[et_pb_section admin_label=”Header – All Pages” global_module=”1221″ transparent_background=”off” background_color=”#1e73be” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” custom_padding=”||0px|”][et_pb_row global_parent=”1221″ admin_label=”row”][et_pb_column type=”4_4″][et_pb_post_title global_parent=”1221″ admin_label=”Post Title” title=”on” meta=”off” author=”on” date=”on” categories=”on” comments=”on” featured_image=”off” featured_placement=”below” parallax_effect=”on” parallax_method=”on” text_orientation=”left” text_color=”light” text_background=”off” text_bg_color=”rgba(255,255,255,0.9)” module_bg_color=”rgba(255,255,255,0)” title_all_caps=”off” use_border_color=”off” border_color=”#ffffff” border_style=”solid” title_font=”|on|||” title_font_size=”35″ custom_padding=”10px|||”] [/et_pb_post_title][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” global_module=”1228″ fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” custom_padding=”0px||0px|” padding_mobile=”on” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” gutter_width=”3″][et_pb_row global_parent=”1228″ admin_label=”Row” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” use_custom_gutter=”off” gutter_width=”3″ custom_padding=”0px||0px|” padding_mobile=”off” allow_player_pause=”off” parallax=”off” parallax_method=”off” make_equal=”off” parallax_1=”off” parallax_method_1=”off” column_padding_mobile=”on”][et_pb_column type=”4_4″][et_pb_text global_parent=”1228″ admin_label=”Text” background_layout=”light” text_orientation=”left” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [breadcrumb] [/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” fullwidth=”off” specialty=”off”][et_pb_row admin_label=”Row”][et_pb_column type=”1_2″][et_pb_text admin_label=”Return to 105 Index” background_layout=”light” text_orientation=”center” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [button link=”https://ie.frs102.com/members/premium-toolkit/frs-105/” type=”big” color=”red”] Return to FRS 105 Main Menu[/button] [/et_pb_text][/et_pb_column][et_pb_column type=”1_2″][et_pb_text admin_label=”Return to Section 25 Home” background_layout=”light” text_orientation=”center” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [button link=”https://ie.frs102.com/members/premium-toolkit/frs-105/section-25/” type=”big” color=”red”] Return to Section 25 Home[/button] [/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” gutter_width=”3″][et_pb_row admin_label=”Row”][et_pb_column type=”4_4″][et_pb_text admin_label=”Main Body Text” background_layout=”light” text_orientation=”justified” use_border_color=”off” border_color=”#ffffff” border_style=”solid” module_id=” “]

Section 25 – Foreign Currency Translation

It is likely that entities transact business with customers and suppliers who are invoiced/invoice in a currency which is not the entity’s functional currency. It is also possible that entities have branches in countries outside of the company’s home country. Section 25 deals with such issues including:

- how to determine an entities functional currency;

- the retranslation of foreign currencies into an entities functional currency;

- the retranslation of foreign operations which are branches into the financial statements; and

- providing detailed rules on the rate to use when retranslating these foreign currencies.

Scope of this section

Extract from FRS 105 – Section 25.1

25.1 A micro-entity may have transactions in foreign currencies. This section prescribes how to include foreign currency transactions in the financial statements of a micro- entity. Where a micro-entity has a foreign branch, the micro-entity should refer to the requirements of Section 30 Foreign Currency Translation of FRS 102 to determine if the foreign branch has a different functional currency, and if so, should apply the requirements of Section 30 of FRS 102 to those transactions undertaken by the foreign branch.

OmniPro comment

Where a foreign branch exists Section 25.1 above refers the readers to Section 30 of FRS 102 to determine the functional currency of the foreign branch.

A key starting point with regard to defining what currency is a foreign currency for an entity is the assessment of the entity’s functional currency. Any currency which is not the entity’s functional currency is then a foreign currency under which the rules of Section 25 are followed.

It is clear that every entity has its own functional currency including group companies and branches so every entity should review its own circumstances to determine its functional currency. Although not dealt with in Section 25, we can look to Section 30.3, 30.4 and 30.5 of FRS 102 to identify the primary and secondary indicators of an entity’s functional currency. These should be reviewed when determining the functional currency of the entity and where a foreign branch exists the functional currency of the branch.

In determining a functional currency more weight is given to the primary indicators, before considering the secondary and other evidence which are purely provided to give supporting evidence to determine an entity’s functional currency.

The steps involved in determining a functional currency in order of priority are:

1) Review the primary indicators to provide evidence of the functional currency

– Determine the currency of the primary sales and cash inflows – this will often be the currency in which the sales prices for its goods and services are denominated and settled. Questions to ask include:

– What currency are the principal sales invoices raised in?

– What currency are sales contracts determined in?

– What currency are cash receipts in?

– Determine the currency of primary purchases and cash outflows – this will often be the currency in which the costs are denominated and settled. Questions to ask include:

– What currency are the principal expenses incurred in?

When reviewing the above indicators, an entity assesses what currency the majority of the costs and sales are denominated in.

If there is still doubt from reviewing the above primary factors an entity should then move to the secondary factors to see if this can provide further support.

2) Secondary indicators merely provide supporting evidence in determining a functional currency. The questions to ask are:

– What is the currency in which the entity is financed (financing activities) i.e. the currency in which debt is raised and equity is obtained.

– Where financing is raised in and serviced by funds primarily generated by the entity’s local operation, this could indicate that the local currency is the functional currency.

– What currency is the operating income retained or is it retained?

Indicators of this would be the local currency in which the entity maintains its excess working capital balance.

If there is still doubt from reviewing the above secondary factors an entity should then move to step 3 where relevant to see if this can provide further support.

3) Where an entity is a subsidiary, associate, joint venture or branch then if steps 1 and 2 do not provide conclusive evidence, the entities should review:

– The degree of autonomy the entity has from its parent

Indicators of significant autonomy and therefore indicating that the entity has a different functional currency to the parent include:

– Ability to enter into its own contracts

– Ability to negotiate its own finance

– Ability to determine how it invests excess cash

– Not merely an entity that sells goods on behalf of its parent and then transfers cash to the parent.

– Frequency of transactions with reporting entity.

– Indicators that the entity has the same functional currency to its parent include: Frequent intercompany transactions and trading dealings with the parent company.

.- Cash flow impact on reporting entity (parent company)

Indicators that there is little impact on the cash flows of the parent.

– No significant cash flow impact as the foreign entity can hold its own cash in its local currency and determine what to invest this in. It does not have to remit funds regularly.

– Financing

Indicators that the entity has a different functional currency to its parent include:

– Financing being obtained in the local currency and serviced by funds generated in the foreign operation. Little or no financing provided by the parent.

Appendix I of FRS 105 defines a foreign operation as ‘an entity that is a subsidiary, associate, joint venture or branch of a reporting entity, the activities of which are based or conducted in a country or currency other than those of the reporting entity’.

For some entities it will be very easy to determine a functional currency however for others it may not be. Judgement will be required. More weight should be put on the primary indicators.

Each entity’s circumstances must be looked at in isolation, it cannot be reviewed from a group perspective.

Examples

Example 1: Intermediary holding company

UK Parent A is a UK company with a functional currency as FC. It has a 100% subsidiary called Intermediate Co which in turn owns 100% of a trading subsidiary Company B whose function currency is CU.

The Intermediate Co merely holds the investment in Company B and obtains CU borrowings from the bank to make this investment. The borrowings are guaranteed by Parent UK Co.

In this instance what is the functional currency of Intermediate Co?

Applying the guidance in Section 30.3 to 30.5 as follows:

Primary indicators:

- currency in which costs or income is derived – As Intermediate Co does not generate revenue and only incurs minimal expenses, this indicator is not that relevant.

Secondary indicators:

- Operating activities – this is not relevant as the company does not generate any cash flows it merely holds the investment

- Financing activities – Intermediate Co has obtained CU borrowings to make the acquisition, however this is only a secondary indictor and section 30.5 has to be reviewed for foreign operations.

Factors specific to foreign operations:

- Degree of autonomy – Section 30.5(a) states that where the activities of the foreign operation is an extension of the reporting entity and has very little autonomy, then the foreign entity is likely to have the functional currency of its parent. – In this example, as Intermediate Co has merely been put in funds through UK Parent A (by parent A providing finance by way of guarantee to the bank) and it has akin made an investment into a subsidiary on UK Parent Co’s behalf, this would indicate that the functional currency of the parent is that of the UK Parent Co i.e. FC.

- Frequency of transaction with parent – All transactions are with the parent thereby indicating it should take the functional currency of the parent.

- Cash flow impact on reporting entity – not that relevant

- Financing – Parent Co has provided the funds therefore this suggest it is an extension of the Parent Co.

Based on the facts and circumstances outlined Intermediate Co’s functional currency should be FC and not CU.

Example 2: Intermediate holding Company

If we take example 1 and this time assume that no bank borrowings was obtained and instead UK Parent Co provided the loan finance or equity finance. In this case the same determination would be obtained i.e. the functional currency of Intermediate Co is FC.

Example 3: Intermediate holding Company

If we take example 1 and in this case the money to fund the investment in Company B is obtained from a sister company. In this case the functional currency of the Intermediate Co would likely be the functional currency of the sister company.

Example 4: Functional currency

Company A is a trading company resident in Ireland. Company A predominately sells its goods in CU with 30% of sales being made in FC. The company’s principal costs are wages and stock purchases. These are all paid in CU.

Based on the primary indicators, the functional currency of Company A is CU. The secondary indicators do not need to be reviewed as it is clear from the primary indicators.

Example 5: Functional currency

Company A is a trading company resident in Ireland. Company A predominately sells its goods in CU with 30% of sales being made in FC. The company’s principal costs are wages and stock purchases. These are mainly denominated and settled in FC.

The company is financed through CU borrowings.

In this case the primary indicators do not give conclusive evidence so therefore one must move to the secondary indicators. The secondary indicators are financing activities and from review of same we can see that this is carried out in CU.

On this basis it would appear the functional currency is CU.

Example 5A: Branch

Company A has a branch in a foreign country and sells goods in a foreign currency (fc). The functional currency of company A excluding the branch is CU. The branch costs are recharged from Company A in CU. The branch does not hold excess cash instead it is transferred to Company A. Based on the facts the functional currency of the branch is CU as it does not have a huge autonomy from its parent.

The functional currency should remain the same and cannot change unless there is a change in the business operations.

Initial recognition

Extract From FRS 105 – Section 25.2 – 25.6

Initial recognition

25.2 A foreign currency transaction is a transaction that is denominated or requires settlement in a foreign currency, including transactions arising when a micro-entity:

(a) buys or sells goods or services whose price is denominated in a foreign currency;

(b) borrows or lends funds when the amounts payable or receivable are denominated in a foreign currency; or

(c) otherwise acquires or disposes of assets, or incurs or settles liabilities, denominated in a foreign currency.

25.3 A micro-entity shall record a foreign currency transaction by applying to the foreign currency amount the spot exchange rate at the date of the transaction unless:

(a) the transaction is to be settled at a contracted rate, in which case that rate shall be used; or

(b) where a trading transaction is covered by a related or matching forward contract, in which case the rate of exchange specified in that contract shall be used.

25.4 The date of a transaction is the date on which the transaction first qualifies for recognition in accordance with this FRS. For practical reasons, a rate that approximates the actual rate at the date of the transaction is often used, for example, an average rate for a week or a month might be used for all transactions in each foreign currency occurring during that period. However, if exchange rates fluctuate significantly, the use of the average rate for a period is inappropriate.

Reporting at the end of the subsequent reporting periods

25.5 At the end of each reporting period, unless it is applying a contracted rate in accordance with paragraph 25.3 a micro-entity shall:

(a) translate foreign currency monetary items using the closing rate; and

(b) translate non-monetary items that are measured in terms of historical cost in a foreign currency using the exchange rate at the date of the

25.6 A micro-entity shall recognise, in profit or loss in the period in which they arise, exchange differences arising on the settlement of monetary items or on translating monetary items at rates different from those at which they were translated on initial recognition during the period or in previous periods.

OmniPro comment

Definition of monetary items

A monetary item is defined in Appendix I of FRS 105 as ‘units of currency held and assets and liabilities to be received or paid in a fixed or determinable number of units of currency’. Examples of monetary items include the below items denominated in foreign currencies on the balance sheet:

- Cash

- Debtors, other debtors, refundable deposits

- Loans payable and receivables

- Investment in preference shares which are considered to be debt in accordance with Section 17

- Trade creditors

- Provision and accruals where they will be settled in cash

- Financial liabilities as determined by Section 9 (i.e. the debt portion of preference shares)

- Pension or other employee benefits to be paid in cash

- Cash dividends recognised as a liability

- Warranty provision where a cash refund is provided.

Recognition of monetary items

Assets/liabilities denominated in foreign currencies should be translated on initial recognition at the spot rate at the date of the transaction unless:

- The transaction has an agreed contracted rate from the outset in which case that rate must be utilised; or

- Where a forward foreign currency contract exists to cover the sale, then the forward contract rate in which case that rate must be utilised.

The date of the transaction will depend on the circumstances. With regard to sales made in foreign currencies the date of the transaction will be the date the risks and rewards of ownership transfer which will depend on the conditions of the sale, it can be on delivery to the customer or dispatch from the entity site.

With regard to purchases of physical goods, the transaction date would be the date the risk and rewards transfer. For purchases which are service type items, it would usually be the date the service is provided or the date of the invoice.

In practice the date of the invoice is used when deciding on the transaction date which in reality should equate to when the risk and rewards transfer.

Some entities use an average exchange rate for the week or month when deciding the exchange rate to use. This method is acceptable as long as the exchange rate does not fluctuate hugely during the period. If it does, then the rate on the day should be used.

Where a forward contract rate exists to cover sales for a month the average forward rate may be used when translating the transaction to the functional currency.

Retranslation of monetary assets which are not settled pre year end

If at the period end date, the monetary assets have not been settled then the foreign currency amount is retranslated at:

- the exchange rate at the reporting date i.e. the spot rate at the period end date; UNLESS EITHER OF THE BELOW APPLIES IN WHICH CASE THE BELOW RATE MUST BE APPLIED AS APPLICABLE

- there is a forward foreign currency contract in place to cover the foreign currency transaction in which case the forward foreign currency contract rate to cover the foreign currency transaction should be used if applicable; or

- There is a contract in place which specifically states the rate that the transaction must be settled at in which case the contracted rate as included in the original contract for the transaction should be used if applicable.

It is important to emphasise that where a forward rate or contract rate exists, it must be used (the spot rate cannot be used).

Where there are a number of foreign currency transactions which are covered by a number of forward currency contracts, an entity can retranslate the year end foreign currency balances at the average forward contract rate to cover the net foreign exchange balance. See example below for further details.

The difference between the amount at which it was initially booked and the year end retranslated amount is posted to foreign exchange gain/loss in the profit and loss account.

Derivatives

Note forward currency contracts are not fair valued instead they are held off balance sheet. Instead the average forward rate can be used to retranslate foreign currency balances.

Example 6: Retranslation of monetary asset – purchase where no contracted rate in operation and no forward contract to cover the purchase

Company A whose functional currency is CU purchased good’s from a foreign supplier on credit for FC10,000 on 1 October when the exchange rate was CU1=FC0.80p. Company A’s year end is 31 December. The invoice was not paid by the year end date and the exchange rate was CU1=FC0.85p. The invoice was paid on 30 January of the following year when the exchange rate was CU1=FC0.90p. The accounting treatment of this transaction is:

At date of transaction

|

|

CU |

CU |

|

Dr Inventory (FC10,000/.80p) |

12,500 |

|

|

Cr Accounts Payable |

|

12,500 |

Being journal to recognise the purchase at the transaction date at the spot rate

At year end date

|

|

CU |

CU |

|

Dr Accounts Payable |

735* |

|

|

Cr Unrealised Foreign Exchange Gain in P&L |

|

735 |

Being journal to recognise the foreign exchange gain for the movement in rate to year end

*the amount to be recognised as a foreign exchange gain is determined to be the difference between the amount recognised at the date of transaction of CU12,500 less the year end carrying amount using the year end spot rate of CU11,765 (i.e. FC10,000/.85)= CU735

At payment date

|

|

CU |

CU |

|

Dr Accounts Payable (being carrying amount at 31 December) |

11,765 |

|

|

Cr Bank (FC10,000/0.90) |

|

11,111 |

|

Cr Foreign Exchange Gain in P&L |

|

654 |

Being journal to reflect realised profit on settlement

Example 7: Retranslation of monetary asset – purchase where contracted rate in operation as stated in contract

Company A whose functional currency is CU purchased good’s from a foreign supplier on credit for FC10,000 on 1 October when the exchange rate was CU1=FC0.80p. The rate included in the purchase contract with regard to the amount to be paid was CU1=FC0.75. Company A’s year end is 31 December. The invoice was not paid by the year end date and the exchange rate was CU1=FC0.85p. The invoice was paid on 30 January of the following year when the exchange rate was CU1=FC0.90p. The accounting treatment for this transaction is:

At date of transaction

|

|

CU |

CU |

|

Dr Inventory (FC10,000/.75p) |

13,333 |

|

|

Cr Accounts Payable |

|

13,333 |

Being journal to recognise the purchase at the rate in the contract on the transition date (note there is no choice here, once a contract rate exists it must be used).

At year end date

|

|

CU |

CU |

|

Dr Accounts Payable |

0* |

|

|

Cr Unrealised Foreign Exchange Gain in P&L |

|

0 |

Being journal to recognise the foreign exchange gain for the movement in rate to year end

*the amount to be recognised as a foreign exchange gain is determined to be the difference between the amount recognised at the date of transaction of CU13,333 less the year end carrying amount using the rate in the contract of CU13,333 (i.e. FC10,000/.75)= CUNil

At payment date

|

|

CU |

CU |

|

Dr Accounts Payable (being carrying amount at 31 December) |

13,333 |

|

|

Cr Bank (FC10,000/0.75 being the rate in the contract) |

|

13,333 |

Being journal to reflect realised profit on settlement

Example 8: Retranslation of monetary asset – purchase where forward currency contract exists to cover the purchase

Company A whose functional currency is CU purchased good’s from a foreign supplier on credit for FC10,000 on 1 October when the exchange rate was CU1=FC0.80p. The Company also holds a forward currency contract to cover this purchase and the rate is at CU1=FC0.75p. Company A’s year end is 31 December. The invoice was not paid by the year end date and the exchange rate was CU1=FC0.85p. The invoice was paid on 30 January of the following year when the exchange rate was CU1=FC0.90p. The accounting treatment for this transaction is:

At date of transaction

|

|

CU |

CU |

|

Dr Inventory (FC10,000/.75p) |

13,333 |

|

|

Cr Accounts Payable |

|

13,333 |

Being journal to recognise the purchase at the rate in the forward contract that covers the purchase (note there is no choice here, once a forward contract exists to cover the purchase it must be used).

At year end date

|

|

CU |

CU |

|

Dr Accounts Payable |

0* |

|

|

Cr Unrealised Foreign Exchange Gain in P&L |

|

0 |

Being journal to recognise the foreign exchange gain for the movement in rate to year end

*the amount to be recognised as a foreign exchange gain is determined to be the difference between the amount recognised at the date of transaction of CU13,333 less the year end carrying amount using the rate in the forward currency contract to cover the purchase of CU13,333 (i.e. FC10,000/0.75)= CUNil

At payment date

|

|

CU |

CU |

|

Dr Accounts Payable (being carrying amount at 31 December) |

13,333 |

|

|

Cr Bank (FC10,000/0.75 being the rate in the contract) |

|

13,333 |

Being journal to reflect realised profit on settlement – nil as must remain at the forward rate throughout.

Example 9: Retranslation of monetary asset – sale where no forward currency contract rate or contracted rate exists

Company A whose functional currency (but also sells goods in FC) is CU sold good’s to a foreign customer on credit for FC10,000 on 1 October when the exchange rate was CU1=FC0.80p. Company A’s year end is 31 December. The invoice was not paid by the year end date and exchange rate was CU1=FC0.85p. The invoice was paid on 30 January of the following rate when the exchange rate was CU1=FC0.90p. We are ignoring the stock movement in the example. The accounting treatment of this transaction is:

At date of transaction

|

|

CU |

CU |

|

Dr Trade Debtors (FC10,000/.80p) |

12,500 |

|

|

Cr Revenue |

|

12,500 |

Being journal to recognise the sale at the transaction date

At year end date

|

|

CU |

CU |

|

Dr Unrealised Foreign Exchange Loss in P&L |

735 |

|

|

Cr Trade Debtors |

|

735* |

Being journal to recognise the unrealised foreign exchange loss for the movement in rate to year end

*the amount to be recognised as a foreign exchange loss is determined to be the difference between the amount recognised at the date of transaction of CU12,500 less the year end carrying amount using the year end spot rate of CU11,765 (i.e. FC10,000/.85)= CU735

At payment date

|

|

CU |

CU |

|

Dr Bank (FC10,000/0.90p) |

11,111 |

|

|

Dr Foreign Exchange Loss in P&L |

654 |

|

|

Cr Trade Debtors (being carrying amount at 31 December) |

|

11,765 |

Being journal to reflect realised loss on settlement

Example 10: Retranslation of monetary asset – sale where forward currency contract exists to cover the sale

Company A whose functional currency (but also sells goods in FC) is CU sold good’s to a foreign customer on credit for FC10,000 on 1 October when the exchange rate was CU1=FC0.80p. The Company also holds a forward currency contract to cover this sale and the rate is at CU1=FC0.75p Company A’s year end is 31 December. The invoice was not paid by the year end date and exchange rate was CU1=FC0.85p. The invoice was paid on 30 January of the following rate when the exchange rate was CU1=FC0.90p. We are ignoring the stock movement in the example. The accounting treatment of this transaction is:

At date of transaction

|

|

CU |

CU |

|

Dr Trade Debtors (FC10,000/.75p) |

13,333 |

|

|

Cr Revenue |

|

13,333 |

Being journal to recognise the sale at the transaction date

At year end date

|

|

CU |

CU |

|

Dr Unrealised Foreign Exchange Loss in P&L |

0 |

|

|

Cr Trade Debtors |

|

0 |

Being journal to recognise the unrealised foreign exchange loss for the movement in rate to year end

*the amount to be recognised as a foreign exchange loss is determined to be the difference between the amount recognised at the date of transaction of CU13,333 less the year end carrying amount using the rate in the forward currency contract to cover the sale of CU13,333 (i.e. FC10,000/.75)= CUNil

At payment date

|

|

CU |

CU |

|

Dr Bank (FC10,000/0.90p) |

13,333 |

|

|

Cr Trade Debtors (being carrying amount at 31 December) |

|

13,333 |

Being journal to reflect realised loss on settlement– nil as must remain at the forward rate throughout.

Example 11: Retranslation of monetary asset – sale where there is a number of sales and forward currency contracts in place to cover the sale/year end foreign currency balance

Company A whose functional currency (but also sells goods in FC) is CU sold good’s to a number of foreign customers on credit for FC13,000 from 1 October to 31 December. As a forward contract was in place the company recognised the sale at the average forward contract rate to cover the sale based on the forward contracts in place for the month in which the money is to be received. At 31 December the Company had total FC contracts in place to cover the net receivable balance, the total open forward contracts at year end was FC13,000.

The company has the following monetary assets and liabilities at the year end date as stated in the respective ledgers:

FC amount @ mth end CU amount at month end as per ledgers

Trade debtors 15,000 18,500

Trade creditors (3,000) (3,600)

Accruals (1,000) (1,300)

Net amount 11,000 13,600

Assume the average forward currency contract rate to cover the exposure of the net FC11,000 is CU1=FC0.87 (note this is merely obtained by taking the total open forward currency contracts of CU13,000 and using the first CU11,000 of these contracts to cover the net foreign currency exposure.

The adjustment required at the year end date is as follows:

FC amount @ mth end CU amount at month end as required at the forward average rate

Trade debtors 15,000 17,241

Trade creditors (3,000) (3,448)

Accruals (1,000) (1,149)

Net amount 11,000 12,644

Amount carried at the year end as per ledger before adjustment = CU13,600

Amount to be retranslated to so as to show at forward rate = CU12,646 (FC11,000 / 0.87)

Adjustment required CU956

The journal required at the year end date for the unsettled amounts is:

|

|

CU |

CU |

|

Dr FX loss in P&L |

956 |

|

|

Cr Accruals |

|

956 |

Being journal to recognise the foreign currency balances at the forward contract rate (note not posted directly to each category instead go either to prepaids or accruals depending on whether it is a debit or credit balance.)

Definition of non-monetary items

Section 25 does not define non-monetary items instead they are taken to be the opposite of monetary items. In effect the essential feature of a non-monetary items is the absence of a right to receive (or an obligation to deliver) a fixed or determinable number of units of currency. Examples of non-monetary items include:

- Deferred income

- Warranty where cash refund not provided

- Prepaids for goods or services (e.g. prepaid rent, maintenance services, progress payments on assets which are non-refundable)

- Property, plant and equipment

- Provisions that are settled by non-monetary assets

- Investment in equity instruments as determined by Section 17

- Inventories

- Intangible assets

- Advances paid on purchases (if linked to specific purchases)

- Advances received on sales (if linked to specific sales)

- Equity shares issued or other equity capital of the company

Non-monetary assets not fair valued

Section 25 states that all non-monetary assets should be retranslated at the exchange rate on the date of the transaction unless:

- The transaction has an agreed contracted rate from the outset in which case that rate must be utilised; or

- Where a forward foreign currency contract exists to cover the transaction, then the forward contract rate in which case that rate must be utilised.

How one determines the date of the transaction has been discussed further above.

The non-monetary item is then carried at that amount (i.e. the amount recognised initially) for the duration of its life. There is no retranslation of the item at each reporting date. Where such an asset is impaired, the recoverable amount is translated at the exchange rate applicable at the date when the value is determined. Comparing the previous historic cost with the new revalued recoverable amount may not result in an impairment as the historic amount may still be higher.

Example 12: Retranslation of non-monetary asset assuming there is no contract rate of any kind to cover the purchase

Company A whose functional currency is CU purchased a fixed asset from a foreign supplier on credit for FC10,000 on 1 October when the exchange rate was CU1=FC0.80p. Company A’s year end is 31 December. The invoice was not paid by the year end date and exchange rate was CU1=FC0.85p. The invoice was paid on 30 January of the following year when the exchange rate was CU1=FC0.90p. The accounting treatment of this transaction is:

At date of transaction

|

|

CU |

CU |

|

Dr PPE (FC10,000/.80p) |

12,500 |

|

|

Cr Accounts Payable |

|

12,500 |

Being journal to recognise the purchase at the transaction date

At year end date

No foreign exchange adjustment is made as the asset is carried at the rate determined at the date of the transaction. It is not revalued to the year end rate. The creditor balance is retranslated at year end spot rate with the other side of the transaction hitting the profit and loss as per the journal below:

|

|

CU |

CU |

|

Dr Trade Creditors |

735 |

|

|

Cr Unrealised Foreign Exchange Gain in P&L |

|

735* |

Being journal to recognise the unrealised foreign exchange loss for the movement in rate to year end

*the amount to be recognised as a foreign exchange loss is determined to be the difference between the amount recognised at the date of transaction of CU12,500 less the year end carrying amount using the year end spot rate of CU11,765 (i.e. FC10,000/.85)= CU735

At payment date

|

|

CU |

CU |

|

Dr Accounts Payable (being carrying amount at 31 December) |

11,765 |

|

|

Cr Bank (FC10,000/0.90p) |

|

11,111 |

|

Cr Foreign Exchange Gain in P&L |

|

654 |

Being journal to reflect foreign exchange gain on payment

Example 13: Retranslation of non-monetary asset assuming there is a contracted rate in the contract

Company A whose functional currency is CU purchased a fixed asset from a foreign supplier on credit for FC10,000 on 1 October when the exchange rate was CU1=FC0.80p. The rate included in the purchase contract with regard to the amount to be paid was CU1=FC0.75. Company A’s year end is 31 December. The invoice was not paid by the year end date and exchange rate was CU1=FC0.85p. The invoice was paid on 30 January of the following year when the exchange rate was CU1=FC0.90p. The accounting treatment of this transaction is:

At date of transaction

|

|

CU |

CU |

|

Dr PPE (FC10,000/.75p) |

13,333 |

|

|

Cr Accounts Payable |

|

13,333 |

Being journal to recognise the purchase at the transaction date

At year end date

No foreign exchange adjustment is made as the asset is carried at the rate determined at the date of the transaction. It is not revalued to the year end rate. The creditor balance is also not retranslated at year end spot rate as there is a set contract rate in place hence no FX gain or loss hits the profit or loss account.

At payment date

|

|

CU |

CU |

|

Dr Accounts Payable (being carrying amount at 31 December) |

13,333 |

|

|

Cr Bank (FC10,000/0.75p being the contracted rate) |

|

13,333 |

Being journal to reflect payment and no FX gain/loss as amount paid is equal to amount it was originally booked in at.

If a forward foreign currency contract existed in this situation as opposed to the rate being included specifically in the contract, the solution will be the same as this one.

Example 14: Retranslation of non-monetary asset – impairment of asset

Take example 8 above and assume an impairment review has been carried out on this asset at the end of year 1. The recoverable amount of the asset is determined to be FC7,000 retranslated to CU at the date of the impairment was CU9,333 (FX rate CU1=FC.75). The carrying amount at the same date in the balance sheet is CU8,000. As the recoverable amount is still in excess of the carrying amount no impairment is required.

Guidance on retranslating foreign branches which are deemed to have a different functional currency to the main company (note if the functional currency of the branch is the same then the rules stated above apply)

The below illustrates how a foreign branch results that is deemed to have a different functional currency to the main company should be retranslated into order to prepare financial statements for the company as a whole. See the beginning of the section for determining whether the branch has a different functional currency. If the functional currency is the same then the below would not be applicable instead the guidance mentioned above would be applicable.

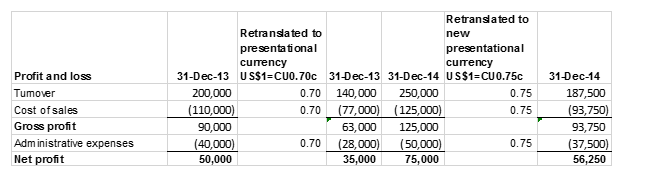

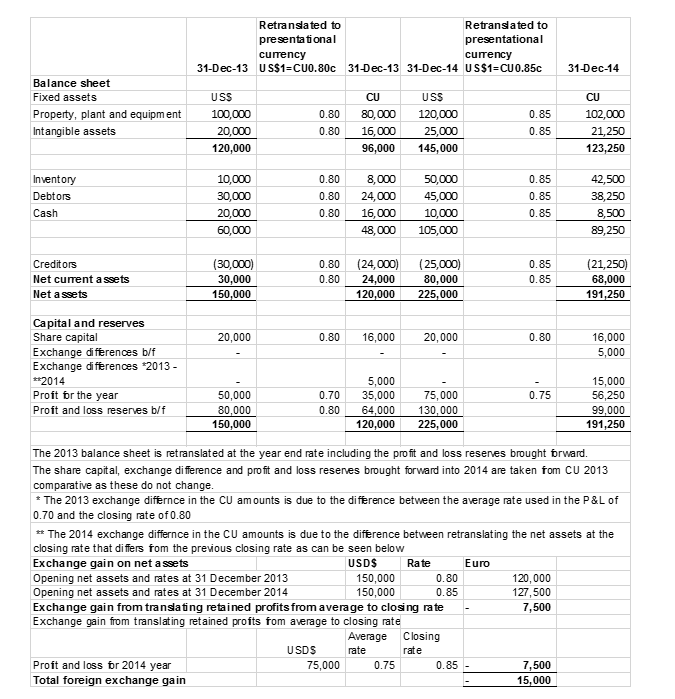

Example 15: Conversion of a branch with the different functional currency that the company itself

Company A has a functional currency of CU. It has a US branch, Branch B. The spot rate at 31 December 2013 and 31 December 2014 was US$1=CU0.80c and US$1=CU0.85c. The average rate for the 31 December 2014 and 31 December 2013 year end is US$1=CU0.75c and US$1=CU0.70c respectively.

See below the work required to retranslate Branch B’s financial statements from the functional currency of US$ to the functional currency of the company as a whole of CU.

Once the above exercise is done it is then added to the results of the main balance of the company where the functional currency is already in CU.

Transition exemptions

Section 28 provides no transition exemptions on adoption of Section 25. Therefore any difference between old GAAP/FRSSE/FRS 102 and Section 25 have to be applied retrospectively.

Principal transition adjustments

- Use of contracted forward rates required to be utilised under FRS 105 (Applicable for entities transitioning from FRSSE, old GAAP and FRS 102 to FRS 105)

Old GAAP (SSAP 20) and FRSSE (Section 13) gave entities a choice where an entity held forward foreign currency contracts to cover the foreign currency transaction to either recognise:

- the transaction on the transaction date at the spot rate on that date or at the forward contract currency rate.

- The unsettled balances at the period end spot rate or the average forward contract rate to cover the net foreign exchange exposure.

FRS 102 requires all foreign currency transactions to be measured at the spot rate at the date of the transaction and the unsettled foreign currency balance at period end at the spot rate. The foreign currency could not use a forward rate or contract rate. Instead any forward foreign currency contracts had to be fair valued.

FRS 105 on the other hand requires where a forward currency contract exists to initially recognise the transaction at the forward contract rate or the contract rate included in the contract where one exists. There is no choice here, the spot rate cannot be utilised.

Given the difference between the GAAP’s an adjustment will be required on transition from FRSSE/old GAAP /FRSSE to FRS 105 in cases where the entity has forward currency contracts in place to match the sale and cover the unsettled foreign currency balance at period end and the entity did not use the forward contract rate under old GAAP to recognise the foreign currency transactions, instead it used the spot rates. In such cases an adjustment will be required for the following:

- to restate the foreign currency contracts in the P&L from the spot rate on the date to the forward rate (this will likely be a reclassification adjustment from sales and operating expenses);

- to restate the foreign currency balances from the year end spot rate to the average forward foreign exchange contract to cover the net foreign currency exposure;

- to derecognise the fair value of the forward foreign currency contract (the derivative) recognised under FRS 26 from the balance sheet. NOTE THIS IS ONLY APPLICABLE TO FRS 26 ADOPTERS. NOT THAT LIKELY FOR SMALL ENTITES.

Given the differences between FRS 105 and FRS 102 adjustments will be required if the entity has foreign currency transactions where there is a matching forward currency contract in place or where there is a contracted rate as per the contract. In such cases an adjustment will be required for the following:

- to restate the foreign currency contracts in the P&L from the spot rate on the date to the forward rate (this will likely be a reclassification adjustment from sales, and operating expenses);

- to restate the foreign currency balances from the year end spot rate to the average forward foreign exchange contract to cover the net foreign currency exposure;

- to derecognise the fair value of the forward foreign currency contract (the derivative) recognised under FRS 102 from the balance sheet.

Example 16: Restatement from spot rate to contracted rate under FRS 105 (Applicable for entities transitioning from FRSSE, old GAAP and FRS 102 to FRS 105 where forward foreign currency contracts are in place)

Company A entered into forward foreign currency contracts in relation to its foreign currency sales. Company A recognised these sales at the spot rate on the date of sale as opposed to the forward contract rate and retranslated any unsettled debtor balances at the year end spot rate (required by FRS 102 and a choice to do this under FRSSE/old GAAP). The sales figure had the sales been recognised at the matching forward contract rate would have been CU30,000 higher and the corresponding operating expense/FC gain/loss figure CU30,000 lower.

The carrying amount of the trade debtors at the below dates were:

|

|

31/12/14 |

31/12/15 |

|

Debtors in Foreign Currency |

FC100,000 |

FC50,000 |

|

Cash in Foreign Currency |

FC70,000 |

FC80,000 |

|

Year-end Spot Rate |

CU1=FC0.75p |

CU1=FC0.82p |

|

Average Forward Rate to cover net foreign currency exposure |

CU1=FC0.80p |

CU1=FC0.79235 |

|

Debtors as Stated in Balance Sheet |

133,333 |

60,975 |

|

Cash as Stated in Balance Sheet |

93,333 |

97,561 |

FRS 105 requires such companies to recognise the sale at the forward contract rate where the sales are matched with this and recognise the unsettled debtors at the forward contract rate.

The following adjustments would be required:

On 1 January 2015

The carrying amount at 1 January using the year end forward contract rate to cover the exposure as required by FRS 105 should have been:

Debtors – FC100,000/0.80p i.e. year end rate= CU125,000

Cash – FC70,000/0.80p i.e. year end rate= CU87,500

|

|

Debtors |

Cash |

|

Carry Amount at average forward rate |

CU125,000 |

CU87,500 |

|

Carrying Amount per the Balance Sheet |

CU133,333 |

CU93,333 |

|

Difference – FX loss |

CU8,333 |

CU5,833 |

Journals required

|

|

CU |

CU |

|

Dr Profit and Loss Reserves for Foreign Exchange Gain |

14,166 |

|

|

Cr Debtors |

|

8,333 |

|

Cr Cash |

|

5,833 |

Being journal to reflect adjustment required to show foreign currency balances at average forward currency rate

|

|

CU |

CU |

|

Dr Corporation Tax in Balance Sheet (CU14,166*10%) |

1,417 |

|

|

Cr Profit and Loss Reserves for Corporation Tax |

|

1,417 |

Being journal to reflect corporation tax on the adjustment to reflect tax refundable to be claimed on this in the future and show correct corporation tax charge under FRS 105

Journals required at 31 December 2015 assuming the above journals are posted to balance sheet and P&L reserves

The carrying amount at 31 December 2015 using the year end forward contract rate should have been:

Debtors – FC50,000/0.82p i.e. year end rate= CU63,103

Cash – FC80,000/0.82p i.e. year end rate= CU102,564

|

|

Debtors |

Cash |

|

Carry Amount at average forward rate |

CU63,103 |

CU102,564 |

|

Carrying Amount per the Balance Sheet |

CU60,975 |

CU97,561 |

|

Difference – FX gain |

CU2,128 |

CU5,003 |

|

Journals required |

CU |

CU |

|

|

|

|

|

Dr Debtors |

2,128 |

|

|

Dr Cash |

5,003 |

|

|

Cr Foreign Exchange Loss in P&L |

|

7,131 |

Being journal to reflect adjustment required to show foreign currency balances at forward contract rate

|

|

CU |

CU |

|

Dr Corporation Tax in P&L |

713 |

|

|

Cr Corporation Tax in Balance Sheet (CU7,131*10%) |

|

713 |

Being journal to reflect Corporation tax on the adjustment to reflect the fact that a tax deduction was claimed on this in the prior year and therefore this will be taxable over the next 5 years under the tax transitional arrangements. It ensure the correct corporation tax charge is shown under FRS 105 as if it applied from inception.

|

|

CU |

CU |

|

Dr Operating expenses |

30,000 |

|

|

Cr Sales in P&L |

|

30,000 |

Being journal to restate the sales to the matching forward contract rates as required under FRS 105

The journals posted for the 1 January 2015 will also have to be reversed into the profit and loss account as we have assumed these were posted in 31 December 2015 so as to show the correct opening reserves:

|

|

CU |

CU |

|

|

|

|

|

Dr Debtors |

8,333 |

|

|

Dr Cash |

5,833 |

|

|

Cr Foreign Exchange Gain in P&L |

|

14,166 |

Being journal to reflect reversal of prior year FX adjustment

|

|

CU |

CU |

|

Dr Corporation Tax in P&L |

1,417 |

|

|

Cr Corporation Tax in Balance Sheet (CU14,166*10%) |

|

1,417 |

Being journal to reflect reversal of prior year Corporation tax on the adjustment above

Journals required in the year ended 31 December 2016 year end assuming the above journals are posted to reserves etc

|

|

CU |

CU |

|

Cr FX gain in P&L |

7,131 |

|

|

Dr Debtors |

|

2,128 |

|

Dr Cash |

|

5,003 |

Being journal to reverse the 2015 journals on the forward contract was closed out in the year.

|

|

CU |

CU |

|

Dr Corporation Tax in Balance Sheet |

143 |

|

|

(713/5 years) |

|

|

|

Cr Corporation Tax P&L |

|

143 |

Being journals to reflect the 1/5th release of the Corporation tax liability recognised in 2015 to reflect the fact that 1/5th of the amount will be taxed i.e. CU1,426*10% (CU7,131/5 years) in the 2016 tax computation in line with the tax transition guidelines. Note this assumes that the tax journal posted will include the transition tax adjustment for the CU143 when it is finally recognised. If there was no corporation tax in 2016, then the CU143 would still be released as a credit to the P&L as it would be no longer payable to the tax authorities. As no deferred tax can be recognised under FRS 105 it cannot be held as a deferred tax liability on the balance sheet as a timing difference. The remaining CU570 (CU713-CU143) will still be included as a liability at the year end in the corporation tax nominal and released over the remaining 4 periods.

Assuming the 2016 TB is prepared under GAAP similar journals will be required to be posted in 2016.

For entities that applied FRS 102 prior to the transition to FRS 105 using this example a journal would also be required to derecognise the fair value of the derivative i.e. the forward foreign exchange contract from the balance sheet.

2) Derivatives recognised at fair value under FRS 102 – not permitted under FRS 105 (difference only applicable to FRS 102 adopters entities that previously applied FRS 26)

Under Section 9 of FRS 105 derivatives must be carried at cost less impairment and released to the P&L over the life of the contract. They cannot be fair valued. This was the same treatment as was required under FRSSE and for non FRS 26 old GAAP entities.

FRS 102 and FRS 26 of old GAAP on the other hand required that such derivatives be fair valued. Therefore where a company had previously carried these at fair value under FRS 102/FRS 26 they will need to be derecognised under FRS 105.

Where hedge accounting was adopted any deferred tax recognised would have to be derecognised as part of the overall derecognition of deferred tax. Where the fair value was recognised in the P&L as opposed to OCI then there will be corporation tax consequences. Any items which fall out for tax purposes will have to be taxed/tax deductible over a 5 year period from year ended 31 December 2016 on (this relates to the net adjustment at the end of the comparative year). The corporation tax is adjusted such that the correct balance is shown in the balance sheet and P&L as it would have been had FRS 105 applied from inception.

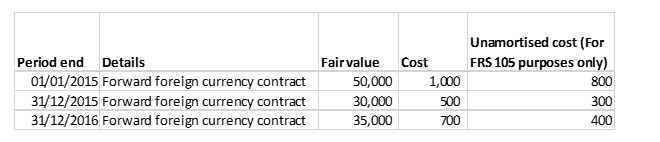

Example 17: Derecognition of derivatives

Company A entered into a number of forward foreign currency contracts. Details of the contracts including costs and fair values open at each period end were as follows:

As FRS 105 does not permit fair valuing of derivatives an adjustment is required on transition to restate it to unamortised cost. FRS 105 does require disclosure of these forward contracts in the financial statements. Assume the corporation tax rate is 10% and hedge accounting was not applied under FRS 102.

Assume the corporation tax rate is 10% and that the net transition adjustment at the end of the comparative year is taxable over a 5 year period.

The journals required on transition are:

On 1 January 2015

|

|

CU |

CU |

|

Dr P&L reserves |

44,280 |

|

|

Dr Corporation tax on balance sheet (49,200*10%) |

4,920 |

|

|

Cr Derivatives (CU50,000-CU800) |

|

49,200 |

Being journal to derecognise the fair value and restate to balance required under FRS105

In the year ended 31 December 2015:

|

|

CU |

CU |

|

Dr P&L reserves (CU50,000-CU800) |

44,280 |

|

|

Dr Corporation tax on balance sheet (49,200*10%) |

4,920 |

|

|

Cr Derivatives |

|

49,200 |

Being journal to derecognise the fair value and restate to un-amortised cost at the date of transition

|

Dr Derivatives ((CU50,000-CU30,000)-(CU800-CU300)) |

19,500 |

|

|

Cr Admin expenses – 2015 – Movement in Fair value of derivatives |

|

19,500 |

|

Dr Corporation tax in P&L (CU19,500*10%) |

1,950 |

|

|

Cr Corporation tax in balance sheet |

|

1,950 |

Being journal to reverse fair value adjustment recognised under FRS 102 inc tax in 2015

In the year ended 31 December 2016:

|

|

CU |

CU |

|

Dr P&L reserves (CU50,000-CU800) |

44,280 |

|

|

Dr Corporation tax on balance sheet (49,200*10%) |

4,920 |

|

|

Cr Derivatives |

|

49,200 |

Being journal to derecognise the fair value and restate to un-amortised cost at the date of transition

|

Dr Derivatives ((CU50,000-CU30,000)-(CU800-CU300)) |

19,500 |

|

|

Cr P&L reserves – 2015 – Movement in Fair value of derivatives net of tax |

|

17,550 |

|

Cr Corporation tax in balance sheet |

|

1,950 |

Being journal to reverse fair value adjustment recognised under FRS 102 and tax impact in 2015

|

|

CU |

CU |

|

Dr Admin expenses – 2016 – Movement in Fair value of derivatives |

4,900 |

|

|

Cr Derivatives ((CU35,000-CU30,000)-(CU400-CU300)) |

|

4,900 |

Being journal to reverse fair value adjustment recognised under FRS 102 inc tax in 2016

|

Dr Corporation tax in balance sheet ((CU30,000-300)/5 yrs= CU5,940*10%) |

594 |

|

|

Cr Corporation tax in P&L |

|

594 |

Being journal to reflect the additional deduction for 1/5th of the derivative previously taxed up to 31/12/15 which will taxed again in the future when the contract matures under FRS 105. Note this assumes that the tax journal posted will include the transition tax adjustment for the CU594 when it is finally recognised. If there was no corporation tax in 2016, then the CU594 would still be released as a credit to the P&L as it would be no longer payable to the tax authorities. As no deferred tax can be recognised under FRS 105 it cannot be held as a deferred tax liability on the balance sheet as a timing difference. The remaining CU2,376 (CU2,970-CU594) will still be included as a liability at the year end in the corporation tax nominal and released over the remaining 4 yrs.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]