday arrangements and defined contribution pension plans.

(a) Short term benefits

Short term benefits, including holiday pay and other similar non-monetary benefits, are recognised as an expense in the period in which the service is received.

(b) Annual bonus plans

The company recognises a provision and an expense for bonuses where the company has a legal or constructive obligation as a result of past events and a reliable estimate can be made.

(c) Defined contribution pension plans

The Company operates a defined contribution plan. A defined contribution plan is a pension plan under which the company pays fixed contributions into a separate fund. Under defined contribution plans, the company has no legal or constructive obligations to pay further contributions if the fund does not hold sufficient assets to pay all employees the benefits relating to employee service in the current and prior periods.

For defined contribution plans, the company pays contributions to privately administered pension plans on a contractual or voluntary basis. The company has no further payment obligations once the contributions have been paid. The contributions are recognised as employee benefit expense when they are due. Prepaid contributions are recognised as an asset to the extent that a cash refund or a reduction in the future payments is available.

(d) Defined benefit pension plan

Defined benefit pension scheme assets are measured at fair value. Defined benefit pension scheme liabilities are measured on an actuarial basis using the projected unit credit method. The excess of scheme liabilities over scheme assets is presented on the balance sheet as an asset or liability. Deferred tax is shown separately within deferred tax. The defined benefit pension charge to operating profit comprises the current service cost, past service costs, introductions, curtailments and settlements. The net interest cost on the scheme liabilities is presented in the profit and loss account as other finance expense. Actuarial gains and losses arising from changes in actuarial assumptions and from experience surpluses and deficits are recognised in other comprehensive income for the year in which they occur together with the return on plan assets, less amounts included in net interest.

[/et_pb_text][et_pb_text admin_label=”Text 5″ _builder_version=”3.17.6″]

1AC10.2.2.1.1.23 Preference share capital

Redeemable preference shares and the cumulative preference dividend reserve have been classified as liabilities in the balance sheet. The preference dividend is charged in arriving at the interest cost in the profit and loss account. (include the following where applicable) However no dividends will be paid on the cumulative preference shares until the company has positive profit and loss reserves.

1AC10.2.2.1.1.24 Share capital

Ordinary shares are classified as equity. Incremental costs directly attributable to the issue of new ordinary shares or options are shown in equity as a deduction, net of tax, from the proceeds.

1AC10.2.2.1.1.25 Related party transactions

The company discloses transactions with related parties which are not wholly owned with the same group. It does not disclose transactions with members of the same group that are wholly owned.

1AC10.2.2.1.1.26 Interest income

Interest income is recognised using the effective interest method.

1AC10.2.2.1.1.27 Taxation

Tax is recognised in the profit and loss account, except to the extent that it relates to items recognised in other comprehensive income or directly in equity. In this case tax is also recognised in other comprehensive income or directly in equity respectively.

(e) Current tax

Current tax is calculated on the profits of the period. Current tax is determined using tax rates (and laws) that have been enacted or substantively enacted by the balance sheet date.

(f) Deferred tax

Deferred tax arises from timing differences that are differences between taxable profits and total comprehensive income as stated in the financial statements. These timing differences arise from the inclusion of income and expenses in tax assessments in periods different from those in which they are recognised in financial statements.

Deferred tax is provided in full on temporary differences arising between the tax bases of assets and liabilities and their carrying amounts in the financial statements.

Deferred tax is determined using tax rates (and laws) that have been enacted or substantively enacted by the balance sheet date and are expected to apply when the related deferred income tax asset is realised or the deferred tax liability is settled. Deferred tax is recognised in the profit and loss account or other comprehensive income depending on where the revaluation was initially posted.

Deferred tax assets are recognised to the extent that it is probable that future taxable profits will be available against which the temporary differences can be utilised.

Current or deferred taxation assets and liabilities are not discounted.

NOTE: INCLUDE THE BELOW IF CONSOLIDATED FINANCIAL STATEMENTS ARE BEING PREPARED

If a temporary difference arises from initial recognition of an asset or liability in a transaction other than a business combination that at the time of the transaction does not affect accounting or taxable profit or loss, no deferred tax is recognised. Deferred tax is provided on temporary differences arising on investments in subsidiaries and associates and joint ventures, except where the timing of the reversal of the temporary difference is controlled by the Group and it is probable that the temporary difference will not reverse in the foreseeable future.

1AC10.2.2.1.1.28 Tangible fixed assets

Cost

Tangible fixed assets are recorded at historical cost or deemed cost (note include valuation here where appropriate), less accumulated depreciation and impairment losses. Cost includes prime cost, overheads and interest incurred in financing the construction of tangible fixed assets. Capitalisation of interest ceases when the asset is brought into use.

Freehold premises are stated at cost (or deemed cost for freehold premises held at valuation at the date of transition to FRS 102 where the optional transition exemption under S.35.10(a) of FRS 102 has been applied) less accumulated depreciation and accumulated impairment losses.

The company previously adopted a policy of revaluing freehold premises and they were stated at their revalued amount less any subsequent depreciation and accumulated impairment losses. The company has adopted the transition exemption under FRS 102 paragraph 35.10(d) and has elected to use the previous revaluation as deemed cost OR The company has adopted the transition exemption under FRS 102 paragraph 35.10(C) and has elected to use the fair value as deemed cost. (THIS PARAGRAPH IS ONLY APPLICABLE FOR THE TRANSITION YEAR)

The difference between depreciation based on the deemed cost charged in the profit and loss account and the asset’s original cost is transferred from the non-distributable reserve to retained earnings through equity.

Equipment and fixtures and fittings are stated at cost less accumulated depreciation and accumulated impairment losses.

Where investment property can no longer be reliably measured without undue cost or effort these assets are reclassified to property, plant and equipment at the carrying amount prior to the transfer and depreciated over the useful economic lives.

Spare parts that are acquired as part of an equipment purchase which are only to be used in connection with these specific assets are initially capitalised and amortised as part of the equipment. Spare parts which are expected to be used during more than one period are capitalised as property, plant and equipment.

NOTE: Policy to be included where a policy of revaluation has been chosen: