[et_pb_section admin_label=”Header – All Pages” global_module=”1221″ transparent_background=”off” background_color=”#1e73be” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” custom_padding=”||0px|”][et_pb_row global_parent=”1221″ admin_label=”row”][et_pb_column type=”4_4″][et_pb_post_title global_parent=”1221″ admin_label=”Post Title” title=”on” meta=”off” author=”on” date=”on” categories=”on” comments=”on” featured_image=”off” featured_placement=”below” parallax_effect=”on” parallax_method=”on” text_orientation=”left” text_color=”light” text_background=”off” text_bg_color=”rgba(255,255,255,0.9)” module_bg_color=”rgba(255,255,255,0)” title_all_caps=”off” use_border_color=”off” border_color=”#ffffff” border_style=”solid” title_font=”|on|||” title_font_size=”35″ custom_padding=”10px|||”] [/et_pb_post_title][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” global_module=”1228″ fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” custom_padding=”0px||0px|” padding_mobile=”on” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” gutter_width=”3″][et_pb_row global_parent=”1228″ admin_label=”Row” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” use_custom_gutter=”off” gutter_width=”3″ custom_padding=”0px||0px|” padding_mobile=”off” allow_player_pause=”off” parallax=”off” parallax_method=”off” make_equal=”off” parallax_1=”off” parallax_method_1=”off” column_padding_mobile=”on”][et_pb_column type=”4_4″][et_pb_text global_parent=”1228″ admin_label=”Text” background_layout=”light” text_orientation=”left” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [breadcrumb] [/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” fullwidth=”off” specialty=”off”][et_pb_row admin_label=”Row”][et_pb_column type=”1_2″][et_pb_text admin_label=”Return to 105 Index” background_layout=”light” text_orientation=”center” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [button link=”https://ie.frs102.com/members/premium-toolkit/frs-105/” type=”big” color=”red”] Return to FRS 105 Main Menu[/button] [/et_pb_text][/et_pb_column][et_pb_column type=”1_2″][et_pb_text admin_label=”Return to Section 10 Home” background_layout=”light” text_orientation=”center” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [button link=”https://ie.frs102.com/members/premium-toolkit/frs-105/section-11/” type=”big” color=”red”] Return to Section 11 Home[/button] [/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” gutter_width=”3″][et_pb_row admin_label=”Row”][et_pb_column type=”4_4″][et_pb_text admin_label=”Main Body Text” background_layout=”light” text_orientation=”justified” use_border_color=”off” border_color=”#ffffff” border_style=”solid” module_id=” “]

Section 11 – Investments in Joint Ventures

This section defines jointly controlled operations and jointly controlled assets. It also sets out how such ventures should be accounted for on the balance sheet. Joint ventures which are jointly controlled entities do not come within the scope of this standard instead these are dealt with in Section 7.

Joint ventures defined

Extract from FRS 105 – Section 11.3 – 11.4

11.3 Joint control is the contractually agreed sharing of control over an economic activity, and exists only when the strategic financial and operating decisions relating to the activity require the unanimous consent of the parties sharing control (the venturers).

11.4 A joint venture is a contractual arrangement whereby two or more parties undertake an economic activity that is subject to joint control. Joint ventures can take the form of jointly controlled operations, jointly controlled assets, or jointly controlled entities.

OmniPro comment

It is clear that a joint venture does not have to be a company, it can be an unincorporated business. No one party can have control above the other and in order for one to exist there must be at least 2 parties. Unanimous consent is required in the arrangement. Unanimous consent means that any party to the arrangement can prevent any of the other parties, or group of other parties, from making decisions of a strategic, financial or operating nature without its consent.

When the contractual arrangement identifies one venturer as the manager of the joint venture, it should be clear that the operator does not control the operation; it is merely running the business in line with the ventures’ wishes as a whole. It cannot take action without the approval of the other venturers on key strategic, financial or operating decisions. Examples of types of strategic decisions that would require unanimous consent are:

- Major financing;

- Approving a business plan;

- Approving a budget;

- Remuneration policy;

- Share issues; and

- Significant asset disposals and acquisitions.

There are three types of joint ventures namely;

- Jointly controlled operations;

- Jointly controlled assets; and

- Jointly controlled entities.

Each of these are explained further below.

Although FRS 105 does not define what the strategic, financial and operating decisions would cover, these are generally understood to include areas such as budgeting, capital expenditure, treasury management, dividend policy, production, marketing, sales and human resources.

Appendix I in FRS 105 defines control as the ‘power to govern the financial and operating policies of an entity so as to obtain benefits from its activities’.

Section 11 does not define what is meant by a contractual arrangement. However in order for it to be contractual in nature, it must be in writing and agreed by all parties. The rules may be incorporated in the articles of association or by way of a shareholders agreement. IAS 31 of IFRS states that this contract arrangement should set out the following:

- The activity, duration and reporting obligations of the joint venture;

- The rules for appointment of the board of directors or equivalent governing body of the joint venture and the voting rights of the venturers;

- The capital contributions to be made by the venturers; and

- Rules with regard to the sharing by the venturers of the output, income, expenses, or results of the joint venture.

In order to be a joint venture there is no requirement that the shareholders own the same percentage shares/rights in the entity. If the contractual agreement makes it clear the unanimous agreement is required this is the key determination.

Example 1: Determining if joint control exists

X, Y and Z enter into an agreement to start a joint entity. Entity A, X, Y and Z own 30%, 50% and 20% respectively. All parties enter into a contractual agreement whereby it is agreed that a unanimous decision is required from X and Y on all major strategic financial and operating decisions.

In this instance X and Y are joint venturers and will account for this as a joint venture under the rules of Section 7 and 11. Z would account for the investment under the rules of section 9. As consolidated financial statements cannot be prepared under FRS 105, in reality in this situation whether it was a joint venture or an associate it would be accounted for in the same way (i.e. at cost less impairment).

Jointly controlled operations

Extract from FRS 105 – Section 11.5 – 11.6

11.5 The operation of some joint ventures involves the use of the assets and other resources of the venturers rather than the establishment of a corporation, partnership or other entity, or a financial structure that is separate from the venturers themselves. Each venturer uses its own property, plant and equipment and carries its own inventories. It also incurs its own expenses and liabilities and raises its own finance, which represent its own obligations. The joint venture activities may be carried out by the venturer’s employees alongside the venturer’s similar activities. The joint venture agreement usually provides a means by which the revenue from the sale of the joint product and any expenses incurred in common are shared among the venturers.

11.6 In respect of its interests in jointly controlled operations, a venturer shall recognise in its financial statements:

- the assets that it controls and the liabilities that it incurs; and

- the expenses that it incurs and its share of the income that it earns from the sale of goods or services by the joint venture.

Jointly controlled operations

Jointly controlled operations are effectively operations where equipment etc. is shared but ownership does not pass nor is ownership shared. It is in fact not a legal entity. Each party incurs its own costs and incurs its own liabilities.

An example would be where two or more venturers combine their operations, resources or expertise to jointly manufacture market and distribute a product. Each venturer undertakes a different part of the manufacturing process and bears its own costs. Revenue from the sales of the product is shared on the basis of the contractual agreement. There is no separate entity doing this work.

Accounting for a jointly controlled operation

As the assets, liabilities, income and expenses will already be reflected in the individual financial statements, no consolidation adjustments are required as they are already included. A separate set of books is not required to be kept however it is likely that they will be kept so the performance of the entity can be determined.

Example 2: Loans to jointly controlled operation

Company X and Y entered into a jointly controlled operation where the contractual agreement makes it clear that it is owned 50/50 by each party. However in order to get the operation started, Company X had to provide a loan of CU100,000 and Company Y a loan of CU200,000 to the joint operation.

Therefore the total borrowings in the joint operation are CU300,000 and under the agreement costs and revenues are shared 50/50 which includes the liabilities of the joint operation. Therefore Company Y has to recognise an asset for the amount receivable from Company X and Company X has to recognise its liability.

The way in which the amount payable to Company Y in Company X’s financial statements should be accounted for is as follows:

|

|

CU |

CU |

|

Dr Amounts due from Joint Venture |

50,000 |

|

|

Cr Amounts due to Company Y |

|

50,000* |

*(CU300,000*50%) = CU150,000. Therefore, amount to be shown as a receivable is the amount of the loan given of CU200,000 less CU150,000 being the element that Company Y legally had to make (CU50,000).

Example 2: Loans to jointly controlled operation

Company X and Y entered into a jointly controlled operation where the contractual agreement makes it clear that it is owned 50/50 by each party. However in order to get the operation started, Company X had to provide a loan of CU100,000 and Company Y a loan of CU200,000 to the joint operation.

Therefore the total borrowings in the joint operation are CU300,000 and under the agreement costs and revenues are shared 50/50 which includes the liabilities of the joint operation. Therefore Company Y has to recognise an asset for the amount receivable from Company X and Company X has to recognise its liability.

The way in which the amount payable to Company Y in Company X’s financial statements should be accounted for is as follows:

|

|

CU |

CU |

|

Dr Amounts due from Joint Venture |

50,000 |

|

|

Cr Amounts due to Company Y |

|

50,000* |

*(CU300,000*50%) = CU150,000. Therefore, amount to be shown as a receivable is the amount of the loan given of CU200,000 less CU150,000 being the element that Company Y legally had to make (CU50,000).

Note the above P&L and balance sheet is shown in greater detail than what is required to be included in the FRS 105 financial statements. The formats and wording actually used will be as per the requirements of Section 4 and 5.

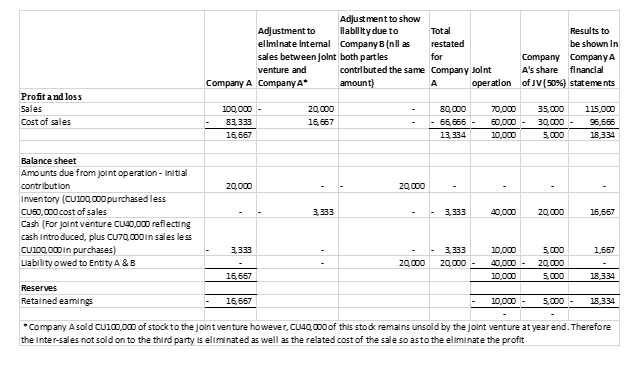

Example 3: Accounting for a jointly controlled operation

Company A manufacturers a product. It has entered into an agreement with a packaging and marketing Company, Company B to create a jointly controlled operation. A contractual agreement makes it clear that all decisions require unanimous consent. As per the agreement the profits and liabilities are shared 50/50. As part of the agreement Company A will charge the operation on a cost plus 20% basis. Both parties are required to contribute CU20,000 each.

During the year Company A sold CU100,000 of goods to the joint operation which cost Company A CU83,333.

The joint operation made sales of CU70,000 and it cost the joint operation CU60,000. To account for these joint operation sales in Company A’s financial statements, the below is required:

Note the above P&L and balance sheet is shown in greater detail than what is required to be included in the FRS 105 financial statements. The formats and wording actually used will be as per the requirements of Section 4 and 5.

Jointly controlled assets

Extract from FRS 105 – Section 11.7 – 11.8

11.7 Some joint ventures involve the joint control, and often the joint ownership, by the venturers of one or more assets contributed to, or acquired for the purpose of, the joint venture and dedicated to the purposes of the joint venture.

11.8 In respect of its interest in a jointly controlled asset, a venturer shall recognise in its financial statements:

- its share of the jointly controlled assets, classified in accordance with the format adopted set out in Section 4 Statement of Financial Position;

- any liabilities that it has incurred;

- its share of any liabilities incurred jointly with the other venturers in relation to the joint venture;

- any income from the sale or use of its share of the output of the joint venture, together with its share of any expenses incurred by the joint venture; and

- any expenses that it has incurred in respect of its interest in the joint

OmniPro comment

Jointly controlled assets are effectively operations where ventures’ contribute equally towards the cost of one or more assets and they are owned jointly. No legal entity is created.

Funds provided to the jointly controlled assets are treated the same way as included in the example above for jointly controlled operations.

Accounting for jointly controlled assets

As the assets, liabilities, income and expenses will already be reflected in the individual financial statements, no consolidation adjustments are required as they are already included in the entity financial statements. A separate set of books is not required to be kept however it is likely that they will be kept so the performance of the entity can be determined.

Example 4: Jointly controlled assets

Company A, B & C entered into a joint venture whereby they decided to purchase a specially designed warehouse for holding frozen food. As part of the joint venture agreement, all parties had equal say in the operation of the facility and therefore meet the definition of a joint venture. Company A, B & C contributed CU10,000, CU40,000 and CU40,000 respectively which is reflective of the ownership in the asset. The cost of the asset was CU100,000.

The costs are shared in proportion to the ownership. During year 1 the joint venture incurred CU10,000 in costs to maintain the facility excluding depreciation. The property is being depreciated over 5 years. Company A made sales from this unit of CU100,000. This would be accounted in the books of Company A as follows:

|

|

CU |

CU |

|

Dr PPE |

10,000 |

|

|

Cr Cash |

|

10,000 |

Being journal to recognise the portion of the asset on Company A’s balance sheet

|

|

CU |

CU |

|

Dr Property Expenses |

1,000 |

|

|

Cr Bank (CU10,000*10%) |

|

1,000 |

Being journal to reflect Company A’s portion of expenses

|

|

CU |

CU |

|

Dr Depreciation |

2,000 |

|

|

Cr Accumulated Depreciation on PPE (CU100,000/5yrs*10%) |

|

2,000 |

Being journal to reflect depreciation charge on Company A’s portion of the assets

|

|

CU |

CU |

|

Dr Debtors |

100,000 |

|

|

Cr Sales |

|

100,000 |

Being journal to reflect sales by Company A.

Jointly Controlled Entities

For the avoidance of doubt, jointly controlled entities are joint ventures that involve the establishment of a corporation, partnership or other entity in which the venture has an interest and there is a contractual arrangement between the ventures’ establishing joint control over the economic activity (i.e. there is a separate legal entity). This Section does not deal with the accounting for such entities instead the accounting for these entities are dealt with Section 7 of FRS 105.

Disclosure in the notes

Extract From FRS 105 – Section 11.9

11.9 A micro-entity shall determine the amount of any financial commitments, guarantees and contingencies not recognised in the statement of financial position arising from its jointly controlled operations and jointly controlled assets and disclose that amount within the total amount of financial commitments, guarantees and contingencies (see paragraph 6A.2).

OmniPro comment

FRS 105 requires minimal disclosure. See example disclosures below

Example 5: Example disclosures

a) The company has pledged the building that it owns as security on loans taken out with the bank. The total value of these loans on the balance sheet at year end for which security is held was €XX (2014:€XX).

b) The company had capital commitments of €30,000 at the year ended 31 December 2015 (2014:€nil) in relation to the purchase of equipment. This commitment has been secured by a fixed and floating charge on the stock.

c) At 31 December 2015, the company had the following commitments under non-cancellable operating leases that expire as follows:

|

|

2015 |

2014 |

|

2015 |

2014 |

|

|

|

|

|

€ |

€ |

|

€ |

€ |

|

|

Within one year |

|

1,000 |

800 |

|

145,000 |

145,000 |

|

|

Within two to five years |

|

5,000 |

4,800 |

|

100,000 |

100,000 |

|

|

Greater than five years |

|

– |

– |

|

– |

– |

|

|

Total |

|

6,000 |

5,600 |

|

|

|

d) At the year end, the company had forward foreign exchange contrasts in place totaling €2,000 (2014: €nil) for the sale of British pound.

Transition exemptions

Section 28 provides no transition exemptions on adoption of Section 11. Therefore any difference between old GAAP/FRSSE/FRS 102 and Section 11 have to be applied retrospectively. In reality there should be no differences for the area’s applicable to micro entities in either of the previous GAAP’s therefore it is likely there will be no adjustments in any event.

Principal transition adjustments

Given that Section 11 only deals with jointly controlled assets/operations and given that investments in and transactions with jointly controlled entities is outside the scope of FRS 105 (as FRS 105 does not permit consolidated financial statements to be prepared), there are no differences between FRS 105 and the previous GAAPs from the point of view of jointly controlled assets/operations. Hence no adjustments are expected on transition from any of the previous GAAP’s.

See the accounting for investments in jointly controlled entities in Section 7 and 9 (i.e. such investments must be held at cost less impairment in the individual entity financial statements, consolidated financial statements are not permitted to be prepared). The differences in the accounting for such entities in the individual financial statements has been discussed in Section 9.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]