[et_pb_section admin_label=”Header – All Pages” global_module=”1221″ transparent_background=”off” background_color=”#1e73be” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” custom_padding=”||0px|”][et_pb_row global_parent=”1221″ admin_label=”row”][et_pb_column type=”4_4″][et_pb_post_title global_parent=”1221″ admin_label=”Post Title” title=”on” meta=”off” author=”on” date=”on” categories=”on” comments=”on” featured_image=”off” featured_placement=”below” parallax_effect=”on” parallax_method=”on” text_orientation=”left” text_color=”light” text_background=”off” text_bg_color=”rgba(255,255,255,0.9)” module_bg_color=”rgba(255,255,255,0)” title_all_caps=”off” use_border_color=”off” border_color=”#ffffff” border_style=”solid” title_font=”|on|||” title_font_size=”35″ custom_padding=”10px|||”] [/et_pb_post_title][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” global_module=”1228″ fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” custom_padding=”0px||0px|” padding_mobile=”on” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” gutter_width=”3″][et_pb_row global_parent=”1228″ admin_label=”Row” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” use_custom_gutter=”off” gutter_width=”3″ custom_padding=”0px||0px|” padding_mobile=”off” allow_player_pause=”off” parallax=”off” parallax_method=”off” make_equal=”off” parallax_1=”off” parallax_method_1=”off” column_padding_mobile=”on”][et_pb_column type=”4_4″][et_pb_text global_parent=”1228″ admin_label=”Text” background_layout=”light” text_orientation=”left” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [breadcrumb] [/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” fullwidth=”off” specialty=”off”][et_pb_row admin_label=”Row”][et_pb_column type=”1_2″][et_pb_text admin_label=”Return to 105 Index” background_layout=”light” text_orientation=”center” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [button link=”https://ie.frs102.com/members/premium-toolkit/frs-105/” type=”big” color=”red”] Return to FRS 105 Main Menu[/button] [/et_pb_text][/et_pb_column][et_pb_column type=”1_2″][et_pb_text admin_label=”Return to Section 18 Home” background_layout=”light” text_orientation=”center” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [button link=”https://ie.frs102.com/members/premium-toolkit/frs-105/section-18/” type=”big” color=”red”] Return to Section 18 Home[/button] [/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” gutter_width=”3″][et_pb_row admin_label=”Row”][et_pb_column type=”4_4″][et_pb_text admin_label=”Main Body Text” background_layout=”light” text_orientation=”justified” use_border_color=”off” border_color=”#ffffff” border_style=”solid” module_id=” “]

Section 18 – Revenue

Section 18 deals with the recognition and measurement of revenue for the sale of goods (purchase for resale or produced), rendering of services, provision of construction contracts, interest, royalties and dividends. It also details the disclosure requirements for these revenues.

Scope

Extract from FRS 105 – Section 18.1 – 18.2

18.1 This section shall be applied in accounting for revenue arising from the following transactions and events:

a) the sale of goods (whether produced by the micro-entity for the purpose of sale or purchased for resale);

b) the rendering of services;

c) construction contracts in which the micro-entity is the contractor; and

c) the use by others of micro-entity assets yielding interest, royalties or

18.2 Revenue or other income arising from lease agreements is dealt with in Section 15 Leases.

Revenue – definition and basic requirements

OmniPro comment

Definition of revenue

Appendix 1 of FRS 105 defines revenue as the ‘gross inflow of economic benefits during the period arising in the course of the ordinary activities of the entity when those inflows result in increases in equity, other than increases relating to contributions from equity participants’.

From the above definition it is evident that an item will only be shown as revenue where it is incurred in the ordinary course of business. As an example, a short-term car hire company who rents cars to customers and at the end of the cars life disposes of these cars. These cars would be classed as property, plant and equipment in the company’s financial statements. In this case the items that are sold in the ordinary course of business is the provision of car services in return for a fee. Therefore the fee charged to customer for the provision of the car would be recorded as revenue. However, on the sale of the vehicle the proceeds from the sale would not be shown in revenue instead this would be posted below the revenue line to be shown as a profit/loss on disposal. The sale of the vehicles is not the trade of the company. If in this example, the company also sold second hand cars, then it is possible for the sale of the car to be shown in revenue as the sale of cars is also a business which the company is engaged in.

Revenue within the scope of Section 18 shall only be recognised, at a minimum, when all of the following criteria:

- Revenue can be measured reliably; and

- It is probable that the economic benefits associated with the transaction can flow to the entity.

Note the above is the minimum requirements, additional requirements apply to the sale of goods and rendering of services. These are discussed further below.

Probable here is defined as ‘more likely than not’ in Appendix I of FRS 105. Until the probable threshold has been past no revenue can be recognised. Note where at the time of sale where credit is provided by the entity, the likelihood of receiving payment was probable and subsequently after issuing the invoice it now looks like there is doubt about receiving all or some of the sale recognised, the provision booked against the receivable balance should be posted to expenses in the profit and loss and should not be debited against sales. See example 1

Example 1: Probable or possible criteria on sale

Company A sold goods to customer B regularly on 2 months credit. There was no history of non payment in the past. On 1 February due to financial difficulties customer B contacted Company A and all its creditors to enter into an arrangement to restructure its debts. On 4 February Company A ships a product to Customer B which was ordered in January. For this sale, the revenue should not be recognised until the money is received from Customer B as it is not probable that it will be paid for.

For the balance outstanding on the trade debtors listing in relation to sales made pre 1 February any provision required should be posted as a debit to expenses in the profit and loss account as opposed to a debit to revenue.

The reliable measurement should be very straight forward for a sale of goods as they would be sold at an agreed sales price. However, issues may arise in relation to measuring services or construction activities reliably as there is more judgement involved.

Measurement of revenue

Extract from FRS 105 – Section 18.3 – 18.4

18.3 A micro-entity shall measure revenue at the amount receivable, taking into account any trade discounts, prompt settlement discounts and volume rebates allowed by the micro- entity.

18.4 A micro-entity shall include in revenue only the gross inflows of economic benefits received and receivable by the micro-entity on its own account. A micro-entity shall exclude from revenue all amounts collected on behalf of third parties such as sales taxes, goods and services taxes and value added taxes. In an agency relationship, a micro-entity (the agent) shall include in revenue only the amount of its commission. The amounts collected on behalf of the principal are not revenue of the micro-entity

OmniPro comment

Sales incentives/rebates/settlement

As detailed in Section 18.3 above, revenue should be measured at the fair value of the consideration received or receivable which is the total sales value less any discounts and rebates given to the customer, less any sales taxes which has to be paid over to a third party. Usually the fair value will be the invoiced value however there may be instances where discounts and rebates are provided after the sale is recognised based on volumes sold to the customer or early settlements.

In relation to sales incentives provided to customers when entering into a contract, these are usually treated as rebates and will be deducted from revenue on initial recognition. See example 2 and 3 below

Example 2: Sales incentives/rebates

Company A provides to customer’s sales incentives to purchase its goods as follows. Where sales for the year are:

CU0-CU50,000 a sales rebate of 0% is applied

CU50,000-CU75,000 a sales rebate of 2% is applied

>CU75,000 a sales rebate of 5% is applied

The listed sales price for Company A product is CU100 plus VAT of CU23. Company A sells goods to customer B. In the past Customer B has always purchased between CU50,000-CU75,000 from Company A and it is probable a similar level will be purchased from Company A for the coming year. When recognising the sale on delivery to the customer the expected rebate to be issued at the end of the year should be incorporated. The journal to be posted on recognition is:

|

|

CU |

CU |

|

Dr Debtors |

123 |

|

|

Cr Revenue |

|

100 |

|

Cr VAT Liability |

|

23 |

Being journal to recognise the sale

|

|

CU |

CU |

|

Dr Revenue (CU100 * 2% being the most probable rate that will be achieved) |

2 |

|

|

Cr Rebate Accrual |

|

2 |

Being journal to reflect estimated rebate payable to the customer based on current sales

If during the year, it looks like the total sales will exceed CU75,000 then the higher rebate of 5% should be applied so a catch up charge on the rebate should be posted to sales to increase the rebate of 2% previously recognised on sales prior to that date to 5%.

Example 3: Early settlements

Company A sells goods on credit to customers. It gives customers a 5% settlement discount if the invoices are paid within 7 days. From past experience 30% of customers take up this option. If we assume sales for the month were CU100,000 which occur at month end, the total revenue to be recognised should be:

CU100,000 * (30%* 5%) = CU1,500. Hence the journal required is to Cr settlement discount accrual and Dr revenue

Principal versus agent

Section 18.4 deals with the revenue recognition for a company acting as principal or agent.

‘An entity is acting as an agent when it does not have the exposure to the significant risks and rewards associated with the sale of goods or the rendering of services. One feature indicating that an entity is acting as an agent is that the amount the entity earns is predetermined, being either a fixed fee per transaction or a stated percentage of the amount billed to the customer’ (Appendix I FRS 105).

‘An entity is acting as a principal when it has exposure to the significant risks and rewards associated with the sale of goods or the rendering of services. Features that indicate that an entity is acting as a principal include:

- the entity has the primary responsibility for providing the goods or services to the customer or for fulfilling the order, for example by being responsible for the acceptability of the products or services ordered or purchased by the customer;

- the entity has inventory risk before or after the customer order, during shipping or on return;

- the entity has latitude in establishing prices, either directly or indirectly, for example by providing additional goods or services; and

- the entity bears the customer’s credit risk for the amount receivable from the customer.’ (FRS 105 Appendix I).

Example 4: Principal vs Agent

Company A purchases goods from Company B as part of a distribution agreement. The distribution agreement states that:

- Company A takes the inventory into its warehouse and transports and invoices the goods to the final customer but also packages these

- Where Company A has excess stock it can be returned to Company B without any penalty

- Company A is responsible for insuring the goods while in inventory however obsolete stock can be returned

- Company A has no right in determining the selling price, this is dictated by Company B. The mark up included in the sales price by Company A is dictated by Company B – markup is set at 50% of the sales price.

- In the event of default in payment by the customer after all avenues have been exhausted Company B bears the risk of bad debts

During the month Company A sold CU100,000 of the products. The company purchased CU80,000 in stock from Company B which existed at year end.

Based on the evidence available, Company A is acting as agent as it has no say in determining the selling price, bears no inventory risk nor credit risk. Company A would therefore only recognise the net amount as revenue (i.e. the sales price less the cost of purchase of the goods). Company B is the principal and should not recognise any revenue until the Company A sells the goods on to the final customer, it should continue to carry these in stock as it is akin to a consignment stock agreement. The journals required in the month for Company A are:

|

|

CU |

CU |

|

Dr Debtors |

33,333 |

|

|

Cr Revenue (CU100,000 being the sales price less CU66,667 being the purchase price as Company A earns a 50% mark-up) |

|

33,333 |

Being journal to recognise the net commission earned on the sale

The journals required in the month for Company B are:

|

|

CU |

CU |

|

Dr Debtors |

100,000 |

|

|

Cr Revenue |

|

100,000 |

Being journal to reflect the amounts owed from Company A. Note the inventory of CU53,333 (CU80,000- mark up of CU26,667) is kept in the books of Company B as this inventory is still under the control of Company B.

If in the above example, Company A held the inventory risk in full or could determine the selling price this would usually indicate that it is acting as principal and Company A would then show inventory on the balance sheet and the gross revenue in the revenue line and the cost of the products in cost of sales.

Example 5: Principal vs agent

Company A is a retailer that deals in cash so there is no credit risk. The company sells the following products:

Classification

Mobile phone e-top up’s which are printed from a machine as required. Agent

Stamps (bought in bulk by the retailer and bears the risk if they are

not sold) Principal

National lottery tickets which are printed from a machine as required Agent

Scratch cards (bought in bulk by the retailer and bears the risk if

they are not sold) Principal

As can be seen where the retailer sells items which are sold in electronic form the seller is acting as an agent as it bear no risk i.e. it does not need to hold inventory of the items and there is no risk of obsolescence, it bears no credit risk as cash is received when sold. In these instances, the sales commission received should be recognised as turnover.

Where there is a tangible product and where the retailer is required to hold stock and bears the risk of loss if these are damaged or stolen then they are acting as a principal. Therefore the gross sales should be recognised in revenue and the cost of the products shown in cost of sales.

Deferred payment

Extract from FRS 105 – Section 18.5

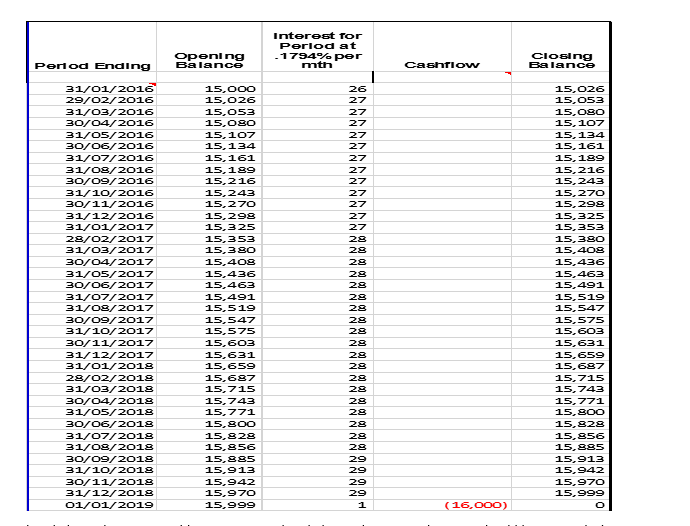

18.5 If payment is deferred beyond normal credit terms, the amount of revenue recognised is equal to the cash price available on the transaction date. Any excess of the deferred payment amount over the cash price available on the transaction date is recognised as interest and accounted for in accordance with paragraph 9.14(a).

OmniPro comment

See below illustration of Section 18.5 in the examples below.

Example 6: Sales on deferred credit terms

A micro-entity sells goods to a customer for CU100. Customers are usually required to pay within 14 days of the invoice date, but the micro-entity agrees with the customer that payment will be deferred for one year. The micro-entity sells the same item for CU90, if payment is received within the usual credit terms.

The cash price for the goods and thereby the transaction price is CU90. Assume the credit term is over three months and the sale occurred at the start of the month.

The journals required at initial recognition and subsequently are:

|

|

CU |

CU |

|

Dr Debtors |

90 |

|

|

Cr Turnover |

|

90 |

Being journal to recognise the sale at the cash price

|

|

CU |

CU |

|

|

Dr Debtors (CU100-CU90)/2mth*1mth |

5 |

|

|

|

Cr Interest Income |

5 |

||

Being journal to release the interest income for month 1 so that the trade debtor balance increases to CU95 at the end of month one.

Example 7: Sale with unusual credit terms – cash price not easily determined

Company A sold goods worth CU200,000 with unusual credit terms on 01/01/16. The credit provided is for a period up to 31/12/21. Assume the cash price could not be easily determined easily. In order to ascertain the cash price the company would present value the CU200,000 at a market rate of interest for loan of the same length. Assume for the purposes of this example that market rate of interest is 5%.

The present value is CU200,000 / (1.05)^5 = CU156,705

|

|

CU |

CU |

|

Dr Debtors |

156,705 |

|

|

Cr Turnover |

|

156,705 |

Being journal to recognise the sale at the estimated cash price

|

|

CU |

CU |

|

Dr Debtors (CU200,000-CU156,705)/ 5 yrs |

8,659 |

|

|

Cr Interest Income |

|

8,659 |

Being journal to release the interest income for year 1

|

CU |

CU |

|

|

Dr Debtors (CU200,000-CU156,705)/ 5 yrs |

8,659 |

|

|

Cr Interest Income |

|

8,659 |

Being journal to release the interest income for year 2

Note the same type of journal will be recognised for years 3-5 so that the debtor balance is CU200,000 at the date of receipt

Exchanges of goods or services

Extract from FRS 105 – Section 18.6-18.7

18.6 A micro-entity shall not recognise revenue:

(a) when goods or services are exchanged for goods or services that are of a similar nature and value; or

(b) when goods or services are exchanged for dissimilar goods or services but the transaction lacks commercial substance.

18.7 A micro-entity shall recognise revenue when goods are sold or services are exchanged for dissimilar goods or services in a transaction that has commercial substance. In that case, the micro-entity shall measure the transaction:

(a) at the fair value of the goods or services received, adjusted by the amount of any cash transferred;

(b) if the amount under (a) cannot be measured reliably, then at the fair value of the goods or services given up adjusted by the amount of any cash transferred; or

(c) if the fair value of neither the goods or services received nor the goods or services given up can be measured reliably, then at the carrying amount of the goods or services given up adjusted by the amount of any cash transferred.

OmniPro comment

Transactions of the above nature is unusual in practice.

Example 7A: Exchange of goods

Company A sold goods worth CU10,000 in return for the customer transferring ownership in a motor vehicle worth the same value. In this situation revenue should be recognised for CU10,000. The journal would be to debit PPE CU10,000 and credit revenue.

Example 7B: Exchange of goods

If we assume in example 7a that the fair value of the vehicle was CU9,000. The same journals would be to debit PPE with CU9,000 and credit Revenue CU9,000.

Identification of the revenue transaction

Extract from FRS 105 – Section 18.8

18.8 A micro-entity shall apply the recognition criteria to the separately identifiable components of a single transaction when necessary to reflect the substance of the transaction. For example, a micro-entity applies the recognition criteria to the separately identifiable components of a single transaction when the selling price of a product includes an identifiable amount for subsequent servicing. Conversely, a micro- entity applies the recognition criteria to two or more transactions together when they are linked in such a way that the commercial effect cannot be understood without reference to the series of transactions as a whole.

OmniPro comment

The revenue recognition criteria should be applied to each separable component of a single transaction. Each sale must be analysed to assess if elements within the sale can be segregated such that the fair value of the consideration received is split accordingly.

In assessing whether there are separately identifiable components, an entity should consider whether it has in the past sold the individual components separately or plans to do so in the future. However, even if this is not the case, they may also be deemed to be separate components if sold separately in the market place. The example would be where a product included an amount for subsequent servicing, then the entity would apply the revenue recognition criteria to the separable identified components i.e. sale of the product and sale of the servicing element.

Where two or more transactions are linked in such a way that the commercial effect cannot be understood without reference to the transaction as a whole, then the recognition would apply to the transaction as a whole.

In applying the above guidance it should be considered from the point of view of the supplier as opposed to the point of view of the buyer as to the thinking of what the buyer believes they are purchasing i.e. does the customer think they are purchasing a number of different components or just one component.

When assessing this under old GAAP, FRS 5 (FRSSE-Section 4) required concentration on the meaning of operating independently. Operating independently meant that each component represents a separate good or service that can be provided to customers, either as a stand-alone basis or as an optional extra.

Where separate components exist the total consideration receivable should be separated on a relative fair value basis. Note Section 18 does not mandate the use of the relative fair value method so judgement can be used however it is usually considered to be the most appropriate method. Other methods include cost plus a reasonable margin and the residual value. Entities should use which ever method is most appropriate but should apply that method consistently.

Example 8: Identifying separable components and allocating relative fair value

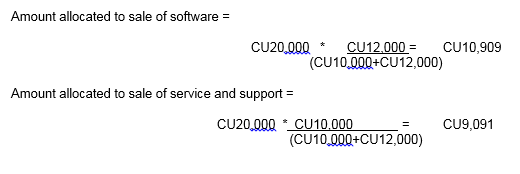

Company A is engaged in the business of both selling software and providing service and support. Company A sells these bundled together or can sell them separately. Company A sold the software and the service and support as a bundled product to a customer for CU20,000. The fair value is the software was sold separately is CU12,000 and the fair value of the servicing and support if sold separately is CU10,000.

As these two types of sales have differing points for recognition of revenue, and given that they are sold independently, means that the sales price of CU20,000 should be allocated between the two components. The price for each component should be determined on a relative fair value basis as follows:

The initial sale would be journaled as follows:

|

|

CU |

CU |

|

Dr Trade Debtors |

20,000 |

|

|

Cr Software Revenue |

|

10,909 |

|

Cr Service and Support Revenue |

|

9,091 |

As the transfer of the software/cd to the customer is when the risks and rewards of ownership pass, the condition for recognition would be met. However as service and support is only recognised over the life of the support contract, the sale should be deferred and released over the life of the support contract assuming work is carried out evenly throughout that period.

Therefore the journal required would be to:

|

|

CU |

CU |

|

Dr Service and Support Revenue |

9,091 |

|

|

Cr Deferred Income |

|

9,091 |

Note if in the example above the fair value of both of the offerings came to exactly CU20,000 then obviously the relative fair value formula would not need to be utilised. In the example above on the recognition of the software element, the cost of sale would be recognised for the software product.

As the cost for the servicing are expensed as incurred it will be met by the release of the deferred income element over the life of the service contract.

Example 9: Identifying separable components and allocating relative fair value – goods

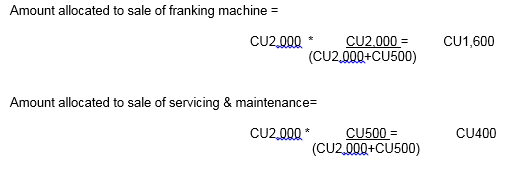

Company A sells franking machines but also provides a service for servicing and maintenance, which can be purchased separately but where a customer purchases these together they get a discount. The cost of purchasing a franking machine on its own is CU2,000 and for purchasing a service and maintenance contract is CU500. Where both are purchased together, the customer is charged CU2,000. Assume a customer has purchased both for CU2,000.

To recognise this sale, the relative fair values will need to be determined.

Amount allocated to sale of franking machine =

The initial sale would be journaled as follows:

|

|

CU |

CU |

|

Dr Trade Debtors |

2,000 |

|

|

Cr Goods Revenue |

|

1,600 |

|

Cr Service and Maintenance Revenue |

|

400 |

As the transfer of the machine to the customer is when the risks and rewards of ownership pass, the condition for recognition would be met. However as service and maintenance is only recognised over the life of the contract, the sale should be deferred and released over the life of the support contract assuming work is carried out evenly throughout that period.

Therefore the journal required would be to:

|

|

CU |

CU |

|

Dr Service and Maintenance Revenue |

400 |

|

|

Cr Deferred Income |

|

400 |

The cost of sale on the sale of the goods would be recognised at the same time as the recognition of the sale.

Where the method used results in a loss on either one of the separable components, then provision for the loss should be made and where appropriate a cost plus reasonable margin approach should be used.

Example 10: Relative fair value results in a loss

If we take example 9 and assume the cost of producing the franking machine is CU1,200 and the estimated cost of providing the service and maintenance support is CU450.

In this particular instance as a result of using relative fair value this has resulted in a loss of CU50 (CU450-CU400) being shown on the maintenance element. Initially the company should assess if this in fact is the economic reality and if it appears to be, then, the loss should be provided for. The journals to be posted are:

|

|

CU |

CU |

|

Dr Trade Debtor |

2,000 |

|

|

Cr Revenue – Goods |

|

1,600 |

|

Cr Deferred Income – Maintenance |

|

400 |

Being journal to reflect the sale and deferral of income for the maintenance contract

|

|

CU |

CU |

|

Dr Cost of Sales – Cost of Franking Machine |

1,200 |

|

|

Dr Cost of Sales – Loss on Maintenance Contract |

50 |

|

|

Cr Inventory |

|

1,200 |

|

Cr Accrual for Loss on Maintenance Contract |

|

50 |

Being journal to reflect cost of sale and provision for future loss

Example 11: Cost plus a reasonable margin

If the entity felt the loss in example 10 was not economic reality, then they could use another approach such as the cost plus a reasonable margin. Here the company would assess how the profit would be allocated as there is a profit overall on the contract of CU350 (CU2,000-CU1,200-CU450). Based on experience the company believe the profit should be split CU325 to the goods and CU25 to the service contract. In this case the journals would be:

|

|

CU |

CU |

|

Dr Trade Debtor |

2,000 |

|

|

Cr Revenue – Goods (cost of CU1,200 + CU325 profit) |

|

1,525 |

|

Cr Deferred Income – Maintenance (cost of 450 + CU25 profit) |

|

475 |

Being journal to reflect the sale and deferral of income for the maintenance contract

|

|

CU |

CU |

|

Dr Cost of Sales – Cost of Franking Machine |

1,200 |

|

|

Cr Inventory |

|

1,200 |

Being journal to reflect cost of sale on goods

A linked transaction is where an entity sells raw material parts to a manufacturer who carried out further work on these and where there is an agreement that the same entity will purchase the parts back from the manufacturer at a set price, then no sale should be recognised in the books as this transaction has no substance as the entity still holds the inventory risk and is obliged to buy it back from the manufacturer.

Customer loyalty awards

Section 18.8 does not specifically refer to loyalty awards, however this is dealt with in the appendix to Section 18 of FRS 105. In this appendix it is made clear that the credits awarded are a separable component of the sale and the fair value of that element should be deferred until the credit is redeemed. The fair value of the credits is the amount for which the award credits could be sold.

Where an entity has a history of the proportion of the population that are likely to redeem these points, this proportion can be utilised when deciding the amount to defer. However, where award credits are being issued for the first time, it may be more appropriate to defer the whole amount allocated for the fair value of those award schemes.

Therefore where determining the fair value of the award the following should be considered:

- The percentage of awards expected to be redeemed

- The normal selling price of the initial sale of goods or service when the loyalty award is not available; and

- The normal selling price for the goods or service for which the voucher is being redeemed.

Example 12: Customer loyalty awards (Extracted from FRS 105 – Section 18A.16-18A.17)

A micro-entity sells product A for CU100. Purchasers of product A get an award credit enabling them to buy product B for CU10. The normal selling price of product B is CU18. The entity estimates that 40 per cent of the purchasers of product A will use their award to buy product B at CU10. The normal selling price of product A, after taking into account discounts that are usually offered but that are not available during this promotion, is CU95.

The fair value of the award credit is 40% * [CU18 – CU10] = CU3.20. The entity allocates the total revenue of CU100 between product A and the award credit by reference to their relative fair values of CU95 and CU3.20 respectively. Therefore:

(a) Revenue for product A is CU100 * [CU95 / (CU95 + CU3.20)] = CU96.74

(b) Revenue for product B is CU100 * [CU3.20 / (CU95 + CU3.20)] = CU3.26

The journals to reflect the above are to

|

|

CU |

CU |

|

Dr Bank |

100 |

|

|

Cr Revenue |

|

96.74 |

|

Cr Deferred income |

|

3.26 |

Once the award credit is presented on purchase of product B for CU10. The deferred income of CU3.26 is released to revenue (i.e. CU13.26 recognised on the sale).

Sale of goods

Extract from FRS 105 – Section 18.9 – 18.12

18.9 A micro-entity shall recognise revenue from the sale of goods when all the following conditions are satisfied:

(a) the micro-entity has transferred to the buyer the significant risks and rewards of ownership of the goods;

(b) the micro-entity retains neither continuing managerial involvement to the degree usually associated with ownership nor effective control over the goods sold;

(c) the amount of revenue can be measured reliably;

(d) it is probable that the economic benefits associated with the transaction will flow to the micro-entity; and

(e) the costs incurred or to be incurred in respect of the transaction can be measured reliably.

18.10 The assessment of when a micro-entity has transferred the significant risks and rewards of ownership to the buyer requires an examination of the circumstances of the transaction. In most cases, the transfer of the risks and rewards of ownership coincides with the transfer of the legal title or the passing of possession to the buyer. This is the case for most retail sales. In other cases, the transfer risks and rewards of ownership occurs at a time different from the transfer of legal title or the passing of possession.

18.11 A micro-entity does not recognise revenue if it retains significant risks and rewards of ownership. Examples of situations in which the micro-entity may retain the significant risks and rewards of ownership are:

(a) when the micro-entity retains an obligation for unsatisfactory performance not covered by normal warranties;

(b) when the receipt of the revenue from a particular sale is contingent on the buyer selling the goods;

(c) when the goods are shipped subject to installation and the installation is a significant part of the contract that has not yet been completed; and

(d) when the buyer has the right to rescind the purchase for a reason specified in the sales contract, or at the buyer’s sole discretion without any reason, and the micro- entity is uncertain about the probability of return.

18.12 If an entity retains only an insignificant risk of ownership, the transaction is a sale and the entity recognises the revenue. For example, a seller recognises revenue when it retains the legal title to the goods solely to protect the collectability of the amount due. Similarly, an entity recognises revenue when it offers a refund if the customer finds the goods faulty or is not satisfied for other reasons, and the entity can estimate the returns reliably. In such cases, the entity recognises a provision for returns in accordance with Section 16 Provisions and Contingencies.

OmniPro comment

Section 18.9 above details the specific requirement for when a sale should be recognised. One of the key features for recognition is that the risks and rewards of ownership must have transferred before revenue is recognised. Examples of where risk and rewards of ownership may not have transferred as given in Section 18.11 are:

(a) when the entity retains an obligation for unsatisfactory performance not covered by normal warranties;

(b) when the receipt of the revenue from a particular sale is contingent on the buyer selling the goods;

(c) when the goods are shipped subject to installation and the installation is a significant part of the contract that has not yet been completed; and

(d) when the buyer has the right to rescind the purchase for a reason specified in the sales contract, or at the buyer’s sole discretion without any reason, and the entity is uncertain about the probability of return.

In relation to the ongoing managerial involvement as stated in Section 18.9(b) some indicators of this would be:

- Seller guarantees the return of the buyer’s investment, or a return on that investment, for a significant period

- Seller can control future onward sale price

- Seller has control over the re-sale of the goods

- The terms of the agreement mean that it is likely the purchase will return the goods to the seller

- The seller is responsible for the management of the goods after sale.

Right of return in exchange for cash/vouchers

Where an entity sells goods and allows customer to bring them back within a certain time of purchase for cash or vouchers as long as they are not damaged etc. then a certain level of revenue should be deferred/provision made for such returns. Where an entity has past experience about the level of returns this should be incorporated, if not the full amount should be deferred.

Example 13: Right of return in exchange for cash/vouchers

A clothes retailer selling goods and provides the customer a right to return the goods within 20 days. Based on past experience 5% of customers return the goods in return for cash or vouchers. The margin on the sale is generally 20%. The total sales for the month were CU10,000.

At month end the Company should defer 5% of the sales revenue for the estimated returns and increase inventory/other assets by 5% of the cost. The journals to be posted would be:

|

|

CU |

CU |

|

Dr Revenue (CU10,000*5%) |

500 |

|

|

Cr Deferred Income |

|

500 |

Being journal to defer the risk of returns

|

|

CU |

CU |

|

Dr Inventory/Other Asset (assuming the stock can be sold for equal to more than its cost) |

400 |

|

|

Cr Cost of Sales (CU10,000*80%=CU8,000 being the cost * 5%) |

|

400 |

The provision and asset is released as the clothes are returned or when the time period for the return lapses. The journal required on physical return is:

|

|

CU |

CU |

|

Dr Deferred Income (or revenue where provision is utilised in full) |

XX |

|

|

Cr Bank (or deferred revenue where voucher issued) |

|

XX |

Discount coupon

Where a coupon has been distributed the entity does not recognise a liability for the coupon issued. Instead the coupon is debited against revenue when it is redeemed.

Example 14: Discount coupons

Company A issued coupons in a local supermarket providing a discount of 10% on redemption.

In this case no provision is made at the time of issue as it is merely a cost of promoting the stores.

Example 15: Discount coupons – buy one get one free

Company A issued coupons in a local supermarket which allowed a customer to get a free raincoat when a pair of wellingtons is purchased.

In this case no provision is required on issuance unless they are onerous contracts. However, when the coupon is redeemed, the costs relating to the coupons (i.e. the discounts) are charged to cost of sales. This is a cost of sale and not a marketing cost. The revenue recognised is the price paid by the customer and the cost of sales is the costs of both products.

Example 16: Gift vouchers

Company A issues gift vouchers during the month for CU10,000.

The sale of the gift vouchers should be included within deferred revenue and revenue should not be recognised until the shorter of when:

- The vouchers are redeemed

- Vouchers pass the sell by date

- Where there is a long history that allows the Company to determine when it becomes remote that a voucher will be redeemed with the estimate adjusted based on changes in redemption patterns.

The journal required to account for the voucher is:

|

|

CU |

CU |

|

Dr Bank |

XXX |

|

|

Cr Deferred Revenue/Voucher Liability |

|

XXX |

Example 17: Sale of extended guarantee

Company A sells a sofa with a standard guarantee of 6 months but provides an option to the customer to purchase an extended guarantee of one year.

In this instance recognition of the revenue for the purchase of the extended option only begins at the end of the normal 6 month period and from that date is released over the one year period of the extended warranty.

Note the normal guarantee provision is posted as a cost into cost of sales.

Example 18: Interest free credit

Company A sells goods interest free to customers for 6 months. Company A enters into an arrangement with a finance company whereby the finance company pays Company A the invoice price less finance charges.

The net sales amount after deduction of the finance charges should be recognised in revenue.

Recognition where risk and rewards of ownership based on shipment terms

The timing of when the risk and rewards of ownership transfer differs depending on the terms of delivery. There are a number of shipping terms which have different meanings.

Where shipping terms are free on board (FOB), this would mean that the risk and rewards of ownership should transfer when the goods are loaded onto the ship at the sellors port. At that point the purchaser is required to insure and transport the products to the final destination and will incur loss if they are damaged on route. Revenue can be recognised in this instance once proof has been obtained that the goods are on the ship. This would be similar for the sipping term ‘carriage, insurance and freight’ (CIF).

However where the shipping terms and contract state that goods do not pass until it reaches the port of destination, then revenue cannot be recognised until that time. Obviously in all these cases the other requirements in Section 18.9 should be complied with.

Sale of goods with retention of title clause

Section 18.9 does not require title to have transferred instead it requires the risks and rewards of ownership to have transferred. Therefore where all the conditions have been met a sale can be recognised where a retention of title clause exists. The reservation of title is merely held as a fall back in the event of non-payment.

Bill and hold sales

See extract from the appendix to Section 18 FRS 105 below which details the revenue recognition requirements for bill and hold arrangements. A bill and hold merit arrange is an arrangement where delivery is delayed at the buyer’s request but the buyer takes title and accepts billing.

‘Bill and hold’ sales

The seller recognises revenue when the buyer takes title, provided:

(a) it is probable that delivery will be made;

(b) the item is on hand, identified and ready for delivery to the buyer at the time the sale is recognised;

(c) the buyer specifically acknowledges the deferred delivery instructions; and

(d) the usual payment terms apply.

Revenue is not recognised when there is simply an intention to acquire or manufacture the goods in time for delivery (Section 18A.3).

Goods shipped subject to conditions

See extract from the appendix to Section 18 FRS 105 below which details the revenue recognition requirements for goods shipped subject to conditions. It is not always apparent when the installation occurs and therefore when revenue should be recognised. If it is difficult to ascertain or where installation is integral to the item, then revenue cannot be recognised until the installation is complete unless the fair value of the installation element can be determined. Where fair value of the separate element can be determined and it is a key part to show the product is functional then no revenue can be recognised for any goods delivered.

1) Goods shipped subject to conditions: installation and inspection

The seller normally recognises revenue when the buyer accepts delivery, and installation and inspection are complete. However, revenue is recognised immediately upon the buyer’s acceptance of delivery when:

a) the installation process is simple, for example the installation of a factory-tested television receiver that requires only unpacking and connection of power and antennae; or

b) the inspection is performed only for the purposes of final determination of contract prices, for example, shipments of iron ore, sugar or soya beans (Section 18A.4).

2) Goods shipped subject to conditions: on approval when the buyer has negotiated a limited right of return

If there is uncertainty about the possibility of return, the seller recognises revenue when the shipment has been formally accepted by the buyer or the goods have been delivered and the time period for rejection has elapsed (Section 18A.5).

3) Goods shipped subject to conditions: consignment sales under which the recipient (buyer) undertakes to sell the goods on behalf of the shipper (seller)

The shipper recognises revenue when the goods are sold by the recipient to a third party (Section 18A.6).

4) Goods shipped subject to conditions: cash on delivery sales

The seller recognises revenue when delivery is made and cash is received by the seller or its agent (Section 18A.7).

Lawaway sales

For layaway sales under which the goods are delivered only when the buyer makes the final payment in a series of instalments, the seller recognises revenue from such sales when the goods are delivered. However, when experience indicates that most such sales are consummated, revenue may be recognised when a significant deposit is received, provided the goods are on hand, identified and ready for delivery to the buyer (Section 18A.8).

Payments in advance

For orders when payment (or partial payment) is received in advance of delivery for goods not currently held in inventory, for example, the goods are still to be manufactured or will be delivered direct to the buyer from a third party, the seller recognises revenue when the goods are delivered to the buyer (Section 18A.9).

Sale and repurchases agreements

For a sale and repurchase agreement on an asset other than a financial asset, the seller must analyse the terms of the agreement to ascertain whether, in substance, the risks and rewards of ownership have been transferred to the buyer. If they have been transferred, the seller recognises revenue. When the seller has retained the risks and rewards of ownership, even though legal title has been transferred, the transaction is a financing arrangement and does not give rise to revenue. For a sale and repurchase agreement on a financial asset, the derecognition provisions of Section 9 apply (Section 18A.10). Examples of a sale and repurchase agreement in relation to a lease is given in Section 15-Leases.

Sales to intermediate parties, such as distributors, dealers or others for Resale

The seller generally recognises revenue from such sales when the risks and rewards of ownership have been transferred. However, when the buyer is acting, in substance, as an agent, the sale is treated as a consignment sale (Section 18A.11). Consignment sale means it stays in the sellers stock until used by the customer.

Subscriptions to publications and similar items

When the items involved are of similar value in each time period, the seller recognizes revenue on a straight-line basis over the period in which the items are dispatched. When the items vary in value from period to period, the seller recognises revenue on the basis of the sales value of the item dispatched in relation to the total estimated sales value of all items covered by the subscription (Section 18A.12).

Instalment sales, under which the consideration is receivable in instalments

The seller recognises revenue based on the cash price a customer would pay at the date of sale. If the total amount paid through instalments is greater than the cash price payable at the date of sale, any excess is recognised as interest and released to the profit and loss account as interest income on a straight line basis over the life of the credit term (Section 18A.13).

Agreements for the construction of real estate

Extract from FRS 105 – Section 18A.14-18A.15

18A.14 A micro-entity that undertakes the construction of real estate, directly or through subcontractors, and enters into an agreement with one or more buyers before construction is complete, shall account for the agreement using the percentage of completion method, only if:

(a) the buyer is able to specify the major structural elements of the design of the real estate before construction begins and/or specify major structural changes once construction is in progress (whether it exercises that ability or not); or

(b) the buyer acquires and supplies construction materials and the micro-entity provides only construction services.

18A.15 If the micro-entity is required to provide services together with construction materials in order to perform its contractual obligation to deliver real estate to the buyer, the agreement shall be accounted for as the sale of goods. In this case, the buyer does not obtain control or the significant risks and rewards of ownership of the work in progress in its current state as construction progresses. Rather, the transfer occurs only on delivery of the completed real estate to the buyer.

OmniPro comment

See examples below for illustration of the above points.

Example 19: Construction real estate – buyer has the right to specify structural design

Company A is engaged in the purchase of land and the development of property. The company purchased the land and have entered into an agreement with a customer whereby the customer would purchase the land from Company A and contract Company A to construct the customers house to that customer’s specific requirements. The customer supplies all the materials. The price for the purchase of the land should be paid on transfer of title.

In this example as the customer is able to specify the type of house that they want built and is also providing the material for Company A, Company A should account for the sale on the construction of the property on a percentage of completion basis. The sale of the land can be recognised when title to the land is transferred to the customer i.e. before the house is built.

Example 20: Construction real estate – buyer has no right to specify structural design

Company A is a construction company and purchased land to construct a number of houses on it. The Company offers customers an opportunity to purchase the house off the plan, and provide the customers with a limited number of choice with regard to the houses being built as planning has already been obtained by Company A. The customer can detail what way they want the interior to be designed i.e. choice of colour, tiling, utensils etc. The price is agreed on signing the contract. The customer must pay a deposit of 10% and the remainder on completion of the property.

In this example as the customer has no ability to negotiate a significant part of the structures of the house (i.e. the structures themselves are pre-determined), they have only acquired a right to acquire the house at the set price from the beginning. Here as Company A retains the majority of risks and rewards of ownership no revenue should be recognised on the construction of the house until the conditions in Section 18.9 are met which is likely to be on completion of the house and the legal transfer of the house to the buyer.

Company A has to incur the cost of all material for the house.

Rendering of services

Extract from FRS 105 – Section 18.13 – 18.15 & Section 18.18, 18.20-18.21

18.13 When the outcome of a transaction involving the rendering of services can be estimated reliably, a micro-entity shall recognise revenue associated with the transaction by reference to the stage of completion of the transaction at the end of the reporting period (sometimes referred to as the percentage of completion method). The outcome of a transaction can be estimated reliably when all the following c conditions are satisfied:

(a) the amount of revenue can be measured reliably;

(b) it is probable that the economic benefits associated with the transaction will flow to the micro-entity;

(c) the stage of completion of the transaction at the end of the reporting period can be measured reliably; and

(d) the costs incurred for the transaction and the costs to complete the transaction can be measured reliably.

Paragraphs 18.18 to 18.24 provide guidance for applying the percentage of completion method.

18.14 When services are performed by an indeterminate number of acts over a specified period of time, a micro-entity recognises revenue on a straight-line basis over the specified period unless there is evidence that some other method better represents the stage of completion. When a specific act is much more significant than any other act, the micro-entity postpones recognition of revenue until the significant act is executed.

18.15 When the outcome of the transaction involving the rendering of services cannot be estimated reliably, a micro-entity shall recognise revenue only to the extent of the expenses recognised that are recoverable.

Percentage of Completion

18.18 This method is used to recognise revenue from rendering services (see paragraphs 18.13 to 18.15) and from construction contracts (see paragraphs 18.16 and 18.17). A micro-entity shall review and, when necessary, revise the estimates of revenue and costs as the service transaction or construction contract progresses.

18.20 A micro-entity shall recognise costs that relate to future activity on the transaction or contract, such as for materials or prepayments, as an asset if it is probable that the costs will be recovered.

18.21 A micro-entity shall recognise as an expense immediately any costs whose recovery is not probable.

OmniPro comment

Service recognition criteria

The recognition criteria in relation to future economic criteria being probable has already been discussed above so no further discussion is required on this as this applies the same to services as it does to goods.

Similarly a reliable measurement must be available in order for revenue to be recognised. When providing a service not only costs incurred to date must be incorporated but also future costs to be incurred needs to be determined before any revenue can be recognised. It may not always be easy to assess the future costs to be incurred especially in construction contracts.

In relation to costs incurred to date, consideration also needs to be given as to whether any of these costs can be deferred.

Where costs incurred up to the date of assessing revenue relate to inventory which will be used in future periods or which relate to PPE or intangibles, these costs should be ignored and instead capitalised (interest costs cannot capitalised under Section 20). An asset should only be capitalised in any event if it meets the definition of an asset i.e. it will provide future economic benefits. However not all such costs would be deferred. An example would be staff training, although this benefits the whole project, it must be expensed as incurred.

Where a reliable estimate of either future costs, percentage of completion cannot be determined, revenue should only be recognised to the extent that it covers costs incurred up to that date if it is probable the costs incurred to date will be recoverable (i.e. no profit recognised). This is likely to be the case in the early stages of the transactions.

Example 20A: Reliable measurement

Company A carries out architectural services. It has entered into a contract to provide services for a fixed price of CU500,000. This contract is the first of its type. At the end of year 1, the firm has incurred CU100,000 in costs. At the year end Company A cannot determine what the future costs are likely to be. As a result the company should recognise revenue of CU100,000 such that no profit or loss is recognised.

Example 20B: Reliable measurement

If we take example 20A and now assume at the end of year 2 the company expects a loss on the project of CU100,000. Company A should recognise a provision for this future loss of CU100,000.

Where the collectability of any amount already recognised as revenue is no longer probable, a provision should be made and debited against revenue in that period.

Where change in the estimates of revenue occurs these are recognised in revenue prospectively.

Intermediate number of acts over specified period

Section 18.14 refers to services being performed by an indeterminate number of acts over a, specified period of time and the requirement to recognise the revenue over the specified period of time unless there is another method which better reflects the stage of completion. An example here would be a maintenance contract entered into with a customer for one year. In this case revenue would be recognised on a straight line basis over the life of the maintenance contract (e.g. maintenance contract for CU120,000 per annum, then revenue would be recognised at CU10,000 per month). Costs of providing the maintenance services should be expensed as incurred with no deferral etc.

Service with a significant act

Section 18.14 also deals with a service which has a significant act which is much more significant than any other act and the fact that the revenue should be recognised until the significant act is executed. The reason for this is that the entity has not yet performed under the contract. Where the significant act has been performed but consideration is contingent, revenue can be recognised to the extent that the entity can determine that there is a probable inflow of economic benefits that can be reliably measured.

Stage payments may not necessarily identify when a significant act has been performed so judgement may be required. The key point is to ensure the service contract is clearly defined so that the contract defines when value has been given under the service. If the seller performs under these terms it would be appropriate to recognise based on this.

Example 21: Stage of completion – detailed in the contract

Company A is an architect company that provides services to the client. Before a service is provided Company A requires customers to sign a contract stating that the Company has the right to receive payment for any work performed and will be paid for services rendered at the appropriate rate in the contract, even if the contract is broken. If we assume the fee for preparing a drawing of a house including an initial consultation for a customer is CU1,000.

In this case, Company A can recognise revenue over the period in which Company A works on the drawing and meets with the client (i.e. on the percentage of completion basis). If the customer decides to cancel the contract halfway through, then Company A can still recover CU500 from the customer because per the terms of the contract the customer agreed to pay on this basis.

Example 22: Stage of completion

If we take example 21 and assume that the terms of the contract stated that Company A had no right to receive payment until the drawing was completed, then revenue cannot be recognised until the significant act i.e. the completion of the drawing has been fulfilled.

Stage of completion method

Revenue is recognised under this method by reference to when the work is performed. This is the same method used for measuring revenue in construction contracts as detailed below. In applying this, the method that can be used as stated in Section 18.19 of the standard are:

(a) the proportion that costs incurred for work performed to date bear to the estimated total costs. Costs incurred for work performed to date do not include costs relating to future activity, such as for materials or prepayments;

(b) surveys of work performed; and

(c) completion of a physical proportion of the contract work or the completion of a proportion of the service contract.

Progress payments and advances received from customers often do not reflect the work performed.’

Therefore the key driver of revenue recognition is the extent of work performed not the progress payments. Any progress payments in excess of the work performed should be included in deferred revenue and any accrued payments should be shown as accrued revenue where an invoice has not been raised.

The standard does not specify which of the three methods above should be used, it instead leaves this open to judgement, but the one used should reflect the actual amount of work done in the period. The method used should not overstate the work completed.

The proportion of costs measure uses the amount, inputs or efforts put into the contract measured in terms of cost.

Example 23: Proportion of costs method

Company A is a solicitors firm. They have entered into a contract with a customer to carry out work on the transfer of a property to a third party. Under the terms of the contract a fee of CU2,000 will be charged. The Company estimate that this will cost the firm CU1,300 at the firms charge out rates. At the end of the month the company has incurred CU650 in costs. On this basis 50% (CU650 costs incurred over the CU1,300 total costs expected) of revenue can be recognised (i.e. CU1,000).

For the other two methods mentioned in (b) and (c) above (i.e. survey of work completed method or the completion of the physical proportion of the contract method), these are an output measure as they relate to the degree of output work done through physical verification. This method would not be applicable for a professional firm as it cannot be measured. This is more applicable to a physical contract which can physically be observed. For example where a company is constructing houses it can physically see the houses that are complete.

Other specific examples as extracted from the Appendix to Section 18

Installation fees

The seller recognises installation fees as revenue by reference to the stage of completion of the installation, unless they are incidental to the sale of a product, in which case they are recognised when the goods are sold (Section 18A.18).

Servicing fees included in the price of the product

When the selling price of a product includes an identifiable amount for subsequent servicing (e.g. after sales support and product enhancement on the sale of software), the seller defers that amount and recognises it as revenue over the period during which the service is performed. The amount deferred is that which will cover the expected costs of the services under the agreement, together with a reasonable profit on those services (Section 18A.19).

Advertising commissions

Media commissions are recognised when the related advertisement or commercial appears before the public. Production commissions are recognised by reference to the stage of completion of the project (Section 18A.20).

Admission fees

The seller recognises revenue from artistic performances, banquets and other special events when the event takes place. When a subscription to a number of events is sold, the seller allocates the fee to each event on a basis that reflects the extent to which services are performed at each event (Section 23A.21).

OmniPro comment

Note where fees are received in advance these should be shown as deferred revenue. Also costs which meet the definition of an asset can be deferred however all advertising costs must be expensed as incurred.

Tuition fees

The seller recognises revenue over the period of instruction (Section 18A.22).

Initiation, entrance and membership fees

Revenue recognition depends on the nature of the services provided. If the fee permits only membership, and all other services or products are paid for separately, or if there is a separate annual subscription, the fee is recognised as revenue when no significant uncertainty about its collectability exists. If the fee entitles the member to services or publications to be provided during the membership period, or to purchase goods or services at prices lower than those charged to non-members, it is recognised on a basis that reflects the timing, nature and value of the benefits provided (Section 18A.23).

Franchise fees

Franchise fees may cover the supply of initial and subsequent services, equipment and other tangible assets, and know-how. Accordingly, franchise fees are recognised as revenue on a basis that reflects the purpose for which the fees were charged. The following methods of franchise fee recognition are appropriate.

a) Franchise fees: Supplies of equipment and other tangible assets

The franchisor recognises the fair value of the assets sold as revenue when the items are delivered or title passes (Section 18A.25).

b) Franchise fees: Supplies of initial and subsequent services

The franchisor recognises fees for the provision of continuing services, whether part of the initial fee or a separate fee, as revenue as the services are rendered. When the separate fee does not cover the cost of continuing services together with a reasonable profit, part of the initial fee, sufficient to cover the costs of continuing services and to provide a reasonable profit on those services, is deferred and recognised as revenue as the services are rendered (Section 18A.26).

The franchise agreement may provide for the franchisor to supply equipment, inventories, or other tangible assets at a price lower than that charged to others or a price that does not provide a reasonable profit on those sales. In these circumstances, part of the initial fee, sufficient to cover estimated costs in excess of that price and to provide a reasonable profit on those sales, is deferred and recognised over the period the goods are likely to be sold to the franchisee. The balance of an initial fee is recognised as revenue when performance of all the initial services and other obligations required of the franchisor (such as assistance with site selection, staff training, financing and advertising) has been substantially accomplished (Section 18A.27).

The initial services and other obligations under an area franchise agreement may depend on the number of individual outlets established in the area. In this case, the fees attributable to the initial services are recognised as revenue in proportion to the number of outlets for which the initial services have been substantially completed (Section 18A.28).

If the initial fee is collectible over an extended period and there is a significant uncertainty that it will be collected in full, the fee is recognised as cash instalments are received (Section 18A.29).

d) Franchise fees: Continuing franchise fees

Fees charged for the use of continuing rights granted by the agreement, or for other services provided during the period of the agreement, are recognised as revenue as the services are provided or the rights used (Section 18A.30).

e) Franchise fees: Agency transactions

Transactions may take place between the franchisor and the franchisee that, in substance, involve the franchisor acting as agent for the franchisee. For example, the franchisor may order supplies and arrange for their delivery to the franchisee at no profit. Such transactions do not give rise to revenue (Section 18A.31).

Fees from the development of customised software

The software developer recognises fees from the development of customised software as revenue by reference to the stage of completion of the development, including completion of services provided for post-delivery service support (Section 18A.32).

Construction contracts

Extract from FRS 105 – Section 18.16 – 18.17

18.16 When the outcome of a construction contract can be estimated reliably, a micro-entity shall recognise contract revenue and contract costs associated with the construction contract as revenue and expenses respectively by reference to the stage of completion of the contract activity at the end of the reporting period (often referred to as the percentage of completion method). Reliable estimation of the outcome requires reliable estimates of the stage of completion, future costs and collectability of billings. Paragraphs 18.18 to 18.24 provide guidance for applying the percentage of completion method.

18.17 The requirements of this section are usually applied separately to each construction contract. However, in some circumstances, it is necessary to apply this section to the separately identifiable components of a single contract or to a group of contracts together in order to reflect the substance of a contract or a group of contracts.

Percentage of completion method

18.18 This method is used to recognise revenue from rendering services (see paragraphs 18.13 to 18.15) and from construction contracts (see paragraphs 18.16 and 18.17). A micro-entity shall review and, when necessary, revise the estimates of revenue and costs as the service transaction or construction contract progresses.

18.19 A micro-entity shall determine the stage of completion of a transaction or contract using the method that measures most reliably the work performed. Possible methods include:

(a) the proportion that costs incurred for work performed to date bear to the estimated total costs. Costs incurred for work performed to date do not include costs relating to future activity, such as for materials or prepayments;

(b) surveys of work performed; and

(c) completion of a physical proportion of the contract work or the completion of a proportion of the service contract.

Progress payments and advances received from customers often do not reflect the work performed.

18.20 A micro-entity shall recognise costs that relate to future activity on the transaction or contract, such as for materials or prepayments, as an asset if it is probable that the costs will be recovered.

18.21 A micro-entity shall recognise as an expense immediately any costs whose recovery is not probable.

18.22 When the outcome of a construction contract cannot be estimated reliably:

(a) a micro-entity shall recognise revenue only to the extent of contract costs incurred that it is probable will be recoverable; and

(b) the micro-entity shall recognise contract costs as an expense in the period in which they are incurred.

18.23 When it is probable that total contract costs will exceed total contract revenue on a construction contract, the expected loss shall be recognised as an expense immediately, with a corresponding provision for an onerous contract (see Section 16 Provisions and Contingencies).

18.24 If the collectability of an amount already recognised as contract revenue is no longer probable, the micro-entity shall recognise the uncollectible amount as an expense rather than as an adjustment of the amount of contract revenue.

OmniPro comment

Definition of construction contract

A construction contract is defined in Appendix I of FRS 105 as ‘a contract specifically negotiated for the construction of an asset or a combination of assets that are closely interrelated or interdependent in terms of their design, technology and function or their ultimate purpose or use’.

Determining whether a construction contract exists is critical as this determines whether revenue is recognised under the percentage of completion method or the revenue is not recognised until the risk and rewards of ownership and control have passed.

In relation to a single construction contract, examples include:

- Building a single property/building whether for residential or commercial purposes

- Building a bridge

In relation to a combination of assets included in the definition of a construction contract would mean:

- Construction of complex plant and machinery

- Housing estate

The section does not define any length for a construction contract however it is usually for more than one year but it can be shorter. Where a construction contract straddles two accounting periods, a contract for less than one year would be relevant.

Combination and segmentation of contracts

Determining whether a contract is a series of separate individual contracts or one single contract for the construction of assets is very important and this will drive the allocation of revenue and profits.

Section 18.17 above provides an entity with details of whether the contract should be broken down or not. In assessing this for where a single contract covers the construction of a number of assets, each of which is a separate asset then consideration would need to be had as to whether there were separate proposals submitted, or if each asset is subject to separate negotiation and if the costs of revenues for each can be determined.

Recognition of Contract revenue and contract costs

When an outcome of a construction contract can be reliably measured an entity must recognise the costs and revenue based on the stage of completion for each year end. Changes in the measurement estimates are corrected prospectively, no prior year adjustment is required. Therefore the amount recognised in revenue can increase or decrease.

As can be seen from the definition of contract revenue and costs below, the key items when measuring the profit to be shown is the costs and the revenue. The contract may not therefore have the same profit margin over its life time. As costs drive the revenue figure.

Contract revenue

The total contract revenue for a contract is usually specified in a contract at a fixed price or a cost plus margin basis. However there may be instances even in a fixed price contract where adjustments are made.

Section 18 does not define what should be included in contract revenue, therefore it is necessary to look to IAS 11 in IFRS which deals with construction contracts for further guidance based on the hierarchy stated in Section 8. Alternatively you can look to Section 2 of FRS 105 which details the concepts and pervasive principals of FRS 105 and from this determine the correct accounting policy. There is no specific requirement to look to IFRS or FRS 102.

IAS 11 states that contract revenue is the amount of revenue initially agreed by the parties together with any variations, claims and incentive payments as long as it is probable that they will result in revenue and can be reliably measured.

The amount of revenue to recognise is the fair value received or receivable. Fair value may change as events occur as the consideration is to be revised as events occur or uncertainties are resolved. These may include:

- contractual matters such as increases in revenue in fixed price contract as a result of cost escalation clauses; or,

- a contract involves a fixed price per unit of output,

- contract revenue may increase as the number of units is increased.

Penalties for delays may reduce revenue. In addition, variations must be taken into account. Variations are instructions by the customer to change the scope of the work to be performed under the contract, including changes to the specification or design of the asset or to the duration of the contract.

Variations are only included in the contract when:

- it is probable the customers will approve the variation; and

- it is probable the customers will approve the amount to be charged for it; and

- the amount can be reliably measured.

For claims made for costs not included in the original contract or arising as an indirect consequence of approved variations, such as customer delays, errors in design and specification or disputed variation the settlement of final amounts is likely determined through negotiation that are subject to uncertainty, such additional amounts being claimed should not be recognised as revenue unless:

- it is probable that the customer will accept the claim; and

- the amount can be measured reliably (IAS 11.14)

Therefore at a minimum the claims must have been agreed in principle and an amount must be very well estimated.

For incentive payments, these should only be recognised if it is probable the milestone will be achieved. For penalties the same position would be held.

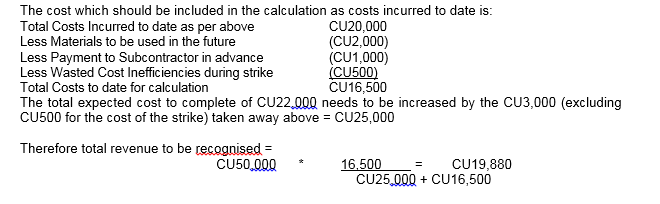

Contract costs

Section 18 does not define what should be included in contract costs. However the costs allowed under Section 10 Inventories would be indicative of what should be included in costs. In addition, guidance can be got from IAS 11 in IFRS.

IAS 11.16-11.17 states that contract costs are those costs that relate directly to the specific contract and to those that are attributable to contract activity in general that can be allocated to the contract. In addition, they include costs that are specifically chargeable to the customer under the terms of the contract. Directly related costs include:

- direct labour costs, including site supervision

- cost of materials used in construction

- depreciation of plant and equipment used in the contract

- cost of moving plant, equipment and materials to and from the contract site

- cost of hiring plant and equipment

- cost of design and technical assistance that is directly related to the contract

- the estimated costs of rectification and guarantee work, including expected warranty costs; and

- claims from third parties

- any administration costs or research and development costs which are specifically reimbursable under the terms of the contract.

- Cost relating directly to the contract, which were incurred in gaining the business may be included if they have been incurred and at the time it is probable the contract will be obtained. However costs which were specifically written off due to the chance of success not being probable cannot be reinstated at a later date.