[et_pb_section admin_label=”Header – All Pages” global_module=”1221″ transparent_background=”off” background_color=”#1e73be” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” custom_padding=”||0px|”][et_pb_row global_parent=”1221″ admin_label=”row”][et_pb_column type=”4_4″][et_pb_post_title global_parent=”1221″ admin_label=”Post Title” title=”on” meta=”off” author=”on” date=”on” categories=”on” comments=”on” featured_image=”off” featured_placement=”below” parallax_effect=”on” parallax_method=”on” text_orientation=”left” text_color=”light” text_background=”off” text_bg_color=”rgba(255,255,255,0.9)” module_bg_color=”rgba(255,255,255,0)” title_all_caps=”off” use_border_color=”off” border_color=”#ffffff” border_style=”solid” title_font=”|on|||” title_font_size=”35″ custom_padding=”10px|||”] [/et_pb_post_title][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” global_module=”1228″ fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” custom_padding=”0px||0px|” padding_mobile=”on” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” gutter_width=”3″][et_pb_row global_parent=”1228″ admin_label=”Row” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” use_custom_gutter=”off” gutter_width=”3″ custom_padding=”0px||0px|” padding_mobile=”off” allow_player_pause=”off” parallax=”off” parallax_method=”off” make_equal=”off” parallax_1=”off” parallax_method_1=”off” column_padding_mobile=”on”][et_pb_column type=”4_4″][et_pb_text global_parent=”1228″ admin_label=”Text” background_layout=”light” text_orientation=”left” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [breadcrumb] [/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” fullwidth=”off” specialty=”off”][et_pb_row admin_label=”Row”][et_pb_column type=”1_2″][et_pb_text admin_label=”Return to 105 Index” background_layout=”light” text_orientation=”center” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [button link=”https://ie.frs102.com/members/premium-toolkit/frs-105/” type=”big” color=”red”] Return to FRS 105 Main Menu[/button] [/et_pb_text][/et_pb_column][et_pb_column type=”1_2″][et_pb_text admin_label=”Return to Section 9 Home” background_layout=”light” text_orientation=”center” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [button link=”https://ie.frs102.com/members/premium-toolkit/frs-105/section-9/” type=”big” color=”red”] Return to Section 9 Home[/button] [/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” gutter_width=”3″][et_pb_row admin_label=”Row”][et_pb_column type=”4_4″][et_pb_text admin_label=”Main Body Text” background_layout=”light” text_orientation=”justified” use_border_color=”off” border_color=”#ffffff” border_style=”solid” module_id=” “]

Section 9 – Financial Instruments

Section 9 deals with the recognition, derecognition and measurement criteria of all financial instruments including investments in subsidiaries, associates and joint ventures. It also details the indicators or impairment for financial assets that are classed as financial instruments.

The section covers all financial assets and liabilities other than those stated in Section 9.3 below. Examples of financial instruments covered include:

- cash;

- accounts receivable and payable (trade debtors and creditors);

- commercial paper and commercial bills held;

- all types of bank accounts;

- bonds, loans and similar instruments regardless of the terms;

- loans receivable/payable regardless of terms

- investments of all kind (in shares, long term loans etc.);

- investment in listed shares, collective investment funds

- investment in subsidiary, associate or joint ventures (jointly controlled entities)

- options, warrants, futures contracts, forward contracts and interest rate swaps

- accrued income

- preference shares which are classified as a liability under Section 17 of FRS 105

Scope and definition of financial asset and liability

Extract from FRS 105 – Section 9.4 & Extract from Glossary to FRS 105

Section 9.3 clarifies that this section does not apply to the following financial instruments:

- Financial instruments that meet the definition of a micro-entity’s own equity, and the equity component of compound financial instruments issued by the reporting micro-entity that contain both a liability and an equity component (see Section 17 Liabilities and Equity).

- Leases, to which Section 15 Leases applies. However, the derecognition requirements in paragraphs 9.21 to 9.23 and impairment accounting requirements in paragraphs 9.16 to 9.19 apply to derecognition and impairment of receivables recognised by a lessor and the derecognition requirements in paragraphs 9.25 and 9.26 apply to payables recognised by a lessee arising under a finance lease.

- Employers’ rights and obligations under employee benefit plans, to which Section 23 Employee Benefits applies.

- Financial instruments, contracts and obligations to which Section 21 Share-based Payment applies.

- Reimbursement assets and financial guarantee contracts accounted for in accordance with Section 16 Provisions and Contingencies.

- Contracts for contingent consideration in a business combination (see Section 14 Business Combinations and Goodwill). This exemption applies only to the acquirer.

Extract from Glossary to FRS 105 – A financial asset is any asset that is:

- Cash

- An equity instrument of another equity

- A contractual right:

- To receive cash or another financial asset from another entity; or

- To exchange financial assets or financial liabilities with another entity under conditions that are potentially favourable to the entity

- A contract that will or may be settled in the entity’s own equity instruments and:

- Under which the entity is or may be obliged to receive a variable number of the entity’s own equity instruments; or

- That will or may be settled other than by the exchange of a fixed amount of cash or another financial asset for a fixed number of the entity’s own equity instruments. For this purpose, the entity’s own equity instruments do not include instruments that are contracts for the future receipt or delivery of the entity’s own equity instruments.

A financial liability is any liability that is:

- A contractual liability to deliver cash or another financial asset from another entity; or

- To exchange financial assets or liabilities with another entity under conditions that are potentially unfavourable to the entity;

- A contract that will or may be settled in the entities own equity instruments and:

- Under which the entity is or may be obliged to deliver a variable number of the entity’s own equity instruments; or

- That will or may be settled other than by the exchange of a fixed amount of cash or another financial asset for a fixed number of the entity’s own equity instruments. For this purpose, the entity’s own equity instruments do not include instruments that are contracts for the future receipt or delivery of the entity’s own equity instruments.

OmniPro comment

Based on the above definitions the below items are not considered to be financial instruments for the purposes of this section:

- Tangible and intangible fixed assets

- Investment property;

- Stocks/inventory;

- Prepayments for good or services;

- Deferred income and warranty obligations where settled by delivery of goods or services;

- Accrued dividend where the entity does not have to deliver cash; and

- Current tax.

- Leases (impairment rules do apply)

- Pension liabilities

- Share based payment arrangements

- Contracts for contingent consideration for the acquirer

- Assets and guarantees accounted for in accordance with Section 16 ‘Provisions’

The below items are financial instruments for the purpose of Section 9:

- cash;

- accounts receivable and payable (trade debtors and creditors);

- commercial paper and commercial bills held;

- all types of bank accounts;

- bonds, loans and similar instruments regardless of the terms;

- loans receivable/payable;

- investments of all kind (in shares, long term loans etc.);

- investment in listed shares, collective investment funds and any other type of investment;

- investment in subsidiary, associate or joint ventures (jointly controlled entities);

- options, warrants, futures contracts, forward contracts and interest rate swaps;

- accrued income;

- preference shares which are classified as a liability under Section 17 of FRS 105;

- deposit accounts of all kinds

Initial recognition of financial assets and liabilities

Extract from FRS 105 – Section 9.4 – 9.7

9.4 A micro-entity shall recognise a financial asset or a financial liability only when the micro-entity becomes a party to the contractual provisions of the instrument.

Initial measurement

9.5 A financial asset or financial liability is recognised initially at its cost. The cost is measured at the transaction price.

|

Examples – Transaction price of a financial asset or liability |

|

1 For a loan the transaction price is the amount borrowed or loaned. |

|

2 For trade receivables or payables (trade debtors or trade creditors) the transaction price equals the invoice price unless payment is deferred beyond normal credit terms (see paragraph 9.6). |

|

3 For an investment the transaction price is the consideration given (e.g. cash paid to acquire the investment). |

|

4 For an option the transaction price is the premium paid to purchase the option. |

OmniPro comment

Examples of the transaction price is as follows:

- Bonds = amount of consideration paid out for the bond (excluding any transaction costs)

- Loans = Value of loan received/advanced

- Trade debtors/creditors = invoice price or where payment is deferred beyond normal credit terms, the cash price of those goods sold/services rendered.

- Options, forward contracts, interest rate swaps = the cost of purchasing these instruments.

- Related party loans i.e. loans to and from group companies, directors, shareholders regardless of the terms = Value of loan received/advanced

As can be see it is irrelevant what terms are included in relation to loans (i.e. whether interest is charged, whether it is repayable on demand or not etc.), in all instances the loan should initially be measured at the actual amount of the loans received or advanced in the financial statements (i.e. no need to discount at market rate etc.)

Payment deferred beyond normal credit terms

Extract from FRS 105 – Section 9.6

9.6 When a micro-entity purchases inventory, property, plant and equipment, investment property or sells goods or services with settlement deferred beyond normal credit terms, the transaction price is the cash price available on the date of the transaction (see Sections 10 Inventories, 12 Property, Plant and Equipment and Investment Property and 18 Revenue respectively).

OmniPro comment

Where favourable terms have been received or given the purchase/sale and related creditor/debtor must be recognised at the cash price at the date of the transaction

Example 1: Transaction price when payment is deferred

A micro-entity sells goods to a customer for CU100. Customers are usually required to pay within 14 days of the invoice date, but the micro-entity agrees with the customer that payment will be deferred for one year. The micro-entity sells the same item for CU90, if payment is received within the usual credit terms.

The cash price for the goods and thereby the transaction price is CU90. Assume the credit term is over two months and the sale occurred at the start of the month.

The journals required at initial recognition and subsequently are:

|

|

CU |

CU |

|

Dr Debtors |

90 |

|

|

Cr Turnover |

|

90 |

Being journal to recognise the sale at the cash price

|

|

CU |

CU |

|

Dr Debtors (CU100-CU90)/2mth*1mth |

5 |

|

|

Cr Interest Income |

|

5 |

Being journal to release the interest income for month 1 so that the trade debtor balance increases to CU95 at the end of month one.

Example 2: Purchase with unusual credit terms

If we take example 1, and show the accounting for the purchaser in this case. For the purchasing company the journals to post are:

|

|

CU |

CU |

|

Dr Inventory |

100 |

|

|

Cr Trade Creditors |

|

100 |

Being journal to reflect purchase of stock at full price

|

|

CU |

CU |

|

Dr Trade Creditors |

10 |

|

|

Cr Inventory |

|

10 |

Being journal to reflect the deemed financing element of the sale so as to show the correct cost

|

|

CU |

CU |

|

Dr Interest Expense in P&L (CU100/-CU10)2mths * 1 mth) |

5 |

|

|

Cr Trade Creditors |

|

5 |

Being journal reflect the deemed interest expense in the profit and loss for the one month.

|

|

CU |

CU |

|

Dr Interest Expense in P&L (CU10/2mths * 1 mth) |

5 |

|

|

Cr Trade Creditors |

|

5 |

Being journal reflect the deemed interest expense in the profit and loss for the second month so as to show CU 100 at the time of payment.

Example 3: Sale with unusual credit terms – cash price not easily determined

Company A sold goods worth CU200,000 with unusual credit terms on 01/01/16. The credit provided is for a period up to 31/12/20. Assume the cash price could not be easily determined easily. In order to ascertain the cash price the company would present value the CU200,000 at a market rate of interest for loan of the same length. Assume for the purposes of this example that market rate of interest is 5%.

The present value is CU200,000 / (1.05)^5 = CU156,705

|

|

CU |

CU |

|

Dr Debtors |

156,705 |

|

|

Cr Turnover |

|

156,705 |

Being journal to recognise the sale at the estimated cash price

|

|

CU |

CU |

|

Dr Debtors (CU200,000-CU156,705)/ 5 yrs |

8,659 |

|

|

Cr Interest Income |

|

8,659 |

Being journal to release the interest income for year 1

|

|

CU |

CU |

|

Dr Debtors (CU200,000-CU156,705)/ 5 yrs |

8,659 |

|

|

Cr Interest Income |

|

8,659 |

Being journal to release the interest income for year 2

Note the same type of journal will be recognised for years 3-5 so that the debtor balance is CU200,000 at the date of receipt

Transaction costs

Extract from FRS 105 – Section 9.7 & 9.

9.7 Transaction costs shall be added to the cost of a financial asset or shall be deducted from the cost of a financial liability, unless they are not material in which case they are recognised immediately as an expense in profit or loss.

|

Examples – Transaction costs |

|

1 A micro-entity receives a bank loan of CU500. The bank charges CU5 in arrangement fees. The micro-entity determines that the transaction costs are immaterial and recognises them immediately in profit or loss as an expense. The cost of the loan is CU500. |

|

2 A micro-entity is making an investment and buys shares in another entity for CU1,000. The micro-entity incurs legal fees and other transaction costs totalling CU100. The micro-entity determines that the transaction costs are material and includes them in the cost of the investment. The total cost of the investment is CU1,100. |

|

3 A micro-entity takes out a forward foreign currency exchange contract and is charged a fee of CU30. The micro-entity determines that the transaction costs are material. The total cost of the forward foreign currency exchange contract is CU30. |

9.15 Transaction costs not immediately recognised in profit or loss in accordance with paragraph 9.7, are recognised in profit or loss on a straight-line basis over the term of the contract.

|

Example 1: Measurement of a loan liability |

|

A micro-entity receives a loan of CU1,000 on 1 January 20X0. The micro-entity pays loan arrangement fees of CU50. The contractual interest rate is five per cent payable annually in arrears on 31 December. The loan is repayable after two years. The micro-entity’s annual reporting period ends on 31 December. The micro-entity determines that the loan arrangement fees (transaction costs) are material and on 1 January 20X0 recognises the loan at its transaction price of CU1,000 less the transaction costs of CU50. The transactions costs of CU50 are recognised in the profit and loss account on a straight-line basis over two years, ie CU25 each year. The carrying value of the loan is as follows: Year Carrying Interest at Transaction Cash Carrying amount at 5% costs in payments amount at 1 Jan profit or 31 Dec loss CU CU CU CU CU 20X0 (950) (50) (25) 50 (975) 20X1 (975) (50) (25) 1,050 0 |

|

Example 2: Measurement of a loan asset |

|

A micro-entity makes an interest-free loan of CU900 on 1 January 20X0. The loan is repayable after two years. In 20X1 the micro-entity agrees that the borrower only needs to repay CU450 which is paid on 31 December 20X1. The micro-entity’s annual reporting period ends on 31 December. The loan is recognised at its transaction price of CU900 on 1 January 20X0. In 20X1 an impairment loss for the uncollectability of CU450 is recognised. The carrying amount of the loan is as follows: Year Carrying Impairment Cash receipts Carrying amount at amount at 1 Jan 31 Dec CU CU CU CU 20X0 900 – – 900 20X1 900 (450) (450) 0 |

OmniPro comment

Transaction costs are only required to be added to the financial asset or deducted from the financial liability if they are material. If they are not material they can be expensed immediately.

Transaction costs are incidental costs directly attributable to the acquisition, issue or disposal of the financial asset or liability. They are usually:

- the arrangement fees,

- commitment fees, or

- facility fees.

These costs are added to the amount originally received where it is an asset or deducted from a liability.

Transaction costs do not include:

- debt premium or discounts;

- finance costs; or

- internal administration costs.

Once the transaction costs are considered material and therefore have been included with the related financial asset or liability they should be released to the profit and loss account on a straight line basis over the term of the contract with the following exception:

transaction costs incurred in acquiring investments in shares of all kinds should not be released and instead subject to the cost less impairment rules.

Example 4: Material loan arrangement fees

On 30 June 2016 the company restructured its loan finances and an arrangement fee of CU1,500 was charged and CU500 in directly attributable legal fees which is considered material (CU2,000 in total). The restructured loan is repayable over a 3 year period. Assume the company’s year-end is 31 December 2016. The journals required to effect this arrangement fee are:

|

|

CU |

CU |

|

Dr loan Liability |

2,000 |

|

|

Cr Bank/Accruals |

|

2,000 |

Being journal to set the arrangement fee against the loan

|

|

CU |

CU |

|

Dr interest expense (CU2,000/3 yrs *.5 yr) |

333 |

|

|

Cr loan Liability |

|

333 |

Being journal to release the arrangement fee for the 6 months to 31/12/16

The remaining unamortised portion at 31 December 2016 will be released to the P&L over the next 2.5 years (i.e.CU667 per annum)

Allocation of interest income or expense

Extract from FRS 105 – Section 9.8 – 19.12

9.14 A micro-entity shall allocate total interest income or expense over the term of the contract as follows:9.13 Total interest income or expense is the difference between the initial transaction price and the total amount of the subsequent contractual receipts or payments, excluding transaction costs.

- For transactions where settlement is deferred beyond normal credit terms (see paragraph 9.6), total interest income or expense shall be allocated on a straight- line basis over the term of the contract.

- In all other cases, interest income or expense is allocated at a constant rate on the financial asset’s or financial liability’s carrying amount excluding transaction costs not yet recognised in profit or loss (see paragraph 9.12(b)). The applicable rate will normally be the contractual rate of interest and may be a variable or a fixed rate.

OmniPro comment

Interest income and expenses may arise in the following circumstances:

- Sales or purchases where settlement is deferred beyond normal credit terms as these transactions are initially recognised at the cash price

- Premium and discounts on bonds

- Unwinding of the discount on liabilities/assets accounted for in accordance with Section 16 ‘Provisions and Contingencies’

Only where the interest income/expense arises in relation to the sales/purchases where settlement is deferred beyond normal credit terms can it be released to the profit and loss over the term of the contract (i.e. the length of the credit provided). See examples 1 to 3 above for illustration of this point.

In all other cases it must be released at a constant rate on the financial asset/liability’s carrying amount excluding transaction costs not yet recognised in the P&L (can be at a fixed or variable rate). See below illustration of this point.

Example 5: Bonds – discount/premium

On 1 January 2015 Company A invested in a 5.625% Government bond at cost of €15,000 which reflected a discount of €1,000. This bond matures in two years’ time. The company also incurred transaction costs of CU500. The IRR is 0.1794% per month. This can also be calculated by use of the excel formula however it is usually provided on purchase of the bond (note in reality it is likely that using a straight line basis would not differ substantially from the implicit rate). Interest due on the bond has not been received at 31 December 2016 (i.e. the company’s year-end date). There were no transaction costs incurred on the purchase.

FRS 105 requires any discount or premium on a bond to be released as interest income/expense over the remaining life of the bond where material at a contractual rate of interest (implicit rate of return).

In order to reflect the release of this discount and the accrued interest, the following journals are required.

The interest income has not been recorded as receivable at the year end. The following journal is required to record the interest correctly:

|

|

CU |

CU |

|

Dr Government bond (CU15,000+CU500) |

15,500 |

|

|

Cr Bank |

|

15,500 |

Being journal to reflect the purchase of the bond and the capitalisation of transaction costs on initial recognition

|

Dr Bank (CU16,000*5.625%) |

900 |

|

|

Cr interest income in P&L |

|

900 |

Being journal to reflect the interest for year 1

|

Dr interest costs with the transaction fee write off in P&L (CU500/2yrs *1yr) |

250 |

|

|

Cr Government Bond |

|

250 |

Being journal to release the arrangement fee for completion of 1 year on a straight line basis

|

Dr Government Bond |

325 |

|

|

Cr interest income in P&L |

|

325 |

Being journal to reflect the release of the discount from date of acquisition to year end date and the accrued interest earned.

The same types of journals will be posted in year 2

If the bond was purchased at a discount a similar treatment would be required (except there would be a debit for the release of the premium).

Subsequent measurement

Extract from FRS 105 – Section 9.8 – 19.12

9.8 At the end of each reporting period, a micro-entity shall measure financial instruments as follows, without any deduction for transaction costs the micro-entity may incur on sale or other disposal:

- Investments in preference shares or ordinary shares and investments in subsidiaries and associates and interests in jointly controlled entities shall be measured at cost less impairment.

- Derivatives shall be measured as set out in paragraph 10.

- Financial instruments other than those covered by paragraphs (a) and (b) shall be measured as set out in paragraphs 9.12 to 9.15.

All financial assets must be assessed for impairment or uncollectability. See paragraphs 9.16 to 9.19.

Derivatives

9.9 Derivatives include forward foreign currency exchange contracts and interest rate swaps. More examples are given in paragraph 9.2(g).

9.10 The transaction price of a financial instrument that is a derivative plus any transaction costs not immediately recognised in profit or loss (see paragraph 9.7) less any impairment losses recognised to date, is allocated to profit or loss over the term of the contract on a straight- line basis, unless another systematic basis of allocation is more appropriate.

Contractual payments

9.11 Under a derivative contract a micro-entity may be required to make or may be entitled to receive payments. A micro-entity shall recognise amounts payable or receivable as they accrue.

Financial instruments measured in accordance with paragraph 9.8(c)

9.12 Financial instruments other than those covered in paragraphs 9.8(a) and 9.8(b) are measured as follows:

- the transaction price (see paragraph 9.5);

- plus, in the case of a financial asset, or minus in the case of a financial liability, transaction costs not yet recognised in profit or loss (see paragraph 15);

- plus the cumulative interest income or expense recognised in profit or loss to date (see paragraphs 9.13 and 9.14);

- minus all repayments of principal and all interest payments or receipts to date;

- minus in the case of a financial asset, any reduction (directly or through the use of an allowance account) for impairment or uncollectability (see paragraphs 9.16 to 9.19).

OmniPro comment

Investments in any kind of preference and ordinary shares must be accounted for at cost less impairment. It includes investments in:

- Listed shares

- Subsidiaries

- Associates

- Joint ventures (jointly controlled entities);

- Investment in shares not mentioned above

Example 6: Investment in Subsidiary/associate/Joint venture/holding less than an associate/listed shares

Company A invested CU100,000 in return for the issuance of 1,000 ordinary shares in Company B which made company B a subsidiary of Company A. Legal and professional costs of CU1,000 were incurred which are considered material. The carrying amount of the investment in Company B is held at CU100,000 unless an impairment arises.

The journals requires are:

|

|

CU |

CU |

|

Dr investment |

101,000 |

|

|

Cr bank/creditors |

|

101,000 |

Being journal to recognise the investment at cost

At the end of year 2 an indication of an impairment arose and as a result the investment was written down to CU60,000 in the books of Company A (CU41,000 recognised as an impairment expense in the P&L).

The journals requires are:

|

|

CU |

CU |

|

Dr administrative expenses – impairment charge |

41,000 |

|

|

Cr investment |

|

41,000 |

Being journal to write down the asset to the recoverable amount

At the end of year 4 the previous impairment had reversed. Hence the carrying amount of the investment in Company B was written back up from CU60,000 to CU101,000 at the time in the books of Company A.

The journals requires are:

|

|

CU |

CU |

|

Dr investment |

41,000 |

|

|

Cr administrative expenses – impairment charge |

|

41,000 |

Being journal to reverse prior impairment

Note if the above were listed shares or shares which gave the company a less than significant influence the journals would be the same.

Derivatives

When a derivatives i.e. forward contracts, interest rate swaps is entered into it must be measured at the transaction price plus transaction costs where material, less impairment and subsequently this should be released to the profit and loss account over the term of the contract.

Example 7: Derivatives

Company A entered into a forward contract to purchase FC 100,000 at a rate of CU1= FC0.8 at the start of the year which matures in 1.5 years time. The initial fee charged was CU1,500 plus transaction costs of CU100 which is material for the purposes of this entity. Assume at the start of year 2 that that the fair value of the forward contract was nil as the currency have moved in an unfavourable way (i.e. if this were sold it would not be purchased by any willing buyer as it is out of the money).

The journals required on initial recognition and subsequently are:

|

|

CU |

CU |

|

Dr derivatives/ other debtors/ prepayments |

1,600 |

|

|

Cr Bank/Creditors |

|

1,600 |

Being journal to recognise the cost of the derivative on the balance sheet

|

|

CU |

CU |

|

Dr FX gain/loss in administrative expenses (CU1,600/1.5 years * 1 years) |

1,067 |

|

|

Cr derivatives/other debtors/ prepayments |

|

1,067 |

Being journal to release the cost of the derivative over the life to year end date. If there was no impairment prior to the date of maturity the journal in the following year would also be CU533 but would be spread over the remaining months.

|

|

CU |

CU |

|

Dr impairment in administrative expenses (carrying amt of 533 reduced to nil as a result of impairment |

533 |

|

|

Cr derivatives/other debtors/ prepayments |

|

533 |

Being journal to recognise the impairment of the derivative at the start of year 2.

Note no further journal required at the date of maturity as it has a nil carrying amount. If prior to maturity the impairment reversed and it had a fair value, the previous impairment could be reversed but it could not be reversed above what it would have been had no impairment occurred. From then on, this restated amount would be written off over the remaining life. For example if we assume the impairment reversed at the end of March, then CU266 (CU533-(CU1,600/1.5 years*2.5mths) – Being the number of mouths to maturity) of the impairment above would be reversed at that date and the remaining CU267 would be written off over the remaining months on a straight line basis).

Financial instruments coming within this section other than investments in shares or derivatives as detailed above are subsequently measured at:

- transaction price,

- plus (if an asset)/minus (if a liability) transaction costs where material,

- plus interest income or expense;

- less repayments of interest and capital up to the period end date

- minus impairments.

Examples of the types covered by this are:

- cash;

- accounts receivable and payable (trade debtors and creditors);

- commercial paper and commercial bills held;

- all types of bank accounts;

- bonds, loans and similar instruments regardless of the terms;

- loans receivable/payable regardless of terms

- investment in collective investment funds/unit linked funds etc.

- preference shares which are classified as a liability under Section 17 of FRS 105

See example above for application of these rules to bonds.

Example 8: Loans

Company A received a loan from its parent company, Company B of CU100,000. This loan is interest free and repayable as follows:

End of year 2 CU30,000

End of year 5 CU70,000

Assume at the end of year 3 there was doubt about Company A’s ability to repay the loan due to financial difficulty, so only CU50,000 of the remaining loan could be repaid. At the end of year 4, the impairment indicator had reversed somewhat and the amount that could be repaid was likely to be CU60,000. Subsequently it became clear the full CU70,000 could be paid.

The journals required to reflect this in Company A are:

On the date of initial recognition

|

|

CU |

CU |

|

Dr bank |

100,000 |

|

|

Cr loan liability |

|

100,000 |

Being journal to recognise the loan on the balance sheet

At the end of Year 2:

|

|

CU |

CU |

|

Dr Loan liability |

30,000 |

|

|

Cr bank |

|

30,000 |

Being journal to reflect repayment at end of year 2

At the end of Year 5:

|

|

CU |

CU |

|

Dr Loan liability |

70,000 |

|

|

Cr bank |

|

70,000 |

Being journal to reflect repayment at end of year 2

The journals required to reflect this in Company B are:

On the date of initial recognition and at end of year 2:

As per above except the journals are the opposite way around.

At the end of Year 3:

|

|

CU |

CU |

|

Dr impairment of debtors/loan in P&L (CU70,000-CU50,000) |

20,000 |

|

|

Cr Loan Asset |

|

20,000 |

Being journal to reflect impairment at year end

At the end of Year 4:

|

|

CU |

CU |

|

Dr Loan Asset (CU70,000-CU60,000) |

10,000 |

|

|

Cr reversal of impairment of debtors/loan in P&L |

|

10,000 |

Being journal to reflect part reversal of prior year impairment

At the end of Year 5:

As per above except the journals are the opposite way around.

As can be seen above a liability cannot be derecognised until it has been formally cancelled of forgiven.

Impairment of financial assets

Recognition and measurement

9.16 At the end of each reporting period, a micro-entity shall assess whether there is evidence of impairment of any financial asset.

9.17 Evidence that a financial asset could be impaired includes the following events:

- significant financial difficulty of the debtor;

- a breach of contract, such as a default or delinquency in interest or principal payments;

- the creditor, for economic or legal reasons relating to the debtor’s financial difficulty, granting to the debtor a concession that the creditor would not otherwise consider;

- it has become probable that the debtor will enter bankruptcy or other financial reorganisation;

- declining market values of the asset or similar assets;

- significant changes with an adverse effect on the asset that have taken place in the technological, market, economic or legal environment; and

- the contract has become an onerous

9.18 A micro-entity shall measure an impairment loss for financial assets as set out below. An impairment loss is immediately recognised in profit or loss.

- An investment in preference shares or ordinary shares and an investment in subsidiaries and associates and an interest in jointly controlled entities is impaired and an impairment loss shall be recognised if the asset’s carrying amount exceeds the best estimate of the asset’s selling price as at the reporting date.

- An asset that is a derivative is impaired and an impairment loss shall be recognised if the asset’s carrying value exceeds the asset’s fair value less costs to sell.

- An asset measured in accordance with paragraph 9.8(c), is impaired and an impairment loss shall be recognised, if the asset’s carrying amount exceeds the total of estimated net cash flows that can be generated from the asset. When the effect of the time value of money is material, the amount of the net cash flows shall be the present value of the estimated net cash flows. The discount rate shall be the asset’s current contractual interest rate.

Reversal

9.19 A micro-entity shall reverse a previously recognised impairment loss if in a subsequent period the amount of an impairment loss decreases and the decrease can be related to an event occurring after the impairment was recognised (eg an improvement in the debtor’s credit rating). The micro-entity shall recognise the amount of the reversal in profit or loss immediately.

OmniPro comment

At the end of each reporting period an entity is required to assess whether there are indicators/objective evidence of impairment of financial assets and if there is an impairment should be booked. Detailed in Section 9.17 above are the detailed impairment indicators. They are summarised as follows:

(a) significant financial difficulty of the issuer or obligor;

(b) a breach of contract, such as a default or delinquency in interest or principal payments;

(c) the creditor, for economic or legal reasons relating to the debtor’s financial difficulty, granting to the debtor a concession that the creditor would not otherwise consider;

(d) it has become probable that the debtor will enter bankruptcy or other financial reorganisation;

(e) declining market values of the asset or similar assets;

(f) Significant changes with an adverse effect that have taken place in the technological, market, economic or legal environment; and

(g) a contract has become an onerous contract.

The standard does state that assets cannot be grouped. However it would be practice for all ordinary and preference shares to be assessed for impairment individually. Other financial assets can be grouped where it is determined appropriate and can usually be done on a collective basis where it is performed on the basis of credit risks.

Examples of impairments and how they are accounted for is included in the examples above. Note impairment of investments in subsidiaries, associates and joint ventures are covered by this Section as per Section 9.18(a) above. In assessing whether an impairment exists you should assess the best estimate of the selling price of the investment at the reporting date. In assessing this, one could utilise the guidance on valuation of privately held companies and apply a multiple based on this to assess whether this amount is in excess of the recoverable amount. It may also be possible to argue that you could apply the value in use method based on the result of the company in which the shares are held. Value in use has been discussed further in Section 22.

Example 9: Investment in subsidiary

Company A holds a 100% investment in Company B (cost CU500,000). At the year end Company B’s performance was far less than expected and a significant loss was incurred. As a result Company B’s net assets was CU400,000. The significant loss made by Company B is an impairment indicator. As it is likely that it would be difficult to determine the fair value less cost to sell in an active market, the value in use model could be utilised to determine whether an impairment is required. In this particular case, it may be appropriate to impair the investment down to the net asset amount of CU400,000 assuming Company B itself has completed an impairment review on its end. However the starting point is to assess the best estimate of the selling price of this investment.

Onerous contracts

Extract from FRS 105 – Section 9.20

9.20 At each reporting date a micro-entity shall assess whether a derivative constitutes an onerous contract. A derivative is an onerous contract when the expected unavoidable payments exceed the economic benefits expected to be received from the derivative. A derivative which does not mitigate a specific risk or risks of a micro-entity is an onerous contract when the expected payments exceed the expected cash receipts under the contract. The present obligation arising from an onerous contract shall be measured in accordance with Section 16.

|

Example: Assessment of whether a derivative is onerous |

|

A micro-entity takes out a loan with a variable rate of interest. In order to mitigate the risk of fluctuating interest payments, the micro-entity enters into an interest rate swap. Through the interest rate swap the micro-entity pays a fixed rate of interest and receives a variable rate of interest equal to the interest on the loan. Scenario 1: Interest rates are going down and as a result the payments made by the micro- entity under the interest rate swap are higher than the receipts. The interest rate swap is not an onerous contract because the micro-entity continues to benefit from the interest rate swap by effectively paying a fixed rate of interest on the loan. Scenario 2: The micro-entity repays the loan early, but the interest rate swap cannot be terminated. The micro-entity expects that the payments due under the interest rate swap exceed the receipts. The interest rate swap is an onerous contract because the micro-entity no longer derives a benefit from it. |

Dercognition of a financial asset

Extract from FRS 105 – Section 9.21 – 9.23

9.21 A micro-entity shall derecognise a financial asset only when:

- the contractual rights to the cash flows from the financial asset expire or are settled;

- the micro-entity transfers to another party substantially all of the risks (eg slow or non-payment risk) and rewards of ownership (eg future cash flows from a debtor); or

- when no future economic benefits are expected from holding it or its

9.22 A micro-entity shall recognise any gain or loss on the derecognition of a financial asset in profit or loss when the item is derecognised.

9.23 If a micro-entity received any proceeds from the transfer of a financial asset, but the conditions in paragraph 9.21 are not met, a micro-entity shall continue to recognise the asset in its entirety and shall recognise a financial liability for the consideration received. The asset and liability shall not be offset. In subsequent periods, the micro- entity shall recognise any income on the transferred asset and any expense incurred on the financial liability.

|

Example 1: Debt factoring arrangement that qualifies for derecognition |

|

A micro-entity sells a group of its accounts receivable to a bank at less than their carrying amount. The micro-entity is obliged to remit promptly to the bank all amounts collected, but it has no obligation to the bank for slow payment or non- payment by the debtors. In this case, the micro-entity has transferred to the bank substantially all of the risks and rewards of ownership of the receivables. Accordingly, it removes the receivables from its statement of financial position (ie derecognises them), and it shows no liability in respect of the proceeds received from the bank. The micro- entity recognises a loss calculated as the difference between the carrying amount of the receivables at the time of sale and the proceeds received from the bank. The micro-entity recognises a liability to the extent that it has collected funds from the debtors but has not yet remitted them to the bank. |

|

Example 2: Debt factoring arrangement that does not qualify for derecognition |

|

The facts are the same as in the preceding example except that the micro-entity has agreed to buy back from the bank any receivables for which the debtor is in arrears as to principal or interest for more than 120 days.

In this case, the micro-entity has retained the risk of slow payment or non-payment by the debtors – a significant risk with respect to receivables. Accordingly, the micro-entity does not treat the receivables as having been sold to the bank, and it does not derecognise them. Instead, it treats the proceeds from the bank as a loan. The micro-entity continues to recognise the receivables as an asset until they are collected or written off as uncollectible. |

Transfers of non-cash collateral

Extract from FRS 105 – Section 9.24

9.24 When a micro-entity participates in arrangements where it provides or receives financial assets other than cash as collateral (eg a micro- entity pledges commercial papers as security against a loan), the micro-entity shall apply the requirements of paragraphs 11.35(b) to 11.35(d) of FRS 102.

Derecognition of a financial liability

Extract from FRS 105 – Section 9.25-9.26

9.25 A micro-entity shall derecognise a financial liability (or a part of a financial liability) only when it is extinguished – ie when the obligation specified in the contract is discharged, is cancelled or expires.

9.26 A micro-entity shall recognise any gain or loss on the derecognition of a financial liability (or a part of a financial liability) in profit or loss when the item is derecognised.

OmniPro comment

See application of the above guidance.

Example 10: asset recognised due to settlement

Company A loans CU100,000 to another entity which attracted a market interest rate and was repayable in year 5.

The asset can be derecognised at the end of year 5 i.e. when the loan is fully repaid. If the loan is repaid earlier then it is derecognised on the date it is repaid.

In Section 9.21(b), a financial asset can be derecognised when the entity transfers to another party substantially all of the risks and rewards of ownership of the financial asset.

Example 11: sale of debtors with recourse

Company A arranges invoice discounting with a bank. They sell their book of debtors which is stated at CU200,000 for CU180,000. However the company retains the credit risk. The company manages the debtors book and pays over any receipts to the bank. Given that substantially all the risk and rewards of ownership have not been transferred, as Company A will incur any bad debt risk, the debtor balance cannot be derecognised. As a result the way in which this CU180,000 is recognised is to:

|

|

CU |

CU |

|

Dr bank account |

180,000 |

|

|

Cr invoice discounting liability |

|

180,000 |

NOTE: the interest charged by the bank is charged to the P&L as incurred and any transaction costs are released over the life of the arrangement on a straight line basis where material.

Example 12: sale of debtors with recourse

Company A arranges invoice discounting with a bank. They sell their book of debtors which is stated at CU200,000 for CU180,000. The bank also takes on the credit risk. The company manages the debtors book and pays over any receipts to the bank. Given that substantially all the risk and rewards of ownership have been transferred, the company can derecognise the trade debtor balance. The journal to derecognise this is to:

|

|

CU |

CU |

|

Dr Bank Account |

180,000 |

|

|

Dr Profit and Loss – Bank Charges |

20,000 |

|

|

Cr Trade Debtors |

|

200,000 |

A financial asset can be derecognised when the entity, despite having retained some significant risks and rewards of ownership, has transferred control of the asset to another party and the other party has the practical ability to sell the asset in its entirety. These are the key requirements.

As detailed in 9.24, where non cash collateral is provided (e.g. in the form of shares or debt) it needs to be separated and disclosed in the financial statements, however it is not derecognised until the entity defaults on any loan.

Example 13: Forgiveness of debt

Company A took out a loan to purchaser a property for CU70,000 a number of years ago. A number of years later due to the recession the market value of the property was CU15,000 with no likelihood that it will increase in the future. The carrying amount in the accounts was CU30,000. The amount of the loan attached to this property at that time was CU40,000. The bank has agreed to write off the difference of CU25,000 following the sale of the property. The journals required to account for this assuming the bank has given formal notice to forgive are:

|

|

CU |

CU |

|

Dr Bank |

15,000 |

|

|

Dr loss on disposal on fixed assets in P&L (30,000 – 15,000) |

15,000 |

|

|

Cr Fixed Assets |

|

30,000 |

Being journal to derecognise the asset and reflect the loss on disposal.

|

|

CU |

CU |

|

Dr Loan Liability |

40,000 |

|

|

Cr Bank |

|

15,000 |

|

CR Exceptional item – on write off of debt |

|

30,000 |

Being journal required to reflect the write off of the loan and the payment of the proceeds on sale of the asset to the bank.

Presentation

Extract from FRS 105 – Section 9.27

9.27 A financial asset and a financial liability shall be offset and the net amount presented in the statement of financial position when, and only when, a micro-entity:

- currently has a legally enforceable right to set off the recognised amounts; and

- intends either to settle on a net basis, or to realise the asset and settle the liability simultaneously.

OmniPro comment

Unless there is a legal entitlement there is no right of set off. Therefore for example an invoice discounting facility with recourse, the liability in relation to funds advanced from the bank cannot be set against the trade debtor balance.

Disclosures in the notes

Extract from FRS 105 – Section 9.28 – 9.29

9.28 A micro-entity shall determine the amount of any financial commitments, guarantees and contingencies not recognised in the statement of financial position arising from its financial instruments and disclose that amount within the total amount of financial commitments, guarantees and contingencies (see paragraph 6A.2).

9.29 A micro-entity shall disclose an indication of the nature and form of any financial asset given as security in respect of its commitments, guarantees and contingencies (see paragraph 6A.3).

OmniPro comment

See illustration of the disclosures below:

Guarantees, contingencies and other financial commitments

a) The company had capital commitments of €30,000 at the year ended 31 December 2015 (2014:€nil) in relation to the purchase of equipment[1]. This commitment has been secured by a fixed and floating charge on the stock, debtors and any other assets owned by the company.

b) The company has entered into a guarantee for the benefit of its subsidiary/holding company/sister company. The total amount of this guarantee was €XX.

c) At the year end, the company had forward foreign exchange contracts in place totalling €2,000 (2014: €nil) for the sale of British pounds.

Principal transition adjustments

OmniPro comment

1) De-recognition of investments from fair value/revaluation to cost and the related deferred tax impact (if applicable).

Under FRSSE/old GAAP there was a choice to hold investments in subsidiaries, associates and joint ventures in the individual financial statements at either cost less impairment or revalued amount with movements in valuation recognised in the STRGL/revaluation unless it was considered permanent in which case it was recognised in the STRGL where a previous upward revaluation was held and then to the P&L (revaluation policy). Where a revaluation policy was adopted no deferred tax was required to be recognised.

FRS 102 offers the choices as per FRSSE/old GAAP above (only difference is that the revaluation is recognised in OCI/revaluation reserve) but in addition gives the company an option to carry the investment at fair value with movements in fair value recognised in the profit and loss account. FRS 102 also required deferred tax to be considered on any movements in fair value from cost.

FRS 105 only permits such investments to be carried at cost less impairment.

Where investments in subsidiaries/associates/joint ventures are recognised at fair value/revaluation under FRSSE/FRS 102 in the individual financial statements on transition to FRS 105, an adjustment will be required to

- derecognise the previous carrying amount to cost less impairment; and

- if applicable deferred tax will also have to be derecognised (applicable for entities transitioning from FRS 102 only).

Where the fair value is below original cost, no adjustment will be required as this would be the cost less impairment amount also. However if deferred tax asset was recognised on the downward valuation this would need to be derecognised.

Example 14: Restatement of investment in subsidiaries/associates/joint ventures to cost less impairment (previously carried at fair value through P&L under FRS 102)

Company A in its individual financial statements under FRS 102 had adopted a policy of fair valuing investments in subsidiaries/associates/joint ventures through the profit and loss. Assume 1 January 2015 is the date of transition. The fair value of the investment at 1 January 2015, 31 December 2015 and 31 December 2016 was CU120,000, CU95,000 and CU125,000 respectively in the FRS 102 financial statements. The cost of the investment was CU100,000 at 1 January 2015 and 31 December 2015 & 2016 which represented the original cost. A deferred tax rate of 20% was used to reflect deferred tax on the uplift under FRS 102. The adjustments required on transition to restate to cost less impairment and the reversal of the related deferred tax are (note in reality the deferred tax on this fair value adjustment would likely be derecognised as one journal with deferred tax on all other timing differences as discussed in Section 24 of FRS 105, however we have shown the derecognition here for educational purposes):

1 January 2015

|

|

CU |

CU |

|

Dr Profit and Loss Reserves (CU120,000-CU100,000) |

20,000 |

|

|

Cr Investments in Subsidiaries/associates/joint ventures |

|

20,000 |

Being journal to restate the investment to cost

|

|

CU |

CU |

|

Dr Deferred Tax Liability (CU20,000*20%) |

4,000 |

|

|

Cr Profit and Loss Reserves |

|

4,000 |

Being journal to derecognise the deferred tax under FRS 105 as it cannot be recognised

Journals required in the 31 December 2015 year assuming the above journals are posted to reserves etc.

|

|

CU |

CU |

|

Dr Investments in Subsidiaries/associates/joint ventures |

20,000 |

|

|

Dr Impairment of investments in P&L |

5,000 |

|

|

Cr Fair Value Movement in Subsidiaries in P&L (CU120,000-CU95,000) |

|

25,000 |

Being journal to reverse previous fair value movement and just reflect the impairment from cost to CU95,000 (i.e. only CU5k debit to P&L)

|

|

CU |

CU |

|

Dr Deferred Tax in P&L |

4,000 |

|

|

Cr Deferred Tax Liability (CU20,000*20%) |

|

4,000 |

Being journal to reverse deferred tax movement recognised in the 2015 year under FRS 102

Journals required in the 31 December 2016 year assuming the above journals are posted to reserves etc.

|

|

CU |

CU |

|

Dr Fair Value Movement in Subsidiaries/associates/joint ventures in P&L (CU125,000-CU100,000) |

30,000 |

|

|

Cr Reversal of impairment of investments in P&L |

|

5,000 |

|

Cr Investments in Subsidiaries/ associates/joint ventures |

|

25,000 |

Being journal to reverse the fair value movement recognised in the P&L in 2016 under FRS 102 so as to restate the investment to cost and to reverse the previous impairment so as to show it at cost as the impairment has reversed

|

|

CU |

CU |

|

Dr Deferred Tax Liability ((CU125,000-CU100,000)*10%) |

5,000 |

|

|

Cr Deferred Tax in P&L |

|

5,000 |

Being journal to reverse deferred tax movement recognised in the P&L under FRS 102.

Note this example is also applicable for any investment previously carried at fair value under FRS 102 (e.g. non-puttable ordinary and preference shares which gave less than a significant influence and could be reliably measured or investments/bonds/unit linked funds carried at fair value as they met the definition as a complex financial instruments under FRS 102 that needed to be carried at fair value under FRS102 that need to be carried at fair value under FRS 102).

Example 15: Restatement of investment in subsidiaries/associates/joint ventures to cost less impairment (previously carried at fair value through OCI/STRGL under FRS 102/FRSSE/Old GAAP)

If we take example 14 above and assume Company A in its individual financial statements has adopted a policy of fair valuing investments in Subsidiaries/associates/joint ventures through other comprehensive income under FRS 102 and the STRGL under FRSSE/Old GAAP this time. The journals required would be as follows.

1 January 2015

|

|

CU |

CU |

|

Dr Revaluation Reserve |

|

20,000 |

|

Cr Investments in Subsidiaries/ associates/joint ventures (CU120,000-CU100,000) |

20,000 |

|

Being journal to restate the investment to cost

|

Below journal is only applicable if transitioning from FRS 102. Not applicable if transitioning from FRSSE/Old GAAP) |

CU |

CU |

|

Dr Deferred Tax Liability |

4,000 |

|

|

Cr Deferred Tax in Revaluation Reserve (CU20,000*20%) |

|

4,000 |

Being journal to derecognise the deferred tax under FRS 105 as it cannot be recognised

Journals required in the 31 December 2015 year assuming the above journals are posted to reserves

|

|

CU |

CU |

|

Dr Investments in Subsidiaries/ associates/joint ventures (CU120,000-CU95,000) |

20,000 |

|

|

Dr Impairment of investments in P&L |

5,000 |

|

|

Cr Fair Value Movement in Profit and Loss |

|

5,000 |

|

Cr Fair Value Movement in Subsidiaries in OCI/STRGL/ Revaluation Reserve |

|

20,000 |

Being journal to reverse the revaluation movement and just recognise the impairment below cost in the P&L as required under FRS 105.

|

Below journal is only applicable if transitioning from FRS 102. Not applicable if transitioning from FRSSE) |

CU |

CU |

|

Dr Deferred Tax in Revaluation Reserve/OCI/STRGL (CU20,000*20%) |

4,000 |

|

|

Cr Deferred Tax Liability |

|

4,000 |

Being journal to reverse deferred tax movement recognised in the 2015 year under FRS 102/FRSSE/Old GAAP

Journals required in the 31 December 2016 year assuming the above journals are posted to reserves

|

|

CU |

CU |

|

Dr Profit and Loss Fair Value Movement in P&L |

5,000 |

|

|

Dr Fair Value Movement in Subsidiaries/ associates/joint ventures in Revaluation Reserve/OCI/STRGL |

25,000 |

|

|

Cr Reversal of impairment of investments in P&L |

|

5,000 |

|

Cr Investments in Subsidiaries (CU125,000-CU100,000) |

|

25,000 |

Being journal to reverse the fair value movement recognised in the OCI/STRGL in 2016 under FRS 102/FRSSE/Old GAAP so as to restate the investment to cost and to reverse the previous impairment so as to show it at cost as the impairment has reversed.

|

Below journal is only applicable if transitioning from FRS 102. Not applicable if transitioning from FRSSE) |

CU |

CU |

|

Dr Deferred Tax Liability ((CU125,000-CU100,000)*20%) |

5,000 |

|

|

Cr Deferred Tax in Revaluation Reserve/OCI/STRGL |

|

5,000 |

Being journal to reverse deferred tax movement recognised in the P&L under FRS 102/FRSSE/Old GAAP.

Example 16: Restatement of investment in subsidiaries/associates/joint ventures to cost less impairment-no adjustment where fair value is less than cost)

Company A in its individual financial statements under FRS 102 had adopted a policy of fair valuing investments in subsidiaries/associates/joint ventures through the profit and loss or alternatively at fair value through OCI/STRGL for FRS 102/FRSSE/Old GAAP. Assume 1 January 2015 is the date of transition. The fair value of the investment at 1 January 2015, 31 December 2015 and 31 December 2016 was CU90,000, CU95,000 and CU80,000 respectively in the FRS 102/FRSSE/Old GAAP financial statements. The cost of the investment was CU100,000 at 1 January 2015 and 31 December 2015 & 2016 which represented the original cost. Assume a deferred tax asset was not recognised under previous GAAP.

In this case no transition adjustments are required as under FRS 105 the cost less impairment value would equal the amounts booked under old GAAP/FRS 102/FRSSE.

2) Listed shares and other investments previously held at fair value restated to cost less impairment (FRS 102 only)

Under FRS 102 the company was required to carry listed shares at fair value with the movement in fair value recognised in the P&L. Deferred tax also needed to be taken into account.

FRS 105 does not permit any assets to be carried at fair value/market value instead such investments must be stated at cost less impairment.

As a result a transition adjustment is required to restate the carrying amount of investments from market value to cost less impairment and the reversal of the related deferred tax if applicable (note in reality the deferred tax on this fair value adjustment would likely be derecognised as one journal with deferred tax on all other timing differences as discussed in Section 24 of FRS 105, however we have shown the derecognition here for educational purposes). An adjustment may also be required where some of the assets were held at fair value and these shares were sold since the date of transition.

Where the fair value is below original cost, no adjustment will be required as this would be the cost less impairment amount also. However if a deferred tax asset was recognised on the downward valuation this would need to be derecognised. The below example illustrates uplifts however the same logic would apply if there were downward movements and the downward movement did not result in the investment going below original cost. See examples 14 and 16 above for further details (the same concepts apply).

The below example can also be applied to any other investment recognised at fair value (e.g. shares held at market value, collective investment funds, complex financial instruments as defined in FRS 102 such as loans, bonds etc.).

Example 17: Restatement of listed shares to cost less impairment – applicable on transition from FRS 102

Company A prepared FRS 102 accounts prior to the date on transition. Assume the date of transition is 1 January 2015. The company held listed shares at fair value with movement in the fair value recognised in the profit and loss account.

In year ended 31 December 2016 the company disposed of some of these listed shares. The cost of those shares was CU15,856 but the carrying amount in the books at the date of disposal under FRS 102 was CU17,356. The fair value movement recognised in the P&L in the 2015 and 2016 year was CU5,000 and CU2,000 respectively. Assume deferred tax recognised at 1 January 2015, 31 December 2015 and 2016 was CU250, CU750 and CU950 respectively under FRS 102. See further details in the table below:

The journals required on transition are:

On 1 January 2015

|

|

CU |

CU |

|

Dr P&L Reserves |

2,500 |

|

|

Cr Investment in shares |

|

2,500 |

Being journal to restate the listed shares to cost from market value at the date of transition

|

|

CU |

CU |

|

Dr Deferred tax on balance sheet |

250 |

|

|

Cr P&L Reserves |

|

250 |

Being journal to derecognise deferred tax at date of transition as cannot be recognised under FRS 105 (in reality this would be derecognised as part of one journal for the derecognition of all deferred tax on the balance sheet however this is included for educational purposes)

In the year ended 31 December 2015:

|

|

CU |

CU |

|

Dr P&L Reserves |

2,500 |

|

|

Cr Investment in shares |

|

2,500 |

Being journal to restate the listed shares to cost from market value at the date of transition

|

|

CU |

CU |

|

Dr Deferred tax on balance sheet |

250 |

|

|

Cr P&L Reserves |

|

250 |

Being journal to derecognise deferred tax at date of transition as cannot be recognised under FRS 105 (in reality this would be derecognised as part of one journal for the derecognition of all deferred tax on the balance sheet however this is included for educational purposes)

|

Dr Other Operating income – 2015 movement |

5,000 |

|

|

Cr Investment in shares |

|

5,000 |

Being journal to reverse the movement on the fair value of listed shares posted in 2015 under FRS 102 rules

|

|

CU |

CU |

|

Dr Deferred tax on balance sheet |

500 |

|

|

Cr Deferred tax in P&L (CU750-250) |

|

500 |

Being journal to derecognise deferred tax movement in 2015 as DT cannot be recognised under FRS 105 (in reality this would be derecognised as part of one journal for the derecognition of all deferred tax on the balance sheet however this is included for educational purposes)

In the year ended 31 December 2016:

|

|

CU |

CU |

|

Dr P&L Reserves |

2,500 |

|

|

Cr Investment in shares |

|

2,500 |

Being journal to restate the listed shares to cost from market value at the date of transition

|

|

CU |

CU |

|

Dr Deferred tax on balance sheet |

250 |

|

|

Cr P&L Reserves |

|

250 |

Being journal to derecognise deferred tax at date of transition as cannot be recognised under FRS 105 (in reality this would be derecognised as part of one journal for the derecognition of all deferred tax on the balance sheet however this is included for educational purposes)

|

Dr P&L Reserves – Other Operating income – 2015 movement |

5,000 |

|

|

Cr Investment in shares |

|

5,000 |

Being journal to reverse the movement on the fair value of listed shares posted in 2015 under FRS 102 rules

|

|

CU |

CU |

|

Dr Deferred tax on balance sheet |

500 |

|

|

Cr P&L Reserves |

|

500 |

Being journal to derecognise deferred tax movement in 2015 as DT cannot be recognised under FRS 105 (in reality this would be derecognised as part of one journal for the derecognition of all deferred tax on the balance sheet however this is included for educational purposes)

|

Dr Other Operating income in P&L– 2016 movement |

2,000 |

|

|

Cr Investment in shares |

|

2,000 |

Being journal to reverse the movement on the fair value of listed shares posted in 2016 under FRS 102 rules

|

Dr Investment in shares (CU17,356-CU15,856) |

1,500 |

|

|

Cr profit on disposal in P&L |

|

1,500 |

Being journal to reflect the additional profit on disposal of listed shares previously not included in P&L as it was held at fair value at each year end.

Note here there was a disposal in 2016, if this was in the comparative year a similar journal would be required which would be brought forward to reserves in the current year. If there was no disposal then the last journal here would not be applicable

|

|

CU |

CU |

|

Dr Deferred tax on balance sheet |

200 |

|

|

Cr Deferred tax in P&L |

|

200 |

Being journal to derecognise deferred tax movement in 2016 as DT cannot be recognised under FRS 105 (in reality this would be derecognised as part of one journal for the derecognition of all deferred tax on the balance sheet however this is included for educational purposes)

3) Sale/purchase of goods/services on unusual credit terms/deferred credit terms – restatement from effective interest method to the straight line method (applicable to entities transitioning from FRS 102 only)

Under FRS 102 where sales/purchases were made on unusual credit terms, entities are required to measure such transactions at the cash price or the present value of the future cash flows discounted at a market rate of interest with the difference being released as interest income/expense over the life of the credit term on an effective interest basis.

FRS 105 requires the company to recognise this sale/purchase initially at the cash price where material (or the present value of the receipt at a market rate of interest if the cash price cannot be determined) and to recognise the difference as interest income/expense over the life of the credit term on a straight line basis. This differs from FRS 102 where it must be released under the effective interest rate method. There will also be a requirement to adjust the corporation tax asset/liability to restate the tax to what it would have been had FRS 105 been applied from inception.

Given that this is an adjustment on transition assume the tax which has fallen out will be taxable/tax deductible in line with revenue guidance over a 5 year period (i.e. from year ended 31 December 2016 and four more years from then).FRS 105 requires the company to recognise this sale/purchase initially at the cash price where material (or the present value of the receipt at a market rate of interest if the cash price cannot be determined) and to recognise the difference as interest income/expense over the life of the credit term on a straight line basis. This differs from FRS 102 where it must be released under the effective interest rate method. There will also be a requirement to adjust the corporation tax asset/liability to restate the tax to what it would have been had FRS 105 been applied from inception.

Example 18: Sale/purchase of goods/services on unusual credit terms/deferred credit terms – restatement from effective interest method to the straight line method (applicable to entities transitioning from FRS 102 only)

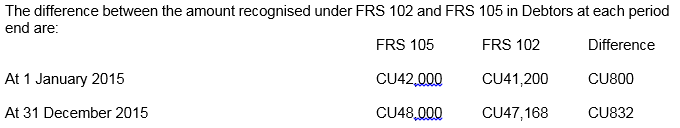

Company A previously applied FRS 102. Assume the date of transition is 1 January 2015. Company A sold goods worth CU54,000 with unusual credit terms on 01/01/14. The credit provided is for a period up to 31/12/16. The normal cash price for these goods would be CU36,000. Under FRS 102 this was required to be measured at the cash price or the present value of the future cash flows discounted at a market rate of interest with the difference being released as interest income over the life of the credit term on an effective interest basis. The amount recognised in turnover at 1 January 2014 under FRS 102 was CU36,000 and the trade debtor balance at 31 December 2014 and 31 December 2015 and 2016 was CU41,200, CU47,168 and CUNil respectively.

The amount that should have been recognised as revenue under FRS 105 is the cash price of CU36,000 which is as per FRS 102. The difference between the CU54,000 and the CU36,000 (i.e. CU18,000) should be recognised on a straight line basis (i.e. CU18,000/3 years= CU6,000) as interest income over the 3 year extended credit period. Therefore the required debtor balance under FRS 105 at the date of transition/1 January 2015 is CU42,000 (CU36,000+CU6,000), the 31 December 2015 is CU48,000 (CU42,000+CU6,000) and the 31 December 2016 is CUNil. Assume a corporation tax rate of 10%.

If we assume for the purposes of this example that this is material and therefore an adjustment is required on transition.

As the above amount at 31 December 2015 has fallen out, in line with tax authorities’ guidelines this must be taxed over a 5 year period from 31 December 2016 on. Therefore the company is liable for the CU832 that fell out for corporation tax purposes on transition to FRS 105 as it was not previously taxed (this amount has previously not been taxed in the tax computation and this income will not be recognised again in the future under FRS 105 as it has been posted to P&L reserves). Therefore an addback of CU166 (CU832/5yrs) or CU17 in tax terms will be included in the tax computation for 31 December 2016 and for a further 4 years. Assume these figures are material for the purposes of this example.

The journals required on transition are:

On 1 January 2015

|

|

CU |

CU |

|

Dr Debtors |

800 |

|

|

Cr Corporation tax on balance sheet (CU800*10%) |

|

80 |

|

Cr Opening P&L Reserves |

|

720 |

Being journal to reflect sale at the cash price plus interest income at the date of transition and the related corporation that that would have been booked had it been prepared under FRS 105

In the year ended 31 December 2015:

|

|

CU |

CU |

|

Dr Debtors |

800 |

|

|

Cr Corporation tax on balance sheet (CU800*10%) |

|

80 |

|

Cr Opening P&L Reserves |

|

720 |

Being journal to reflect sale at the cash price plus interest income at the date of transition and the related corporation that that would have been booked had it been prepared under FRS 105

|

|

CU |

CU |

|

Dr Debtors |

32 |

|

|

Dr Corporation tax in P&L |

3 |

|

|

Cr Corporation tax on balance sheet (CU32*10%) |

|

3 |

|

Cr Interest Income in P&L |

|

32 |

Being journal to post the finance income released in 2015 to profit and loss and the related corporation tax refundable

In the year ended 31 December 2016:

|

|

CU |

CU |

|

Dr Debtors |

800 |

|

|

Cr Corporation tax on balance sheet (CU800*10%) |

|

80 |

|

Cr Opening P&L Reserves |

|

720 |

Being journal to reflect sale at the cash price plus interest income at the date of transition and the related corporation that that would have been booked had it been prepared under FRS 105

|

Dr Debtors |

32 |

|

|

Cr Corporation tax on balance sheet (CU32*10%) |

|

3 |

|

Cr Opening Reserves (Interest income 2015 net of tax) |

|

29 |

Being journal to post the additional finance income released in 2015 to profit and loss reserves brought forward

|

|

CU |

CU |

|

Dr Interest income |

832 |

|

|

Cr Debtors |

|

832 |

Being journal to reverse the journals posted above as the sale has been closed out in the 2016 year and therefore is no longer included in debtors (ensures the interest income in 2016 is only stated at CU6,000)

|

Dr Corporation tax on balance sheet (CU83/5 yrs) |

|

17 |

|

Cr Corporation tax in P&L |

17 |

Being journal to reflect the additional addback for 1/5th of the sale not previously taxed up to 31/12/15 which has therefore fallen out under FRS 105. Note this assumes that the tax journal posted will include the transition tax adjustment for the CU17 when it is finally recognised. If there was no corporation tax in 2016, then the CU17 would still be released as a credit to the P&L as it would be no longer payable to the tax authorities. As no deferred tax can be recognised under FRS 105 it cannot be held as deferred tax liability on the balance sheet as a timing difference. The remaining CU68 (CU83-CU17) will still be included as a liability at the year end in the corporation tax nominal and released over the remaining 4 yrs.

4) Sale/purchase of goods/services on unusual credit terms/deferred credit terms – (applicable to entities transitioning from FRSSE/Old GAAP or FRS 102 where not correctly accounted for under those standards)

We have already described the treatment of such transaction under FRS 102. FRSSE/old GAAP requirements are as per FRS 105 as detailed in 3 above (i.e. where the difference between the cash price and the invoice price differs, then this difference should be released to the P&L over the credit term on a straight line basis). Although this was required the entity may not have correctly accounted for this under the previous GAAP due to an error. If this error is material this should be corrected on transition to FRS 105.