[et_pb_section admin_label=”Header – All Pages” global_module=”1221″ transparent_background=”off” background_color=”#1e73be” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” custom_padding=”||0px|”][et_pb_row global_parent=”1221″ admin_label=”row”][et_pb_column type=”4_4″][et_pb_post_title global_parent=”1221″ admin_label=”Post Title” title=”on” meta=”off” author=”on” date=”on” categories=”on” comments=”on” featured_image=”off” featured_placement=”below” parallax_effect=”on” parallax_method=”on” text_orientation=”left” text_color=”light” text_background=”off” text_bg_color=”rgba(255,255,255,0.9)” module_bg_color=”rgba(255,255,255,0)” title_all_caps=”off” use_border_color=”off” border_color=”#ffffff” border_style=”solid” title_font=”|on|||” title_font_size=”35″ custom_padding=”10px|||”] [/et_pb_post_title][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” global_module=”1228″ fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” custom_padding=”0px||0px|” padding_mobile=”on” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” gutter_width=”3″][et_pb_row global_parent=”1228″ admin_label=”Row” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” use_custom_gutter=”off” gutter_width=”3″ custom_padding=”0px||0px|” padding_mobile=”off” allow_player_pause=”off” parallax=”off” parallax_method=”off” make_equal=”off” parallax_1=”off” parallax_method_1=”off” column_padding_mobile=”on”][et_pb_column type=”4_4″][et_pb_text global_parent=”1228″ admin_label=”Text” background_layout=”light” text_orientation=”left” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [breadcrumb] [/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” fullwidth=”off” specialty=”off”][et_pb_row admin_label=”Row”][et_pb_column type=”1_2″][et_pb_text admin_label=”Return to 105 Index” background_layout=”light” text_orientation=”center” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [button link=”https://ie.frs102.com/members/premium-toolkit/frs-105/” type=”big” color=”red”] Return to FRS 105 Main Menu[/button] [/et_pb_text][/et_pb_column][et_pb_column type=”1_2″][et_pb_text admin_label=”Return to Section 28 Home” background_layout=”light” text_orientation=”center” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [button link=”https://ie.frs102.com/members/premium-toolkit/frs-105/section-28/” type=”big” color=”red”] Return to Section 28 Home[/button] [/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” gutter_width=”3″][et_pb_row admin_label=”Row”][et_pb_column type=”4_4″][et_pb_text admin_label=”Main Body Text” background_layout=”light” text_orientation=”justified” use_border_color=”off” border_color=”#ffffff” border_style=”solid” module_id=” “]

Section 28 – Transition to this FRS

This section applies to a first-time adopter of this FRS, regardless of whether its previous accounting framework was EU-adopted IFRS or another set of generally accepted accounting principles (GAAP), FRS 102, such as its national accounting standards, or another framework such as the local income tax basis. Where FRS 105 financial statements have been prepared previously but these did not contain an explicit and unreserved statement of compliance with FRS 105 then they must submit the accounts with this statement and the requirements of Section 28 or restate the prior year’s results in line with the requirements of Section 8.

First-time adoption

Extract from FRS 105 – Section 28.3 – 28.6

28.3 A first-time adopter of this FRS shall apply this section in its first financial statements that conform to this FRS.

28.4 A micro-entity’s first financial statements that conform to this FRS are the first financial statements prepared in accordance with this FRS if, for example, the micro-entity:

(a) did not present financial statements for previous periods; or

(b) presented its most recent previous financial statements under previous UK and Republic of Ireland requirements or FRS 102 and that are therefore not consistent with this FRS in all respects.

28.5 Paragraph 3.9 defines a complete set of financial statements for a micro-entity.

28.6 Paragraph 3.10 requires a micro-entity to disclose, in a complete set of financial statements, comparative information in respect of the preceding period for all amounts presented in the financial statements. Therefore, a micro-entity’s date of transition to this FRS is the beginning of the earliest period for which the micro-entity presents full comparative information in accordance with this FRS in its first financial statements that comply with this FRS.

OmniPro comment

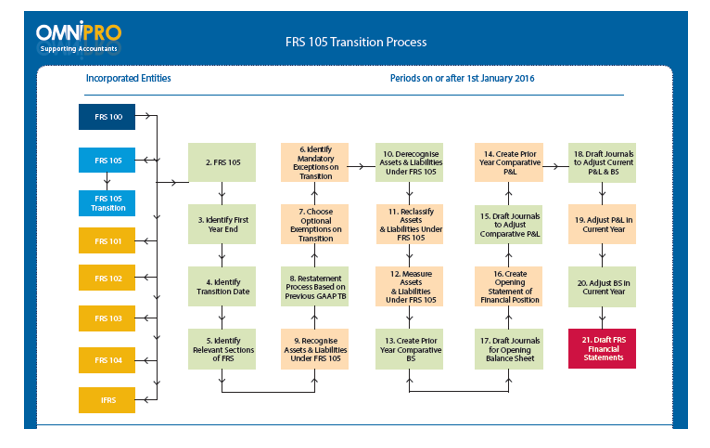

FRS 105 should be applied by all entities for periods beginning after 1 January 2016. The date of transition is therefore the beginning of the comparative period included in its first financial statements in conformity with FRS 105. The length of the comparative period is irrelevant, it is the date from the start of that comparative period which dictates the transition date. Note the an entity can early adopt FRS 105 for periods beginning on or after 1 January 2015.

Example 1: Transition date

Company A has a 31 December year end for each period. Therefore the first financial statements in conformity with FRS 105 is for the year ended 31 December 2016. The date of transition is therefore the 1 January 2015. Therefore the balances at 1 January 2015 form the opening balances under FRS 105 and will need to be restated to conform to FRS 105. The year end 31 December 2015 will also have to be restated.

Example 2: Transition date

Company A usually had a 31 December year end. However the prior year financial statements were prepared for the 18 month period 1 July 2014 to 31 December 2015. The date of transition is therefore the 1 July 2014.

A complete set of financial statements comprise:

- Balance sheet;

- Profit and loss account;

- Notes to the accounts in line with the requirements of the Companies Act with regard to entitles preparing accounts under the Micro Companies Regime. Notes these are required to be included on the foot of the balance sheet.

- Comparatives required

See Section 4 and 5 for the layout of the financial statements. See Section 6 for the disclosures to be included in the financial statements.

See below an example disclosure for insertion in the financial statements. Note as the notes are required to be included on the foot of the balance sheet this statement will be included under the notes.

Example 3: Sample statement of compliance with the micro entity provisions

These financial statements have been prepared in accordance with the provisions applicable to companies subject to the micro companies/entities regime and in accordance with Financial Reporting Statement 105 ‘The Financial Statement Reporting Standard applicable to Micro Entities Regime’. The financial statements were approved by the Board of Directors on (Insert date) and authorised for issue on (insert date). They were signed on its behalf by

Procedures for preparing financial statements at the date of transition

Extract from FRS 105 – Section 28.7 – 28.8

28.7 Except as provided in paragraphs 28.9 to 28.11, a micro-entity shall, in its opening statement of financial position as of its date of transition to this FRS (ie the beginning of the earliest period presented):

(a) recognise all assets and liabilities whose recognition is required by this FRS;

(b) not recognise items as assets or liabilities if this FRS does not permit such recognition;

(c) reclassify items that it recognised under its previous financial reporting framework as one type of asset, liability or component of equity, but are a different type of asset, liability or component of equity under this FRS; and

(d) apply this FRS in measuring all recognised assets and

This section does not require the opening statement of financial position to be presented.

28.8 The accounting policies that a micro-entity uses in its opening statement of financial position under this FRS may differ from those that it used for the same date using its previous financial reporting framework. The resulting adjustments arise from transactions, other events or conditions before the date of transition to this FRS. Therefore, a micro-entity shall recognise those adjustments directly in equity reserves at the date of transition to this FRS.

OmniPro comment

When measuring assets and liabilities the values (fair values) should reflect the conditions that existed at the date of transition.

See transition guide

Mandatory exceptions to retrospective application – derecognition

Extract from FRS 105 – Section 28.9(a)(i)(ii)

28.9 On first-time adoption of this FRS, a micro-entity shall not retrospectively change the accounting that it followed under its previous financial reporting framework for any of the following transactions:

(a) Derecognition of financial assets and financial liabilities

Financial assets and financial liabilities derecognised under a micro-entity’s previous accounting framework before the date of transition shall not be recognised upon adoption of this FRS. Conversely, for financial assets and liabilities that would have been derecognised under this FRS in a transaction that took place before the date of transition, but that were not derecognised under a micro-entity’s previous accounting framework, a micro-entity may choose:

(i) to derecognise them on adoption of this FRS; or

(ii) to continue to recognise them until disposed of or settled.

OmniPro comment

Appendix I of FRS 105 defines derecognition as the removal of a previously recognised asset or liability from an entity’s statement of financial performance.

Where assets/liabilities were derecognised under old GAAP/FRS 102 they cannot be re-recognised under FRS 105. It is likely that there were will not be many instances where this arise, however where it does this rule must be complied with.

Mandatory exceptions to retrospective application – accounting estimates

Extract from FRS105: Section 35.9(b)

(a) Accounting estimates.

OmniPro comment

A change in accounting estimate cannot be adjusted retrospectively. For example if it transpires that a bad debt provision was misstated, an entity cannot post the correct bad debt provision to retained earnings at the date of transition instead this estimate is posted prospectively in the comparative period.

Likewise where previously fixed assets were depreciated over a set useful life and a reassessment was made at the date of transition an entity cannot post the difference into opening reserves on transition, instead the change of policy must be made in the comparative year and adjusted prospectively with the relevant disclosures included.

In essence it requires the estimates used under old GAAP to be used on the date of transition to FRS 105. It cannot consider subsequent events that came to light after the date the previous GAAP accounts were signed off.

Another example would be a provision for a loss on a court case which was included in previous GAAP financial statements where it subsequently transpired after the date of signing the comparative and opening balance sheet financial statements that the entity did not lose and therefore resulted in the provision being overstated. In this case no adjustment is made instead this is washed through the following year e.g. if the provision was overstated at the end of the comparative period then it would not be adjusted instead it would be adjusted in the current period.

If on the other hand there was an error (as opposed to a change in estimate) then this would have to be adjusted retrospectively (and disclosed also for ROI entities).

Optional exemptions

28.1 A micro-entity may use one or more of the following exemptions in preparing its first financial statements that conform to this FRS:

(a) Business combinations and goodwill

(b) Share-based payment transactions

(c) Investment properties

(d) Compound financial instruments

(e) Arrangements containing a lease

(f) Decommissioning liabilities included in the cost of property, plant and equipment or investment property

(g) Dormant companies

(h) Lease incentives

Optional exemptions – Business combinations and goodwill

Extract from FRS105: Section 28.10(a)

A micro-entity may use one or more of the following exemptions in preparing its first financial statements that conform to this FRS:

A first-time adopter is not required to apply Section 14 Business Combinations and Goodwill to business combinations that were effected before the date of transition to this FRS. However, if a first-time adopter restates any business combination to comply with Section 14, it shall restate all later business combinations. If a first-time adopter does not apply Section 14 retrospectively, the first-time adopter shall recognise and measure all its assets and liabilities acquired or assumed in a past business combination at the date of transition to this FRS in accordance with paragraphs 28.7 to 28.9 or, if applicable, with paragraphs 28.10(b) to (h) except that no adjustment shall be made to the carrying amount of goodwill.

OmniPro comment

Under old GAAP/FRSSE, the creation of a separate intangible asset from goodwill was very difficult as it not only had to be measured reliably but also needed to be separable. Therefore where it did not meet the definition for recognition it was consumed within goodwill. Under FRS 102 the intangible does not have to be separable and therefore more intangibles are recognised resulting in less goodwill requiring recognition (and more intangibles).

FRS 105 applies to business combinations where trade assets and liabilities are acquired as opposed to shares. FRS 105 does not permit intangibles to be separated from goodwill where a business combination arises. The amount paid above the fair value acquired must be recognised as goodwill.

Therefore without this exemption for business combinations entered into pre the date of transition, entities would have to review all prior business combinations and derecognise any intangibles that it created separately and instead subsume this within goodwill and adjust amortisation accordingly if the useful life differed for both. The adjustment is most likely to arise for entities transitioning from FRS 102 to FRS 105 as under old GAAP/FRSSE it is unlikely that any intangibles would have been separately shown.

The above exemption allows entities to not restate the business combinations, intangibles and goodwill recognised on business combinations entered into prior to the date of transition ,instead the intangibles, goodwill recognised at the date of transition remain. Goodwill cannot be adjusted on transition where this exemption is taken.

Under FRS 102 (not applicable to entities transitioning from old GAAP or FRSSE), deferred tax requires deferred tax to be recognised on all differences between the fair value of the assets and liabilities acquired and the book value in the acquirees books with the exception of goodwill. This exemption does not prevent an adjustment from being made for this however any adjustment to derecognise the goodwill must be set against P&L reserves brought forward as opposed to goodwill as goodwill cannot be adjusted on transition when this adjustment is claimed (under FRS 102 the deferred tax would have increased/decreased the goodwill).

In addition, if under FRS 102/FRSSE, assets or liabilities were not recognised under the rules of old GAAP, an adjustment to retained earnings will be required where this adjustment is applicable. It is unlikely that an adjustment will be required in this area where the previous entity adopted Irish/UK GAAP/FRSSE/FRS 102 as the requirements for measurement and recognition were similar to FRS 105 (other than in relation to deferred tax under FRS 102 as discussed above and the requirement to split out intangibles as discussed above).

Shared-based payment transactions

Extract from FRS105: Section 28.10(b)

A first-time adopter is not required to apply Section 21 Share-based Payment to obligations arising from share-based payment transactions that were settled before the date of transition to this FRS.

OmniPro comment

Section 28.10(b) provides an exemption whereby share based payments which were granted and settled prior to the date of transition can continue to be accounted for under old GAAP (i.e. FRS 20) / FRS 102 but any new shares granted since the date of transition should be accounted for under Section 21. In addition Cash settled transactions settled prior to the date of transition do not have to be accounted for under Section 21.

Optional exemptions – Investment properties

Extract from FRS105: Section 28.10(c)

A first-time adopter is not required to retrospectively apply paragraph 12.15 to determine the depreciated cost of each of the major components of an investment property at the date of transition to this FRS. If this exemption is applied, a first-time adopter shall:

(i) Determine the total cost of the investment property including all of its components. Where no depreciation had been charged under the micro- entity’s previous financial reporting framework, this can be calculated by reversing any revaluation gains or losses previously recorded in equity reserves.

(ii) The cost of land, if any, shall be separated from buildings.

(iii) Estimate the total depreciated cost of the investment property (excluding land) at the date of transition to this FRS, by recognising accumulated depreciation since the date of initial acquisition calculated on the basis of the useful life of the most significant component of the item of investment property (eg the main structural elements of the building).

(iv) A portion of the estimated total depreciated cost calculated in paragraph (iii) shall then be allocated to each of the other major components (ie excluding the most significant component identified above) to determine their depreciated cost. The allocation should be made on a reasonable and consistent basis. For example, a possible basis of allocation is to multiply the current cost to replace the component by the ratio of its remaining useful life to the expected useful life of a replacement component.

(v) Any amount of the total depreciated cost not allocated under paragraph (iv) shall be allocated to the most significant component of the investment property.

OmniPro comment

Section 28.10 provides an exemption to allow entities an exemption from Section 12.15 to determine the depreciated cost of each of the major components of an investment property at the date of transition to FRS 105. Where this exemption is applied, a first-time adopter shall apply the criteria above (note this is to be completed on a property by property basis). See examples below which illustrate how this exemption can be applied in practice.

Under Section 12 of FRS 105 investment property must be held at cost less depreciation and impairment. It cannot be held at market value

FRSSE

Under FRSSE/old GAAP investment property was required to be held at market value on the balance sheet with movements in the market value of the investment property recognised in the STRGL and then to the revaluation reserve unless a devaluation was permanent in nature in which case it was recognised in the profit and loss. Deferred tax was not required to be recognised on any fair value movement.

FRS 102

Under FRS 102, investment property was required to be held at fair value on the balance sheet with the movements in the fair value of the investment property recognised in the P&L with one exception that being that:

(a) it could be held at cost less accumulated depreciation and impairment where the requirement to fair value caused undue cost or effort for the company.

FRS 102 also required deferred tax to be recognised on any fair value movement.

Impact

Therefore in both cases on transition an adjustment is required to derecognise the investment property at fair value and recognise the property at cost less depreciation and impairment at that date and since the date of transition and the related deferred tax if applicable (note in reality the deferred tax on this fair value adjustment would likely be derecognised as one journal with deferred tax on all other timing differences as discussed in Section 24 of FRS 105, however we have shown the derecognition here for educational purposes). An adjustment may also be required where investment property was held at fair value and this were sold since the date of transition (i.e. in the comparative year).

If under FRS 102 the entity took the option not to fair value investment property due to undue cost or effort then no adjustment will be required on transition.

Where the fair value is below original cost and accumulated depreciation, no adjustment will be required as this would be the cost less accumulated depreciation and impairment amount also. However if a deferred tax asset was recognised on the downward valuation this would need to be derecognised. The below example illustrates uplifts however the same logic would apply if there were downward movements and the downward movement did not result in the investment going below original cost less accumulated depreciation.

As stated above Section 28.10 allows companies an exemption an exemption from Section 12.15 to determine the depreciated cost of each of the major components of an investment property at the date of transition to FRS 105. This has been illustrated in the example below.

Example 1: Investment property restated to cost less depreciation and impairment from fair value (applicable to FRSSE/old GAAP entities that transition)

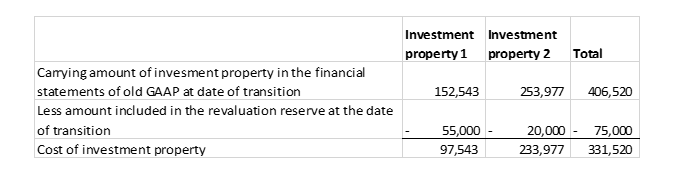

Company A holds 2 investment properties. Under FRSSE/old GAAP investment property was required to be held at market value on the balance sheet with movements in the market value of the investment property recognised in the STRGL and then to the revaluation reserve unless a devaluation was permanent in nature in which case it was recognised in the profit and loss. There was no requirement to recognise deferred tax unless there was a binding agreement to sell.

Under Section 12 of FRS 105 investment property must be held at cost less depreciation and impairment. It cannot be held at market value.

At the date of transition CU75,000 was included in the revaluation reserve with respect to investment property (split CU55,000 to property 1 and CU20,000 to property 2). An uplift of CU100,000 and CU150,000 was recognised in the 2015 and 2016 financial statements respectively (through the STRGL and the revaluation reserve). Assume the uplifts in each year are on property 1. Assume the carrying amount at the date of transition of the investment properties is CU406,520.

There are two investment properties at the date of transition and no additional properties were acquired since transition. The total cost of the land included within investment property is CU50,000 split CU25,000 to investment property 1 and CU25,000 to investment property 2. Assume the 2 properties were purchased at the same time on 1 January 2011. Assume that investment property 2 was disposed of on 30 June 2016 and at that date the carrying amount was CU253,977 which equated to the sales price at that date.

Therefore on transition an adjustment is required to derecognise the investment property at market value and recognise the property at cost less depreciation and impairment at the date and since the date of transition.

FRS 105 recognises that it may be a significant amount of work to determine the cost less depreciation amount at the date of transition and as a result included an exemption in Section 28.10(c) of FRS 105 to make the calculation easier. The exemption included provides a 5 step process to determine the cost less depreciation at the date of transition (that being 1 January 2015 for this entity). Assume that the other major components which have different life’s to the structure after the most significant components (that being the structure) are the lifts and the air conditioning system.

Step 1: The total cost of the investment properties at the date of transition is CU331,520 as determined below:

Carrying amount of investment properties at date of transition of CU406,520 less the amount included in the revaluation reserve of CU75,000 = CU331,520.

From review of the accounting records, it is noted that this cost is split CU97,543 to investment property 1 and CU233,977 to investment property 2.

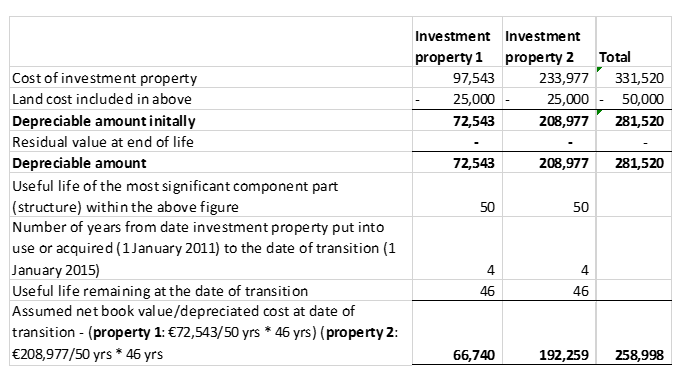

Step 2: The total cost of land included in the cost in step 2 is CU50,000 split CU25,000 per investment property as per the facts.

Step 3: The total depreciable amount is therefore €72,543 for property 1 and €208,977 for property 2 as calculated below:

The most significant component within the depreciable amount for each property is the structure itself. Therefore the useful life of this structure is the basis for determining the net book value under FRS 105 at the date of transition. If we assume the useful life of the structure is 50 years. The NBV at the date of transition is as follows:

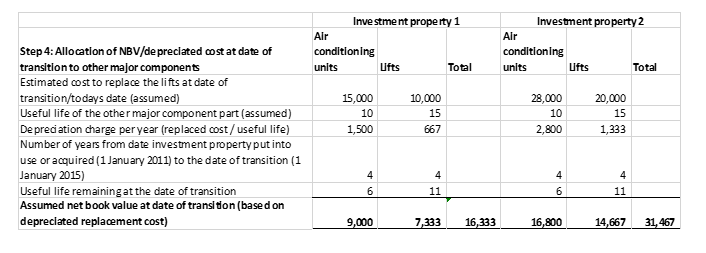

Step 4:

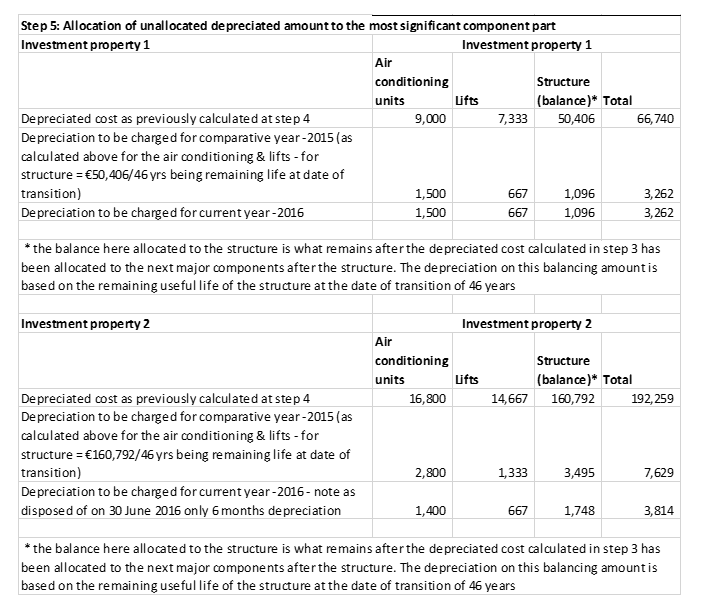

Step 5:

Step 6: Calculate the depreciation to be recognised in total on the investment properties in the current and comparative year.

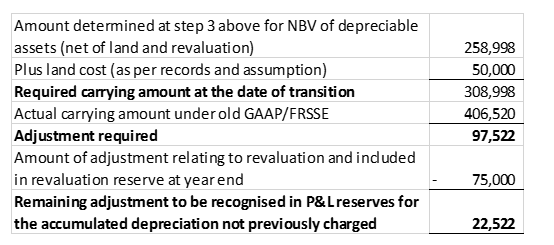

Step 7: Determine the adjustment to be made at the date of transition to profit and loss reserves

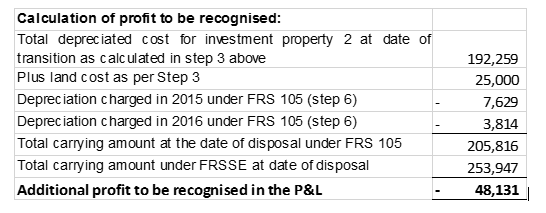

Step 8: Adjustment to profit on disposal of investment property where disposed of in the comparative or current year and held at market value.

As investment property 2 was disposed of in 2016 assuming the 2016 accounts were originally prepared under FRSSE/Old GAAP the profit on disposal will have been less (or if applicable loss on disposal would have been more) if the accounts are prepared under FRS 105 as the asset would have been held at cost less depreciation and impairment. As a result a transition adjustment is required.

The transition adjustments to reflect the correct balance under FRS 105 are:

On 1 January 2015:

|

|

CU |

CU |

|

Dr revaluation reserve (being amount in revaluation reserve at date of transition) |

75,000 |

|

|

Dr opening profit and loss reserves (step 7) |

22,522 |

|

|

Cr investment properties |

|

97,522 |

Being journal to restate the investment properties to cost less depreciation and to post the catch up on the depreciation to reserves

In the year ended 31 December 2015:

|

|

CU |

CU |

|

Dr revaluation reserve (being amount in revaluation reserve at date of transition) |

75,000 |

|

|

Dr opening profit and loss reserves (step 7) |

22,522 |

|

|

Cr investment properties |

|

97,522 |

Being journal to restate the investment properties to cost less depreciation and to post the catch up on the depreciation to reserves at date of transition

|

Dr depreciation/administrative expenses (step 6) |

10,891 |

|

|

Cr accumulated depreciation/investment properties |

|

10,891 |

Being journal to reflect depreciation on the investment properties in the year

|

Dr revaluation reserve |

100,000 |

|

|

Cr investment property |

|

100,000 |

Being journal to reverse fair value movement recognised on investment properties in the 2015 year as not permitted under FRS 105

In the year ended 31 December 2016:

|

|

CU |

CU |

|

Dr revaluation reserve (being amount in revaluation reserve at date of transition) |

75,000 |

|

|

Dr opening profit and loss reserves (step 7) |

22,522 |

|

|

Cr investment properties |

|

97,522 |

Being journal to restate the investment properties to cost less depreciation and to post the catch up on the depreciation to reserves at date of transition

|

Dr P&L reserves (step 6) |

10,891 |

|

|

Cr accumulated depreciation/investment properties |

|

10,891 |

Being journal to reflect depreciation on the investment properties for the comparative year

|

Dr revaluation reserve |

100,000 |

|

|

Cr investment property |

|

100,000 |

Being journal to reverse fair value movement recognised on investment properties in the 2015 as not permitted under FRS 105

|

|

CU |

CU |

|

Dr depreciation/administrative expenses (step 6) – 2016 |

7,077 |

|

|

Cr accumulated depreciation/investment properties |

|

7,077 |

Being journal to reflect depreciation on the investment properties in the 2016 year

|

Dr investment properties (step 8) |

48,131 |

|

|

Cr profit on disposal in P&L |

|

48,131 |

|

Dr P&L reserves |

20,000 |

|

|

Cr revaluation reserve |

|

20,000 |

Being journal to reflect the additional profit on disposal of investment property 2 previously not included in P&L as it was held at revalued amount and the reversal of posting under FRSSE for reclassification of profit realised from revaluation reserve to P&L reserves.

|

Dr revaluation reserve |

150,000 |

|

|

Cr investment property |

|

150,000 |

Being journal to reverse fair value movement recognised on investment properties in the 2016 year as not permitted under FRS 105

Example 2: Investment property restated to cost less depreciation and impairment from fair value (applicable to FRS 102 entities that transition)

If we take the facts as in example 18 and the calculations performed in steps 1-8 but this time assume the movements were recognised through the profit and loss as opposed to the STRGL/revaluation reserve as is required under FRS 102. In addition assume the deferred tax liability recognised on the uplifts in the FRS 102 books was CU15,000, CU35,000 and CU65,000 at 1 January 2015, 31 December 2015 and 31 December 2016.

A transition adjustment is required to derecognise the fair values and restate at cost less depreciation and impairment as well as an adjustment to derecognise the deferred tax impact. In reality the deferred tax on this fair value adjustment would likely be derecognised as one journal with deferred tax on all other timing differences as discussed in Section 24 of FRS 105, however we have shown the derecognition here for educational purposes). The only difference in the steps here is in step Step 7 as the revaluation reserve is not applicable – hence this step is replicated below:

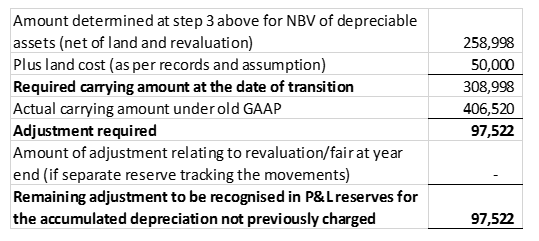

Step 7: Determine the adjustment to be made at the date of transition to profit and loss reserves

The transition adjustments to reflect the correct balance under FRS 105 are:

On 1 January 2015:

|

|

CU |

CU |

|

Dr Opening P&L Reserves (CU97,522-CU15,000) |

82,522 |

|

|

Dr Deferred tax liability |

15,000 |

|

|

Cr Investment properties (step 7) |

|

97,522 |

Being journal to restate the investment properties to cost less depreciation and to post the catch up on the depreciation to reserves at date of transition and derecognise deferred tax

In the year ended 31 December 2015:

|

|

CU |

CU |

|

Dr Opening P&L Reserves (CU97,522-CU15,000) |

82,522 |

|

|

Dr Deferred tax liability |

15,000 |

|

|

Cr Investment properties (step 7) |

|

97,522 |

Being journal to restate the investment properties to cost less depreciation and to post the catch up on the depreciation to reserves at date of transition and derecognise deferred tax

|

Dr depreciation/administrative expenses (step 6) |

10,891 |

|

|

Cr accumulated depreciation/investment properties |

|

10,891 |

Being journal to reflect depreciation on the investment properties in the 2015 year

|

Dr Deferred tax liability (CU35k-CU15k) |

20,000 |

|

|

Cr Deferred tax in P&L |

|

20,000 |

Being journal to reverse deferred tax on fair value movement recognised under FRS 102 in 2015 as it is not permitted to be recognised under FRS 105

|

Dr Other Operating Income in P&L for uplift in 2015 |

100,000 |

|

|

Cr investment property |

|

100,000 |

Being journal to reverse fair value movement recognised on investment properties in the 2015 year as not permitted under FRS 105

In the year ended 31 December 2016:

|

|

CU |

CU |

|

Dr Opening P&L Reserves (CU97,522-CU15,000) |

82,522 |

|

|

Dr Deferred tax liability |

15,000 |

|

|

Cr Investment properties (step 7) |

|

97,522 |

Being journal to restate the investment properties to cost less depreciation and to post the catch up on the depreciation to reserves at date of transition and derecognise deferred tax

|

Dr P&L reserves for 2015 depreciation (step 6) |

10,891 |

|

|

Cr accumulated depreciation/investment properties |

|

10,891 |

Being journal to reflect depreciation on the investment properties for the comparative year

|

Dr Deferred tax liability |

20,000 |

|

|

Cr P&L reserves for 2015 for reversal of Deferred tax in 2015 |

|

20,000 |

Being journal to reverse deferred tax on fair value movement recognised in 2015 as it is not permitted to be recognised under FRS 105

|

Dr P&L reserves – Other Operating Income for 2015 FV movement |

100,000 |

|

|

Cr investment property |

|

100,000 |

Being journal to reverse fair value movement recognised on investment properties in the 2015 as not permitted under FRS 105

|

|

CU |

CU |

|

Dr depreciation/administrative expenses (step 6) – 2016 |

7,077 |

|

|

Cr accumulated depreciation/investment properties |

|

7,077 |

Being journal to reflect depreciation on the investment properties in the 2016 year

|

Dr investment properties (step 8) |

48,131 |

|

|

Cr profit on disposal in P&L |

|

48,131 |

Being journal to reflect the additional profit on disposal of investment property 2 previously not included in P&L as it was held at fair value under FRS 105.

|

Dr Other Operating Income in P&L for uplift in 2016 |

150,000 |

|

|

Cr investment property |

|

150,000 |

Being journal to reverse fair value movement recognised on investment properties in the 2016 year as not permitted under FRS 105

|

Dr Deferred tax liability (CU65k-CU35k) |

30,000 |

|

|

Cr Deferred tax in P&L |

|

30,000 |

Being journal to reverse deferred tax on fair value movement recognised under FRS 102 in 2016 as it is not permitted to be recognised under FRS 105

Example 3: Restatement of property, plant and equipment from revalued amount or fair value as deemed cost under FRS 102 to historic cost less accumulated depreciation under FRS 105 (applicable to entities transitioning from FRS 102)

Company A applied a revalued amount as deemed cost under FRS 102 (i.e. claimed exemption under Section 35 to treat fair value/revalued amount as deemed cost). Note this resulted in the carrying amount being included at an amount in excess of the historic cost less accumulated depreciation. Under FRS 102 at the date of transition to FRS 102 the company recognised the uplift in a reserve called ‘other reserve’ or the revaluation reserve.

The amount recognised in the ‘other reserve’ at the date of transition under FRS 102 was CU150,000 less the deferred tax of CU18,750 (as required to recognise this deferred tax under FRS 102). Each year the company transferred the depreciation on the revaluation uplift of CU3,000 from profit and loss reserves to the ‘other reserve’ as the amount included in the ‘other reserve’ is realised. The CU3,000 reflects the additional depreciation charged on the revaluation uplift and the deferred tax impact of this is CU375 assuming a deferred tax rate of 12.5%. Therefore the amount in the ‘other reserve’ before the deferred tax impact of CU18,750 reflects the amount by which the fixed assets are stated above the original cost less depreciation (a check should be performed to ensure that this is the original cost less depreciation by reviewing the accounting records).

On transition to FRS 105 an adjustment is required to derecognise the revaluation and restate the assets to cost less depreciation and impairment. In addition as Section 24 of FRS 105 does not permit deferred tax to be included on the balance sheet this should also be derecognised. In reality the deferred tax on this fair value/revaluation adjustment would likely be derecognised as one journal with deferred tax on all other timing differences as discussed in Section 24 of FRS 105, however we have shown the derecognition here for educational purposes).

Note if the company did not apply the policy of transferring the depreciation charged on the uplift in value from the P&L reserve to the ‘other reserve’ each year, an exercise would need to be performed to determine the original cost less depreciation (it would not be possible to clear out the revaluation reserve to fixed assets as below as some of the amount in the other reserve would have to be set against the profit and loss reserves).

The following journals are required to be recognised on transition:

On 1 January 2015:

|

|

CU |

CU |

|

Dr revaluation/other reserve |

150,000 |

|

|

Cr tangible fixed assets |

|

150,000 |

Being journal to restate the tangible fixed asset to cost less depreciation as required under FRS 105

|

Dr Deferred tax liability |

18,750 |

|

|

Cr Other Reserves |

|

18,750 |

Being journal to derecognise the deferred tax previously recognised on the uplift to other reserves at the date of transition (that being the deferred tax still to be unwound)

In the year ended 31 December 2015:

|

|

CU |

CU |

|

Dr Opening Revaluation reserve |

150,000 |

|

|

Cr tangible fixed assets |

|

150,000 |

Being journal to restate the tangible fixed assets to cost from revalued amount at the date of transition

|

Dr Deferred tax liability |

18,750 |

|

|

Cr Other Reserves |

|

18,750 |

Being journal to derecognise the deferred tax previously recognised on the uplift to other reserves at the date of transition (that being the deferred tax still to be unwound)

|

Dr tangible fixed assets |

3,000 |

|

|

Cr depreciation/administrative expenses in P&L for 2015 |

|

3,000 |

Being journal to reverse the depreciation charge posted on the revaluation uplift in the 2015 year so as to show depreciation charge on the historic amount

|

Dr P&L reserves |

3,000 |

|

|

Cr Other reserve |

|

3,000 |

Being journal to reverse the previous reclassification of the depreciation on the revalued amount from profit and loss reserves to the other reserve as required for 2015 under Company law where a revaluation policy is applied

|

Dr Other Reserves |

375 |

|

|

Cr P&L Reserves |

|

375 |

Being journal to reverse the reclassification under old GAAP of the transfer from P&L reserve to the other reserve for the deferred tax released on the depreciation on the uplift in the 2015 year

|

Dr Deferred tax in P&L – 2015 |

375 |

|

|

Cr Deferred tax liability |

|

375 |

Being journal to reverse the release of the deferred tax on the depreciation on the revalued amount in 2015 as a result of the restatement to historic cost as this is no longer applicable

In the year ended 31 December 2016:

|

|

CU |

CU |

|

Dr Opening Revaluation reserve |

150,000 |

|

|

Cr tangible fixed assets |

|

150,000 |

Being journal to restate the tangible fixed assets to cost from revalued amount at the date of transition

|

Dr Deferred tax liability |

18,750 |

|

|

Cr Other Reserves |

|

18,750 |

Being journal to derecognise the deferred tax previously recognised on the uplift to other reserves at the date of transition (that being the deferred tax still to be unwound)

|

Dr tangible fixed assets |

3,000 |

|

|

Cr P&L Reserves for the 2015 depreciation adjustment |

|

3,000 |

Being journal to reverse the depreciation charge posted on the revaluation uplift in the 2015 year

|

Dr P&L reserves |

3,000 |

|

|

Cr Other reserve |

|

3,000 |

Being journal to reverse the previous reclassification of the depreciation on the revalued amount from profit and loss reserves to the other reserve for 2015 as required under Company law where a revaluation policy is applied

|

Dr Other Reserves |

375 |

|

|

Cr P&L Reserves |

|

375 |

Being journal to reverse the reclassification under old GAAP of the transfer from P&L reserve to the other reserve for the deferred tax released on the depreciation on the uplift in the 2015 year

|

Dr P&L Reserves for Deferred tax – 2015 |

375 |

|

|

Cr Deferred tax liability |

|

375 |

Being journal to reverse the release of the deferred tax on the depreciation on the revalued amount in 2015 as a result of the restatement to historic cost as this is no longer applicable

|

|

CU |

CU |

|

Dr tangible fixed assets |

3,000 |

|

|

Cr depreciation/administrative expenses in P&L in 2016 |

|

3,000 |

Being journal to reverse the depreciation charge posted on the revaluation uplift in the current year

|

Dr Other Reserves |

375 |

|

|

Cr P&L Reserves |

|

375 |

Being journal to reverse the reclassification under old GAAP of the transfer from P&L reserve to the other reserve for the deferred tax released on the depreciation on the uplift in the 2016 year

|

Dr Deferred tax in P&L – 2016 |

375 |

|

|

Cr Deferred tax liability |

|

375 |

Being journal to reverse the release of the deferred tax on the depreciation on the revalued amount in 2016 as a result of the restatement to historic cost as this is no longer applicable

Optional exemptions – Compound financial instruments

Extract from FRS105: Section 28.10(d)

Paragraph 17.11 requires a micro-entity to split a compound financial instrument into its liability and equity components at the date of issue. A first- time adopter need not separate those two components if the liability component is not outstanding at the date of transition to this FRS.

OmniPro comment

Accounting for compound financial instruments under old UK/Irish GAAP/FRSSE/FRS 102 and FRS 105 is the same, therefore this exemption is not likely to have a lot of applicability.

The effect of this exemption is that split accounting does not have be performed if the liability component was settled prior to the date of transition. See Section 17 of this manual for an example of how to apply split accounting.

Optional exemptions – Arrangements containing a lease

Extract from FRS105: Section 28.10(e)

A first-time adopter may elect to determine whether an arrangement existing at the date of transition to this FRS contains a lease (see paragraph 15.4) on the basis of facts and circumstances existing at that date, rather than when the arrangement was entered into.

OmniPro comment

The above exemption is straight forward. It is unlikely to be applicable in many instances especially for entities transitioning from FRS 102.

Optional exemptions – Decommissioning liabilities included in the cost of property, plant and equipment or investment property

Extract from FRS105: Section 28.10(f)

Paragraph 12.9(c) states that the cost of an item of property, plant and equipment or investment property includes the initial estimate of the costs of dismantling and removing the item and restoring the site on which it is located, the obligation for which a micro-entity incurs either when the item is acquired or as a consequence of having used the item during a particular period for purposes other than to produce inventories during that period. A first-time adopter may elect to measure this component of the cost of an item of property, plant and equipment or investment property at the date of transition to this FRS, rather than on the date(s) when the obligation initially arose.

OmniPro comment

Where an entity previously applied old UK/Irish GAAP/FRSSE/FRS 102 the entity was also required to recognise a liability for the future decommissioning cost therefore a provision should already have been made, hence the exemption would not be applicable.

Optional exemptions – Dormant companies

Extract from FRS105: Section 28.10(g)

A company within the Act’s definition of a dormant company may elect to retain its accounting policies for reported assets, liabilities and equity at the date of transition to this FRS until there is any change to those balances or the company undertakes any new transactions.

OmniPro comment

Where this exemption is claimed, this fact must be disclosed in the financial statements prepared under previous GAAP rules.

A company is considered to be dormant where it had no significant accounting transactions in the period and its assets and liabilities comprise only permitted assets and liabilities (i.e. investments in shares of, and amounts due to or from, other group undertakings. In determining whether or when a company is dormant, the following shall be disregarded:

(a) any transaction arising from the taking of shares in the company by a subscriber to the constitution as a result of an undertaking of his or her in connection with the formation of the company;

(b) any transaction consisting of the payment of—

(i) a fee to the Registrar on a change of the company’s name;

(ii) a fee to the Registrar on the re-registration of the company; or

(iii) a fee to the Registrar for the registration of an annual return.

Where an entity becomes non-dormant in the future and therefore can no longer apply old GAAP accounting principles it cannot claim any of the first time adoption exemptions mentioned in this Section as technically that year is not the first year of transition.

Optional exemptions – Lease incentives

Extract from FRS105: Section 28.10(h)

A first-time adopter is not required to apply paragraphs 15.15 and 15.25 to lease incentives provided the term of the lease commenced before the date of transition to this FRS. The first-time adopter shall continue to recognise any residual benefit or cost associated with these lease incentives on the same basis as that applied at the date of transition to this FRS.

OmniPro comment

Under old UK/Irish GAAP/FRSSE any lease incentives received were released from the beginning of the lease up to the date of the first market rent review. Under FRS 105 these incentives are released over the length of the lease. In effect, it is released over a shorter period under old UK/Irish GAAP/FRSSE.

Therefore, where lease incentives were received prior to the date of transition these leases can continue to be released in line with old GAAP (i.e. over the life of the lease) where this exemption is claimed. All leases entered into from the date of transition have to be accounted for in line with Section 15 of FRS 105.

If the entity does not claim this exemption, retrospective adjustments are required to restate the lease incentive accrual to what it should be based on Section 15 in FRS 105.

Where a lease incentive is received since the date of transition (i.e. in the comparative period) a transition adjustment will be required to account for this incentive over the life of its lease. The below example illustrates this.

Note there is no difference between FRS 102 and FRS 105 here therefore this exemption is not applicable for entities transitioning from FRS 102.

Example 4: Lease incentives since date of transition (applicable to entities transitioning from old GAAP/FRSSE)

Company A’s date of transition is 1 January 2015 i.e. 31 December year end. Company A entered into a lease on 2 January 2015 for 10 years with a landlord for a premises it occupies. As part of the agreement the landlord provided a 3 month rent free period (lease incentive of CU200,000/12mths*3mths=CU50,000). The rent payable on the lease per annum is CU200,000. As part of the agreement, the landlord agreed to provide the first 3 months rent free. A rent review/break clause was included which could be initiated at the end of year 5. Under old GAAP, this lease incentive was released to the P&L over the 5 years as was dictated by that GAAP. Therefore at 31 December 2014 the lease incentive accrual under old GAAP was CU40,000 (i.e. the value of the rent free period of CU50,000 / 5 years * 4 years that remain) and the rent cost in the P&L was CU190,000. Assume a corporation tax rate of 10%. The adjustment will be tax deductible over a 5 year period in the tax computation.

Under Section 15, the lease incentive needs to be written off over the life of the lease which is 10 years. See below for the calculation of what should have been accrued at the 31 December 2014.

The journals required to be posted in Company A’s TB at the 31 December 2015 to correct the old GAAP postings are:

|

|

CU |

CU |

|

Dr Rental Expense in P&L (CU45,000-CU40,000) |

5,000* |

|

|

Cr Lease Incentive Accrual BS |

|

5,000 |

Being journal to reverse understatement of accrual under old GAAP

From year 2 on, the CU45,000 is written back to the profit and loss and set against the rental expense i.e. at the end of year 2 the accrual would be reduced to CU40,000 (CU50,000-CU5,000 for 2014 – CU5,000 for 2015) to show the net cost of CU195,000 per annum.

If in the above example the landlord provided a contribution of CU50,000 towards the cost of fixed assets or towards the cost of relocating, the treatment would be the same.

* Calculate the actual total rental payments over the 10 years i.e. actual rent payments are only paid for 9 years and 9 months = CU200,000 *9.75 years= CU1,950,000. Therefore the total amount of rent to be charged over the life of the lease is = CU1,950,000/10 years = CU195,000 per annum or CU16,250 per month. Therefore for the first 3 months an accrual is required as no payment is made. The accrual is then reduced over the life of the lease (the value of the rent free period was CU50,000). Therefore the accrual required at 31 December 2014 was CU45,000 (CU50,000 less the amount utilised in 2014 of CU5,000 (being CU50,000 / 10 years) compared to the old GAAP accrual of CU40,000.

Given that the company has already been taxed on the additional credit posted in old GAAP of CU5,000 and given that if FRS 105 had of been applied in that year the additional CU5,000 would not have been taxed , a corporation tax asset should be recognised for the fact that this will be recouped in future tax computations (assumed tax deductible over 5 years for the purposes of this example.

The journals required in the comparative year are:

|

|

CU |

CU |

|

Dr Corporation Tax Asset (CU5,000*10%) |

500 |

|

|

Cr Corporation Tax P&L |

|

500 |

Being journal to reflect Corporation tax on the above adjustment so as to show the correct tax under FRS 105 as if FRS 105 had of applied from inception.

For the year ended 31 December 2016, a similar adjustment will be required (plus the profit and loss reserve adjustment for 2014), however no corporation tax will be required on the 2016 adjustment as the tax computation has not been submitted to the tax authorities at the time of preparing the financial statements. 1/5th of the corporation tax asset of CU500 recognised in 2015 will have to be released in 2016 for the fact that a deduction will be obtained in the tax computation for this 1/5th in 2016. The journal required is:

|

|

CU |

CU |

|

Dr Corporation Tax in P&L |

100 |

|

|

Cr Corporation Tax Asset |

|

100 |

Being journal to reflect the additional deduction for 1/5th of the credit previously taxed up to 31/12/16 under old GAAP which has therefore fallen out on transition to FRS 105 and if FRS 105 had of been applied in the comparative year, the corporation tax charge would be less. Note this assumes that the tax journal posted will include the transition tax adjustment for the CU100 when it is finally recognised. If there was no corporation tax in 2016, then the CU100 would still be released as a debit to the P&L as it would be no longer refundable from the tax authorities. As no deferred tax can be recognised under FRS 105 it cannot be held as deferred tax asset on the balance sheet as a timing difference if it cannot be utilised. The remaining CU400 (CU500-CU100) will still be included as an asset at the year end in the corporation tax nominal and released over the remaining 4 yrs.

Impracticability

Extract from FRS105: Section 28.11

28.11 If it is impracticable for a micro-entity to restate the opening statement of financial position at the date of transition for one or more of the adjustments required by paragraph 28.7, the micro-entity shall apply paragraphs 28.7 to 28.10 for such adjustments in the earliest period for which it is practicable to do so.

28.12 Where applicable to the transactions, events or arrangements affected by applying these exemptions, a micro-entity may continue to use the exemptions that are applied at the date of transition to this FRS when preparing subsequent financial statements, until such time when the assets and liabilities associated with those transactions, events or arrangements are derecognised.

OmniPro comment

Appendix I of FRS 105 states that ‘applying a requirement is impracticable when the entity cannot apply it after making every reasonable effort to do so’. Where an adjustment is not made due to it being impracticable then this must be disclosed. It is only in exceptional cases that this exemption should be claimed.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]