[et_pb_section admin_label=”Header – All Pages” global_module=”1221″ transparent_background=”off” background_color=”#1e73be” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” gutter_width=”3″ custom_padding=”||0px|”][et_pb_row global_parent=”1221″ admin_label=”row”][et_pb_column type=”4_4″][et_pb_post_title global_parent=”1221″ admin_label=”Post Title” title=”on” meta=”off” author=”on” date=”on” categories=”on” comments=”on” featured_image=”off” featured_placement=”below” parallax_effect=”on” parallax_method=”on” text_orientation=”left” text_color=”light” text_background=”off” text_bg_color=”rgba(255,255,255,0.9)” module_bg_color=”rgba(255,255,255,0)” title_all_caps=”off” use_border_color=”off” border_color=”#ffffff” border_style=”solid” title_font=”|on|||” title_font_size=”35″ custom_padding=”10px|||”] [/et_pb_post_title][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” global_module=”1228″ fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” custom_padding=”0px||0px|” padding_mobile=”on” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” gutter_width=”3″][et_pb_row global_parent=”1228″ admin_label=”Row” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” use_custom_gutter=”off” gutter_width=”3″ custom_padding=”0px||0px|” padding_mobile=”off” allow_player_pause=”off” parallax=”off” parallax_method=”off” make_equal=”off” parallax_1=”off” parallax_method_1=”off” column_padding_mobile=”on”][et_pb_column type=”4_4″][et_pb_text global_parent=”1228″ admin_label=”Text” background_layout=”light” text_orientation=”left” text_font_size=”14″ use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [breadcrumb] [/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” fullwidth=”off” specialty=”off”][et_pb_row admin_label=”Row”][et_pb_column type=”1_2″][et_pb_text admin_label=”Text” background_layout=”light” text_orientation=”center” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [button link=”https://ie.frs102.com/members/premium-toolkit/” type=”big” color=”red”] Return to Main Index[/button] [/et_pb_text][/et_pb_column][et_pb_column type=”1_2″][et_pb_text admin_label=”Text” background_layout=”light” text_orientation=”center” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] [button link=”https://ie.frs102.com/members/premium-toolkit/section-27/” type=”big” color=”red”] Return to Section 27 Home[/button] [/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section admin_label=”Section” fullwidth=”off” specialty=”off” transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”off” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”on” make_equal=”off” use_custom_gutter=”off” gutter_width=”3″][et_pb_row admin_label=”Row”][et_pb_column type=”4_4″][et_pb_text admin_label=”Main Body Text” background_layout=”light” text_orientation=”justified” use_border_color=”off” border_color=”#ffffff” border_style=”solid”]

Value in use

Extract from FRS102: Section 27.15 – 27.20

27.15 Value in use is the present value of the future cash flows expected to be derived from an asset. This present value calculation involves the following steps:

(a) estimating the future cash inflows and outflows to be derived from continuing use of the asset and from its ultimate disposal; and

(b) applying the appropriate discount rate to those future cash flows.

27.16 The following elements shall be reflected in the calculation of an asset’s value in use:

(a) an estimate of the future cash flows the entity expects to derive from the asset;

(b) expectations about possible variations in the amount or timing of those future cash flows;

(c) the time value of money, represented by the current market risk-free rate of interest;

(d) the price for bearing the uncertainty inherent in the asset; and

(e) other factors, such as illiquidity, that market participants would reflect in pricing the future cash flows the entity expects to derive from the asset.

27.17 In measuring value in use, estimates of future cash flows shall include:

(a) projections of cash inflows from the continuing use of the asset;

(b) projections of cash outflows that are necessarily incurred to generate the cash inflows from continuing use of the asset (including cash outflows to prepare the asset for use) and can be directly attributed, or allocated on a reasonable and consistent basis, to the asset; and

(c) net cash flows, if any, expected to be received (or paid) for the disposal of the asset at the end of its useful life in an arm’s length transaction between knowledgeable, willing parties.

The entity may wish to use any recent financial budgets or forecasts to estimate the cash flows, if available. To estimate cash flow projections beyond the period covered by the most recent budgets or forecasts an entity may wish to extrapolate the projections based on the budgets or forecasts using a steady or declining growth rate for subsequent years, unless an increasing rate can be justified.

27.18 Estimates of future cash flows shall not include:

(a) cash inflows or outflows from financing activities; or

(b) income tax receipts or payments.

27.19 Future cash flows shall be estimated for the asset in its current condition. Estimates of future cash flows shall not include estimated future cash inflows or outflows that are expected to arise from:

(a) a future restructuring to which an entity is not yet committed; or

(b) improving or enhancing the asset’s performance.

27.20 The discount rate (rates) used in the present value calculation shall be a pre-tax rate (rates) that reflect(s) current market assessments of:

(a) the time value of money; and

(b) the risks specific to the asset for which the future cash flow estimates have not been adjusted.

The discount rate (rates) used to measure an asset’s value in use shall not reflect risks for which the future cash flow estimates have been adjusted, to avoid double-counting.

OmniPro comment

As can be seen from the sections above, there are detailed rules as to what can or cannot be included in the cash flows under the value in use model.

Value in use can be determined on an asset basis or where there is no independent cash flows from that asset, the smallest CGU which incorporates this asset. Value in use calculations at the level of CGU will be required where the fair value less cost to sell cannot be determined or where this is below the carrying amount and:

- goodwill is suspected of being impaired;

- a CGU itself is suspected of being impaired; or

- individual assets are suspected of being impaired and individual future cash flows cannot be identified for them.

Section 27.19 makes it clear that future cash flows should only be estimated in its current condition. It cannot incorporate any future reconstructions not committed nor can it include cash outflows for purchasing fixed assets which enhance the cash flow generation possibilities for the entity. Therefore in reality, the only capital expenditure that should be incorporated into the model is the cost of maintaining the current fixed assets at their current condition and any replacement expenditure on the assets making up a larger asset that requires replacement at various intervals and is depreciated over a shorter life than the main asset. In addition, it should incorporate normal repairs and maintenance costs for maintaining the assets.

Where an entity is committed to future reconstructions which will result in cost savings these may be included in the future cash flows.

Example 12: Determining cash flow to include

Company A is a manufacturing company providing special plywood to the construction industry. During the year there was a large slump in the construction market which was an indicator of impairment. The company has prepared the estimated cash flow and has included the below in the cash flow. Determine which ones will be allowed to be included as part of the value in use calculation.

- The company intends to restructure the company and lay 20 employees off which will result in cost savings of CU200,000 per annum.

Solution: Neither the costs of the reconstruction or the cost savings can be incorporated into estimated future cash flows as the entity was not demonstrately committed to it i.e. it was not provided for in the year end financial statements.

- Next year the company has planned to purchase and install a whole new production line which will allow the company to diversify the type of products it produces such that it can supply material to a separate industry.

Solution: Section 27.19 does not allow planned future capital expenditure which enhances the cash flow potential to be incorporated into the cash flow. Neither does it allow the future additional cash inflows from the proposed expenditure.

- The cost of replacing a component of the main production line which is depreciated at a different rate to the main line has been included in the cash flows.

Solution: Given that this is a component that is separately depreciated from the main production line and it does not enhance the performance of the line above the performance at the date of the value in use calculation, this should be included in the estimated cash outflows. Note the cash flows should incorporate these based on the life of that component so if these parts had to be changed every five years, it would have to be included in the cash flow every five year.

- Assumed a growth rate of 10% per annum for 10 years. The terminal value amount is increased by a further 10%

Solution: When determining whether this cash flow is appropriate, one would have to look at the industry in which the company operates. Given that the market has slumped it would be very unusual for a 10% growth rate to be assumed. On this basis it is likely that these growth rates would need to actually show a reduction for at least the first few years as opposed to an increase. The 10% growth rate for 10 years also seems to be for too long a period. IAS 36 would state that a growth rate should not be incorporated for more than 5 years and as stated in Section 27 from then on a steady rate or declining growth rate should be used. Therefore these growth rates would have to be reduced and usually after 5 years decreasing or no further growth should be assumed. However each circumstance would need to be assessed individually based on the industry in which the entity operates.

- The repairs and maintenance costs is very large when compared to the depreciation charged on the assets during the prior year.

Solution: Although this is an allowable cash flow usually the repairs and maintenance cost included in the cash flow should some way equate to the yearly depreciation charge.

- In calculating the cash flows, the company incorporated the working capital requirements/movements but they compared the present value of the cash flows to the carrying amount they have not included the debtors/creditors/inventory and other working capital items within the carrying amount.

Solution: This is incorrect as the company should compare like with like. In this instance the company should take the net assets relating to the CGU so that they are comparing like with like.

- The company has used a post-tax discount rate

Solution: This is incorrect as a pre-tax discount rate should be used.

- The company has not incorporated any inflation into its workings

Solution: The entity must incorporate the effects of inflation into its cash flows under the standard. Therefore, the expected future inflation needs to be incorporated.

- The company has included tax payments into the cash flow

Solution: The inclusion of tax cash flows is not allowed under Section 27.

- The company has included exceptional income with regard to a return on investment within the terminal value amount as this was included in the last forecasted period.

Solution: The terminal value amount must exclude all abnormal or exceptional items included in the last forecasted periods cash flows as this incorrectly inflates the terminal value amount.

- The company in its cash flow used the profit before tax, amortisation and depreciation.

Solution: This is incorrect as the cash flows should incorporate the earnings before interest, tax, amortisation and depreciation as financing activities should be excluded together with any non-cash costs.

The interest income and expense should therefore have also been excluded in the above example.

Estimating the future pre-tax cash flows

Section 27.17 above provides guidance on the cash flows to be included and specifically states that it can use budgets or forecasts to estimate the cash flows and that an entity may extrapolate the projections based on the budgets or forecasts using a steady or declining growth. Section 27 does not specify how long the projections and budgets can be used before extrapolation must occur. IAS 36 specifically states that this should be used for a maximum of 5 years, for the period before which a steady or declining growth rate could be assumed. It would not be unreasonable to apply this in Section 27. The five year rule is based on the theory that indicates that above-average growth rates will only be achievable in the short term, because such above average growth will lead to competitors entering the market which will lead to a reduction in the growth rate for the economy as a whole.

Inflation should be incorporated in the cash flows and therefore the discount rate used should exclude the effect of inflation or vice versa.

Usually it is appropriate to incorporate the earnings before interest, tax, amortisation and depreciation in the cash flows as financing activities should be excluded and the other items are non-cash items.

Foreign cash flows

Section 27 does not consider how foreign currency cash flows should be translated in the cash flows. Where the cash flows are in a currency which is not the entities functional currency, guidance may be obtained under the hierarchy stated in Section 10 from IAS 36. IAS 36 states that foreign currency cash flows should first be determined in the foreign currency they are generated in and then discounted at a discount rate appropriate to that currency. The entity can then translate the present value calculated in the foreign currency using the spot exchange rate at the date of the value in use calculation.

Steps in calculating VIU

The steps in calculating the value in use are:

Step 1: divide the entity into CGU’s where an asset does not have independent cash flows

Step 2: estimate the future pre-tax cash flows of the CGU under review

Step 3: identify an appropriate discount rate and discount the future cash flows

Step 4: compare the carrying value with the value in use and recognise the impairment loss where applicable.

Value in use – discount rate

As per Section 27.20 the discount rate used should be the pre-tax discount rate that reflects the current market assessments of the time value of money; and the risk specific to the asset for which the future cash flow estimates have not been adjusted.

In essence the discount rate to be applied should be an estimate of the rate that the market would expect on an equally risky investment. The discount rate specific for the asset or CGU will take account of the period over which the asset or CGU is expected to generate cash inflows and it may not be sensitive to short term rates.

In most cases the asset specific rate will not be available from the market and therefore estimates will be required. In practice many entities will use the weighted average cost of capital (WACC) as a starting point to estimate the appropriate discount rate and it is a commonly known methodology. Where WACC is used some of the issues which must be considered are:

- The WACC is a post-tax rate and therefore where the headroom is tight this will need to be adjusted to a pre-tax rate which is not always easy

- The WACC must reflect the risks specific to the asset and not the risks relating to the entity as a whole.

The determination of an appropriate discount rate is a difficult process and will require judgment. Usually sensitivity analysis should also be determined to see the effect a change in discount rate would have. Usually a WACC rate is used and where this shows sufficient head room, then this may suffice. However, where this shows an impairment the pre-tax rate must be used. Other rates that should be looked at is the entity’s incremental borrowing rate or other borrowing rates.

See the example below which shows the difficulty in determining a pre-tax WACC rate.

Example 13: WACC

Company A has calculated a WACC of 5% based on market assumptions. This is the post-tax rate and they require the pre-tax rate for the value in use calculation as it is probable that an impairment exists. The tax rate is 10%. Therefore assuming there is no timing difference the pre-tax WACC is 5.555% (5%/(1-.1)). However as it is likely that there will be large timing differences, then a more detailed method will be required to determine the pre-tax WACC.

The most appropriate WACC model to use is the CAPM model (capital asset pricing model). The formula for to calculate the CAPM is:

Rs= Rf +B(Rm-Rf)

Where:

Rs= return on security we are interested in (expected return on capital assets or return required)

Rm= the expected return from the market as a whole (LSE/ISEQ shows return for all quoted companies in the country

Rf – return available on risk free securities (government bonds etc)

B= beta factor. Market as a whole produces a given return, the beta factor for an individual share measures the volatility of the return on that share to the market as a whole. Market as a whole has a beta factor of 1. Risk free securities have a beta of 0. This factor is the ratio of the return on that share to the markets overall return e.g. return on share is 29% & return on market as a whole was 15%, then beta factor for shares is 29/15=1.93. Beta factor is a measure of the systematic risk of the capital asset. If shares in ABC plc tend to vary twice as much as returns from the market as a whole, so that if market returns (i.e. LSE/ISEQ) increase by 3% returns on ABC plc would be expected to increase by 6% and vice versa. Hence beta factor for ABC is 2

Rm-Rf is the risk premium looked for in return for investing in securities other than risk free securities. From above we can see that the minimum return must at least be the risk free rate.

Value in use – terminal value

In relation to non-current assets, a large component of value attributable to an asset or CGU arises from its terminal value, which is the net present value of all of the forecast free cash flows that are expected to be generated by the asset or CGU after the explicit forecast period.

When the asset is to be sold at the end of its useful life the disposal proceeds and costs should be based on current prices and costs for similar assets, adjusted where necessary for price level changes if the entity has chosen to include this factor in its forecasts and selection of a discount rate.

CGU’s and certain assets have indefinite lives and therefore the amount to be included in the terminal value is usually the amounts in the last forecast period that is presented. It is essential that the terminal year cash flows reflect maintainable cash flows as otherwise any material one off or abnormal cash flows that are forecast for the terminal year will inappropriately increase or decrease the valuation. The maintainable cash flows expected to be generated by the asset or CGU is then capitalised by a perpetuity fact based on either:

- The discount rate if cash flows are forecast to remain relatively constant; or

- The discount rate less the long term growth rate of cash flows are forecasted to grow.

The formula to calculate the terminal value is as follows:

CF * (1+g)/(r-g)

Where CF= maintainable cash flows

g = terminal value growth rate (where applicable)

r = discount rate

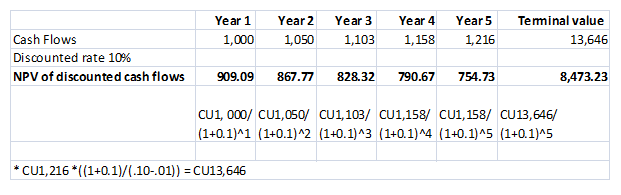

For example, Company A prepared a cash flow for impairment testing purposes based on budgets for years 1 to 5. The assumed discount rate is 10% and the terminal value growth rate is 1%. The projected cash flow including discounting is as per below.

Assets held for service potential

Extract from FRS102: Section 27.20A

27.20A For assets held for their service potential, a cash flow driven valuation (such as value in use) may not be appropriate. In these circumstances value in use (in respect of assets held for their service potential) is determined by the present value of the asset’s remaining service potential plus the net amount the entity will receive from its disposal. In some cases this may be taken to be costs avoided by possession of the asset. Therefore, depreciated replacement cost, may be a suitable measurement model but other approaches may be used where more appropriate

OmniPro comment

It is not common for assets to be held for service potential to be included in profit orientated entities. This would be more applicable for non-profit making entities where fixed assets provide more meaningful benefits then the depreciated replacement cost can be used.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]