[et_pb_section bb_built=”1″ admin_label=”Header – All Pages” transparent_background=”off” background_color=”#1e73be” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” custom_padding=”0px||0px|” next_background_color=”#000000″ custom_padding_tablet=”50px|0|50px|0″ custom_padding_last_edited=”on|desktop” global_module=”1221″][et_pb_row admin_label=”row” global_parent=”1221″ make_fullwidth=”off” use_custom_width=”off” width_unit=”on” use_custom_gutter=”off” custom_padding=”||5px|” allow_player_pause=”off” parallax=”off” parallax_method=”on” make_equal=”off” parallax_1=”off” parallax_method_1=”off” background_position=”top_left” background_repeat=”repeat” background_size=”initial”][et_pb_column type=”4_4″][et_pb_post_title global_parent=”1221″ title=”on” meta=”off” author=”on” date=”on” categories=”on” comments=”on” featured_image=”off” featured_placement=”below” parallax_effect=”on” parallax_method=”on” text_orientation=”left” text_color=”light” text_background=”off” text_bg_color=”rgba(255,255,255,0.9)” module_bg_color=”rgba(255,255,255,0)” use_border_color=”off” border_color=”#ffffff” border_style=”solid” custom_padding=”10px|||” parallax=”on” background_color=”rgba(255,255,255,0)” /][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section bb_built=”1″ fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” custom_padding=”30px||0px|” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” background_color=”#1e73be” prev_background_color=”#000000″ next_background_color=”#ffffff” custom_padding_tablet=”0px||0px|” global_module=”1228″][et_pb_row global_parent=”1228″ make_fullwidth=”off” use_custom_width=”off” width_unit=”on” use_custom_gutter=”off” custom_padding=”30px||0px|” allow_player_pause=”off” parallax=”off” parallax_method=”off” make_equal=”off” parallax_1=”off” parallax_method_1=”off” column_padding_mobile=”on” background_position=”top_left” background_repeat=”repeat” background_size=”initial”][et_pb_column type=”4_4″][et_pb_text global_parent=”1228″ background_layout=”light” text_orientation=”left” use_border_color=”off” border_color=”#ffffff” border_style=”solid” background_position=”top_left” background_repeat=”repeat” background_size=”initial”] [breadcrumb] [/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section bb_built=”1″ fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” gutter_width=”3″ custom_padding_tablet=”0px||0px|” custom_padding_last_edited=”on|desktop” prev_background_color=”#1e73be” next_background_color=”#000000″][et_pb_row][et_pb_column type=”4_4″][et_pb_toggle admin_label=”Index” _builder_version=”3.0.105″ title=”Section 1A – Index” open=”off”]

1A.1.1 Extract from FRS102: Section 1A.1-1A.4

1A.2.1 Section 1A – As applicable to the republic of Ireland

1A.2.1.2 Which companies can avail of Section 1A/Small Company’s regime?

1A.2.1.3 What remains the same?

1A.2.2 Section 1A and UK Companies

1A2.3 Choice to apply section 1A of FRS 102

1A.3.1 Extract from FRS102: Section 1A.5-.1A.6

1A.3.2 OmniPro comment – True and fair view

1A.4 Complete set of financial statements of a small entity

1A.4.1 Extract from FRS102: Section 1A.7-1A.11, Section 1AD.1 and Section 1A.16-1A.20

1A.4.2.1 What Section 1 means in practical terms?

1A.4.2.2 The minimum disclosure requirements and the requirements to still show a true and fair view

1A.4.2.3 Disclosure encouraged under S.1A

1A.4.2.4 Formats of Balance Sheet and profit and Loss Account

1A5 Information to be presented in the statement of financial position

1A5.1 Extract from FRS102: Section 1A.12-1A.13

1A6 Information to be presented in the income statement

1A6.1 Extract from FRS102: Section 1A.14-1A.15

1A7 Voluntary preparation of consolidated financial statements

1A7.1 Extract from FRS102: Section 1A.21-1A.22

1A8.1.1 Guidance on adapting the balance sheet formats

1A8.1.1.1 Extract from FRS102: Section 1AA.1

1A8.1.1.2.2 Required formats for entities

1A8.1.1.2.2.2 Format 1 – Balance sheet – set out in legislation – Schedule 3A

1A8.1.1.2.2.3: Format 2 – balance sheet – set out in legislation – Schedule 3A

1A8.1.1.2.2.4 Example – Format 1 – Balance sheet – practical application

1A8.1.1.2.2.5 Notes required to balance sheet

1A8.2.1 Abridged balance sheet

1A8.2.1.1 Extract from FRS102: Section 1AA.2

1A8.3.1.1 Extract from FRS102: Section 1AA.3-1AA.6

1A8.3.1.2.2 Example adapted/IFRS layout – Balance sheet

1A9.1.1 Guidance on adapting the profit and loss account formats

1A9.1.1.1 Extract from FRS102: Section 1AB.1

1A9.1.1.2.2 Application of format 1 profit and loss account set out in legislation

1A9.1.1.2.3 Application of format 2 – profit and loss account set out in legislation

1A9.1.1.2.4 Example format 1 – profit and loss account.

1A9.1.1.2.5 Notes required to profit and loss account at a minimum

1A9.9.1.2.5.1 Consolidated profit and loss note requirements

1A9.2 Abridged Profit and Loss Account

1A9.2.1 Extract from FRS102: Section 1AB.2

1A9.3 Adapted Profit and Loss Account

1A9.3.1 Extract from FRS102: Section 1AB.3-1AB.4

1A9.3.2.2: Example adapted/IFRS layout on the profit and loss accounts

1AC10 Appendix C to Section 1A (Applicable for UK entities)

1AC10.1 Disclosure requirements for small entities

1AC10.1.1 Extract from FRS102: Section 1AC.1-1AC.2

1A10.1.2.2 What entities must comply with Appendix C

1AC10.2.1 Extract from FRS102: Section 1AC.3-1AC.

1AC10.2.2.1.1 Accounting police disclosure

1AC10.2.2.1.1.2 Basis of preparation

1AC10.2.2.1.1.4 Basis of consolidation (if applicable)

1AC10.2.2.1.4.1 Subsidiary undertakings

1AC10.2.2.1.1.4.2 Associates and joint ventures

1AC10.2.2.1.1.5 Business combinations and goodwill [if applicable]

1AC10.2.2.1.1.8 Intangible assets

1AC10.2.2.1.1.9 Contingent acquisition consideration

1AC10.2.2.1.1.10 Financial assets

1AC10.2.2.1.1.11 General turnover accounting policy notes

1AC10.2.2.1.1.11.2 Turnover accounting policy for an insurance broker Turnover – commission income

1AC10.2.2.1.1.11.4 Turnover accounting policy note where turnover is derived from investments

1AC.10.2.2.1.1.11.5 Turnover accounting policy for a software

1AC10.2.2.1.1.11.6 Turnover accounting policy for a construction company

1AC10.2.2.1.1.12 Government grants

1AC10.2.2.1.1.12.1 Accruals model

1AC10.2.2.1.1.12.2 Performance model

1AC10.2.2.1.1.13 Dividend income

1AC10.2.2.1.1.14 Dividend distribution

1AC10.2.2.1.1.16 Financial instruments

1AC10.2.2.1.1.16.1 Trade and other debtors

1AC10.2.2.1.1.16.2 Cash and cash equivalents.

1AC10.2.2.1.1.16.3 Other financial assets.

1AC10.2.2.1.1.16.4 Trade and other creditors.

1AC10.2.2.1.1.16.7 Offsetting financial instruments.

1AC10.2.2.1.1.17 Compound financial instruments.

1AC10.2.2.1.1.19 Hedge accounting

1AC10.2.2.1.1.20.1 Environmental liabilities

1AC10.2.2.1.1.20.2 Closure costs

1AC10.2.2.1.1.21 Contingencies

1AC10.2.2.1.1.22 Employee Benefits

1AC10.2.2.1.1.23 Preference share capital

1AC10.2.2.1.1.24 Share capital

1AC10.2.2.1.1.25 Related party transactions

1AC10.2.2.1.1.26 Interest income

1AC10.2.2.1.1.28 Tangible fixed assets

1AC10.2.2.1.1.30 Investment properties

1AC10.2.2.1.1.31.1 Finance leases

1AC10.2.2.1.1.31.2 Operating leases

1AC10.2.2.1.1.31.3 Lease incentives

1AC10.2.2.1.1.32 Leasing company accounting policy

1AC10.2.2.1.1.33 Intangible assets

1AC10.2.2.1.1.35 Exceptional items

1AC10.2.2.1.1.36 Share based costs

1AC10.2.2.1.1.37 Investment properties

1AC10.2.2.1.1.38 Biological assets (where fair value is used)

1AC10.2.2.1.1.39 Biological assets – Livestock (where fair value model is adopted)

1AC10.2.2.1.1.40 Biological assets – Forestry (where cost model is adopted)

1AC10.2.2.1.1.41 Biological assets – Livestock (where cost model is adopted)

1AC10.3 Changes in presentation and accounting policies and corrections of prior period errors

1AC10.3.1 Extract from FRS102: Section 1AC.7-1AC.9

1AC10.3.2.2. Prior period adjustment disclosure

1AC10.3.2.2.1 Option 1 – Analysis of prior period adjustments

1AC10.3.2.2.2 Option 2: Analysis of prior period adjustments

1AC10.3.2.2.2.3 Profit and Loss reserves note/statement of changes in equity

1AC10.3.2.2.3 Statement in changes in equity note – prior period error/change in accounting policy

1AC10.3.2.2.4 Illustration of change in accounting policy disclosure

1AC10.3.2.2.4.1 Example extract of a change in accounting policy disclosure

1AD11.3.2.5 Change in classification from prior period

1AC10.4 True and fair override

1AC10.4.1 Extract from FRS102: Section 1AC.10

1AC10.5 Notes supporting the statement of financial position

1AC10.5.1 Extract from FRS102: Section 1AC.11-1AC.19

1AC10.5.2.1 Property, plant and equipment/tangible fixed assets. Including revaluation

1AC 10.5.2.1.1 Borrowing costs

1AC10.5.2.2 Intangible assets including revaulation

1AC10.5.2.4 Illustration of the revaluation reserve disclosures.

1AC10.5.2.5 Investment properties note

1AC10.5.2.6 Alternative layout for the investments note and illustration of financial assets

1AC10.6 Details of indebtness and securities held (if any) 91

1AC10.6.2 Extract from FRS 102: Section 1AC.27

1AC10.7.1 Extract from FRS102: Section 1AC.20-1AC.21

1AC10.8 Fair value measurement

1AC10.8.1 Extract from FRS102: Section 1AC.22-Section 1AC.24 and section 1AC.26

1AC10.8.2.2 Extract from the notes to the financial statements – note on investment property

1AC10.8.2.3 Investment note with investment in subsidiary, joint ventures and other investments

1AC10.8.2.4 Extract of notes to the financial statements – Financial instruments note disclosures

1AC10.8.2.4.1 Extract of notes to the financial statements – Interest receivable and similar income

1AC 8.2.4.2 Extract of notes to the financial statements – interest payable and similar expenses

1AC10.8.2.4.3 Alternative disclosure for profit and loss

1AC10.8.2.4.4 Extract from other comprehensive income showing activity on cash flow hedges:

1AC10.8.2.4.4.1 Cash flow fair value hedge reserve disclosure requirements:

1AC10.9 Indebtedness, guarantees and financial commitments

1AC10.9.1 Extract from FRS102: Section 1AC.27-1AC.31

1AC10.9.2.2 Contingencies note

1AC10.9.2.3 Off-balance sheet arrangements note (section 1AC.31 od Appendix C of FRS 102)

1AC10.9.2.4 Commitments notes (section 1AC.31 of Appendix C of FRS 102)

1AC10.9.2.5 Indebtness note and security disclosures

1AC10.10 Notes supporting the income statement / profit and loss accounts

1AC10.10.1 Extract from FRS102: Section 1AC.32-1AC.33

1AC10.10.2.2 Extract to show required profit and loss disclosures

1AC10.10.2.2.1 Exceptional item defined and the disclosure requirements

1AC10.10.2.2.2 Exceptional item disclosure

1AC10.10.2.3 Employee numbers disclosure:

1AC10.10.2.4 Other profit and loss disclosures

1AC10.11 Related party disclosures

1AC10.11.1 Extract from FRS102: Section 1AC.34-1AC.36

1AC10.11.2.1.1 Related party defined

1AC10.11.2.2 Related party note – with related entities

1AC10.11.2.3 Loans, guarantees, credit transactions entered into the benefit of directors

1AC10.11.2.4 Directors remuneration

1AC10.11.7 Controlling Party disclosure

1AC10.12.1 Extract from FRS102: Section 1AC.37-1AC.39

1AC10.12.2.1 Disclosures required describing the entity

1AC10.12.2.2 Post balance sheet events

1AC10.13.1 Auditors remuneration, Interest income or expense from loans to and from group entities

1AC10.13.1.1 Interest income or expense from loans to and from group entities

1AC10.13.1.2 Auditors remuneration

1AC10.13.2 Debtors and Creditors Note as required by Formats

1AC10.13.3 Share capital disclosures

1AD11 Appendix D to Section 1A (applicable for Republic of Ireland entities only)

1AD11.1 Disclosure requirements for small entities in the Republic of Ireland

1AD11.1.1 Extract from FRS102: Section 1AD.1-1AD.2

1A11.1.2.1 Summary section 1A disclosure checklist

1AD11.2.1 Extract from FRS102: Section 1AD.3-1AD.6

1AD11.2.2.1.1 General information

1AD11.2.2.1.2 Basis of preparation

1AD11.2.2.1.3 Consolidation exemption

1AD11.2.2.1.4 Basis of consolidation – (If Applicable)

1AD11.2.2.1.4.1 Subsidiary undertakings

1AD11.2.2.1.4.2 Associates and joint ventures

1AD11.2.2.1.4.3 Transactions eliminated on consolidation

1AD11.2.2.1.5 Business combinations and goodwill

1AD11.2.2.1.8 Intangible assets

1AD11.2.2.1.9 Contingent acquisition consideration

1AD11.2.2.1.10 Financial assets

1AD11.2.2.1.11.1 General turnover accounting policy notes

1AD11.2.2.11.2 Turnover accounting policy for an insurance broker

1AD11.2.2.11.4 Turnover accounting policy note where turnover is derived from investments Turnover

1AD11.2.2.11.5 Turnover accounting policy for a software company

1AD11.2.2.11.6 Turnover accounting policy for a construction company

1AD11.2.2.12 Government grants

1AD11.2.2.12.2 Performance model

1AD11.2.2.14 Dividend distribution

1AD11.2.2.16 Financial instruments

1AD11.2.2.16.1 Trade and other debtors

1AD11.2.2.16.2 Cash and cash equivalents.

1AD11.2.2.16.3 Other financial assets.

1AD11.2.2.16.4 Trade and other creditors.

1AD11.2.2.16.7 Offsetting financial instruments.

1AD11.2.2.17 Compound financial instruments.

1AD11.2.2.20.1 Environmental liabilities

1AD11.2.2.22 Employee Benefits

1AD11.2.2.23 Preference share capital

1AD11.2.2.25 Related party transactions

1AD11.2.2.28 Tangible fixed assets

1AD11.2.2.30 Investment properties

1AC10.2.2.1.1.31.1 Finance leases

1AD11.2.2.31.2 Operating leases

1AD11.2.2.31.3 Lease incentives

1AC10.2.2.1.1.32 Leasing company accounting policy

1AD11.2.2.33 Intangible assets

1AD11.2.2.35 Exceptional items

1AD11.2.2.36 Share based costs

1AD11.2.2.37 Investment properties

1AD11.2.2.38 Biological assets (where fair value is used)

1AD11.2.2.39 Biological assets – Livestock (where fair value model is adopted)

1AD11.2.2.40 Biological assets – Forestry (where cost model is adopted)

1AD11.2.2.41 Biological assets – Livestock (where cost model is adopted)

1AD11.2.2.1.42 Prior period adjustment – Change in accounting policy

1AD11.2.2.43 Change in accounting estimate

1AD11.3 Changes in presentation and accounting policies and corrections of prior period errors

1AD11.3.2 Extract from Section 1AD.8 to 1AD.10 of S1A of FRS 102

1AD11.3.2.2 Prior year adjustment disclosure

1AD11.3.2.2.1 Option 1: Analysis of prior year adjustments

1AD11.3.2.2.2 Option 2 – Analysis of prior year adjustments

AD11.3.2.2.3 Movement in profit and loss reserves note or statement of changes in equity

1AD11.3.2.4 Example extract of a change in accounting policy disclosure

1AD11.3.2.5 Change in classification from prior period

1AD11.4 True and fair view override

1AD11.4.1 Extracts from FRS 102: Section 1AD.11

1AD11.5 Notes to the statement of financial position – fixed assets

1AD11.5.1 Extract from FRS 102: Section 1AD.13 – 1AD.18

1AD11.5.2.1.3 Intangible assets

1AD11.5.2.1.5 Example disclosure for a revaluation reserve

1AD11.5.2.1.6 Investment properties

1AD11.5.2.1.7 Financial assets note

1AD11.6.1 Extracts from FRS 102: Section 1AD.20 – 1AD.21

1AD11.7 Borrowing/creditors details

1AD11.7.1 Extracts from FRS 102: Sction 1AD.26 – 1AD.28

1AD11.8 Appropriation of profit or loss/profit and loss reserve movements

1AD11.8.1 Extract from FRS 102: Section 1AD.35

1AD11.9 Fair value measurement

1AD11.9.1 Extract from FRS 102; Section 1AC.22 to 1AC.25

1AD11.9.2.1 Analysis – fair value disclosure requirements

1AD11.9.2.2 Extract from the notes to the financial statements

1AD11.9.2.2.1 Investment property

1AD11.9.2.2.3 Financial instrument note disclosures

1AD11.9.2.2.4 Fair value reserve disclosures

1AD11.10 Notes to the income statements/profit and loss account

1AD11.10.1 Extract from FRS 102: Sections 1AD.36 to 1AD .37

1AD11.10.2.2 Extract to show required profit and loss disclosures

1AD11.10.2.2.1 Exceptional item defined and the disclosure requirements

1AD11.10.2.2.1.1 Exceptional item disclosure

1AD11.10.2.2.2 Employee note disclosure

1AD11.10.2.2.3 other profit and loss disclosures

1AD11.11 Related party disclosures – director’s remuneration

1AD11.11.1 Extract from FRS 102: sections 1AD.38 to 1AD.40

1AD11.11.2.1 Related parties defined

1AD11.11.2.1.1 Connected person defined

1AD11.11.2.2 Directors remuneration disclosure

1AD11.11.2.2.1 Make up of director’s remuneration

1AD11.12.1 Extracts from FRS 102: 1AD.41 to 1AD.47

1AD11.12.2.1.1 Application to non-companies

1AD11.12.2.1.2 Get out from disclosure if below a specified value.

1AD11.12.2.2 Disclosures of loans and guarantees for the benefit of directors.

1AD11.13 Related party transactions material transactions with directors

1AD11.13.1 Extracts from FRS 102: Secton 1AD.48

1AD11.13.2.2 Is there exemptions from the disclosure?

1AD11.14 Other related party transactions (other than transactions with director)

1AD11.14.1 Extracts from FRS 102: Section 1AD.51

1AD11.15 Ultimate controlling party

1AD11.15.1 Extract from FRS 102: Section 1A.50

1AD11.16 Post balance sheet events

1AD11.16.1 Extracts from FRS 102: Sections 1A.54

1AD.11.17 Guarantees, financial commitments and contingencies

1AD.11.17.1 Extract from FRS 102: Sections 1AD.28 to 1AD.34

1AD11.17.2.2 Contingencies (1AD.31 and 1AD.34 of Appendix D of FRS 102)

1AD11.18 Holding of own shares

1AD11.18.1 Extract form FRS 102; Section 1AD.49

1AD11.19.1 Extract from FRS 102; Sections 1AD.52 – 1AD.53 and 1AD.55

1AD11.19.2.1 Disclosing legal form, registered office, basis of preparation

1AD11.20 Other items required by the formats under Companies Act

1AD11.20.4 Creditors: amounts falling due within one-year note

1AD11.20.5 Creditors: Amounts falling due after more than one-year note

1AD11.20.6 provision for liabilities

1AE.13.1 Additional disclosures encouraged for small entities

1AE.13.1.1 Extract from FRS102: Section 1AE.1

1AE.13.1.2.2 Statement of compliance

1AE.13.1.2.3.1 Transition note adjustments example

1A11.2.2.1 Transition to FRS 102 – first time exemption – Section 1A

[/et_pb_toggle][/et_pb_column][/et_pb_row][et_pb_row][et_pb_column type=”3_4″][et_pb_text admin_label=”Main Body Text” background_layout=”light” text_orientation=”justified” use_border_color=”off” border_color_all=”off” module_alignment=”left” _builder_version=”3.0.105″]

1A5 Information to be presented in the statement of financial position

1A5.1 Extract from FRS102: Section 1A.12-1A.13

1A.12 A small entity shall present a statement of financial position in accordance with the requirements for a balance sheet set out in either Part 1 General Rules and Formats of Schedule 1 to the Small Companies Regulations or Part 1 General Rules and Formats of Schedule 1 to the Small LLP Regulations

1A.13 Guidance on applying these requirements is set out in Appendix A to this section, which shall be applied by a small entity.

1A5.2 OmniPro comment

As per section 1A.12 and 1A.14 of FRS 102 , entities must follow the formats dedicated in Schedule 3A of Companies Act 2014. These have been illustrated at 1A8.1.2 and 1A9.1.2.1. They can be adopted to an IFRS format if required or adjusted as long as it provides all the details required by Schedule 3A of Companies Act 2014.

See Section 1A, appendix A of FRS 102 for our comments in relation to same. See example of the formats below on the face of the balance sheet. Note a small company can continue to apply the rules for medium and large entities in CA 2006 (for UK entities) or CA 2014 (for ROI entities) if it wishes.

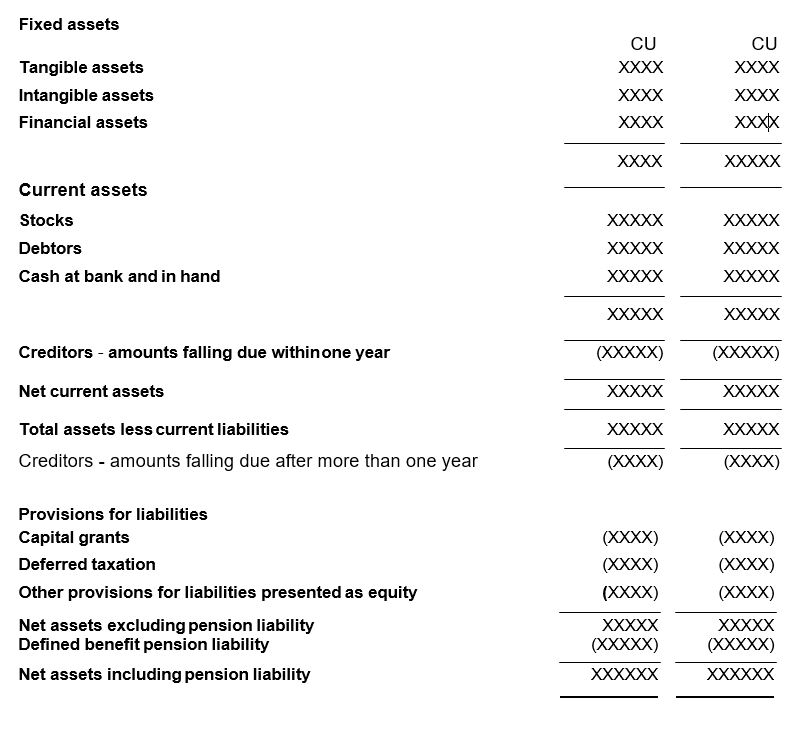

Extract from the Balance Sheet At 31 December 201X

[/et_pb_text][/et_pb_column][et_pb_column type=”1_4″][et_pb_toggle admin_label=”Practical Examples” _builder_version=”3.0.105″ title=”Practical Examples” open=”off”]

Examples

Example 2: Statement of compliance with FRS 102

Example 3: Transition note adjustment

[/et_pb_toggle][/et_pb_column][/et_pb_row][/et_pb_section]