[et_pb_section admin_label=”Header – All Pages” global_module=”1221″ transparent_background=”off” background_color=”#1e73be” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” custom_padding=”||0px|”][et_pb_row global_parent=”1221″ admin_label=”row”][et_pb_column type=”4_4″][et_pb_post_title global_parent=”1221″ admin_label=”Post Title” title=”on” meta=”off” author=”on” date=”on” categories=”on” comments=”on” featured_image=”off” featured_placement=”below” parallax_effect=”on” parallax_method=”on” text_orientation=”left” text_color=”light” text_background=”off” text_bg_color=”rgba(255,255,255,0.9)” module_bg_color=”rgba(255,255,255,0)” title_all_caps=”off” use_border_color=”off” border_color=”#ffffff” border_style=”solid” title_font=”|on|||” title_font_size=”35″ custom_padding=”10px|||”] [/et_pb_post_title][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” global_module=”1228″ fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” custom_padding=”0px||0px|” padding_mobile=”on” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” gutter_width=”3″][et_pb_row global_parent=”1228″ admin_label=”Row” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” use_custom_gutter=”off” gutter_width=”3″ custom_padding=”0px||0px|” padding_mobile=”off” allow_player_pause=”off” parallax=”off” parallax_method=”off” make_equal=”off” parallax_1=”off” parallax_method_1=”off” column_padding_mobile=”on”][et_pb_column type=”4_4″][et_pb_text global_parent=”1228″ admin_label=”Text” background_layout=”light” text_orientation=”left” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [breadcrumb] [/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” fullwidth=”off” specialty=”off”][et_pb_row admin_label=”Row”][et_pb_column type=”1_2″][et_pb_text admin_label=”Return to 105 Index” background_layout=”light” text_orientation=”center” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [button link=”https://ie.frs102.com/members/premium-toolkit/frs-105/” type=”big” color=”red”] Return to FRS 105 Main Menu[/button] [/et_pb_text][/et_pb_column][et_pb_column type=”1_2″][et_pb_text admin_label=”Return to Section 16 Home” background_layout=”light” text_orientation=”center” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [button link=”https://ie.frs102.com/members/premium-toolkit/frs-105/section-16/” type=”big” color=”red”] Return to Section 16 Home[/button] [/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” gutter_width=”3″][et_pb_row admin_label=”Row”][et_pb_column type=”4_4″][et_pb_text admin_label=”Main Body Text” background_layout=”light” text_orientation=”justified” use_border_color=”off” border_color=”#ffffff” border_style=”solid” module_id=” “]

Section 16 – Provisions and Contingencies

Section 16 deals with the recognition, measurement and disclosures for provisions.

Scope of this section

Extract from FRS 105 – Section 16.1 – 16.4

16.1 This section applies to all provisions, contingent liabilities and contingent assets except those provisions covered by other sections of this FRS. Where those other sections contain no specific requirements to deal with contracts that have become onerous, this section applies to those contracts.

16.2 This section does not apply to financial instruments that are within the scope of Section 9 Financial Instruments unless the contracts are onerous contracts or financial guarantee contracts.

16.3 The requirements in this section do not apply to executory contracts unless they are onerous contracts. Executory contracts are contracts under which neither party has performed any of its obligations or both parties have partially performed their obligations to an equal extent.

16.4 The word ‘provision’ is sometimes used in the context of such items as depreciation, impairment of assets, and uncollectible receivables. Those are adjustments of the carrying amounts of assets, rather than recognition of liabilities, and therefore are not covered by this section.

OmniPro comment

Based on the above guidance, examples of provisions which come within the scope of Section 16 are provisions for:

- Product warranties and refunds

- Legal claims

- Future operating costs

- Future operating losses (although within scope, Section 16 does not allow provision for future operating losses

- Onerous contracts

- Financial guarantee contracts

- Dilapidations

- Decommissioning

Examples of provisions which will not come within the scope of Section 16 are:

- Financial instruments in scope under Section 9;

- Contingent liabilities acquired in a business combination

- Leases (unless the leases are onerous)

- Losses on construction contracts

- Income taxes

- Insurance contracts

- Provision for depreciation (covered by Section 12), doubtful debts (covered by Section 9) and impairments (covered by Section 22)

- Executory contracts unless they are onerous. These are contracts where neither party has carried out any of its obligations or where obligations have been performed by both parties for equal amounts.

Initial recognition and subsequent measurement

Extract from FRS 105 – Section 16.5 – 16.12

16.5 A micro-entity shall recognise a provision only when:

a) the micro-entity has an obligation at the reporting date as a result of a past event;

b) it is probable (ie more likely than not) that the micro-entity will be required to transfer economic benefits in settlement; and

c) the amount of the obligation can be estimated reliably.

16.6 The micro-entity shall recognise the provision as a liability in the statement of financial position and shall recognise the amount of the provision as an expense, unless another section of this FRS requires the cost to be recognised as part of the cost of an asset such as inventories or property, plant and equipment.

16.7 The condition in paragraph 16.5(a) means that the micro-entity has no realistic alternative to settling the obligation. This can happen when the micro-entity has a legal obligation that can be enforced by law or when the micro-entity has a constructive obligation because the past event (which may be an action of the micro-entity) has created valid expectations in other parties that the micro-entity will discharge the obligation. Obligations that will arise from the micro-entity’s future actions (ie the future conduct of its business) do not satisfy the condition in paragraph 16.5(a), no matter how likely they are to occur and even if they are contractual. To illustrate, because of commercial pressures or legal requirements, a micro-entity may intend or need to carry out expenditure to operate in a particular way in the future (for example, by fitting smoke filters in a particular type of factory). Because the micro-entity can avoid the future expenditure by its future actions, for example by changing its method of operation or selling the factory, it has no present obligation for that future expenditure and no provision is recognised.

Initial measurement

16.8 A micro-entity shall measure a provision at the best estimate of the amount required to settle the obligation at the reporting date. The best estimate is the amount a micro- entity would rationally pay to settle the obligation at the end of the reporting period or to transfer it to a third party at that time.

a) When the provision involves a large population of items, the estimate of the amount reflects the weighting of all possible outcomes by their associated probabilities. The provision will therefore be different depending on whether the probability of a loss of a given amount is, for example, 60 per cent or 90 per cent. Where there is a continuous range of possible outcomes, and each point in that range is as likely as any other, the mid-point of the range is used.

b) When the provision arises from a single obligation, the individual most likely outcome may be the best estimate of the amount required to settle the obligation. However, even in such a case, the micro-entity considers other possible outcomes. When other possible outcomes are either mostly higher or mostly lower than the most likely outcome, the best estimate will be a higher or lower amount.

When the effect of the time value of money is material, the amount of a provision shall be the present value of the amount expected to be required to settle the obligation. The discount rate (or rates) shall be a pre-tax rate (or rates) that reflect(s) current market assessments of the time value of money and risks specific to the liability. The risks specific to the liability shall be reflected either in the discount rate or in the estimation of the amounts required to settle the obligation, but not both.

16.9 A micro-entity shall exclude gains from the expected disposal of assets from the measurement of a provision.

16.10 When some or all of the amount required to settle a provision may be reimbursed by another party (eg through an insurance claim), the micro-entity shall recognise the reimbursement as a separate asset only when it is virtually certain that the micro-entity will receive the reimbursement on settlement of the obligation. The amount recognised for the reimbursement shall not exceed the amount of the provision. The reimbursement receivable shall be presented in the statement of financial position as an asset and shall not be offset against the provision. In the income statement the expense relating to a provision may be presented net of the amount recognised for a reimbursement.

Subsequent measurement

Extract from FRS 105 – Section 16.11- 16.22

16.11 A micro-entity shall charge against a provision only those expenditures for which the provision was originally recognised.

16.12 A micro-entity shall review provisions at each reporting date and adjust them to reflect the current best estimate of the amount that would be required to settle the obligation at that reporting date. Any adjustments to the amounts previously recognised shall be recognised in profit or loss unless the provision was originally recognised as part of the cost of an asset (see paragraph 16.6). When a provision is measured at the present value of the amount expected to be required to settle the obligation, the unwinding of the discount shall be recognised as interest expense in profit or loss in the period it arises.

OmniPro comment

Section 16.5 details the conditions required for a provision to be included in the financial statements. We will look at each of these separately below.

a) Present obligation as a result of a past event

Present obligation as a result of a past event – legal obligation or a constructive obligation

Legal obligation

A legal obligation is usually quite easy to identify and prove. The legal obligation has to arise from a past event. Examples of legal obligations would be:

- Provision of warranties for products sold where this is documented in the sales agreement

- Obligation arising from non-cancellable operating leases

- Legal obligation as a result of negligence on the entity’s behalf

- Legal requirement under the laws of the country. Note provision only required at the balance sheet date where the law has been substantively enacted at the reporting date. A provision will only be required at that reporting date where the law applies retrospectively.

Constructive obligation

A constructive obligation is defined in FRS 105 glossary. The key point here is that it must result from a past event. A constructive obligation derives from an entity’s actions:

- By established pattern of past practice, published policies or a sufficiently specific current statement, the entity has indicated to other parties that it will accept certain responsibilities; AND

- As a result, the entity has created a valid expectation on the part of those other parties that it will discharge those responsibilities.

Constructive obligations will usually require judgement so all facts and circumstances will need to be reviewed. The key point is that it has created expectations of third parties and/or they cannot withdraw from it. Examples of constructive obligations include:

- Retailers with a policy of providing cash refunds to customers even where the goods are neither faulty or damaged. Note the policy would have to be applied consistently.

- Provision for vouchers issued but not redeemed which are in excess of the stated policy, where the entity e.g. hotel has had a past practice of honoring vouchers which have well past the date for redemption

- Published policies which are available to all parties to see which is over and above what is required by law

- Any communication that has been made to outside parties which the entity cannot realistically withdraw from, as they have created an expectation of outside parties. For example, a decision by a board of directors to carry out a large restructuring is not a constructive obligation as the board can turn back on its decision as it has not communicated to other external parties. However where the management communicate this to all interested parties including employee representative or a public announcement has been made, a constructive obligation exists as they cannot realistically withdraw.

- Restructuring provisions

Example 1: Warranties (as extracted from Appendix to FRS 105 Section 16A.3)

A manufacturer gives warranties at the time of sale to purchasers of its product. Under the terms of the contract for sale, the manufacturer undertakes to make good, by repair or replacement, manufacturing defects that become apparent within three years from the date of sale. On the basis of experience, it is probable (i.e. more likely than not) that there will be some claims under the warranties.

1) Present obligation as a result of a past obligating event – The obligating event is the sale of the product with a warranty, which gives rise to a legal obligation. The past event is the sale of the product to the customer.

2) An outflow of resources embodying economic benefits in settlement: – Probable for the warranties as a whole to be paid as the company has a history of warranty claims so they are expected.

3) Measured reliably – as the company has a history of past warranty claims it can measure the provision reliably.

Conclusion: The entity recognises a provision for the best estimate of the costs of making good under the warranty products sold before the reporting date.

In 20X0, goods are sold for CU100,000. Experience indicates that 90 per cent of products sold require no warranty repairs; 6 per cent of products sold require minor repairs costing 30 per cent of the sale price; and 4 per cent of products sold require major repairs or replacement costing 70 per cent of sale price. Therefore estimated warranty costs are:

|

CU100,000 X 90% X 0 = CU0 CU100,000 X 6% X 30% = CU1,800 CU100,000 X 4% X 70% = CU2,800 Total CU4,600

|

The expenditures for warranty repairs and replacements for products sold in 20X0 are expected to be made 60 per cent in 20X1, 30 per cent in 20X2, and 10 per cent in 20X3, in each case at the end of the period. Because the estimated cash flows already reflect the probabilities of the cash outflows, and assuming there are no other risks or uncertainties that must be reflected, to determine the present value of those cash flows the entity uses a ‘risk-free’ discount rate based on government bonds with the same term as the expected cash outflows (6 per cent for one-year bonds and 7 per cent for two-year and three-year bonds). Calculation of the present value, at the end of 20X0, of the estimated cash flows related to the warranties for products sold in 20X0 is as follows:

|

Year |

|

Expected cash payments (CU) |

Discount rate |

Discount factor |

Present Value (CU) |

|

1 |

60% X CU4,600 |

2,700 |

6% |

0.9434 (at 6% for 1 year) |

2,604 |

|

2 |

30% X CU4,600 |

1,380 |

7% |

0.8734 (at 7% for 2 years) |

1,205 |

|

3 |

10% X CU4,600 |

460 |

7% |

0.8163 (at 7% for 3 years) |

375 |

|

Total |

|

|

|

|

4,184 |

The entity will recognise a warranty obligation of CU41,846 at the end of 20X0 for products sold in 20X0. The journal required is to debit cost of sales and credit provisions. The unwinding of the discounts is reflected as an interest expense.

NOTE: if in this example, the company also sold extended warranty above the standard warranty, any revenue from the sale is deferred and recognised over the extended warranty period.

Example 2: Refunds policy (as extracted from Appendix to FRS 105 Section 16A.4)

A retail store has a policy of refunding purchases by dissatisfied customers, even though it is under no legal obligation to do so. Its policy of making refunds is generally known.

Present obligation as a result of a past obligating event – The obligating event is the sale of the product, which gives rise to a constructive obligation because the conduct of the store has created a valid expectation on the part of its customers that the store will refund purchases.

An outflow of resources embodying economic benefits in settlement – Probable that a proportion of goods will be returned for refund based on past experience.

Conclusion: The entity recognises a provision for the best estimate of the amount required to settle the refunds.

Past events

From the above example it is evident that it is necessary that the obligation has arisen from past events i.e. events that occurred at or before the reporting date. The past event in the examples above was the sale of the products. Sometimes a past event giving rise to the obligation increases over a period of time e.g. a sand-pit/quarry where there is an obligation to reinstate the land to its original condition. In this case a provision would be adjusted each year for the cost of the extra restoration work to establish the material taken out to its original condition.

The obligation cannot arise as a result of future actions. Any obligations that will arise from an entity’s future action no matter how likely they are to occur i.e. conduct of business do not create the need for a provision as it does not meet criteria in Section 16.11. Examples given in the appendix to the standard is the requirement to fit smoke filters in the future due to legal and commercial pressures. In this scenario as the entity can avoid the expense of fitting smoke filters by changing the method in which it operates, it therefore has no obligation at the reporting date as a result of a past event so no provision should be booked.

Example 3: Staff retraining as a result of changes in the income tax system (as extracted from Appendix to FRS 102 Section 16A.7)

The government introduces changes to the income tax system. As a result of those changes, an entity in the financial services sector will need to retrain a large proportion of its administrative and sales workforce in order to ensure continued compliance with tax regulations. At the end of the reporting period, no retraining of staff has taken place.

Present obligation as a result of a past obligating event – The tax law change does not impose an obligation on an entity to do any retraining. An obligating event for recognising a provision (the retraining itself) has not taken place. The entity could hire new staff who are already trained in order to avoid this cost.

Conclusion: The entity does not recognise a provision.

If the law changes in the future, this may create for a requirement for a provision where an action has been taken to get an entity to accept a liability or an entity accepts a liability.

Example 4: Provision required for a future date

Company A operated a waste management plant for many years. Due to the chemicals used in the operation, the land on which the plant operates has been contaminated which has impacted the quality of the water supply. The company does not have to legally correct this contamination. At 31 December 20X4, the company decides that it is not going to accept liability and on this basis no provision is required as the entity does not have a constructive or legal obligation.

At 31 December 20X5, in order to maintain goodwill with the locals and as is consistent with plants with similar issues around the world, the entity makes a public announcement that it will implement procedures to clean up the contaminated land over the next number of years. At 31 December 20X5, a provision is required to be booked for the best estimate of the cost as the entity has a constructive obligation as it has communicated to interested parties that it will make good any damage.

There are instances where it is difficult to assess whether in fact there is a present obligation as a result of a past event present because the entity may determine that there is no obligation as the entity was not at fault or in a legal case the responsibility of the entity has not been established. In these cases it is likely a contingent obligation exists (and disclosure is required only) or where the chances of the plaintiff being successful with proceeding is remote in which case no disclosure is required. In assessing whether a provision exists an assessment needs to made based on evidence available and advice from legal counsel as to whether it is more likely than not, possible or remote and the outcome of this thought process will determine whether a provision should be booked, a disclosure included (contingent liability as possible outflow of economic benefits or reliable estimate cannot be made) or no disclosure included (likelihood deemed remote). In assessing the evidence Section 26 – Events after the end of the reporting period, states that settlement of a court case or further evidence as to its likely outcome which occurs after period end might indicate the existence of an obligation at the reporting date.

Example 5: Court case where difficulty assessing whether present obligation exists (Extracted from Example 8 of Section 16A.8 Appendix of FRS 105)

A customer has sued Entity X, seeking damages for injury the customer allegedly sustained from using a product sold by Entity X. Entity X disputes liability on grounds that the customer did not follow directions in using the product. Up to the date the board authorised the financial statements for the year to 31 December 20X1 for issue, the entity’s lawyers advise that it is probable that the entity will not be found liable. However, when the entity prepares the financial statements for the year to 31 December 20X2, its lawyers advise that, owing to developments in the case, it is now probable that the entity will be found liable.

(a) At 31 December 20X1

Present obligation as a result of a past obligating event: On the basis of the evidence available when the financial statements were approved, there is no obligation as a result of past events as the entity sees that the customer was at fault.

Conclusion: No provision is recognised. The matter is disclosed as a contingent liability unless the probability of any outflow is regarded as remote.

(b) At 31 December 20X2

Present obligation as a result of a past obligating event: On the basis of the evidence available, there is a present obligation. The obligating event is the sale of the product to the customer.

An outflow of resources embodying economic benefits in settlement: Probable.

Conclusion: A provision is recognised at the best estimate of the amount to settle the obligation at 31 December 20X2, and the expense is recognised in profit or loss. It is not a correction of an error in 20X1 because, on the basis of the evidence available when the 20X1 financial statements were approved, a provision should not have been recognized at that time.

NOTE: had management believed at 31 December 20×1 that the likelihood of a transfer of economic benefits were remote, no disclosure would be required.

Profits on disposal of fixed assets excluded

Section 16.9 makes it clear, that any gains from the expected disposal of assets are excluded from the measurement of the provision. Instead this is recognised on the actual disposal of the asset. These should always be excluded from the provision. However, losses on disposal should be incorporated into a provision where relevant. Even where the disposal is relating to restructuring due to closure provision, the profit on the disposal of the premises itself cannot be included.

Reimbursement by a third party for costs

As per Section 16.10, where costs are covered by insurance, the reimbursement should only be recognised as a separate asset where it is virtually certain that it will be received. The reimbursement can be shown net in the profit and loss. Note the max amount that can be recognised cannot exceed the provision. Note the netting in the profit and loss would not be allowed where the client is joint and severally liable.

Example 6: reimbursement by a third party

A case has been taken against company A by an employee for personal injury. Company A is insured for such claims. At year end the company believes the conditions for a provision to be recognised applies. The provision calculated is CU100,000, this includes estimated fees of CU5,000. The company is covered in full under its insurance policy other than for fees. The likelihood of receiving the proceeds is certain as the insurer has to cover this. At year end the company would recognise an asset for CU95,000 on the balance sheet and set this against the provision posted in the P&L so as to show a net debit in the profit and loss of CU5,000 which relates to the legal fees which are not reimbursed.

If in the above example there was an issue whereby the insurance company felt they may not pay, the asset would not be recognised.

b) Probability of transfer of economic benefits

Section 16 does not define what is meant by probable but in practice as was the case under old GAAP this is taken to mean more likely than not or greater than a 50% chance. Once it is not probable then no provision is required to be booked in the year-end financial statements. However where it is less than probable, it may or may not require disclosure.

Where the transfer of economic benefits is not probable then it can only be possible or remote.

Where the transfer is possible then it would generally fall into the category of a contingent liability. A contingent liability only requires disclosure but does not require recognition. See contingent liability section below for further discussion.

Where the transfer is remote then no disclosure or recognition is required under the standard. See contingent liability section below for further discussion.

c) Obligation can be reliably measured

Before a provision can be recognised it must be able to be reliably measured. Section 16.8 deals with the method in which estimation uncertainty should be dealt with. See example 1 above for an illustration how uncertainty can be incorporated into the provision so as to determine a mid-point estimate using a weighting of all possible outcomes.

Example 7: determining most likely outcome where a single obligation

A case has been taken against Company A and the company will have to pay damages of CU500,000. Company A believes it is 60% likely that they will have to pay this. Therefore at year end a provision of CU500,000 is required which may need to be present valued where the time value of money is significant. No probabilities are applied to this rate as there is only one possible outcome.

Example 8: Estimating a provision

Where there is only a single obligation, then the best estimate to settle this should be utilised (the most probable outcome is used).

In order to obtain a reliable estimate it may be appropriate to discuss with legal counsel to determine the likelihood of success or failure and the expected payout based on their experience. This will require judgement and all facts should be looked at. As stated above in assessing the estimate management look at events after the reporting period to assess if this provides better evidence of the amount to be provided or if it is to be provided.

In the very unlikely event that a reliable estimate cannot be measured, then this would be disclosed as a contingent liability. See discussion on contingent liability below.

Present value and the discount rate to be used

Section 16.8 requires where material to present value the future cash flows on initial recognition. This is more often to be material where dilapidation, reinstatement, decommissioning and environmental clean up provisions are to be included but can also apply in all other cases e.g. where the case is expected to drag on for a number of years.

In these particular cases, the amount recognised as a provision is the present values. As with any provision the credit side of the transaction is obviously posted to the provision but where the debit is posted depends on the circumstances. Where a provision is recognised for dilapidation, reinstatement, decommissioning and environmental clean up the debit side will be posted to fixed assets and will be depreciated over the life of the requirement for the provision or as the entity gets the benefit from using the property over its life. In all other cases the debit side would be posted to the profit and loss. Where the debit is posted in the profit and loss will be determined based on whether the expense is exceptional in nature or not. If it is exceptional an entity may include it as an exceptional item in the profit and loss or if not include it within operating costs. See example 1 above and example 9 below for how the present value should be determined.

Discount rate

Section 16.8 states a pre-tax discount rate should be used that reflects current market assessments of the time value of money and the risk specific to the liability. The risk specific to the liability should be in the discount rate used or the cash flows. The easiest way to incorporate risk is to include the risk in the cash flows using a pre-tax risk free discount rate as it is very hard to adjust the discount rate for risk.

The tax-free discount rate would usually be a government bond yield rate which is supported by the example in Section 16 replicated in example 1 above. Where there are a number of years where the cash flows expire then a number of discount rates may need to be applied. See example 1 above for application of the discount rates.

One other point that needs to be considered is whether to incorporate inflation into the discount rate (i.e. to use a real discount rate) or to incorporate inflation into the cash flows (and use the nominal discount rate). The decision taken has an impact on yearly adjustments that gets posted to finance costs and the adjustment that gets posted to operating expenses (note under FRS 105 both would be grouped into ‘Other charges’ on the face of the profit and loss account as interest is not required to be shown separately). If we take example 9 below, and instead of assuming the CU200,000 initially incorporated inflation but instead this represents the CU200,000 expected settlement before inflation the CU200,000 would have to be adjusted for inflation as follows: CU200,000 * 1.04^4= CU243,101. The calculation below would then incorporate this figure when using the discount rate.

Unwinding of the discount

The unwinding of the discount throughout the provisions life is posted to the profit and loss within finance costs. See example 10 of the application for unwinding the discount.

Change in estimate and discount rates

By its nature the provision is an estimate, where there is a change in estimate of the provision this is corrected prospectively in line with Section 8 – Accounting policies. The effect of the change in estimate is posted to operating expenses (‘other charges’ in the face of the P&L under FRS 105) in the profit and loss or to wherever the original provision was posted. See example 9 for application of this change in estimate.

Also where the risk free discount rate changes over the life of the provision due to a material move in the yield on government bonds, this is corrected prospectively and as with a change in estimated cash flows it is posted to operating expenses in the profit and loss.

Example 9: Present valuing a provision, change in estimate/cash flow and change in discount rate

For Company A a provision at the start of year 1 is required for CU200,000 after the effects of inflation with respect to a legal case taken against the company. The case is scheduled to finish at the end of year 4. The risk free discount rate for a government bond for four years at the date of inception is 4.5%. At the end of year 2, the estimated payout is CU210,000 before the effects of inflation. At the end of year 3, the risk free discount rate fluctuated to 4%. See below how these would be accounted for:

|

Year |

Opening Provision |

PV Original Provision at year end from inception using 4.5% discount rate* |

PV revised provision at end of year 2 at discount rate of 4.5% ** |

PV revised provision at year end from end of year 3 at discount rate of 4% *** |

|

Start of year 1 |

|

167,712* |

|

|

|

1 |

167,712 |

175,259 (167,712*1.045) |

n/a |

n/a |

|

2 |

175,259 |

183,146 (175,259*1.045) |

192,303** |

n/a |

|

3 |

183,146 |

191,388 (183,146*1.045) |

200,957 (192,303*1.045) |

201,923*** |

|

4 |

191,388 |

200,000 (191,388*1.045) |

210,000 (200,957*1.045) |

210,000 (201,923*1.04) |

|

*CU200,000*((1/1.045^4)) |

||||

|

**CU210,000*((1/1.045^2)) |

||||

|

***CU210,000*((1/1.04^1)) |

||||

Note 1: Narrative for change in estimate

Following the change in estimate at the end of year 2 the difference of CU9,157 (i.e. the difference between the carrying amount under the original estimate of CU183,146 at the end of year 2 as detailed above and the present value of the revised estimate of CU210,000 which was CU192,303), would be charged as an operating expense item. The difference of CU7,887 between the opening balance under the original provision at the end of year 1 of CU175,259 and the closing balance under the original provision at the end of year 2 of CU183,146 prior to the calculation of the provision for the new estimate represents the unwinding of the discount.

Note 2: Narrative for change in discount rate

Following the change in discount rate at the end of year 3 the difference of CU966 (the difference between the carrying amount under the revised estimate of CU200,957 at the end of year 3 as detailed above and the present value of the revised amount using the 4% discount rate of CU201,923), would be charged as an operating expense item. The difference of CU8,654 between the opening balance under the revised provision at the end of year 2 of CU192,303 and the closing balance under the revised provision at the end of year 3 of CU200,957 prior to the calculation of the provision incorporating the new discount rate represents the unwinding of the discount.

Therefore the journals required throughout the four year period is as follows:

Year 1

|

|

CU |

CU |

|

Dr Operating Expenses/Other charges |

167,712 |

|

|

Cr Provision |

|

167,712 |

Being journal to reflect the initial recognition of the provision at its present value

|

|

CU |

CU |

|

Dr Finance Cost/Other charges (CU175,259-CU167,712) |

7,547 |

|

|

Cr Provision |

|

7,547 |

Being journal to reflect the unwinding of the discount

Year 2

|

|

CU |

CU |

|

Dr Finance Cost/Other charges (CU183,146-CU175,259) |

7,887 |

|

|

Cr Provision |

|

7,887 |

Being journal to reflect the unwinding of the discount

|

|

CU |

CU |

|

Dr Operating Expenses/Other charges (CU192,303-CU183,146) |

9,157 |

|

|

Cr Provision |

|

9,157 |

Being journal to reflect the catch up for the change in estimate

Year 3

|

|

CU |

CU |

|

Dr Finance Cost/Other charges (CU200,957-CU192,303) |

8,654 |

|

|

Cr Provision |

|

8,654 |

Being journal to reflect the unwinding of the discount

|

|

CU |

CU |

|

Dr Operating Expenses/Other charges (CU201,923-CU200,957) |

966 |

|

|

Cr Provision |

|

966 |

Being journal to reflect the catch up for the change in discount rate

Year 4

|

|

CU |

CU |

|

Dr Finance Cost/Other charges (CU210,000-CU201,923) |

8,077 |

|

|

Cr Provision |

|

8,077 |

Being journal to reflect the unwinding of the discount

Onerous contracts

Extract from FRS 105 – Section 16.13

16.13 If a micro-entity has an onerous contract, the present obligation under the contract shall be recognised and measured as a provision (see Example 2 of the Appendix to this section).

OmniPro comment

Appendix 1 to FRS 105 defines an onerous contract as one in which the unavoidable costs of meeting the obligation under the contract exceed the economic benefits expected to be received under it. The unavoidable costs under a contract reflect the least net cost of exiting from the contract. This is the lower of the cost of fulfilling it and any compensation or penalties arising from failure to fulfil it. It is irrelevant as to whether an entity intends to make the cheapest choice or not, the least net cost is the only amount that should be provided for. The economic benefits to be considered are both the direct and indirect benefits.

Where such a contract exists the future operating losses on these contracts should be provided for.

Example 10: Onerous lease

Company A entered into a lease on an office block in year 1 for a 10 year period for CU100,000 per annum. At the end of year 4, due to economic circumstances and reductions in staff the entity no longer has any use for the property and cannot sublease it but are contractually tied in for a further 6 years from that date. The company has discussed with the landlord as to the cost of terminating the lease early which they stated would be CU500,000.

As the entity is contractually committed to pay the lease, there is a present obligation as a result of a past event i.e. the signing of the contract to take on the lease for 10 years for which no further benefits will be obtained and a reliable estimate can be determined, a provision should be recognised for the lower of the cost to terminate of CU500,000 or the future lease amounts payable for 6 years of CU600,000. Therefore a provision should be recognised for CU500,000 and should be present valued where it is considered material.

Example 11: Onerous lease

Take example 10, and this time the entity can sublet the property for the remaining 6 years to a tenant for CU50,000 per annum. In this case a provision would be required for the amount by which the costs exceed the economic benefits which would be the amount net of sublease income which is CU300,000 present valued where material ((CU100,000-CU50,000)*6 years). Even if the premises has not been sublet by the end of year 6, the CU300,000 should still be used where it can be proven that there is a market for the property maybe through evidence provided by an auctioneer and there is evidence of the likely lease per annum that can be obtained. The income received from the sub-tenant would be shown as other income in the financial statements. The provision would be reduced year on year for the amount paid to the tenant in the year. The journals assuming present valuing was not required would be to:

|

|

CU |

CU |

|

Dr Provision |

50,000 |

|

|

Cr Rent Cost |

|

50,000 |

Being journal to reflect the reduction of the provision at each year end

|

|

CU |

CU |

|

Dr Rent Costs |

100,000 |

|

|

Cr Bank |

|

100,000 |

Being journal to reflect the payment of funds to the landlord

|

|

CU |

CU |

|

Dr Bank |

50,000 |

|

|

Cr Rental Income |

|

50,000 |

Being journal to reflect the receipt of funds from the subtenant.

Example 12: Onerous supply contract

Company A entered into a purchase contract with a supplier for 3 years (minimum amount of units to be ordered per annum is CU50,000) at a time when supply of raw materials were scarce for a cost of CU10 per unit. A year later, the price for the same raw material was CU4, however the entity is contractually obliged to purchase a further 100,000 at a minimum from that supplier. The company can still sell the finished goods product which incorporates this part at the higher price at a profit of CU5.

Given that the entity makes a profit overall on the product there is no onerous contract so therefore no provision is required.

If we take the above example and this time assume that the product will be discontinued at the end of year 2 and during year 2, 40,000 finished goods will be sold incorporating the profit of CU5. Therefore in assessing whether an onerous contract exists there would be a need to take the net additional costs of the excess units of CU360,000 (60,000*(CU10-CU4) from the total profit from the sale of the 40,000 units in year 2 of CU200,000 (CU5 profit on finished good * 40,000 units). Therefore a provision should be made for the difference of CU60,000 at the end of year 1.

The same logic as example 12 would be applied to an onerous sales contract.

Future operating losses

Extract from FRS 105 – Section 16.14

16.14 Provisions shall not be recognised for future operating losses (see Example 1 of the Appendix to this section).

OmniPro comment

Section 16 does not allow future operating losses to be recognised as a provision. This is consistent with old GAAP/FRSSE, FRS 102 and IFRS. However under old GAAP/FRSSE, FRS 3 did allow future operating losses to be incorporated into a provision for termination of operations where the decision had been made and communicated prior to the balance sheet date. FRS 105 does not allow this treatment which is also the case under FRS 102.

The reasoning for not allowing operating losses to be provided for is due to the fact that the entity has the choice to cease trading immediately/earlier and therefore it would not have to incur these losses. Hence there is no present obligation. This contrasts with provision for onerous leases where the entity has a contractual obligation to hold on to the lease for its life. However it may indicate that an impairment exists on the assets of the business which is dealt with under Section 22.

See further example extracted from FRS 105, Section 16A.1

Example 13: Future operating losses (Extracted from Section 16A.1 of FRS 105)

An entity determines that it is probable that a segment of its operations will incur future operating losses for several years.

Present obligation as a result of a past obligating event: There is no past event that obliges the entity to pay out resources.

Conclusion: The entity does not recognise a provision for future operating losses. Expected future losses do not meet the definition of a liability. The expectation of future operating losses may be an indicator that one or more assets are impaired (see Section 22 Impairment of Assets).

Restructuring

Extract from FRS 105 – Section 16.15 -16.16

16.15 A restructuring gives rise to a constructive obligation only when a micro-entity:

a) has a detailed formal plan for the restructuring identifying at least:

- the business or part of a business concerned;

- the principal locations affected;

- the location, function, and approximate number of employees who will be compensated for terminating their services;

- the expenditures that will be undertaken; and

- when the plan will be implemented; and

b) has raised a valid expectation in those affected that it will carry out the restructuring by starting to implement that plan or announcing its main features to those affected by it.

16.16 A micro-entity recognises a provision for restructuring costs only when it has a legal or constructive obligation at the reporting date to carry out the restructuring.

OmniPro comment

FRS 105 – Appendix 1 defines a restructuring ‘as a programme that is planned and controlled by management and materially changes either:

- the scope of a business undertaken by an entity; OR

- the manner in which the business is conducted.

Examples of items that would come within the remit of a restructuring are:

- changes in management structure including redundancies of staff so as to significantly reduce the cost base

- the sale or termination of a line of business

- the closure of business locations in a country or region

- fundamental reorganisations that have a material effect on the nature and focus of the entity’s operations.

Section 16.15 above details the requirements in order for a constructive obligation to have arisen before the balance sheet date.

The key requirement in order for a provision to be created is that:

- management have communicated their plans to affected parties prior to the year end date; AND

- there is evidence to prove this.

For example, if a board meeting is held before the year end by management whereby they approved a significant restructuring which involved significant redundancies as a result of the closure of a product line but they have not communicated this to any of the outside/effected parties, then a provision cannot be made as they have not created a valid expectation to third parties, hence they could still pull out of the reorganisation as they could realistically withdraw.

Examples which may prove the management have implemented a detailed restructuring plan are:

- communication to the parties affected by the restructuring whether that be a formal communication to employees as a whole or to employee representatives etc.

- physically dismantling plant that is going to be scrapped/sold

- selling the excess assets as a result of the decision

- making public announcements of the plan

The following are examples of items that could be included in restructuring provisions:

- voluntary redundancies which if not accepted will become mandatory

- compulsory redundancies

- lease cancellation fees for the premises being vacated due to the closure.

The following are examples of items that could not be included in restructuring provisions as they are to be determined costs of ongoing activities:

- relocation expenses of employees

- retraining of the remaining employees

- recruitment costs for new staff

- marketing costs to develop new marketing image

- investments in a new distribution network due to the closure of the old one

- relocation expenses

- Future operating losses up to the date of cessation and closure

- Impairment provision for warehouses etc. as these should be assessed for impairment in accordance with Section 22

- Consulting fees to identify future corporate strategies or organisational structures

- Cost of relocating inventory and equipment that will be used in other factories/locations

- Cost of upgrading computer systems

Example 14: Closure of a division: no implementation before end of reporting period (Extracted from Section 16A.5 of FRS 105)

On 12 December 20X0 the board of an entity decided to close down a division. Before the end of the reporting period (31 December 20X0) the decision was not communicated to any of those affected and no other steps were taken to implement the decision.

Present obligation as a result of a past obligating event: There has been no obligating event, and so there is no obligation.

Conclusion: The entity does not recognise a provision.

Example 15: Closure of a division: communication and implementation before end of reporting period (Extracted from Section 16A.7 of FRS 105)

On 12 December 20X0 the board of an entity decided to close a division making a particular product. On 20 December 20X0 a detailed plan for closing the division was agreed by the board, letters were sent to customers warning them to seek an alternative source of supply, and redundancy notices were sent to the staff of the division.

Present obligation as a result of a past obligating event: The obligating event is the communication of the decision to the customers and employees, which gives rise to a constructive obligation from that date, because it creates a valid expectation that the division will be closed.

An outflow of resources embodying economic benefits in settlement: Probable as it can be reliably measured.

Conclusion: The entity recognises a provision at 31 December 20X0 for the best estimate of the costs that would be incurred to close the division at the reporting date.

Example 16: Restructuring provision – no formal plan

Company A has approved a restructuring of its operations at a board meeting. They have made a formal announcement to all those effected parties. However management have a very general plan as to what locations are to be closed but no final decision has been made.

In this instance although they have a constructive obligation (i.e. the formal communication to the effected parties) they have not a detailed plan of action detailing which locations will be closed and the number of employees that will be made redundant. As there is no detailed plan as required by Section 16.15(a) a provision cannot be created at the year end.

Contingent liabilities

Extract from FRS 105 – Section 16.17

16.17 A contingent liability is either a possible but uncertain obligation or a present obligation that is not recognised because it fails to meet one or both of the conditions (b) and (c) in paragraph 16.5. A micro-entity shall not recognise a contingent liability as a liability, except for provisions for contingent liabilities of an acquiree in a trade and asset acquisition (see Section 14 Business Combinations and Goodwill). Paragraph 16.19 sets out the disclosure requirements for a contingent liability. When a micro-entity is jointly and severally liable for an obligation, the part of the obligation that is expected to be met by other parties is treated as a contingent liability.

OmniPro comment

A contingent liability is defined in Appendix 1 of FRS 105 as:

- ‘a present obligation that arises from past events and whose existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events not wholly within the control of the entity; OR

- a present obligation that arises from past events but is not recognised because:

- it is not probable that an outflow of resources embodying economic benefits will be required to settle the obligation; OR

- the amount of the obligation cannot be measured with sufficient reliability.’

Where a contingent liability exists and where it is possible that there will be an outflow of economic benefits then a disclosure is required in the financial statements. Where the likelihood is considered remote no disclosure is required.

As discussed earlier, it may be unusual to conclude where an estimate cannot be determined given the possibility of using probabilities etc. In trying to assess the liability the entity should consult with experts e.g. solicitors to determine whether those parties can determine the expected out flow.

In reality, a contingent liability will arise:

- where it is possible but not probable (probable being more likely than not) for a future outflow of economic circumstances unless the possibility is remote in which case no disclosure is required.

- A present obligation may have occurred but it can only be determined on occurrence or non-occurrence of a future event

- the future outflow cannot be reliably measured

Where initially an entity has determined a contingent liability existed, the entity should continuously review the facts and circumstances and where it then emerges that a provision is required at that time, this is merely a change in estimate and a provision posted from that date. Section 26 makes it clear that circumstance since year end but before the signing of financial statement should be reviewed to provide further evidence on provisions.

The only exception to non-recognition of contingent liabilities is the case where contingent liabilities are acquired in a business combination.

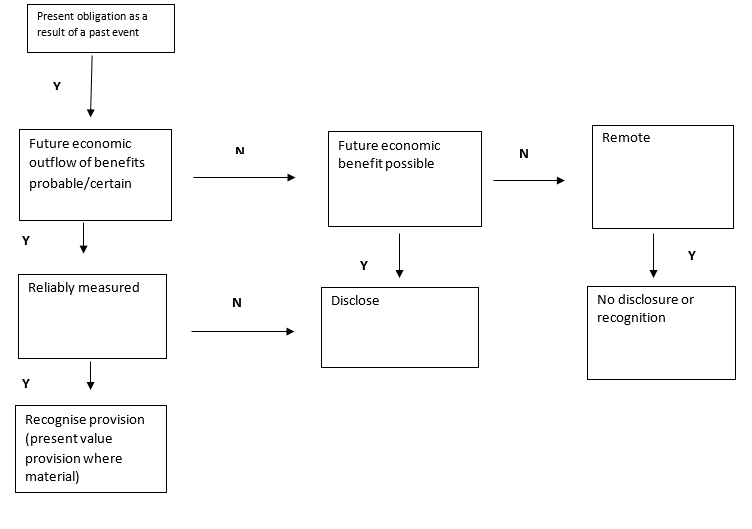

Section 16 – Liability Decision Tree

Example 17: Contingent liability – remote

An employee has taken a case against Company A for unfair dismissal. At year end management have consulted with its legal advisor who believe the possibility of the employee succeeding with the case is remote.

Here there is a present obligation (i.e. the obligation to possibly compensate the employee) as a result of a past event (i.e. the dismissal of the employee) but the likelihood of outflow of economic benefits is remote i.e. not probable. In this particular case, no disclosure is required.

Example 18: Contingent liability – possible

An employee has taken a case against Company A for unfair dismissal. At year end management have consulted with its legal advisor who believe there is a possibility that the employee will succeed however it is not remote. In this particular case this should be disclosed in the notes to the financial statements.

Example 19: Contingent liability – occurrence or non-occurrence of future events/non ability to estimate liabilities

Company A is an insurance underwriter that earns profit commission from insurance companies based on the number of claims made on policies that it has arranged for the insurance company. The commissions recognised can change in future years depending on the future loss ratios in relation to unsettled claims. Given the fact that the ratios can change year on year, the directors believe that it is not possible to estimate any future liabilities. On this basis although it is probable that there will be future economic outflows/inflows, and although there is a present obligation as a result of a past event (i.e. the recognising of commissions year on year), these cannot be measured reliably hence it is appropriate to disclosure these as a contingent liability.

NOTE THE ABOVE IS INCLUDED FOR ILLUSTRATIVE PURPOSE, OBVIOUSLY AN INSURANCE UNDERWRITTER WOULD NOT BE PERMITTED TO PREPARE FINANCIAL STATEMENTS UNDER FRS 105

Contingent assets

Extract from FRS 105 – Section 16.18

16.18 A micro-entity shall not recognise a contingent asset as an asset. However, when the flow of future economic benefits to the micro-entity is virtually certain, then the related asset is not a contingent asset, and its recognition is appropriate.

OmniPro comment

Appendix 1 of FRS 105 defines a contingent asset as:

‘a possible asset that arises from a past event and whose existence will be confirmed with occurrence or non-occurrence of one or more uncertain future events not wholly within the control of the entity’.

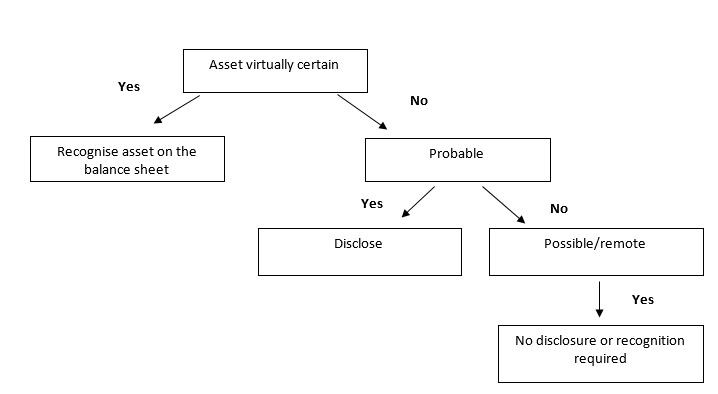

- An asset is only recognised when the inflow of economic benefits are virtually certain.

- Where inflows from a contingent asset is probable (i.e. more likely than not to be received >50%), the contingent asset is not recognised but disclosed.

- Where it is possible or remote the contingent asset is not disclosed or recognised.

See illustration of when a contingent asset should be recognise or instead disclosure required/or not through the use of the illustrative diagram.

Example 20: Contingent assets

Company A has taken a case against company B. At the year end, Company A has won the case and been awarded CU200,000 in damages. However, prior to year end. Company B, appealed to the high court.

Here as there is a risk that Company B might be successful in the appeal, and therefore as the asset is not virtually certain, it cannot be recognised instead it should be disclosed on the basis that it is probable. However the facts and circumstances for each event will need to be looked at to assess if this actually is probable or just possible.

Example 21: Financial guarantees

Company A has provided a guarantee to the bank on behalf of company B whereby they have guaranteed the repayment of a loan if Company B defaults. At the end of year 1, company B is in a very strong financial position. However at the end of year 2, company B is in financial difficulty with very poor cash flows due to the loss of its main customer and as a result there is risk with regard to its going concern.

Based on the facts at the end of year 1, a contingent liability would exist or possibly a contingent liability which requires no disclosure as the probability is remote because:

- Although there is a present obligation as a result of a past event (i.e. the giving of the guarantee to the bank)

- The outflow of economic benefits it not probable as Company B is in a very strong position

Based on the facts at the end of year 2, a provision should be recognised for the estimated cost of honoring the guarantee on the basis that the likelihood of the transfer of economic benefits is probable.

Decommission costs/ reinstatement/ dilapidation provision

Although not dealt with specifically in Section 16, using the concepts and principals of Section 2, the following is some guidance on accounting for these types of costs (as applies under FRS 102). Section 12 deals with when this should be treated as a fixed asset.

Where there is a legal obligation on an entity to reinstate the property to its original condition, then a provision is required assuming it meets the reliably measured condition. Where there is a decommissioning/reinstatement requirement, a provision should be recognised from the date the property is altered by an entity as it is from that point that the property has been altered by the entity and at that point the obligation is there to reinstate it. Where the obligation is through use then this is charged on a yearly basis and the provision increased year on year.

The present value of the cost of reinstatement in recognised as a liability while at the same time capitalised as an asset in the balance sheet on the basis that the change made is providing future economic benefit for the entity and therefore meets the condition for a fixed asset. The amount capitalised is then written off over the life of the lease or property whichever is shorter.

The liability remains on the balance sheet and is increased for the unwinding of the discount over the life of the lease.

Given the degree of estimation involved in determining the cost of remediation at the date of recognition, where a change to the estimate is made no retrospective adjustment is required. Where an increase in the liability is required the additional amount is added to the related asset in that period (i.e. no retrospective adjustment required) subject to a review for impairment to ensure it is not over stating the asset or where a decrease in the liability is required, it is deducted from the related asset and if it is more than the carrying amount it is posted to the profit and loss. The updated asset carrying amount is then depreciated over its remaining useful economic life. The unwinding of the discount is posted to interest cost (to other charges in FRS 105 financial statements as FRS 105 does not require interest costs to be shown separately in the P&L) in the profit and loss over the 50 year life. Note the cost is not allowable for capital allowance purposes on initial recognition.

Example 22: Decommissioning reinstatement costs

A manufacturing plant leased land for 50 years and constructs a factory on this. As part of the lease agreement it must reinstate the land to its original condition. It builds a plant on the land. At that point a provision is made in the books at its estimated present value cost in 50 years time of CU500,000. The accounting required for this transaction is:

|

|

CU |

CU |

|

Dr Fixed Asset |

500,000 |

|

|

Cr Provision |

|

500,000 |

Being journal to recognise the decommissioning cost

On a yearly basis depreciation is charged to write it down over the 50 year life i.e. CU10,000 per annum.

In year 10 the new estimate of the present value cost to reinstate the land is CU600,000. The NBV at that date is CU400,000 (CU500,000/50 yrs*10yrs). Assume the liability included in the accounts after unwinding of the discount is CU550,000. The journals required at this time is as follows:

|

|

CU |

CU |

|

Dr Fixed Asset (CU600,000-CU550,000) |

50,000 |

|

|

Cr Provision |

|

50,000 |

Being journal to write the liability up to the new estimate

From that date the new carrying amount per annum of the asset is CU450,000 (NBV of CU400,000+change in estimate of CU50,000). The depreciation over the remaining life is as follows: New cost of CU450,000/40 yrs =CU11,250

|

|

CU |

CU |

|

Dr Depreciation |

11,250 |

|

|

Cr Accumulated Depreciation |

|

11,250 |

Being journal to reflect the depreciation to be charged from year 10 on

Included in the disclosure section of this manual is an example of an accounting policy for decommissioning and restoration costs (accounting policies are applicable for ROI entities as the FRS 105 financial statement does require the accounting policies to be disclosed – not applicable for UK entities as accounting policies are not required to be disclosed).

Example 23: Reinstatement provision on property which is held on operating lease

Company A took out a 10 year lease on a vacant property in year 1. On signing the lease, the company incurred CU300,000 on fitting out the property. As part of the lease agreement Company A has to reinstate the property to its original condition. The present value of the estimated cost of this reinstatement is CU50,000. Therefore as with example 22, the restoration cost is capitalised and written off over its lease life of 10 years with the unwinding of the discount posted to finance costs(other charges on face of P&L). For changes in the estimated costs, the same process applies as was detailed in Example 22.

Example 24: Dilapidation requirement

Company A leased an office premises and as part of the lease agreement they are required to keep it to the standard it was obtained in. In this case a provision is recognised over the 10 years with the provision increased yearly for the estimated cost of reinstating the property for that particular year. Provision made on the basis that the recognition criteria for a provision are met.

Remediation provision

Although not specifically mentioned in the section, this has been dealt with under IFRS. In effect it arises where contamination/pollution has occurred as a result of the entity producing its products. Where a provision needs to be included in the year end accounts depends on the following circumstances:

- Costs incurred at the company’s option

- Costs required due to existing or new legislation

- Costs that have to be incurred due to environmental damage caused by the company

- Fines relating to the environmental damage.

Where the company has a published environmental policy but no laws are in existence which require rectification, then where the company can prove that in the past it has honored its published statement then a provision should be included for the cost of cleaning up the site/contaminated area. The reason for this is that the entity has created a constructive obligation. Obviously all other requirements for a provision should also be met.

Transition exemptions

Section 28.10(f) allows an entity to ascertain the provision for the decommissioning cost at the date of transition as opposed to ascertaining this at the date the requirement for a provision arose. As old GAAP/FRSSE and FRS 102 required decommissioning provisions this exemption is not likely to be that relevant.

Section 28 of FRS 105 provides no further transition exemptions.

Principals transition adjustments

1) Inclusion of future operating losses in a provision for termination of operations (applicable to entities transitioning from old GAAP/FRSSE to FRS 105 only)

Under old GAAP/FRSSE, a provision could be made under FRS 3 for future operating losses to be incurred between the year end date and the date operations eventually cease. Under Section 16 recognition of such losses are not allowed (this is also the case under FRS 102 hence there would no adjustments for an entity transitioning from FRS 102 to FRS 105). Where a provision for termination/closure has been included on the date of transition or the comparative year, these losses will have to be derecognised.

This will include a deferred tax adjustment for a tax adjustment previously claimed which will not be allowed for tax purposes until the following year under FRS 105. The deferred tax will be released in line with when the adjustment is included in the future tax computations under the tax authorities’ transition rules (that being over a 5 year period under Irish rules).

Example 25: Inclusion of future operating losses in a provision for termination of operations under old GAAP/FRSSE (Only applicable for entities transitioning from old GAAP/FRSSE)

During the year ended 31 December 2014 Company A made a formal announcement to all effected parties that the Company would cease trading on 30 April 2015. At the 31 December 2014 under old GAAP/FRSSE a provision of CU1 million was included for the cost of closure including the cost of redundancies. Included in this provision was CU300,000 for the cost of future losses for the period 1 January to 30 April 2015. The provision for future losses as part of a closure provision was allowed under old GAAP/FRSSE. Assume the corporation tax rate is 10% and the date of transition is 1 January 2015 and the provision was allowable for tax purposes.

Under Section 16 of FRS 105, future operating losses cannot be included in a closure provision. As a result the following transition adjustments are required:

On 1 January 2015

|

|

CU |

CU |

|

Dr Provisions |

300,000 |

|

|

Cr Profit and Loss Reserves |

|

300,000 |

Being journal to reverse the future operating losses included in the provision

|

|

CU |

CU |

|

Dr Profit and Loss Reserves for Corporation Tax (CU300,000*10%) |

30,000 |

|

|

Cr Corporation Tax Liability |

|

30,000 |

Being journal to reflect corporation tax on the above adjustment as a tax deduction was obtained in 2015 however since it has now been taken out under FRS 105, the tax charge that would have arisen had FRS 105 applied from inception is recognised. A deduction will not be allowed until 2015 in which time the corporation tax posting will reverse.

Adjustment required in 2015 financial statements assuming the above journals are posted to reserves

|

|

CU |

CU |

|

Dr Administrative Expenses |

300,000 |

|

|

Cr Provisions |

|

300,000 |

Being journal to reflect reversal of transition posting on 1 January 2015 above for the fact that losses were incurred in 2015 and the provision under old GAAP/FRSSE in 2014 would have been reversed, therefore this journal ensures the losses are shown in the 2015 financial statements.

|

CU |

CU |

|

|

Dr Corporation Tax Liability |

30,000 |

|

|

Cr Corporation Tax P&L |

|

30,000 |

Being journal to reflect the reversal of the corporation tax previously recognised.

No further adjustments are required in the 2015 and 2016 books. If the provision was booked in the 31 December 2015 year end (the comparative year end), then the opening transition journal above would be to debit administration costs in the P&L as opposed to profit and loss reserves. The 2016 journal would be the same as the 2015 journal above. The same corporation tax journal would be posted in the year ended 31 December 2015 as was posted on 1 January 2015(obviously other side posted to tax charge as opposed to P&L reserves) and this corporation tax will reduce over a 5 year period in line with the tax transition rules. In YE 31 December 2015 the tax charge should show the charge that would have applied had FRS 105 applied from inception (i.e. as this deduction would not have been recognised under FRS 105, the tax deduction that was claimed under old GAAP would not be applicable, instead this would be claimed in the 2016 year, hence the reversal of the CU30k).

Assuming the 2016 TB was initially prepared under old GAAP/FRSSE, then the 2016 journal would be the same as the 2015 journals above. However the journal with regard to tax would be to:

|

|

CU |

CU |

|

Dr Corporation Tax Liability (CU30,000/5 years) |

6,000 |

|

|

Cr Corporation Tax P&L |

|

6,000 |

Being journal to reflect the reversal of the 1/5th of the corporation tax liability previously recognised as it is taxable over a 5 year period. Note this assumes that the tax journal posted in 2016 will include the transition tax adjustment for the CU6,000 when it is finally recognised. If there was no corporation tax in 2016, then the CU6,000 would still be released as a credit to the P&L as it would be no longer payable to the tax authorities. As no deferred tax can be recognised under FRS 105 it cannot be held as a deferred tax liability on the balance sheet as a timing difference. The remaining CU24k (CU30k-CU6k) will still be included as a liability at the year end in the corporation tax nominal and released over the remaining 4 yrs.

Disclosures in the notes

Extracts from FRS 105 – Section 16.19

16.19 A micro-entity shall determine the amount of any financial commitments, guarantees and contingencies not recognised in the statement of financial position and disclose that amount within the total amount of financial commitments, guarantees and contingencies (see paragraph 6A.2). A micro-entity is not required to disclose the amount of a contingent liability where the possibility of an outflow of resources is remote.

OmniPro comment

See examples of disclosures below. Note for ROI entities, accounting policies also need to be disclosed under Company Law (this is not applicable for UK entities as UK Company Law does not require such disclosures).

Example 26 – Example contingent liability/asset disclosures

A legal action is pending against the company for alleged unfair dismissal. The directors under advisement from their legal team expect that the claim will be successfully defended. Should the company be unsuccessful in the action the maximum estimated settlement is not expected to exceed CU10,000. It is not practicable as yet to state the timing of the any possible payment.

A legal case has been taken against the company, the outcome of which is uncertain. There is a contingent liability in the range of CU0 to CU400,000 in respect of this case. It is not practicable as yet to state the timing of any possible payment.

A customer has commenced a legal action against the company for defective workmanship. The directors under advisement by their legal team believe that it is possible but not probable the action will succeed and therefore no provision has been made in these financial statements. Should the action succeed the estimated liability would be CU100,000.

There is a potential contingent asset/liability in the future in relation to profit commission agreements entered into with various product producers. However in the opinion of the directors it is not practicable to provide an estimate of the financial effect of this contingent asset/liability as it is based on future loss ratios in relation to unsettled claims.

It is not anticipated that any material liabilities will arise from the contingent liabilities other than those provided for.

Contingent asset

The company is currently pursuing a compensation claim due to the losses sustained as a result of restrictions placed on the company’s assets by a competitor. The claim arose as a result of the loss of earnings due to restrictions imposed on the usage of these assets. The company won a case in the High Court and were awarded damages of CUXXXX and costs. The defendants have appealed the matter to the Supreme Court and the company awaits a date for the hearing of the claim. The company’s legal advisors are confident that the award of damages and costs to the company will not be overturned.

Financial guarantee

The company has entered into a guarantee for the benefit of its subsidiary/holding company/sister company. The total amount of this guarantee was CUXX

Example 27 – Extract from accounting policy in financial statements for provisions – Applicable to ROI entities only

(a) Provisions

Provisions are recognised when the company has a present legal or constructive obligation as a result of past events; it is probable that an outflow of resources will be required to settle the obligation; and the amount of the obligation can be estimated reliably.

Where there are a number of similar obligations, the likelihood that an outflow will be required in settlement is determined by considering the class of obligations as a whole. A provision is recognised even if the likelihood of an outflow with respect to any one item included in the same class of obligations may be small.

Provisions are measured at the present value of the expenditures expected to be required to settle the obligation using a pre-tax rate that reflects current market assessments of the time value of money and the risks specific to the obligation. The increase in the provision due to passage of time is recognised as a finance cost.

The extent a legal or constructive obligation exists, the acquisition costs include the present value of estimated costs of dismantling and removing the asset and restoring the site. A change in estimated expenditures for dismantling, removal and restoration is added to/and or deducted from carrying value of the related asset. To the extent the change results in a negative carrying amount, the difference is recognised in the profit and loss. The change in depreciation is recognised prospectively.

(b) Contingencies

Contingent liabilities, arising as a result of past events, are not recognised when (i) it is not probable that there will be an outflow of resources or that the amount cannot be reliably measured at the reporting date or (ii) when the existence will be confirmed by the occurrence or non-occurrence of uncertain future events not wholly within the company’s control. Contingent liabilities are disclosed in the financial statements unless the probability of an outflow of resources is remote.

Contingent assets are not recognised. Contingent assets are disclosed in the financial statements when an inflow of economic benefits is probable.

Or where remediation provisions are required include the below:

Environmental liabilities

Liabilities for environmental costs are recognised when environmental assessments determine clean-ups are probable and the associated costs can be reasonably estimated. Generally the timing of these provisions coincides with the commitment to a formal plan of action or, if earlier, on divestment or on closure of active sites. The amount recognised at the balance sheet date is the latest best estimate of the expenditure required.

Discounted liabilities in respect of environmental liabilities and closures costs have been classified between amounts due within one year and due after one year. Provisions for long term obligations are discounted at a rate of X%.

OR where closure costs include the below

Closure costs

All costs associated with the decision to cease trading have been recognised in these financial statements. These include a write down of assets, provisions for expected closure costs together with profit and losses expected to be incurred up to date of cessation of trading.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]