[et_pb_section admin_label=”Header – All Pages” global_module=”1221″ transparent_background=”off” background_color=”#1e73be” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” custom_padding=”||0px|”][et_pb_row global_parent=”1221″ admin_label=”row”][et_pb_column type=”4_4″][et_pb_post_title global_parent=”1221″ admin_label=”Post Title” title=”on” meta=”off” author=”on” date=”on” categories=”on” comments=”on” featured_image=”off” featured_placement=”below” parallax_effect=”on” parallax_method=”on” text_orientation=”left” text_color=”light” text_background=”off” text_bg_color=”rgba(255,255,255,0.9)” module_bg_color=”rgba(255,255,255,0)” title_all_caps=”off” use_border_color=”off” border_color=”#ffffff” border_style=”solid” title_font=”|on|||” title_font_size=”35″ custom_padding=”10px|||”] [/et_pb_post_title][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” global_module=”1228″ fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” custom_padding=”0px||0px|” padding_mobile=”on” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” gutter_width=”3″][et_pb_row global_parent=”1228″ admin_label=”Row” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” use_custom_gutter=”off” gutter_width=”3″ custom_padding=”0px||0px|” padding_mobile=”off” allow_player_pause=”off” parallax=”off” parallax_method=”off” make_equal=”off” parallax_1=”off” parallax_method_1=”off” column_padding_mobile=”on”][et_pb_column type=”4_4″][et_pb_text global_parent=”1228″ admin_label=”Text” background_layout=”light” text_orientation=”left” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [breadcrumb] [/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” fullwidth=”off” specialty=”off”][et_pb_row admin_label=”Row”][et_pb_column type=”1_2″][et_pb_text admin_label=”Return to 105 Index” background_layout=”light” text_orientation=”center” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [button link=”https://ie.frs102.com/members/premium-toolkit/frs-105/” type=”big” color=”red”] Return to FRS 105 Main Menu[/button] [/et_pb_text][/et_pb_column][et_pb_column type=”1_2″][et_pb_text admin_label=”Return to Section 17 Home” background_layout=”light” text_orientation=”center” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [button link=”https://ie.frs102.com/members/premium-toolkit/frs-105/section-17/” type=”big” color=”red”] Return to Section 17 Home[/button] [/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” gutter_width=”3″][et_pb_row admin_label=”Row”][et_pb_column type=”4_4″][et_pb_text admin_label=”Main Body Text” background_layout=”light” text_orientation=”justified” use_border_color=”off” border_color=”#ffffff” border_style=”solid” module_id=” “]

Section 17 – Liabilities and Equity

Section 17 deals with the classification of financial instruments as either debt or equity, accounting for compound instruments and purchase of own shares. The key thing to consider is the substance of the transaction when determining whether shares issued should be classed as debt or equity.

Scope

Extract from FRS 105 – Section 17.1 – 17.2

17.1 This section establishes principles for classifying financial instruments as either liabilities or equity and deals with the accounting for compound financial instruments, such as convertible debt. It also addresses the issue of equity instruments, distributions to individuals or other parties acting in their capacity as investors in equity instruments (i.e. in their capacity as owners) and the accounting for purchases of own equity

17.2 This section shall be applied to all types of financial instruments except:

(a) Investments in subsidiaries and associates and interests in jointly controlled entities that are accounted for in accordance with Section 9 Financial Instruments.

(b) Employers’ rights and obligations under employee benefit plans to which Section 23 Employee Benefits applies.

(c) Financial instruments, contracts and obligations under share-based payment transactions to which Section 21 Share-based Payment applies, except that paragraph 17.14 shall be applied to treasury shares issued, purchased, sold, transferred or cancelled in connection with employee share option plans, employee share purchase plans, and all other share-based payment arrangements.

(d) Financial guarantee contracts (see Section 16 Provisions and Contingencies).

OmniPro comment

The scope of Section 17 is very wide and incorporates all financial instruments other than those dealt with in other sections as detailed in Section 17.2.

Classification of an instrument as liability or equity

Extract from FRS 105 – Section 17.3 – 17.6

17.3 Equity is the residual interest in the assets of a micro-entity after deducting all its liabilities. Equity includes investments by the owners of the micro-entity, plus additions to those investments earned through profitable operations and retained for use in the micro-entity’s operations, minus reductions to owners’ investments as a result of unprofitable operations and distributions to owners.

17.4 A financial instrument is classified as equity where the issuer can be required to settle an obligation in cash or by delivery of another financial asset (or otherwise to settle it in such a way that it would be a financial liability) only in the event of the liquidation of the issuer.

17.5 A financial instrument is a financial liability of the issuer where the issuer does not have an unconditional right to avoid settling an obligation in cash or by delivery of another financial asset (or otherwise to settle it in such a way that it would be a financial liability), other than for the reason described in paragraph 17.4.

17.6 Examples of instruments and their classification as equity or liabilities are set out below:

(a) An instrument is classified as equity if the only payment holders of the instruments are entitled to receive is a pro rata share of the net assets of the micro-entity on liquidation.

(b) An instrument is classified as a liability if it obliges the micro-entity to make payments to the holder before liquidation, such as a mandatory dividend.

(c) A preference share that provides for mandatory redemption by the issuer for a fixed or determinable amount at a fixed or determinable future date, or gives the holder the right to require the issuer to redeem the instrument at or after a particular date for a fixed or determinable amount, is a financial liability.

Extract of the definition of a financial liability (extracted from Appendix 1 of FRS 105)

A financial liability is any liability that is:

(a) a contractual obligation:

(i) to deliver cash or another financial asset to another entity; or

(ii) to exchange financial assets or financial liabilities with another entity under conditions that are potentially unfavourable to the entity; OR

(b) a contract that will or may be settled in the entity’s own equity instruments and:

(i) under which the entity is or may be obliged to deliver a variable number of the entity’s own equity instruments; OR

(ii) which will or may be settled other than by the exchange of a fixed amount of cash or another financial asset for a fixed number of the entity’s own equity instruments. For this purpose the entity’s own equity instruments do not include instruments that are themselves contracts for the future receipt or delivery of the entity’s own equity instruments.

OmniPro comment

As can be seen from the definition of a financial liability in the section above, the key question when assessing whether an item is classed as debt or equity is if:

- Ignoring share settlement, the issuer does not have an unconditional right to avoid delivering cash or another financial asset to settle a contractual obligation, only in the event of the liquidation of the issuer.

NOTE: in relation to the mandatory requirement to pay dividend, it is irrelevant whether the company has distributable reserves to pay the dividend. The dividend should still be accrued in the financial statements. Also in relation to the requirement to repurchase the shares, the fact that the entity has no distributable reserves is not taken into account. Just because there is not distributable reserves or there is insufficient cash, does not prevent the dividend from being accrued. Obviously the dividend cannot be paid to the holder until the company has distributable reserves.

Where a financial instrument is classified as debt, the preference shares paid are classified as an interest cost in the financial statements. The preference dividend which is mandatory where not paid should be accrued as the entity is contractually obliged to pay this in the future.

Where it is classified as equity the dividend paid is posted to equity/profit and loss reserves. A dividend declared on an equity share cannot be accrued unless it has been approved by the members in an AGM prior to the year end. If it has not it should not be accrued.

Shares which are deemed to be debt are usually accounted for in line with Section 9 financial instruments.

Note in any of the examples below, we use preference shares however the shares could be called whatever they like i.e. ‘A’ ordinary shares, bonds etc., it is the rights attaching to the instrument that matter. The examples below detail the majority of alternatives that entities may come across in practice and explains the points in the standard above.

Example 1: Redeemable preference shares at option of the holder with mandatory coupon

Company A issued 200,000 10% preference shares of CU1 each in return for CU200,000. The rights attaching to the shares are such that:

- 10% dividend must be paid annually in arrears i.e. CU20,000 mandatory

- The preference shares are redeemable at their par value at the option of the holder at some time in the future.

Given that Company A has a contractual obligation to pay a dividend yearly and is contractually obliged to redeem the shares, these shares would be classified as debt in Company A’s financial statements. The journals required on issue would be to:

|

|

CU |

CU |

|

Dr Bank |

200,000 |

|

|

Cr Preference Shares Liability |

|

200,000 |

The journal required at the end of each year for the dividend payable is:

|

|

CU |

CU |

|

Dr Interest Expenses with Preference Dividend |

20,000 |

|

|

Cr Bank/Preference Dividend Accrual |

|

20,000 |

Example 2: Non-redeemable preference shares with mandatory coupon at market rate

Company A issued 200,000 10% preference shares of CU1 each in return for CU200,000. The rights attaching to the shares are such that:

- 10% dividend must be paid annually in arrears i.e. CU20,000 mandatory

- The preference shares are non-redeemeable or redeemable at the option of the issuer (i.e. Company A) at any time

Given that Company A has a contractual obligation to pay/accrue a dividend yearly, these shares would be classified as debt in Company A’s financial statements as the stream of cash flow is into perpetuity. The journals required in this case are the same as example 1.

Example 3: Non-redeemable preference shares with mandatory coupon at non-market rate

Company A issued 200,000 10% preference shares of CU1 each in return for CU200,000. The market coupon rate on such shares should be 12%. The rights attaching to the shares are such that:

- 10% dividend must be paid year on year i.e. CU20,000 mandatory

- The preference shares are non-redeemeable or redeemable at the option of the issuer (i.e. Company A) at any time

In this particular circumstance, there is both a liability and equity component to these shares. This is in effect a compound financial instrument. The liability element being the mandatory dividend payable and equity element being the residual. Therefore a certain element of the proceeds will be shown in equity and liabilities. See section on compound financial instruments below (example 13).

Note if the above example was at market rate but it also contained rights which stated that additional dividends on top of the coupon rate may be paid at the discretion of the board, it would also be a compound instrument and the market rate for an instrument with the additional option would have to be applied so as to ascertain the liability and equity component.

Example 4: Shares redeemeable at the option of the holder

‘Ordinary shares’ that can be converted into debt, based on fair value of the shares at the date of conversion at the option of the holder

Here this is accounted for as a financial liability on the basis that once converted which is at the option of the holder, there is a contractual obligation to redeem for cash, hence the issuer cannot avoid paying in cash.

Example 5: Non redeemable preference shares with discretionary dividend

Company A issued 200,000 preference shares of CU1 each in return for CU200,000. The rights attaching to the shares are such that:

- Dividend is payable at the discretion of the company

- The preference shares are non-redeemeable

Given that company A has no contractual obligation to redeem or pay dividends, this should be classified as equity in the financial statements. The journal required on issue of the shares are:

|

|

CU |

CU |

|

Dr Bank |

200,000 |

|

|

Cr Equity –Preference Share Capital |

|

200,000 |

Where a discretionary dividend is paid on these equity shares the journal required is to:

|

|

CU |

CU |

|

Dr Equity-Profit and Loss Reserves |

XXX |

|

|

Cr Bank |

|

XXX |

If the dividend was approved by the members prior to the year end, then the dividend can be accrued.

Example 6: Redeemable preference shares at option of issuer with discretionary dividend

Company A issued 200,000 preference shares of CU1 each in return for CU200,000. The rights attaching to the shares are such that:

- Dividend are payable at the discretion of the company

- The preference shares are redeemable at the issuers option at some future date

Given that Company A has no contractual obligation to pay cash, this should be classified as equity in the financial statements. The treatment of any discretionary dividends are posted to equity as in example 5 above. Note even if there was a coupon attached to these preference shares that was only payable at the option of the Company, they would still be classed as equity. Whether the company has a history of paying dividends in the past is irrelevant, it would still be classed as equity as it does not have a contractual obligation to make the dividend payment.

Example 7: Redeemable preference shares at option of issuer with mandatory dividend

Company A issued 200,000 10% preference shares of CU1 each in return for CU200,000. The rights attaching to the shares are such that:

- 10% dividend must be paid annually in arrears i.e. CU20,000 mandatory

- The preference shares are redeemable at the issuers option at some future date

Here assuming the coupon rate of 10%, is the market rate on issue, as Company A has a contractual obligation to pay/accrue a dividend annually, this would be classified as a financial liability. See example 1 for how this would be accounted for if the rate was a non-market rate.

Example 8: Mandatory redeemable preference shares at fixed amount at a fixed or future date with mandatory dividend

Company A issued 200,000 10% preference shares of CU1 each in return for CU200,000. The rights attaching to the shares are such that:

- 10% dividend must be paid annually in arrears i.e. CU20,000 mandatory

- The preference shares are redeemable at a fixed or future date

Given that Company A has a contractual obligation to pay/accrue a dividend yearly and given that they must be redeemed, these shares would be classified as debt in Company A’s financial statements. The journals required in this case are the same as example 1.

Example 9: Mandatory redeemable preference shares at fixed amount at a fixed or future date with dividend payable at the discretion of the issuer

Company A issued 200,000 preference shares of CU1 each in return for CU200,000. The rights attaching to the shares are such that:

- Dividend is payable at the discretion of the company

- The preference shares are mandatory redeemable at a fixed or future date

Here this is in fact a compound instrument as it contains both an equity and liability component. The liability component is the present value of the redemption amount and equity component is equal to the proceeds less liability component. Any dividends paid are taken to relate to the equity component. The present value rate that should be used is the rate that would be charged by a bank for period up to the mandatory redemption date on a similar instrument.

For example assume in the above example, it is mandatory redeemable at the end of year 5 and the market rate of interest for a similar loan would be 8%. Then the present value of CU200,000 is CU136,117 (CU200,000/((1.08^5)). Therefore the amount to be recognised as a liability is CU136,117 and the amount to be recognised in equity is CU63,883. The journal required on intial recognition is:

|

|

CU |

CU |

|

Dr Bank |

200,000 |

|

|

Cr Preference Share Liability |

|

136,117 |

|

Cr Equity |

|

63,883 |

The CU136,117 is then built up to CU200k at the end of the term by applying the interest rate of 8% over the 5 year period as per below

Therefore the journal that would be posted at end of year 1 would be:

|

|

CU |

CU |

|

Dr Interest Cost/Other Charges |

10,889 |

|

|

Cr Preference Share Liability |

|

10,889 |

If a dividend was declared and paid on these shares of CU10,000 during year 1 for example, the following journal would be posted:

|

|

CU |

CU |

|

Dr Equity-Profit and Loss Reserves |

10,000 |

|

|

Cr Bank |

|

10,000 |

However, where any unpaid dividend is added to the redemption amount and this is included in the share rights, the whole instrument is classed as a liability component i.e. CU200,000 and the dividend accrued increases the liability.

Example 10: Redeemable preference shares at holder’s option at some future date with dividend payable at the discretion of the issuer

Company A issued 200,000 preference shares of CU1 each in return for CU200,000. The rights attaching to the shares are such that:

- Dividend is payable at the discretion of the company

- The preference shares are redeemable at some future date at the option of the holder

Here this is in fact a compound instrument as it contains both an equity and liability component assuming that it does not meet the definition in 17.4 (i.e. required to settle on liquidation) in which case it would all be classed as equity. The liability component is the present value of the redemption amount and equity component is equal to the proceeds less liability component. Any dividends paid are taken to relate to the equity component. The present value rate that should be used is the rate that would be charged by a bank for period up to the mandatory redemption date. See example 9 for further details.

However, where any unpaid dividend is added to the redemption amount and this is included in the share rights, the whole instrument is classed as a liability component i.e. CU200,000.

Example 11: Preference shares with dividends payable at the discretion of the issuer and only redeemable on the liquidation of the company

Company A issued 200,000 preference shares of CU1 each in return for CU200,000. The rights attaching to the shares are such that:

- Dividend is payable at the discretion of the company

- The preference shares are redeemable on the liquidation of the company

Here these shares would be classed as equity as per Section 17.4 and 17.6(a) on the basis that every share becomes repayable on a liquidation even ordinary shares.

If in this example, the shares were redeemable on the appointment of a receiver or administrator these would then be classified as a financial liability.

Example 11A: Preference shares/bonds convertible with a mandatory coupon redeemable at the option of the holder, into a fixed number of ordinary shares at any time up to maturity (see example 17 below).

Application of Section 17.4&5

In relation to the above it is clear that regardless of whether a variable or fixed number of shares are to be issued from an entity’s own equity, the instrument is classified as a liability. This differs from FRS 102/old GAAP/FRSSE in that where there is a fixed for fixed option then these shares would be classified as equity. This is not the case under FRS 105. An example of the application of this is detailed in the example 13 and 13b below:

Example 12: Preference shares issued which can be redeemed for no set number of share in the future

Company A issued preference shares of CU1 each in return for CU200,000. The shares are redeemable after 5 years at the option of the holder into ordinary shares up to the value of CU200,000 at that date. Assume at the end of year five the price per ordinary share is CU10

In this particular case it is evident that these should be classified as a financial liability as it does not meet the condition in Section 17.4 above which states that the instrument is only equity where the issuer is only required to settle in cash or by way of another financial asset in the event of liquidation of the company. Section 17.5 goes on to state that an instrument is a financial liability if the issuer has to settle by any means other than through liquidation.

This also makes sense as a variable number of shares will be issued to the holder on redemption depending on the value of the company at that date i.e. at the end of year five 10,000 shares will have to be issued (CU200,000/CU10=10,000) hence there is variability which dictates that these shares are therefore classed as a financial liability. This is also how FRS 102/old GAAP/FRSSE would account for this.

Example 13: Fixed for fixed arrangement

A company receives CU10,000 from another entity/person in return for the company issuing 300 shares in itself in four years time (with no other conditions attached).

In this particular case it is evident that these should be classified as a financial liability as it does not meet the condition in Section 17.4 above which states that the instrument is only equity where the issuer is only required to settle in cash or by way of another financial asset in the event of liquidation of the company. Section 17.5 goes on to state that an instrument is a financial liability if the issuer has to settle by any means other than through liquidation. In this case as this has to be settled in four years time it cannot be avoided (i.e. therefore share are issued regardless of liquidation) hence it is a financial liability. This may have to be present valued at a market rate of interest as per example 9.

Note this differs from the treatment under FRS 102/FRSSE/old GAAP as under the frameworks where a fixed for fixed arrangement applies such as this, then this would be classified as equity as the holder will suffer from a loss and benefit from a gain with regard to a fall/uplift in the value of the company.

Example 13A: Application of the definition of a financial liability point (b)(ii)

An example of this type is where a company has entered into a forward contract to issue shares in itself in return for a foreign currency. Hence as the amount of cash is not fixed, it is a financial liability. In addition, as it is not fixed in the company’s functional currency, it is also classed as a financial liability.

Example 13B: Uncertain future events

Where the payment is conditional on some future event occurring, this should be classified as a financial liability regardless of whether the issuer is in control of the event. This differs from FRS 102/old GAAP as under these frameworks, where the issuer can have control of the event such that it can therefore avoid the circumstance/event occurring, then this instrument would be classified as equity – this is not the case under FRS 105.

Original issue of shares or other equity instruments

Extract from FRS 105 – Section 17.7 – 17.9

17.7 A micro-entity shall recognise the issue of shares or other equity instruments as equity when it issues those instruments and another party is obliged to provide cash or other resources to the micro-entity in exchange for the instruments.

(a) If the micro-entity receives the cash or other resources before the equity instruments are issued, and the micro-entity cannot be required to repay the cash or other resources received, the micro-entity shall recognise the corresponding increase in equity to the extent of consideration received.

(b) To the extent that the equity instruments have been subscribed for but not issued (or called up), and the micro-entity has not yet received the cash or other resources, the micro-entity shall not recognise an increase in equity.

17.8 A micro-entity shall measure the equity instruments at the fair value of the cash or other resources received or receivable, net of direct costs of issuing the equity instruments.

17.9 A micro-entity shall account for the transaction costs of an equity transaction as a deduction from equity, net of any related income tax benefit.

OmniPro comment

See the example below for illustration of the guidance above. It is clear that FRS 105 does not require entities to present value any proceeds where they have not been received initially (that said entities can present value if they wish, it is not specifically disallowed).

Example 14: Accounting treatment on original issue of shares

Company A issued 100,000 ordinary shares of CU1 each for CU200,000 (i.e. at a premium of CU1). The professional fees incurred on the issue of these shares was CU20,000 and the tax rate is 10%. In this instance the holder paid for the shares to be issued and the company then issued the holder with a share certificate. The journals required under the standard detailed above and as required by Company law are:

|

|

CU |

CU |

|

Dr Bank |

200,000 |

|

|

Cr Ordinary Share Capital |

|

100,000 |

|

Cr Share Premium |

|

100,000 |

Being journal to recognise the receipt of cash for the shares and the issuance of share capital at a premium

|

|

CU |

CU |

|

Dr Ordinary Share Capital/Share Premium |

20,000 |

|

|

Cr Bank/Trade Creditors |

|

20,000 |

Being journal required to reflect directly attributable costs of issue

|

|

CU |

CU |

|

Dr Corporation Tax in P&L |

2,000 |

|

|

Cr Ordinary Share Capital/Share Premium (CU20,000 * 10%) |

|

2,000 |

Being journal to reflect tax deduction available on issuance of shares assuming tax is originally charged to the P&L.

Therefore the net amount shown in share capital and share premium is CU183,000 (CU200,000-CU20,000+CU2,000).

Capitalisation or bonus issues of shares

The example below illustrates the how a capitalization of profits or bonus issues should be accounted for. Where a share split occurs the number of shares only changes, the equity balance does not.

Example 15: Capitalisation/bonus issue

Company A had significant distributable reserves. Prior to the issue the company had 100,000 shares of CU1 each. Profit and loss reserves total CU300,000 at the time of the issue. During the year the company decided to capitalise CU50,000 from profit and loss reserves to the appropriation of the said sum as capital to the holders of the 100,000 Ordinary Shares of CU1 in the capital of the Company. The journal required to reflect this transaction in Company A’s books is:

|

|

CU |

CU |

|

Dr Ordinary Share Capital |

50,000 |

|

|

Cr Profit and Loss Reserves |

|

50,000 |

Being journal to reflect capitalisation of shares

Exercise of options, rights and warrants

Extract from FRS 105 – Section 17.10

17.10 A micro-entity shall apply the principles in paragraphs 17.7 to 17.9 to equity issued by means of exercise of options, rights, warrants and similar equity instruments.

OmniPro comment

The effects of options and rights have been illustrated in the examples above.

Convertible debt and similar compound financial instruments

Extract from FRS 105 – Section 17.11 – 17.13

17.11 On issuing convertible debt, or a similar compound financial instrument, a micro-entity shall allocate the proceeds between the liability component and the equity component of the instrument. To make the allocation, the micro-entity shall first determine the amount of the liability component as the fair value of a similar liability that does not have a conversion feature or similar associated equity component. The micro-entity shall allocate the residual amount as the equity component. Transaction costs shall be allocated between the debt component and the equity component on the basis of their relative fair values.

17.12 The micro-entity shall not revise the allocation in a subsequent period.

17.13 In periods after the instruments were issued, the micro-entity shall account for the liability component as a financial instrument in accordance with Section 9. The example shown in the Appendix to Section 22 Liabilities and Equity of FRS 102 illustrates the accounting for convertible debt by an issuer.

OmniPro comment

A compound instrument is an instrument that contains both an equity and debt component. Examples of compound instruments are:

- Mandatory redeemable preference shares/bonds at fixed amount at a fixed or future date with dividend payable at the discretion of the issuer. See example 9 above.

- Redeemable preference shares/bonds at holder’s option at some future date with dividend payable at the discretion of the issuer. See example 10 above.

- Preference shares/bonds convertible with a mandatory coupon redeemable of the option of the holder, into a fixed number of ordinary shares at any time up to maturity (see example 16 below).

See the example provided in Appendix to Section 22 in the FRS below which illustrates Section’s 17.11-17.13. This refers to bonds but the word bond can be replaced with preference shares:

Example 16: Accounting treatment for a compound financial instrument (instrument containing both a debt and equity component – bond with a fixed coupon and convertible at the option of the holder into a variable number of shares (Extracted from the appendix of Section 22 of FRS 102)

On 1 January 20X5 an entity issues 500 convertible bonds. The bonds are issued at par with a face value of CU100 per bond and are for a five-year term, with no transaction costs. The total proceeds from the issue are CU50,000. Interest is payable annually in arrears at an annual interest rate of 4 per cent. Each bond is convertible, at the holder’s discretion, into 25 ordinary shares at any time up to maturity. At the time the bonds are issued, the market interest rate for similar debt that does not have the conversion option is 6 per cent.

Here the liability component is the interest liability on the bond and the principal to be repaid. The equity component being the holder’s option to convert the bonds into a fixed number of equity shares.

When the instrument is issued, the liability component must be valued first, and the difference between the total proceeds on issue (which is the fair value of the instrument in its entirety) and the fair value of the liability component is assigned to the equity component. The fair value of the liability component is calculated by determining its present value using the discount rate of 6 per cent. The calculations and journal entries are illustrated below:

|

|

CU |

|

Proceeds from the bond issue (A) |

50,000 |

|

Present value of principal at the end of five years (see calculations in note 1 below) |

37,363 |

|

Present value of interest payable annually in arrears for five years (see calculations in note 1 below) |

8,425 |

|

Present value liability, which is the fair value of liability component (B) (see calculations in note 1 below) |

45,788 |

|

Residual, which is the fair value of the equity component (A) – (B) |

4,212 |

The issuer of the bonds makes the following journal entry at issue on 1 January 20X5:

|

|

CU |

CU |

|

Dr Cash |

50,000 |

|

|

Cr Financial Liability – Convertible Bond |

|

45,788 |

|

Cr Equity |

|

4,212 |

The CU4,212 represents a discount on issue of the bonds, so the entry could also be shown

‘gross’:

|

|

CU |

CU |

|

Dr Cash |

50,000 |

|

|

Dr Financial Liability – Convertible Bond Discount |

4,212 |

|

|

Cr Financial Liability – Convertible Bond |

|

50,000 |

|

Cr Equity |

|

4,212 |

After issue, the issuer will amortise the bond discount according to the following table

|

|

(a) Interest payment CU |

(b) Total Interest expense = 6% x(e) CU |

Amortisation of bond discount = (b) – (a) CU |

(d) Bond discount = (d) – (c) CU |

(e) Net liability = 50,000 – (d) CU |

|

1/1/20X5 |

|

|

|

4,212 |

45,788 |

|

31/12/20X5

|

2,000 |

2,747 |

747 |

3,465 |

46,535 |

|

31/12/20X6 |

2,000 |

2,792 |

792 |

2,673 |

47,327 |

|

31/12/20X7 |

2,000 |

2,840 |

840 |

1,833 |

48,167 |

|

31/12/20X8 |

2,000 |

2,890 |

890 |

943 |

49,057 |

|

31/12/20X9 |

2,000 |

2,943 |

943 |

0 |

50,000 |

|

Totals |

10,000 |

14,212 |

4,212 |

|

At the end of 20X5, the issuer would make the following journal entry:

|

|

CU |

CU |

|

Dr Interest Expense |

2,747 |

|

|

Cr Bond Discount |

|

747 |

|

Cr Cash |

|

2000 |

Note 1: Calculations

Present value of principal of CU50,000 at 6 per cent

CU50,000/(1.06)^5 = CU37,363

The CU2,000 annual interest payments are an annuity: a cash flow stream with a limited number (n) of periodic payments (C), receivable at dates 1 to n. To calculate the present value of this annuity, future payments are discounted by the periodic rate of interest (i) using the following formula:

PV = C/i * [1 – 1/(1+i)n]

Therefore, the present value of the CU2,000 interest payments is (CU2,000/.06) * [1 – [(1/1.06)5]

= CU8,425

This is equivalent to the sum of the present values of the five individual CU2,000 payments, as follows:

|

|

CU |

|

Present value of interest payment at 31 December 20X5 = 2,000/1.06 |

1,887 |

|

Present value of interest payment at 31 December 20X6 = 2,000/1.062 |

1,780 |

|

Present value of interest payment at 31 December 20X7 = 2000/1.063 |

1,679 |

|

Present value of interest payment at 31 December 20X8 = 2000/1.064 |

1,584 |

|

Present value of interest payment at 31 December 20X9 = 2000/1.065 |

1,495 |

|

Total |

8,425 |

Yet another way to calculate this is to use a table of present value of an ordinary annuity in arrears, five periods, interest rate of 6 per cent per period. (Such tables are easily found on the Internet.) The present value factor is 4.2124. Multiplying this by the annuity payment of CU2,000 determines the present value of CU8,425.

Section 16 of FRS 105 provides no guidance on how to account for the convertible option once it is exercised. In accordance with Section 8, an entity should look to the concepts and principles in Section 2 to determine the treatment that is appropriate. One treatment that would be appropriate would be as follows.

Example 17: compound instrument where conversion is chosen

If we take example 16, and now assume at the end of 5 years, the convertible bond/preference shares are converted into 12,500 shares (i.e. CU50,000/CU100 per bond * 25 shares per bond). Assume the fair value of the shares issued at that date was CU4.50. The journal entries required to account for this is to:

|

|

CU |

CU |

|

Dr Liability |

50,000 |

|

|

Cr Equity |

|

50,000 |

NOTE: the original component stays in equity but can be transferred within equity. No gain or loss is ever recognised on conversion as no money changes hands.

Example 18: compound instrument where conversion is chosen

If we take example 16 above and assume the conversion option was not taken. The journal required is:

|

|

CU |

CU |

|

Dr Liability |

50,000 |

|

|

Cr Bank |

|

50,000 |

The original equity component remains as equity. It may be transferred within equity for classification purposes.

Example 19: Accounting for transaction costs in acquiring a compound financial instrument

If we take example 16 above and assume transaction costs of CU1,000 were incurred. In accordance with Section 17.11 these transaction costs should be apportioned between the debt and equity element of the instrument in proportion to the split determined. For example this CU1,000 would be split as follows in example 17:

The CU916 is netted against the CU45,788 on initial recognition of the financial liability (CU44,872). These transaction costs on the liability element are then released to the P&L over the life of the instrument of 5 years on a straight line basis in line with the rules in Section 9 of FRS 105.

The same type of journals that were posted in example 17 would be posted here for the updated figures above.

Treasury shares

Extract from FRS 105 – Section 17.14

17.14 reasury shares are the equity instruments of a micro-entity that have been issued and subsequently reacquired by the micro-entity. A micro-entity shall deduct from equity the fair value of the consideration given for the treasury shares. The micro-entity shall not recognise a gain or loss in profit or loss on the purchase, sale, transfer or cancellation of treasury shares.

Distributions to owners

Extract from FRS 105 – Section 17.15

17.15 A micro-entity shall reduce its equity reserves for the amount of distributions to its owners (holders of its equity instruments).

OmniPro comment

As illustrated in example 5 above, payment of dividends on the equity classified shares are posted through equity. However no dividend can be paid or approved unless there is distributable reserves. A dividend cannot be accrued unless it has been approved by the members in a general meeting before year end (with the exception of mandatory dividend payable).

For dividends paid on preference shares classified as liabilities these are posted to interest costs in the profit and loss. This was illustrated in example 1 above. See example of layout in the disclosure section.

Transition exemptions

Section 28.10 provides an exemption whereby a first time adopter does not have to split a compound financial instrument if the liability component is not outstanding at the date of the transition. Given that old GAAP/FRSSE – (FRS 25/Section 12 of FRSSE) was almost identical to Section 17, it is unlikely this exemption will need to be availed of. If there was an error in accounting for such a financial instrument a prior year adjustment would have to be shown.

Principal transition adjustments

FRS 105 has simpler rules for determining whether a financial instrument should be classed as debt or equity. FRS 105 states that a financial instrument must be classified as debt/financial liability where the issuer does not have an unconditional right to avoid settling an obligation in cash or delivery of another financial instrument other than by reason of liquidation of the issuer.

FRS 102 and old GAAP/FRSSE have more detailed rules and guidance in this area (liquidation was not the only reason for an item not being classified as a financial liability. It had additional circumstances where the instrument could be classified as equity. For example these frameworks had rules which stated that where a fixed amount of shares was to be exchanged for a fixed amount of debt (and this was known from inception) then this met the definition of equity (under FRS 105 rules this instrument would be classified as a financial liability). Other examples are rules for instruments where settlement was only required on the occurrence and non-occurrence of uncertain future events which the issuer could control, these were considered when determining whether an item was to be classified as debt or equity (if in control of the issuer then it could be classified as equity – This compares to FRS 105 rules where they must be classified as debt/financial liability).

As a result there may be differences on transition where under old GAAP/FRSSE and FRS 102 these were classified as equity for the aforementioned reasons however on transition to FRS 105 they should now be classified as debt.

Given the size of micro entities it is unlikely that entities applying FRS 105 will have these type of instruments so therefore this adjustment is not likely to apply too often in practice.

Example 20: Change in classification from equity to debt on transition from FRS 102/FRSSE/old GAAP

If such a situation was to arise, the journals required on transition are:

|

|

CU |

CU |

|

Dr Equity |

50,000 |

|

|

Cr Financial liability |

|

50,000 |

Being journal to reflect the reclassification of the shares from equity to debt as required under FRS 105

Journals required for year 31 December 2015

|

|

CU |

CU |

|

Dr Equity |

XXX |

|

|

Dr interest cost/other charges |

XX |

|

|

Cr Financial liability |

|

XXX |

|

Cr Equity for dividend posting |

|

XX |

Being journal to reflect the reclassification of the shares from equity to debt as required under FRS 105 in the comparative year and the reclassification of the dividend payment from equity to P&L (originally posted straight to P&L reserves under old GAAP treatment)

2) FRS 105 does not specifically require shares which are issued where payment is deferred to be present valued. FRS 102 specifically requires present valuing where material. FRSSE on the other hand was not explicit. Given that FRS 105 does not ban the use of present valuing it is unlikely that an adjustment would be required on transition from FRS 102 to FRS 105 and therefore the present values could remain.

3) The income tax impact of transition costs and the related transaction costs should be netted against equity under FRS 105. FRSSE/old GAAP did not require this. However given the size of the entities it is likely that this difference will not be material. This difference is not applicable for entities transitioning from FRS 102 as the treatment is the same as FRS 105.

Sample disclosures

Example 21: Accounting policy Disclosures – applicable for ROI entities only:

Sample accounting policies:

(a) Preference share capital

Redeemable preference shares which meet the definition of a liability in Section 17 of FRS 105 have been classified as liabilities in the balance sheet. The preference dividend is charged in arriving at the interest expense in the profit and loss account. (including the following where applicable) However, no dividends will be paid on the cumulative preference shares until the company has positive profit and loss reserves.

(b) Dividend distribution

Dividend distribution to equity shareholders are recognised as a liability in the company’s financial statements in the period in which the dividends are approved by the equity shareholders. These amounts are recognised in profit and loss reserves.

(c) Share capital

Ordinary shares are classified as equity. Incremental costs directly attributable to the issue of new ordinary shares or options are shown in equity as a deduction, net of tax, from the proceeds.

Example 22: Note disclosures – applicable for ROI entities only:

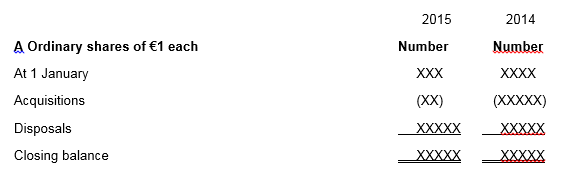

2. Holding of own shares/holding company shares

The company holds the following class of its own shares[1]:

The amount of profits available for distribution which are restricted as a result is €XXX (2014:€XX).

The reason for the acquisition/redemption of shares in the year was due to the buyback of shares from its former shareholder and director in order to allow him to retire etc. etc.

The company holds the following class of its parent company shares[2]:

The amount of profits available for distribution which are restricted as a result is €XXX (2014:€XX).

3. Movement on profit and loss reserves[3]

|

|

|

2015 € |

|

2014 € |

|

Profit and loss reserves brought forward at 1 January [4] |

|

155,000 |

|

1,000 |

|

Profit for the financial year |

|

42,000 |

|

154,000 |

|

Dividend declared and paid (for illustrative purposes) [5] |

|

(x) |

|

(x) |

|

Transfer (to)/from other reserves (for illustrative purposes) |

|

– |

|

– |

|

Purchase/redemption of own shares (if applicable) |

|

– |

|

– |

|

Profit and loss reserve at 31 December |

|

197,000 |

|

155,000 |

[1] S.320(4) and S.328 of CA 2014 requires disclosure of the details of owns shares by class held including movement in the year, a disclosure of the restrictions on profits as a result of this and the reason for acquisition of own shares in the year and the % of called up share capital held at beginning and end of each year.

[2] S.320(4) of CA 2014 requires disclosure of the details of shares of its holding company held by class including movement in the year, a disclosure of the restrictions on profits as a result of this and the reason for acquisition of own shares in the year

[3] Sch 3B(33) requires disclosure of change in P&L reserves and any transfers and dividend to show the balance at the start and end of each year. If not shown in P&L then must be disclosed in the notes. Required to be disclosed in abridged financial statements.

[4] Sch 3B of CA 2014 as amended by CAB 2016 requires the movement on profit and loss reserves to be shown on the face of the P&L.

This can also be called an income statement

[5] Sch 3B(48) requires disclosure of the dividend per share and what shares were declared and paid or declared by not paid in the year in the notes.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]